Cheap Doesn't Mean Bad: A Guide To Smart Spending

Table of Contents

Identifying Your Needs vs. Wants

Before diving into specific savings strategies, it's crucial to understand the difference between your needs and wants. This fundamental distinction is the cornerstone of effective budget-friendly living.

Differentiating Essential and Non-Essential Spending

Differentiating between needs and wants is the first step towards smart spending. Needs are essential for survival and well-being, while wants are desirable but not necessary.

-

Needs: These are the essentials for your daily life. Examples include:

- Housing (rent or mortgage)

- Food

- Transportation (car payments, public transport)

- Utilities (electricity, water, gas)

- Healthcare

- Clothing (basic necessities)

-

Wants: These are items or services that enhance your life but aren't essential. Examples include:

- Luxury items (designer clothing, expensive electronics)

- Eating out frequently

- Entertainment (movies, concerts)

- Travel (vacations)

- Subscriptions (streaming services, gym memberships)

Identifying unnecessary spending habits requires self-awareness and careful tracking. Helpful techniques include:

- Tracking expenses: Using a budgeting app or spreadsheet to monitor your spending provides a clear picture of where your money goes.

- Budgeting apps: Many free and paid apps simplify expense tracking and budgeting, offering insights into your spending habits.

Setting a Realistic Budget

Once you’ve identified your needs and wants, it’s time to create a realistic budget. A budget is a roadmap for your finances, allowing you to allocate funds effectively.

-

Methods for budgeting:

- 50/30/20 rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-based budgeting: Assign every dollar of your income to a specific category, ensuring all your income is accounted for.

-

Resources for budget planning:

- Budgeting templates: Numerous free budgeting templates are available online to help you organize your finances.

- Financial calculators: Online calculators can assist with debt repayment planning, savings calculations, and other financial goals.

Finding Cheap Alternatives Without Compromising Quality

Smart spending doesn't mean sacrificing quality; it means finding cost-effective choices without compromising on value.

Utilizing Comparison Shopping Tools

Comparison shopping is a powerful tool for finding the best deals. Price comparison websites and apps allow you to compare prices from multiple retailers simultaneously.

- Examples of popular comparison shopping tools: Google Shopping, PriceGrabber, Shopzilla.

- Tips for effective comparison shopping:

- Check reviews: Read customer reviews to assess product quality and reliability before making a purchase.

- Consider shipping costs: Factor in shipping fees when comparing prices, as they can significantly impact the final cost.

Exploring Secondhand Markets

The secondhand market offers incredible opportunities for smart spending. Buying used items can save you significant money on various goods.

-

Tips for finding quality used goods:

- Inspect items carefully: Thoroughly examine used items before purchasing to ensure they are in good condition.

- Negotiate prices: Don't be afraid to negotiate prices, especially when buying from individual sellers.

-

Examples of items that are often cost-effective to buy secondhand:

- Clothing

- Furniture

- Books

- Electronics

- Sporting goods

Taking Advantage of Sales and Discounts

Planning your purchases strategically around sales and discounts can save you a substantial amount of money.

-

Strategies for finding sales and discounts:

- Couponing: Utilize coupons and discount codes to reduce the cost of your purchases.

- Loyalty programs: Sign up for loyalty programs to earn points or discounts on future purchases.

- Email subscriptions: Subscribe to email newsletters from your favorite retailers to receive notifications about sales and promotions.

-

Examples of sales events: Black Friday, Cyber Monday, seasonal clearance sales.

Smart Spending in Different Life Areas

Applying smart spending principles to various aspects of your life can yield significant savings.

Grocery Shopping on a Budget

Grocery shopping is a major expense; adopting smart strategies can dramatically reduce your food bill.

- Strategies for reducing food waste: Plan your meals, store food properly, and use leftovers creatively.

- Examples of budget-friendly meal ideas: Soups, stews, pasta dishes, and one-pot meals.

Cost-Effective Entertainment and Leisure

Entertainment doesn't have to break the bank. Numerous affordable options can provide enjoyment without emptying your wallet.

- Examples of free or low-cost activities: Hiking, visiting parks, attending free community events, having picnics.

- Tips for saving money on travel: Travel during the off-season, consider alternative accommodations (Airbnb), utilize public transportation.

Saving on Bills and Utilities

Reducing your monthly bills can free up significant funds for other priorities.

- Tips for lowering energy bills: Use energy-efficient appliances, turn off lights when leaving a room, unplug electronics when not in use.

- Strategies for finding cheaper internet or phone plans: Compare plans from different providers, negotiate with your current provider, consider bundling services.

Conclusion

Smart spending is not about deprivation; it's about making conscious choices to maximize your financial resources. By differentiating needs from wants, finding cheap alternatives, and implementing budget-friendly strategies in various areas of your life, you can achieve significant savings without sacrificing quality. Remember, a little planning and mindful spending can go a long way. Start your journey to smart spending today and discover how "cheap" can actually mean "smart!" For more helpful budgeting tools and resources, visit [link to a relevant resource].

