Ethereum CrossX Signals: Is A $4,000 Price Target Realistic? Institutional Accumulation Analysis

Table of Contents

Understanding Ethereum CrossX Signals

What are CrossX Signals?

Ethereum CrossX signals are predictive indicators derived from analyzing various on-chain and off-chain market data. These signals aren't tied to a specific, publicly available algorithm, but rather represent a confluence of technical and fundamental analysis focusing on order book dynamics, network activity, and large-scale investor behavior. While not a crystal ball, CrossX signals aim to identify potential buying or selling pressure for ETH, helping traders and investors gauge market sentiment. The reliability of these signals depends heavily on the expertise and data sources used in their generation.

Interpreting CrossX Signals for ETH Price Prediction

Interpreting CrossX signals involves analyzing the confluence of several data points. For example, a strong "buy" signal might be triggered by a combination of increasing on-chain activity, a rise in institutional investment, and positive market sentiment reflected in social media and news. Conversely, a "sell" signal could result from a decrease in network activity coupled with negative news impacting overall market confidence. However, it’s crucial to remember that CrossX signals are not foolproof. Their accuracy is influenced by the inherent volatility of the cryptocurrency market and the potential for unexpected events.

- Different types of CrossX signals: These can range from strong buy, weak buy, neutral, weak sell, and strong sell, reflecting varying degrees of conviction.

- Historical accuracy of CrossX signals regarding Ethereum: The historical accuracy of any specific CrossX signal provider needs independent verification and analysis. Past performance is not indicative of future results.

- Factors influencing the accuracy of CrossX signals: Market volatility, major regulatory announcements, unexpected technological breakthroughs, and general macroeconomic conditions can all significantly influence the accuracy of these signals.

Institutional Accumulation of Ethereum: Evidence and Analysis

On-Chain Metrics Showing Institutional Activity

Several on-chain metrics point towards significant institutional accumulation of Ethereum. Large ETH transfers between wallets associated with institutional investors, coupled with a decrease in exchange reserves, strongly suggest that institutions are actively accumulating ETH. Analyzing the flow of ETH reveals substantial movement of large amounts of coins, often outside of publicly traded exchanges, a pattern consistent with institutional investment strategies.

Analyzing Investment Strategies

Institutions might be employing various strategies, including dollar-cost averaging (DCA) – buying consistently over time regardless of price fluctuations – and accumulating ETH in anticipation of future upgrades like Ethereum 2.0. The long-term vision of many institutional investors may be driving their sustained acquisition of ETH, anticipating growth fueled by technological improvements and increased network adoption.

- Specific examples of large ETH transactions linked to institutional investors: While specific attribution is often difficult, the sheer volume of large transactions outside of exchanges is a strong indicator.

- Analysis of exchange reserves and their implications for price: Lower exchange reserves generally suggest reduced selling pressure, which can support price appreciation.

- Discussion of Grayscale and other institutional investment vehicles: Grayscale Investments' Ethereum Trust (ETHE) is a prominent example of institutional interest in ETH, providing a measurable gauge of institutional holdings.

Factors Influencing Ethereum's Price Target

Market Sentiment and Speculation

Current market sentiment plays a crucial role. Positive news, such as successful network upgrades or increased adoption by major companies, can fuel bullish sentiment and drive price increases. Conversely, negative news or regulatory uncertainty can trigger sell-offs, potentially hindering the path to $4,000. Speculative trading also significantly impacts ETH’s price, with periods of intense speculation leading to rapid price swings.

Technological Developments and Network Upgrades

Ethereum's upcoming upgrades, particularly the transition to proof-of-stake (PoS) via Ethereum 2.0 and the implementation of sharding, are significant factors. These upgrades are expected to enhance scalability, security, and efficiency, potentially driving increased adoption and higher demand, thus influencing price appreciation.

Macroeconomic Factors and Regulatory Landscape

Global economic conditions and regulatory changes significantly influence the entire cryptocurrency market, including Ethereum. A positive macroeconomic outlook or supportive regulatory frameworks can bolster investor confidence, supporting price growth. However, negative economic shifts or stringent regulations can trigger widespread sell-offs.

- Impact of positive and negative news cycles on ETH price: Positive news often leads to short-term price surges, while negative news can cause rapid declines.

- Potential benefits of Ethereum 2.0 and its impact on price: Ethereum 2.0 is expected to significantly improve transaction speeds and reduce energy consumption, potentially making ETH more attractive to a broader range of users and investors.

- Regulatory changes in different countries and their influence: Varying regulatory stances across different jurisdictions can create uncertainty and affect investment decisions.

Is $4,000 Realistic? A Balanced Perspective

Weighing the Pros and Cons

While Ethereum CrossX signals and institutional accumulation present bullish indicators suggesting potential for significant price appreciation, it's crucial to acknowledge potential downsides. Market volatility remains a significant risk, and unforeseen events could trigger price corrections. Regulatory uncertainty continues to be a major factor globally, potentially impacting investor confidence and price movements.

