Market Reaction To Trump's Statement On Keeping Powell As Fed Chair

Table of Contents

Initial Market Response to the Announcement

The immediate market reaction to the news of Powell’s retention was a complex mix of relief and uncertainty. While some anticipated a more dramatic shift, the relatively muted response indicated a degree of market acceptance. Key market indices provided a mixed signal.

- Stock Market Indices: The Dow Jones Industrial Average experienced a slight increase of 0.2% immediately following the announcement, while the S&P 500 saw a more modest gain of 0.1%. The Nasdaq Composite remained relatively flat, indicating sector-specific responses to the news.

- Trading Volume: Trading volume was notably higher than the average for the day, suggesting increased investor activity driven by the announcement. This heightened volume indicated significant interest and anticipation surrounding Trump's decision.

- Sectoral Shifts: The financial sector showed some initial volatility, with a slight increase in some banking stocks and a dip in others, reflecting differing perspectives on the implications of continued Powell-led monetary policy for the banking industry.

Analysis of Investor Sentiment

Analyzing investor sentiment reveals a blend of cautious optimism and lingering uncertainty. While the absence of a drastic change at the helm of the Federal Reserve likely calmed some nerves, concerns about Powell's monetary policies persisted.

- Analyst Opinions: Many analysts viewed the retention of Powell as a sign of continuity in economic policy, which, while potentially predictable, was seen as potentially beneficial in terms of stability. However, some expressed concerns about the potential for continued interest rate hikes.

- Bond Yields: Bond yields showed a slight increase following the announcement, suggesting that investors were anticipating a continuation of Powell's relatively hawkish monetary policy stance, with expectations of further interest rate increases to combat inflation.

- Investor Behavior: There was evidence of increased investor activity in defensive sectors such as utilities and consumer staples, indicating some degree of risk aversion despite the relatively positive initial market response.

Long-Term Implications of Powell's Continued Leadership

Powell's continued leadership will likely shape the economic landscape for years to come. His approach to monetary policy will have profound effects on several key economic indicators.

- Interest Rate Trajectory: Under Powell’s continued leadership, interest rates are expected to remain on a gradual upward trajectory, albeit potentially at a slower pace than some had initially anticipated. This is predicated on efforts to control inflation without triggering a significant economic slowdown.

- Impact on Inflation: The effectiveness of Powell's policies in controlling inflation will be a crucial factor in determining the long-term economic outlook. Further rate hikes are designed to curb rising prices, but there are potential downsides to overly aggressive tightening.

- Economic Growth: The balance between controlling inflation and supporting economic growth remains a tightrope walk. Powell's policies will impact the rate of economic expansion, influencing job creation and overall economic health. A comparison with alternative scenarios, such as a more dovish Fed Chair, shows that Powell's policies, while potentially leading to slower growth, are favored to curtail inflation over the long term.

Comparison with Previous Market Reactions to Trump's Economic Decisions

Comparing this market reaction to previous responses to Trump's economic decisions provides crucial context. His pronouncements frequently caused market volatility.

- Past Economic Decisions: Past instances, such as Trump's imposition of tariffs, caused significant market fluctuations and investor uncertainty. His statements on trade often led to rapid shifts in market sentiment.

- Similarities and Differences: While some similarities exist in the level of initial market uncertainty, the muted response to Powell's retention contrasted with the more pronounced reactions to Trump's more unpredictable and disruptive policies.

- Predictability: This situation highlights that while Trump's decisions could often be unpredictable, the market is increasingly adept at anticipating the consequences and thus mitigating extreme volatility.

Conclusion

The market reaction to Trump's decision to retain Jerome Powell as Fed Chair was a complex and multifaceted event. The initial response was relatively subdued, with a mix of positive and negative indicators. Investor sentiment reflected a blend of relief and continued uncertainty regarding future monetary policy. The long-term implications of Powell’s continued leadership are significant and will impact interest rates, inflation, and economic growth for years to come. Comparing this reaction to past instances of Trump's economic policy reveals a pattern of initially heightened volatility followed by a relatively steady adjustment in the market. To stay informed about the evolving market reaction to Trump's decision and the implications of Powell's continued leadership of the Federal Reserve, subscribe to our newsletter and follow our analysis on the latest economic developments.

