Chinese Buyout Firm Weighs Sale Of Chip Tester UTAC

Table of Contents

UTAC's Significance in the Semiconductor Testing Landscape

UTAC holds a prominent position in the semiconductor testing market, offering advanced testing capabilities for a wide range of chips. Its cutting-edge technology, including [mention specific technologies if known, e.g., advanced algorithms for defect detection, high-speed testing capabilities], allows for faster and more accurate testing of complex integrated circuits. This translates to improved yields and reduced production costs for semiconductor manufacturers.

- Market Leadership: UTAC boasts a significant market share in [mention specific market segment if known, e.g., memory chip testing, logic chip testing].

- Technological Advantages: Its unique selling propositions include [mention specific advantages, e.g., higher throughput, lower failure rates, compatibility with next-generation chips].

- Key Clients: UTAC serves a diverse range of clients, including leading semiconductor manufacturers across the globe. These include [mention examples if known, e.g., major players in the memory, logic, and mobile processor markets]. This broad client base underlines UTAC's importance in the semiconductor ecosystem. The chip testing equipment provided by UTAC is crucial for ensuring the quality and reliability of modern electronics.

The Rationale Behind the Potential Sale

The decision by the Chinese buyout firm to consider selling UTAC likely stems from a confluence of factors. While the exact reasons remain undisclosed, several possibilities emerge.

- Market Conditions: Fluctuations in the semiconductor market, including potential softening demand or increased competition, might influence the firm's investment strategy.

- Financial Pressures: The buyout firm might be seeking to consolidate its investment portfolio and free up capital for other ventures. A sale could optimize its financial performance.

- Strategic Realignment: The firm may be looking to divest from less strategically aligned assets to focus on core businesses or emerging technologies. This strategic divestment could improve overall efficiency and profitability.

Potential Buyers and Implications for the Industry

Several entities could be potential acquirers of UTAC. The sale would likely attract significant interest from:

- Competitors in Chip Testing: Established players in the semiconductor testing equipment market would likely see UTAC as a strategic acquisition to expand their market share and technological capabilities.

- Semiconductor Manufacturers: Vertical integration could be a motivating factor for major semiconductor manufacturers looking to gain greater control over their supply chain and testing processes.

- Private Equity Firms: Private equity firms might be interested in acquiring UTAC for its established market position and potential for growth. This M&A activity is common in the technology sector.

The implications of the sale depend on the buyer. Acquisitions by competitors could lead to increased market consolidation and potentially affect pricing and technological innovation. Acquisition by a semiconductor manufacturer could lead to vertical integration, potentially affecting the broader semiconductor supply chain.

Geopolitical Considerations and Regulatory Scrutiny

The involvement of a Chinese buyout firm adds a layer of geopolitical complexity to the UTAC sale. Several factors come into play:

- Trade Regulations: The sale is subject to regulatory scrutiny from various governments, given the sensitive nature of semiconductor technology and national security concerns.

- National Security: Governments may examine the transaction for potential risks related to the transfer of advanced semiconductor testing technologies. This scrutiny is typical for cross-border transactions involving strategically important technologies.

- Regulatory Compliance: The buyout firm will need to navigate complex regulatory processes to ensure compliance with national and international trade laws.

The sale process is likely to face significant regulatory hurdles and geopolitical challenges.

Conclusion: The Future of UTAC and its Implications for the Semiconductor Testing Market

The potential sale of UTAC by a Chinese buyout firm marks a significant event with far-reaching consequences for the semiconductor industry. UTAC's importance as a provider of crucial chip testing equipment, the rationale behind the sale, potential buyers, and significant geopolitical implications are all key factors. The outcome will undoubtedly reshape the competitive landscape of the semiconductor testing market, influencing pricing, innovation, and industry consolidation. To stay informed about developments and future activities of the Chinese buyout firm, follow the UTAC sale closely and stay updated on semiconductor acquisitions. Learn more about Chinese investment in the chip testing market and its impact on global technology.

