Impact Of China-US Trade Talks On Copper Market

Table of Contents

China's Role as a Copper Consumption Powerhouse

China's dominance as the world's largest copper consumer profoundly influences global demand and price dynamics. Its massive infrastructure projects, encompassing sprawling construction initiatives and rapid industrial expansion, fuel an insatiable appetite for copper. This reliance significantly impacts the global copper market's equilibrium.

- Percentage of global copper consumption attributable to China: China consumes over half of the world's refined copper, a figure that continues to grow.

- Key sectors driving Chinese copper demand: Construction, manufacturing (especially electronics and automobiles), and renewable energy projects are major drivers of Chinese copper demand.

- Impact of Chinese economic growth on copper prices: Strong Chinese economic growth directly translates to increased copper demand, typically driving up prices. Conversely, economic slowdowns in China can lead to price drops.

US Influence on Global Copper Supply Chains

The United States, while not the largest consumer, plays a significant role in global copper supply chains as both a major producer and importer. US trade policies, including tariffs and import quotas, can significantly impact copper supply and global pricing.

- Major US copper mining companies and their production capacity: Companies like Freeport-McMoRan and Asarco contribute substantially to US copper production, influencing the global supply.

- Effect of US tariffs on imported copper products: Tariffs imposed by the US on imported copper products can increase costs for domestic consumers and industries, potentially impacting demand.

- Influence of US economic policies on global copper demand: US economic growth and industrial activity affect global copper demand. Strong US growth typically stimulates worldwide demand, benefiting copper producers.