Featured Posts

-

From Bathroom Banter To Broadcast Ai Digest For Scatological Document Analysis

Apr 24, 2025

From Bathroom Banter To Broadcast Ai Digest For Scatological Document Analysis

Apr 24, 2025 -

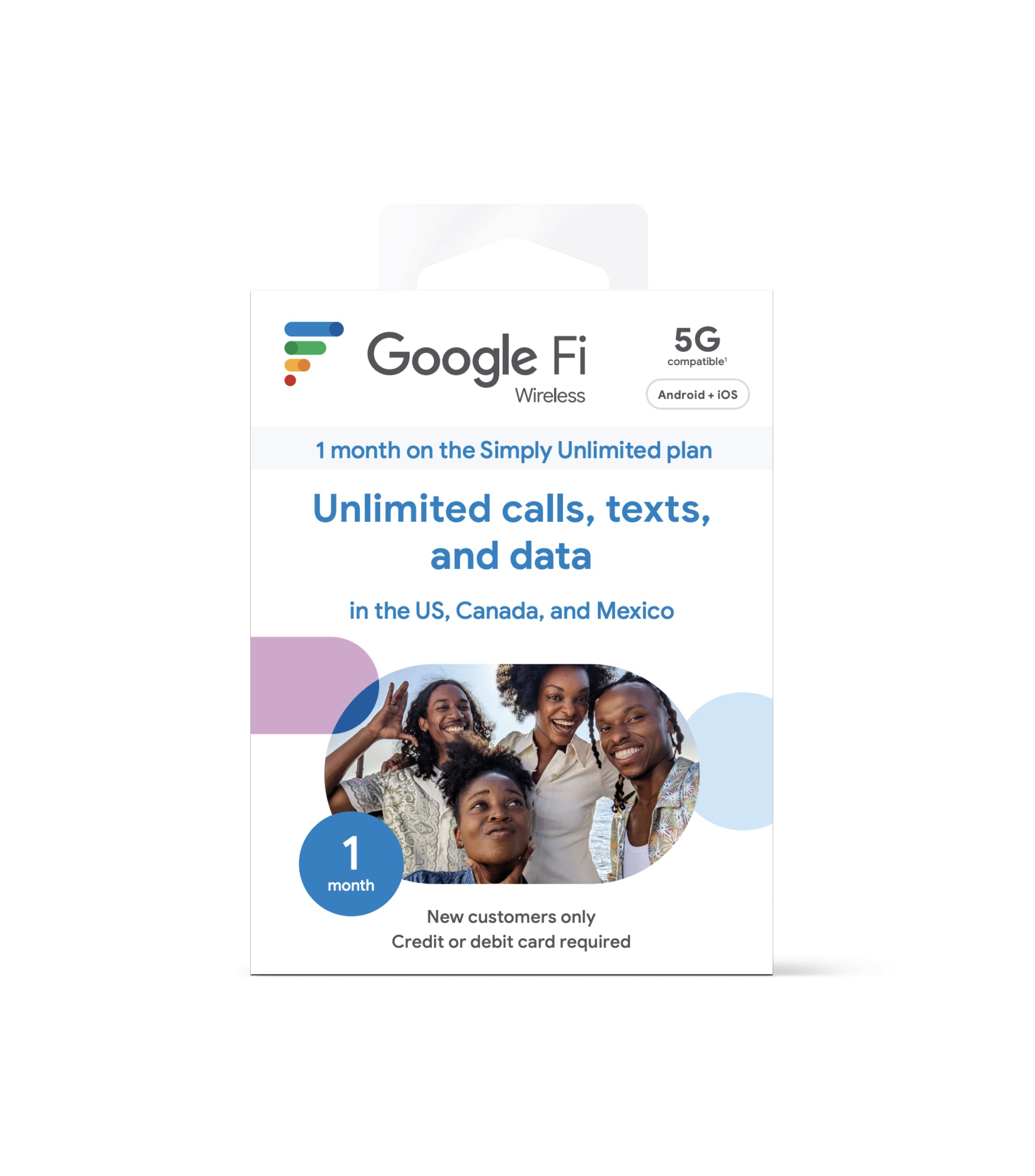

Understanding Google Fis New 35 Unlimited Plan

Apr 24, 2025

Understanding Google Fis New 35 Unlimited Plan

Apr 24, 2025 -

U S Border Patrol Sees Fewer Apprehensions At Canada U S Border White House Data

Apr 24, 2025

U S Border Patrol Sees Fewer Apprehensions At Canada U S Border White House Data

Apr 24, 2025 -

All Star Weekend Herros 3 Pointer Triumph And Cavs Skills Challenge Domination

Apr 24, 2025

All Star Weekend Herros 3 Pointer Triumph And Cavs Skills Challenge Domination

Apr 24, 2025 -

Deportation Flights A New Revenue Stream For A Startup Airline

Apr 24, 2025

Deportation Flights A New Revenue Stream For A Startup Airline

Apr 24, 2025