Copper's Price Increase: A Result Of China's Trade Policy

Table of Contents

China's Role as a Dominant Force in the Copper Market

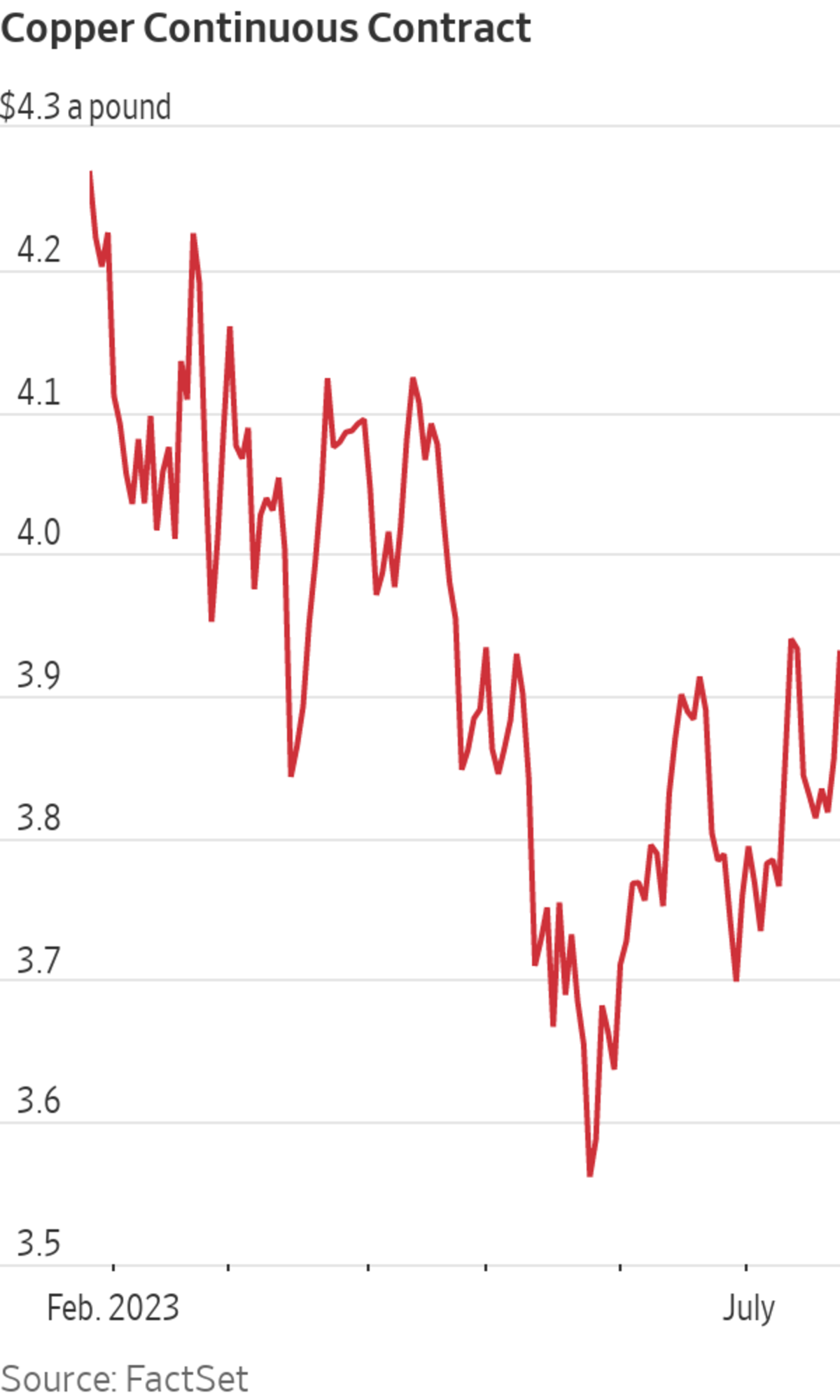

China's influence on the global copper supply is undeniable. Its massive consumption and reliance on imports make it a key player, significantly impacting the copper price forecast.

Massive Copper Consumption

China accounts for a substantial percentage of global copper consumption, driven by its robust economic growth. This demand is fueled by several key sectors:

- Increased infrastructure projects: The ongoing construction of high-speed rail networks, smart cities, and other large-scale infrastructure projects requires vast quantities of copper.

- Rapid industrialization: China's continued industrial expansion, particularly in manufacturing and technology, significantly boosts copper demand.

- Expanding renewable energy sector: The country's ambitious goals for renewable energy, particularly wind and solar power, necessitate substantial copper usage in production and grid infrastructure.

- Growing electric vehicle market: The booming electric vehicle (EV) industry in China requires significant amounts of copper for wiring, batteries, and electric motors, further fueling demand.

Import Reliance and Trade Policies

China's Chinese copper imports are substantial, making it highly vulnerable to global market fluctuations. Its trade policies play a crucial role in shaping the copper market:

- Impact of tariffs on copper imports from specific countries: Tariffs imposed on copper imports from certain nations can restrict supply and increase prices.

- Effects of quotas limiting copper supply: Import quotas can artificially limit the availability of copper, pushing prices higher.

- Strategic stockpiling policies influencing market prices: Government decisions regarding strategic copper stockpiling can significantly impact market dynamics and prices. Any changes to these policies can lead to sharp fluctuations in the copper price increase.

Impact of China's Environmental Regulations on Copper Supply

China's commitment to stricter environmental regulations is another key factor influencing the global copper supply.

Stricter Environmental Standards

China's increasingly stringent environmental standards for mining and smelting operations have resulted in a reduction of domestic copper production. This is due to:

- Closure of inefficient or polluting smelters: Outdated and environmentally damaging smelters have been shut down, directly impacting copper output.