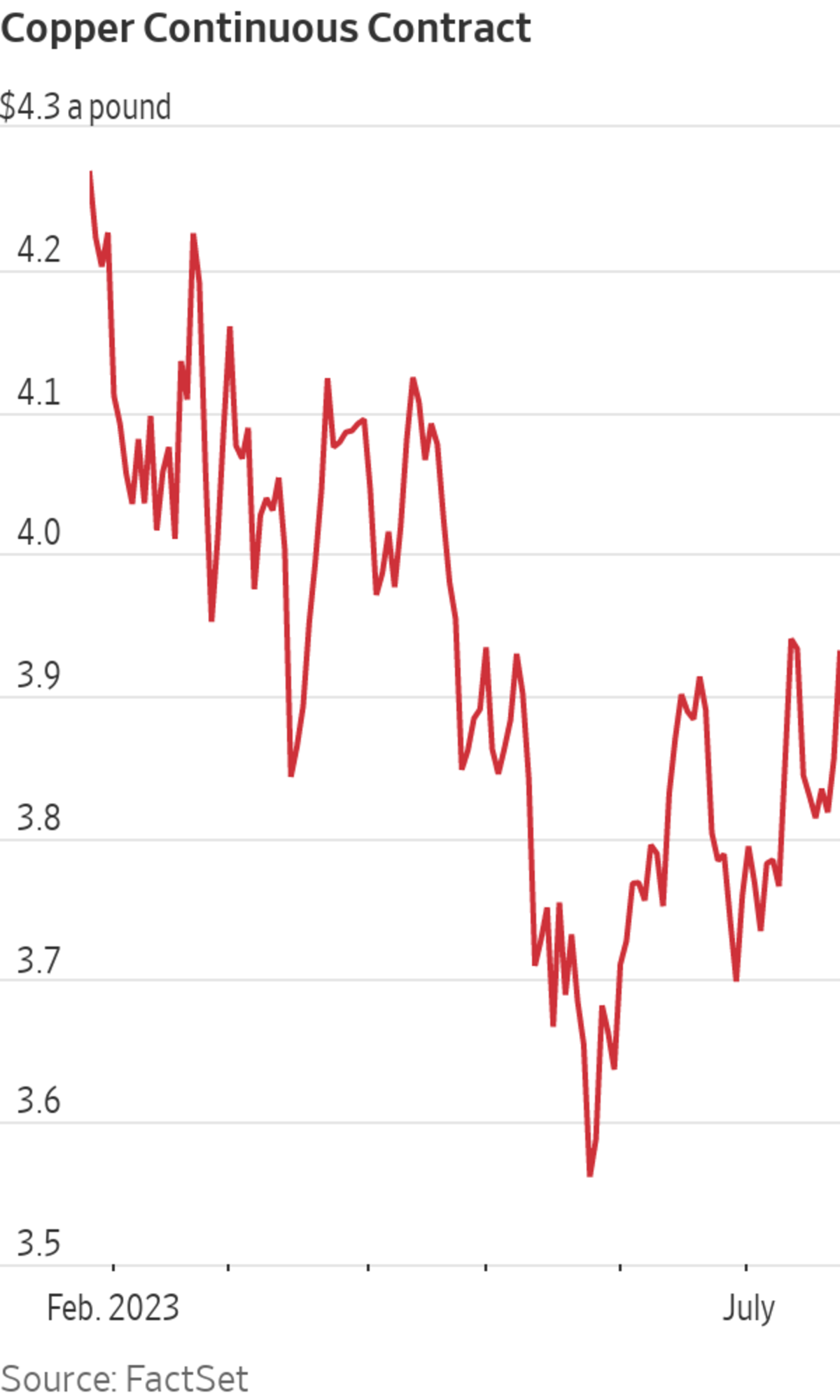

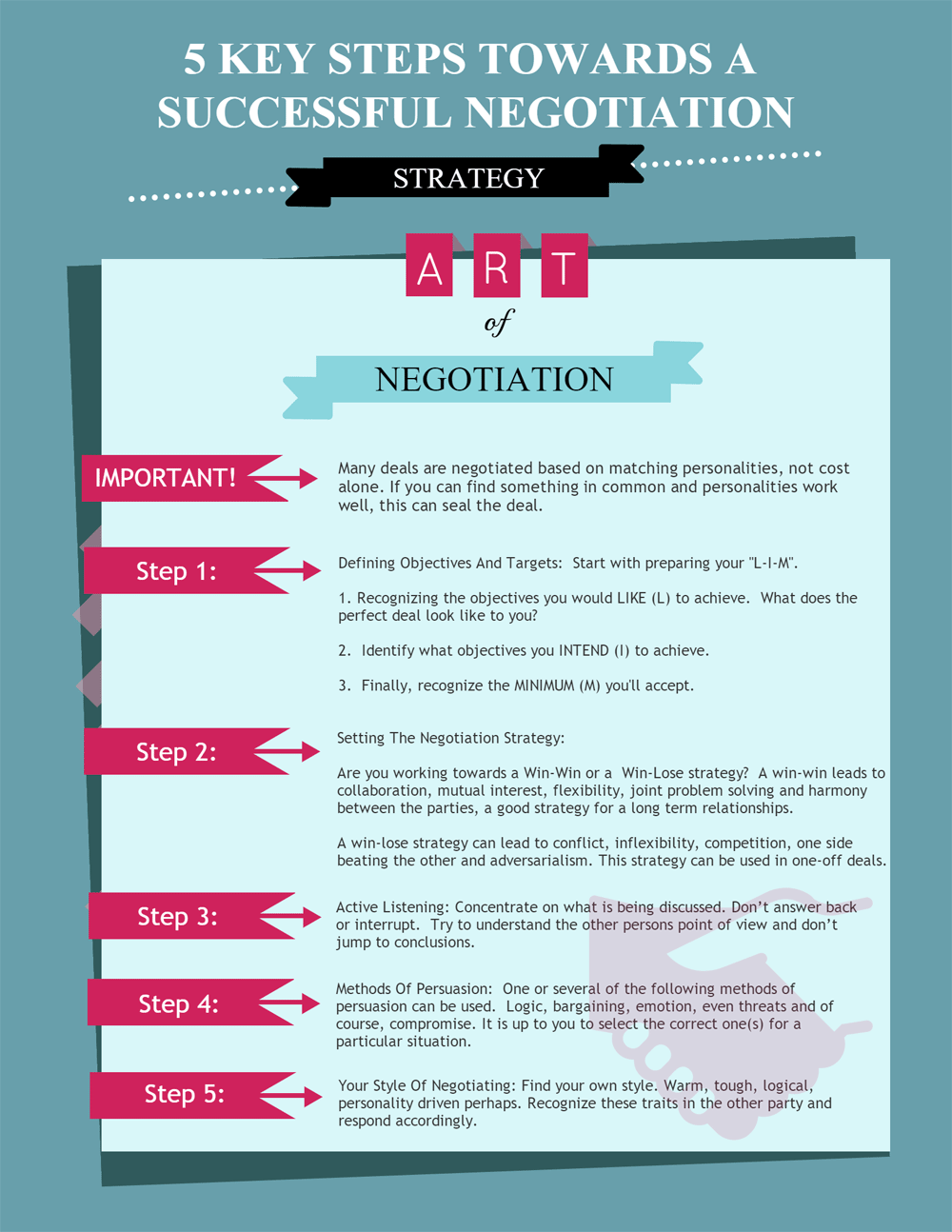

Trade War Impacts on Copper Prices

The historical relationship between China-US trade tensions and copper price volatility is undeniable. Past trade disputes have demonstrably impacted copper pricing, often leading to periods of significant uncertainty.

- Examples of past trade disputes and their impact on copper prices: Previous trade wars have shown that escalating tensions cause uncertainty, impacting investor confidence and leading to price swings.

- Analysis of price fluctuations during periods of heightened trade tension: Historical data clearly shows a correlation between increased trade friction and copper price volatility. Periods of uncertainty often result in price drops as investors become cautious.

- Mention of alternative materials and their potential substitution effect: During periods of high copper prices, alternative materials, such as aluminum, can be substituted, potentially impacting demand.

Forecasting Future Copper Market Trends Based on Trade Relations

Predicting future copper market trends requires careful consideration of the evolving China-US trade relationship. Several scenarios are plausible, each carrying different implications for copper prices.

- Predictions for copper prices based on different trade scenarios: A trade agreement could stabilize prices, whereas escalating tensions could lead to increased volatility.

- Potential impact on copper mining and processing industries: Trade policies significantly impact investment decisions in mining and processing, influencing production levels.

- Investment opportunities and risks in the copper market: The current geopolitical climate presents both significant opportunities and risks for investors in the copper market.

The Role of Speculation and Investor Sentiment

Investor sentiment and speculation play a crucial role in influencing copper prices, particularly during times of trade uncertainty. News and events surrounding trade talks can trigger rapid price fluctuations as investors react to perceived risks and opportunities. This speculative element adds further complexity to predicting copper price movements.

Conclusion: Navigating the Uncertainties – The Future of Copper and China-US Trade

The impact of China-US trade talks on the copper market is undeniable and multifaceted. China's enormous consumption and the US's position in global supply chains make the relationship between these two nations a crucial factor influencing copper prices. Monitoring the evolving trade dynamics between these economic giants is paramount for investors and stakeholders in the copper market. Stay updated on the latest China-US trade negotiations to effectively navigate the complexities of the copper market and make informed investment decisions. Understanding the intricate interplay between global trade relations and copper market dynamics is essential for successful navigation of this crucial sector.