Alternative Price Scenarios

Reaching $4,000 is not guaranteed. Several scenarios are possible. A sustained bull market fueled by continued institutional investment and positive technological developments could easily propel ETH to that level, while a bearish market, driven by macroeconomic factors or negative news, could significantly delay or prevent it.

- Probability of reaching $4,000 based on current analysis: Predicting price with certainty is impossible. The likelihood depends on the interplay of various factors mentioned above.

- Potential roadblocks that could prevent the price from reaching $4,000: Regulatory hurdles, a major market correction, or unexpected technological setbacks could impede progress.

- Realistic price targets based on different levels of risk tolerance: Investors should consider their own risk tolerance and set price targets accordingly, considering various scenarios.

Conclusion

Determining whether Ethereum will reach $4,000 is complex. While Ethereum CrossX signals and substantial institutional accumulation suggest bullish potential, significant risks remain. A balanced perspective acknowledging both the positive and negative influences is crucial. Ultimately, the $4,000 price target remains a possibility, but it's essential to conduct thorough research and consider various market scenarios.

Call to Action: Stay informed about Ethereum CrossX signals and the evolving landscape of institutional investment in ETH. Conduct your own research and make informed decisions based on your risk tolerance and investment goals. Stay tuned for further analysis on Ethereum CrossX signals and the potential for future price movements. [Link to a relevant cryptocurrency resource]

Featured Posts

-

Okc Thunder Vs Portland Trail Blazers March 7th Game Details Time Tv And Streaming

May 08, 2025

Okc Thunder Vs Portland Trail Blazers March 7th Game Details Time Tv And Streaming

May 08, 2025 -

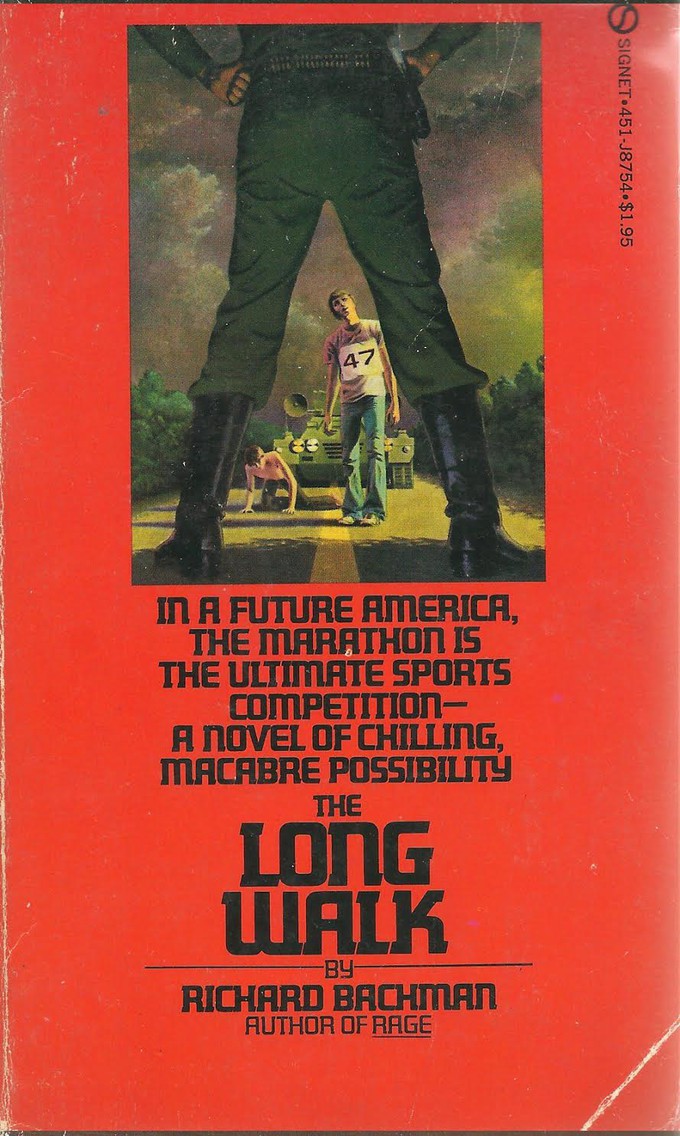

Is The The Long Walk Movie Trailer A Sign Of A Successful Stephen King Adaptation

May 08, 2025

Is The The Long Walk Movie Trailer A Sign Of A Successful Stephen King Adaptation

May 08, 2025 -

Uber Stock Uber Is It Worth The Investment

May 08, 2025

Uber Stock Uber Is It Worth The Investment

May 08, 2025 -

Miras Planlamanizda Kripto Paralarin Rolue Sifre Guevenligi Ve Varlik Koruma

May 08, 2025

Miras Planlamanizda Kripto Paralarin Rolue Sifre Guevenligi Ve Varlik Koruma

May 08, 2025 -

2025 Ptt Is Basvurulari Tarihler Sartlar Ve Basvuru Kilavuzu

May 08, 2025

2025 Ptt Is Basvurulari Tarihler Sartlar Ve Basvuru Kilavuzu

May 08, 2025