Featured Posts

-

Herro Takes Home 3 Point Crown Cavs Sweep Skills Challenge At Nba All Star Weekend

Apr 24, 2025

Herro Takes Home 3 Point Crown Cavs Sweep Skills Challenge At Nba All Star Weekend

Apr 24, 2025 -

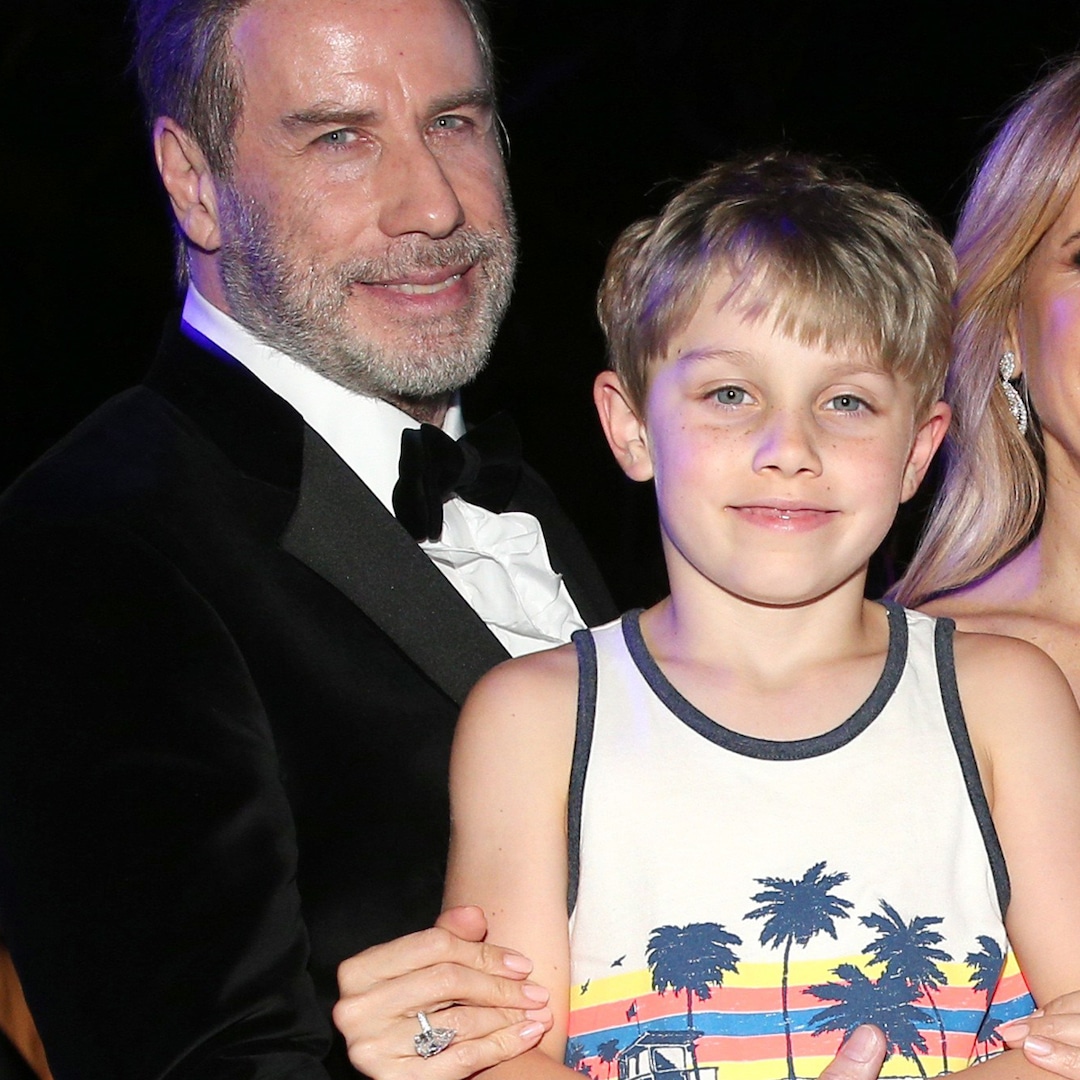

Remembering Jett Travolta John Travolta Shares Photo On His Birthday

Apr 24, 2025

Remembering Jett Travolta John Travolta Shares Photo On His Birthday

Apr 24, 2025 -

Uil State Bound Hisd Mariachis Viral Whataburger Success

Apr 24, 2025

Uil State Bound Hisd Mariachis Viral Whataburger Success

Apr 24, 2025 -

Potential Sale Of Utac Update On Chinese Buyout Firms Plans

Apr 24, 2025

Potential Sale Of Utac Update On Chinese Buyout Firms Plans

Apr 24, 2025 -

Market Reaction To Trumps Statement On Keeping Powell As Fed Chair

Apr 24, 2025

Market Reaction To Trumps Statement On Keeping Powell As Fed Chair

Apr 24, 2025