Featured Posts

-

Jeff Goldblum And Emilie Livingstons Sons At A Football Match

May 06, 2025

Jeff Goldblum And Emilie Livingstons Sons At A Football Match

May 06, 2025 -

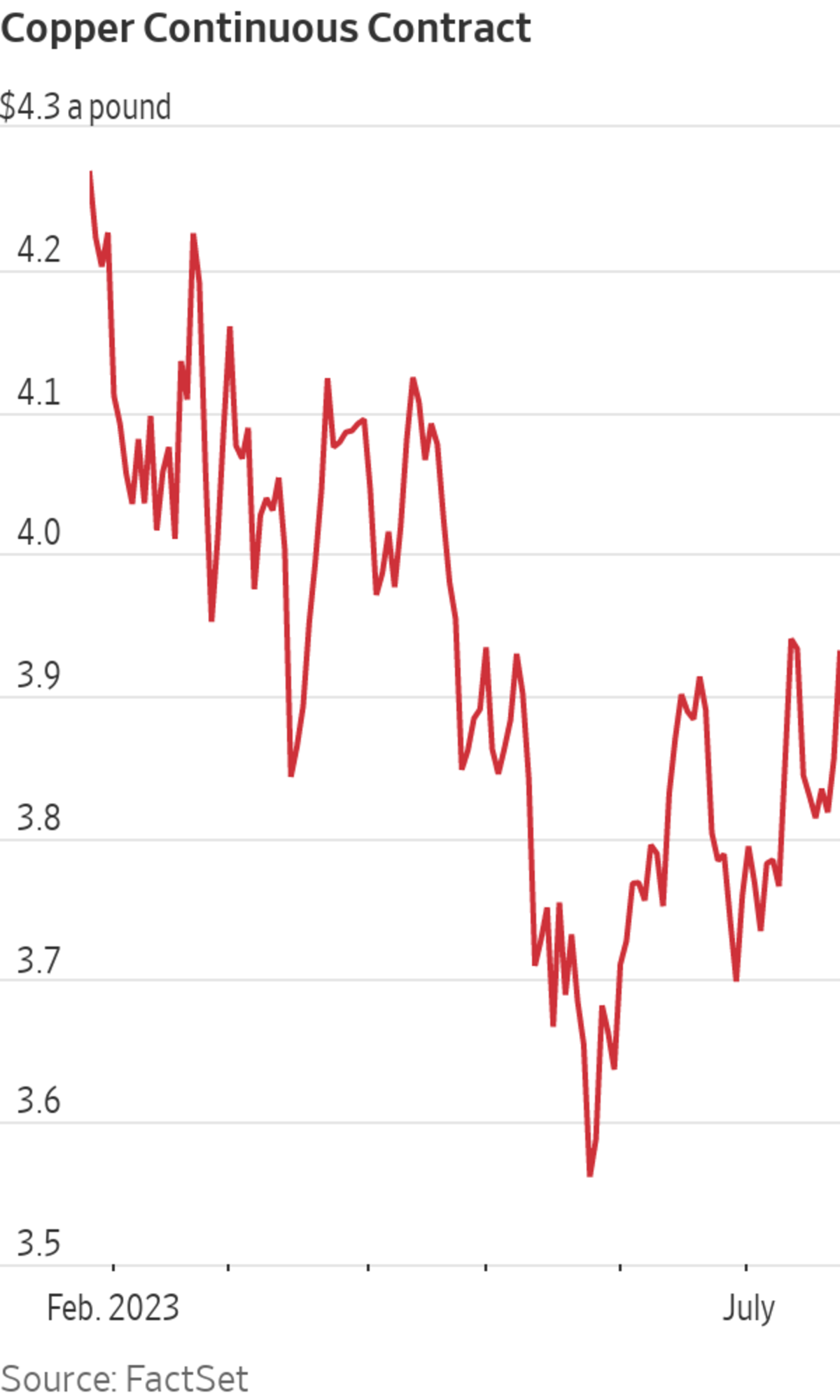

Trumps Negotiation Style Winning Strategies And Pitfalls To Avoid

May 06, 2025

Trumps Negotiation Style Winning Strategies And Pitfalls To Avoid

May 06, 2025 -

Preparation And Presentation Winning A Meeting With Donald Trump

May 06, 2025

Preparation And Presentation Winning A Meeting With Donald Trump

May 06, 2025 -

Bj Novak And Delaney Rowe A Normal Relationship

May 06, 2025

Bj Novak And Delaney Rowe A Normal Relationship

May 06, 2025 -

How To Watch The Celtics Vs Trail Blazers Game On March 23rd Time And Streaming

May 06, 2025

How To Watch The Celtics Vs Trail Blazers Game On March 23rd Time And Streaming

May 06, 2025

Latest Posts

-

Jeff Goldblum On Altering The Flys Ending A Behind The Scenes Look

May 06, 2025

Jeff Goldblum On Altering The Flys Ending A Behind The Scenes Look

May 06, 2025 -

London Welcomes Jeff Goldblum Jurassic Park Fans Turn Out In Force

May 06, 2025

London Welcomes Jeff Goldblum Jurassic Park Fans Turn Out In Force

May 06, 2025 -

Jeff Goldblums Iconic Characters An Analysis Of His Best Performances

May 06, 2025

Jeff Goldblums Iconic Characters An Analysis Of His Best Performances

May 06, 2025 -

Jurassic Parks Jeff Goldblum A London Fan Encounter

May 06, 2025

Jurassic Parks Jeff Goldblum A London Fan Encounter

May 06, 2025 -

Exploring The Career Of Jeff Goldblum His Most Memorable Roles

May 06, 2025

Exploring The Career Of Jeff Goldblum His Most Memorable Roles

May 06, 2025