Featured Posts

-

Ddg Unleashes Dont Take My Son Diss Track Full Lyrics And Analysis

May 06, 2025

Ddg Unleashes Dont Take My Son Diss Track Full Lyrics And Analysis

May 06, 2025 -

Investing In Growth Identifying The Countrys Top Business Locations

May 06, 2025

Investing In Growth Identifying The Countrys Top Business Locations

May 06, 2025 -

Australian Election Potential Market Upswing For Assets

May 06, 2025

Australian Election Potential Market Upswing For Assets

May 06, 2025 -

Ddgs New Song Takes Aim At Halle Bailey The Dont Take My Son Controversy

May 06, 2025

Ddgs New Song Takes Aim At Halle Bailey The Dont Take My Son Controversy

May 06, 2025 -

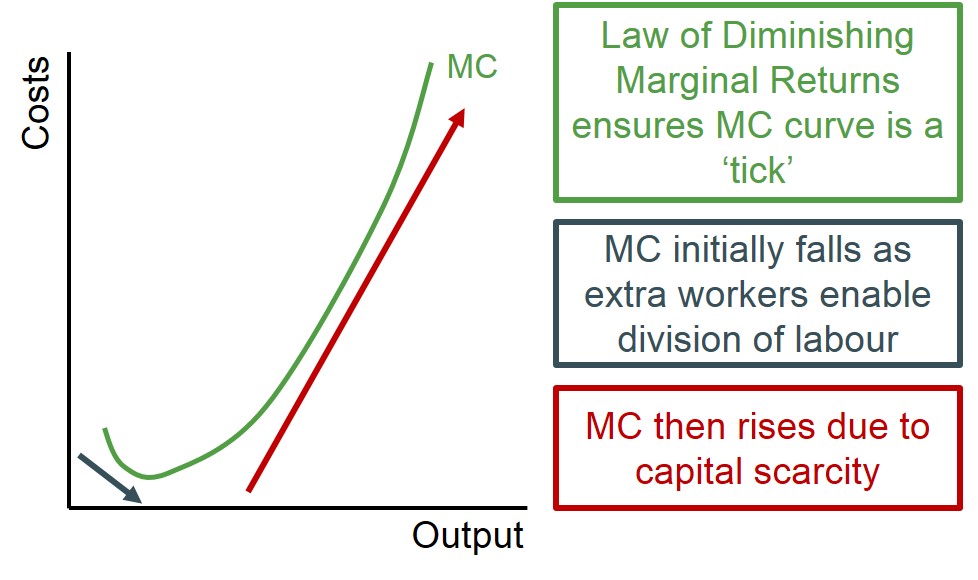

Diminishing Returns For Westpac Wbc The Impact Of Shrinking Margins

May 06, 2025

Diminishing Returns For Westpac Wbc The Impact Of Shrinking Margins

May 06, 2025

Latest Posts

-

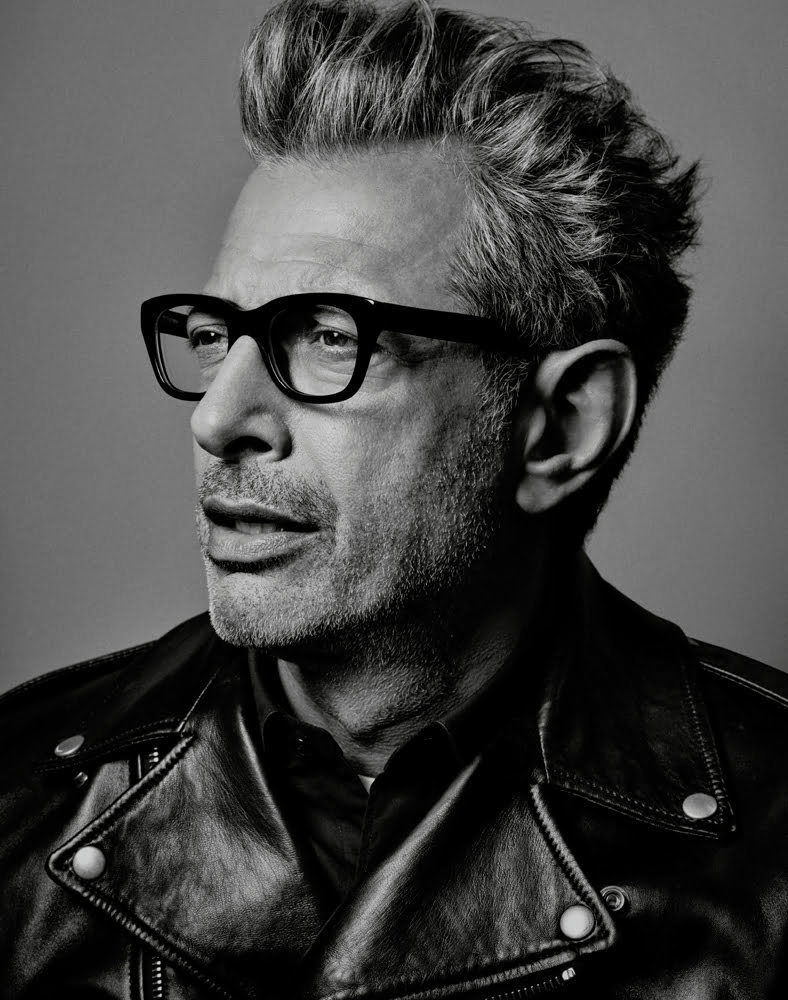

Jeff Goldblums New Album A Surprise Release

May 06, 2025

Jeff Goldblums New Album A Surprise Release

May 06, 2025 -

The Fly Jeff Goldblum Discusses His Idea For An Alternate Ending

May 06, 2025

The Fly Jeff Goldblum Discusses His Idea For An Alternate Ending

May 06, 2025 -

Jeff Goldblum On Altering The Flys Ending A Behind The Scenes Look

May 06, 2025

Jeff Goldblum On Altering The Flys Ending A Behind The Scenes Look

May 06, 2025 -

London Welcomes Jeff Goldblum Jurassic Park Fans Turn Out In Force

May 06, 2025

London Welcomes Jeff Goldblum Jurassic Park Fans Turn Out In Force

May 06, 2025 -

Jeff Goldblums Iconic Characters An Analysis Of His Best Performances

May 06, 2025

Jeff Goldblums Iconic Characters An Analysis Of His Best Performances

May 06, 2025