Potential Sale Of UTAC: Update On Chinese Buyout Firm's Plans

Table of Contents

The Buyout Firm: Identity and Track Record

The Chinese buyout firm spearheading the UTAC acquisition remains largely unnamed, pending official announcements. However, industry sources suggest it's a significant player with a history of strategic investments in technology and manufacturing. Understanding the investor profile is crucial to assessing the potential impact on UTAC.

- Investment History: The firm is known for its focus on undervalued assets with high growth potential, often involving operational restructuring and strategic partnerships. This suggests a potential for significant changes within UTAC's operations.

- Successful Acquisitions: Past acquisitions include [Insert Example 1 – Briefly Describe the Company & Acquisition], demonstrating a capacity for successful integration of acquired entities. Another significant acquisition was [Insert Example 2 – Briefly Describe the Company & Acquisition], which highlights their expertise in [Specific Industry Expertise].

- Financial Strength: The firm boasts substantial financial resources, signifying a capacity to finance the UTAC acquisition and subsequent investments in its growth and development. This financial backing could be crucial for UTAC's long-term success.

- Potential Conflicts of Interest: While initial assessments suggest minimal conflicts of interest, a thorough due diligence process is vital to identify and mitigate any potential issues. Regulatory scrutiny in both China and [UTAC's Country] will be crucial in this regard.

UTAC's Current Situation and Valuation

UTAC's current valuation is a key element in understanding the proposed acquisition price. The company has been experiencing [Positive or Negative Trend] in recent years, influencing its market position and attractiveness to potential buyers.

- Financial Performance: UTAC's recent financial reports show [State Key Financial Indicators: Revenue, Profit Margins, etc.]. This data, combined with market analysis, provides a clear picture of the company's financial health and overall value.

- Market Position: UTAC holds a [Strong/Weak/Niche] market position within the [Industry Sector] industry. Its competitive advantages include [List Key Advantages]. However, challenges include [List Key Challenges, e.g., increased competition, changing market demands].

- Key Assets: The company's core assets include [List Key Assets, e.g., intellectual property, manufacturing facilities, skilled workforce]. These assets are key factors in determining UTAC’s overall valuation.

- Market Trends: Current market trends, such as [Mention relevant industry trends], significantly influence UTAC’s value and future prospects.

Details of the Proposed Transaction

While specifics remain confidential, initial reports suggest a significant purchase price for UTAC. The transaction structure and completion timeline remain uncertain, pending further negotiations and regulatory approvals.

- Acquisition Price: The proposed acquisition price is estimated to be in the range of [Insert Estimated Price Range, if available, or state “undisclosed”]. The final price will depend on the outcome of the due diligence process and final negotiations.

- Transaction Structure: The transaction is expected to be structured as a [Type of Acquisition, e.g., stock purchase, asset purchase]. This choice impacts the legal and tax implications for both parties involved.

- Completion Timeline: The deal is anticipated to close within [Estimated Timeframe, e.g., the next 6-12 months], subject to regulatory approvals and the satisfaction of other conditions precedent.

- Regulatory Approvals: Securing necessary regulatory approvals, particularly in [UTAC's Country] and China, is a crucial step in the process and could potentially impact the deal’s timeline.

Potential Impact on UTAC and its Stakeholders

The UTAC acquisition will likely have significant implications for its employees, customers, and suppliers. Understanding these potential impacts is vital for stakeholders.

- Impact on Employees: Job security remains a primary concern. The buyout firm's approach to workforce integration and retention will determine the impact on UTAC's employees. Potential scenarios include restructuring, layoffs, or opportunities for career advancement.

- Impact on Customers: The acquisition could lead to improvements in product offerings, service quality, or pricing strategies. However, potential disruptions to service or changes in business relationships are also possible.

- Impact on Suppliers: Changes to supply chain management and procurement practices are likely. The buyout firm's approach to supplier relationships will determine the impact on UTAC's existing suppliers.

- Synergies and Growth: The acquisition could unlock synergies between UTAC and the buyout firm's existing portfolio of companies, leading to increased efficiency and market expansion.