- Increased scrutiny of mining practices: More rigorous environmental assessments and stricter mining regulations have increased operational costs and complexities.

- Higher compliance costs impacting profitability and output: The increased cost of complying with environmental regulations has squeezed the profitability of some copper producers, leading to reduced output.

Shifting Global Supply Chains

These regulations are pushing some copper production to other countries, but this shift isn't always sufficient to compensate for the reduced Chinese output. This creates new challenges:

- Increased competition for copper from other producing nations: Other copper-producing countries are now facing increased demand, potentially leading to price hikes.

- Potential bottlenecks in global logistics: Shifting supply chains can lead to logistical bottlenecks and delays, impacting delivery times and potentially increasing costs.

- Impact on transportation costs and delivery times: Increased transportation distances and potential logistical issues can add to the overall cost of copper, contributing to the copper price increase.

The Interplay Between Copper Prices and Geopolitical Factors

Geopolitical factors and market speculation further complicate the copper price forecast.

Trade Tensions and Global Uncertainty

Trade disputes and geopolitical instability introduce significant uncertainty into the copper market, fueling price volatility:

- Impact of trade wars on global copper trade flows: Trade wars can disrupt established trade routes and significantly affect copper flows.

- Effects of sanctions and political instability on copper mining operations in various countries: Political instability in copper-producing regions can disrupt mining operations and affect supply.

- Investor sentiment and its effect on copper futures prices: Investor confidence plays a crucial role, impacting speculation and influencing futures prices.

Investment in Copper Futures and Speculation

Speculation and investment in copper futures contracts amplify price fluctuations:

- How investor behavior drives price movements: Investor sentiment, driven by news and market analysis, directly impacts copper prices.

- The role of hedging strategies in shaping copper prices: Businesses using hedging strategies to mitigate risk can influence price movements.

- Influence of financial markets on commodity prices: The broader financial market climate can also significantly influence commodity prices like copper.

Conclusion

China's trade policies and environmental regulations are profoundly impacting the global copper market, leading to the current copper price increase. Understanding the interplay of consumption, import reliance, environmental regulations, and geopolitical factors is crucial for navigating this dynamic market. To stay informed about future trends and potential shifts in the copper market, continue to monitor China’s trade policies and their influence on global copper supply and copper demand. Stay updated on the latest news concerning copper price increase and its implications for your business.

Featured Posts

-

Impact Of China Us Trade Talks On Copper Market

May 06, 2025

Impact Of China Us Trade Talks On Copper Market

May 06, 2025 -

Abandoned Gold Mines Environmental Contamination And Its Consequences

May 06, 2025

Abandoned Gold Mines Environmental Contamination And Its Consequences

May 06, 2025 -

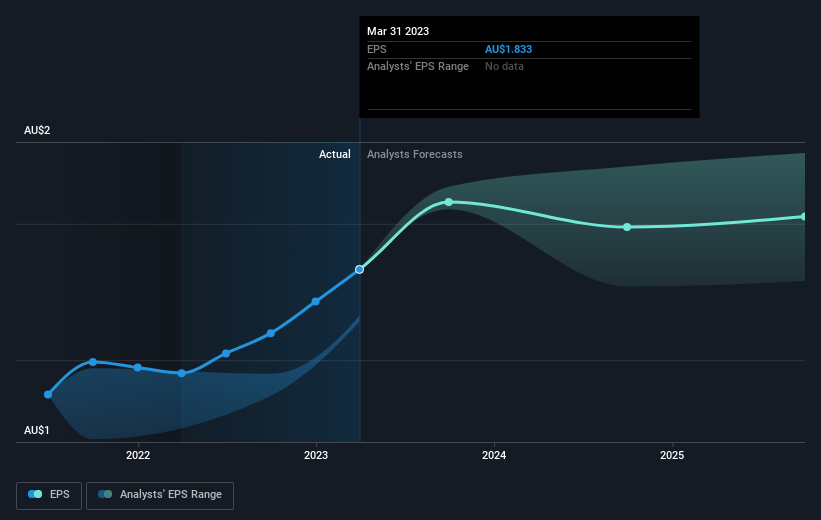

The Impact Of Margin Compression On Westpac Wbc Profitability

May 06, 2025

The Impact Of Margin Compression On Westpac Wbc Profitability

May 06, 2025 -

Venices Sinking Crisis Innovative Engineering To Raise The City Above The Tides

May 06, 2025

Venices Sinking Crisis Innovative Engineering To Raise The City Above The Tides

May 06, 2025 -

The Sex Lives Of College Girls No Season 3 Renewal After Cancellation

May 06, 2025

The Sex Lives Of College Girls No Season 3 Renewal After Cancellation

May 06, 2025

Latest Posts

-

Watch March Madness Live Streams A Guide To Cord Cutting

May 06, 2025

Watch March Madness Live Streams A Guide To Cord Cutting

May 06, 2025 -

Uchastie Aliny Voskresenskoy Iz Magnitogorska V Seriale Univer Molodye

May 06, 2025

Uchastie Aliny Voskresenskoy Iz Magnitogorska V Seriale Univer Molodye

May 06, 2025 -

Alina Voskresenskaya Rol V Novom Sezone Univer Molodye Na Tnt

May 06, 2025

Alina Voskresenskaya Rol V Novom Sezone Univer Molodye Na Tnt

May 06, 2025 -

Ugoda Nitro Chem 310 Mln Investitsiy Z S Sh A V Polschu

May 06, 2025

Ugoda Nitro Chem 310 Mln Investitsiy Z S Sh A V Polschu

May 06, 2025 -

Nba Playoffs Bracket 2025 Round 1 Tv Schedule

May 06, 2025

Nba Playoffs Bracket 2025 Round 1 Tv Schedule

May 06, 2025