Regulatory and Political Considerations

The UTAC acquisition is subject to regulatory scrutiny in multiple jurisdictions. Potential hurdles include antitrust concerns, national security reviews, and broader geopolitical factors.

- Foreign Investment Regulations: The acquisition will be subject to foreign investment regulations in both China and [UTAC's Country]. These regulations may require approvals or impose restrictions on the deal.

- China-[Country] Relations: The geopolitical relationship between China and [UTAC's Country] could influence the regulatory review process and the overall feasibility of the transaction.

- Antitrust Concerns: Antitrust regulators will assess the potential impact of the acquisition on competition within the industry, potentially requiring divestitures or other remedies.

- National Security Review: Depending on the nature of UTAC’s business and its strategic importance, national security reviews could significantly delay or even block the acquisition.

Conclusion

The potential sale of UTAC to a Chinese buyout firm presents a complex picture. The transaction's details, while still emerging, highlight significant opportunities and challenges. The final outcome depends heavily on the completion of due diligence, securing regulatory approvals, and navigating potential geopolitical complexities. The uncertainties surrounding the deal's final terms and impact on UTAC and its stakeholders remain significant.

Call to Action: Stay informed on the latest developments in the ongoing UTAC sale process. Keep checking back for updates and analysis on this significant transaction as the situation continues to unfold. Further research into the UTAC acquisition and its implications is recommended to understand the long-term effects of this Chinese buyout.

Featured Posts

-

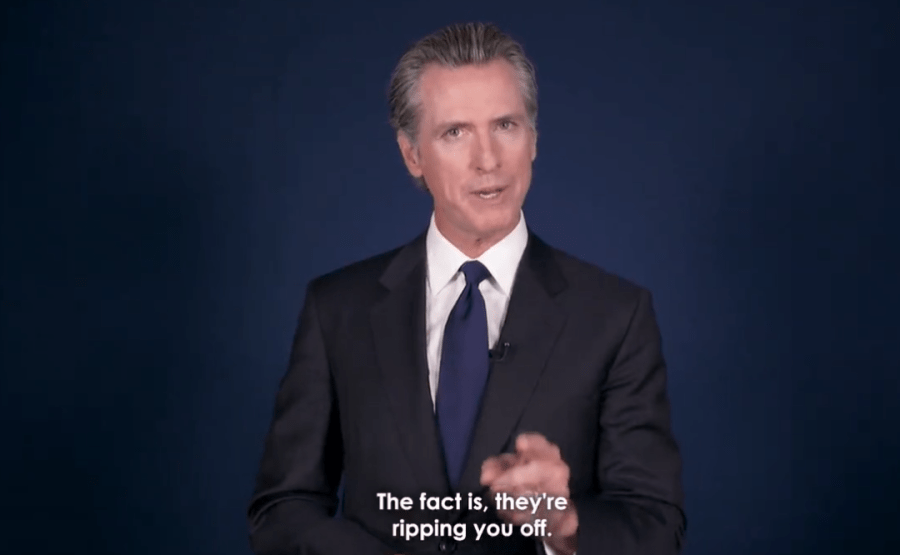

California Gas Prices Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025

California Gas Prices Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025 -

Understanding The Rally In Chinese Stocks In Hong Kong

Apr 24, 2025

Understanding The Rally In Chinese Stocks In Hong Kong

Apr 24, 2025 -

Blockchain Analysis Leader Chainalysis Integrates Ai Through Alterya Acquisition

Apr 24, 2025

Blockchain Analysis Leader Chainalysis Integrates Ai Through Alterya Acquisition

Apr 24, 2025 -

B And B Recap Thursday April 3 Liams Health Crisis And Hopes Living Arrangements

Apr 24, 2025

B And B Recap Thursday April 3 Liams Health Crisis And Hopes Living Arrangements

Apr 24, 2025 -

Google Fi 35 Unlimited A Budget Friendly Mobile Option

Apr 24, 2025

Google Fi 35 Unlimited A Budget Friendly Mobile Option

Apr 24, 2025