Australian Election: Potential Market Upswing For Assets

Table of Contents

The upcoming Australian election is generating considerable buzz, particularly regarding its potential impact on the Australian market and asset values. This article explores how various election outcomes could influence different asset classes, providing insights for investors navigating this period of uncertainty. We will delve into the potential upswing for various assets and offer considerations for strategic investment planning in the post-election landscape. Understanding the potential market upswing for assets is crucial for informed investment decisions.

Impact of Coalition Win on Asset Markets

A Coalition victory is generally anticipated to maintain the current economic trajectory.

Potential for Continued Economic Stability

A Coalition government typically prioritizes fiscal conservatism and economic stability. This could lead to:

- Continued low interest rates: Maintaining a stable interest rate environment is conducive to business investment and consumer spending.

- Positive business confidence: Consistent policies and a focus on deregulation can boost investor confidence and stimulate economic activity.

- Stable infrastructure spending: While perhaps not as expansive as Labor's proposals, continued investment in infrastructure projects would support related industries.

Historically, the ASX 200 has shown relatively stable growth under Coalition governments, although this is not guaranteed and depends on numerous economic factors. Specific policy proposals like targeted tax cuts for businesses could further stimulate the ASX 200 and other market indices.

Sector-Specific Opportunities

Several sectors could experience significant growth under a Coalition government:

- Resources: Continued focus on resource extraction and export could benefit mining companies and related businesses.

- Construction: Ongoing infrastructure projects, albeit at a potentially more measured pace than under Labor, would sustain demand in the construction sector.

Specific companies within these sectors, whose performance is linked to government policy and infrastructure spending, represent potential investment opportunities. Careful analysis of individual company performance and projections is vital before making any investment decisions.

Impact of Labor Win on Asset Markets

A Labor government is expected to implement more expansive social and economic policies.

Potential for Increased Government Spending and Investment

A Labor win could significantly increase government spending on:

- Infrastructure: Large-scale infrastructure projects would create jobs and stimulate economic growth.

- Social programs: Increased spending on social welfare and services could boost consumer spending, but might also lead to inflationary pressures.

This increased spending could lead to:

- Higher inflation: Increased demand could outpace supply, leading to price increases.

- Rising interest rates: The Reserve Bank of Australia (RBA) may respond to rising inflation by increasing interest rates.

- Impact on the Australian dollar: Increased government spending could affect the exchange rate.

Focus on Renewable Energy and Green Technologies

A Labor government's emphasis on renewable energy and climate change action could benefit:

- Renewable energy companies: Significant investments in renewable energy infrastructure and technologies are likely.

- Green technology companies: Companies involved in developing and implementing sustainable technologies could experience substantial growth.

Policy initiatives aimed at promoting renewable energy and reducing carbon emissions would be key drivers of this sector's performance.

Managing Risk and Uncertainty in the Post-Election Market

Regardless of the election outcome, managing risk is paramount.

Diversification Strategies

To mitigate risk, investors should diversify their portfolios across various asset classes:

- Shares: Exposure to different sectors and market caps is crucial.

- Property: Real estate can offer a hedge against inflation and provide rental income.

- Bonds: Fixed-income securities can provide stability and income during market volatility.

- Alternative investments: Consideration of alternative investments can further diversify risk.

Importance of Long-Term Investment Strategies

Maintaining a long-term investment horizon is crucial:

- Set financial goals: Clearly defined financial goals will guide investment decisions.

- Stick to your investment plan: Avoid impulsive reactions to short-term market fluctuations.

- Regularly review your portfolio: Periodic review ensures your portfolio remains aligned with your goals.

Conclusion

The Australian election significantly impacts asset markets. A Coalition victory may lead to continued economic stability, while a Labor win could boost specific sectors like renewable energy. Regardless of the outcome, diversification and a long-term investment strategy are crucial for navigating the post-election market. Understanding the potential market upswing for assets following the Australian election is vital for informed investment decisions. Contact us today to discuss your investment strategy and explore opportunities to leverage the potential upswing in the Australian market. Let's analyze your portfolio and prepare for a successful post-election financial future.

Featured Posts

-

Nba Playoffs Game 1 Knicks Vs Celtics Predictions And Best Bets

May 06, 2025

Nba Playoffs Game 1 Knicks Vs Celtics Predictions And Best Bets

May 06, 2025 -

Venices Sinking Crisis Innovative Engineering To Raise The City Above The Tides

May 06, 2025

Venices Sinking Crisis Innovative Engineering To Raise The City Above The Tides

May 06, 2025 -

Romanias Presidential Runoff What To Expect

May 06, 2025

Romanias Presidential Runoff What To Expect

May 06, 2025 -

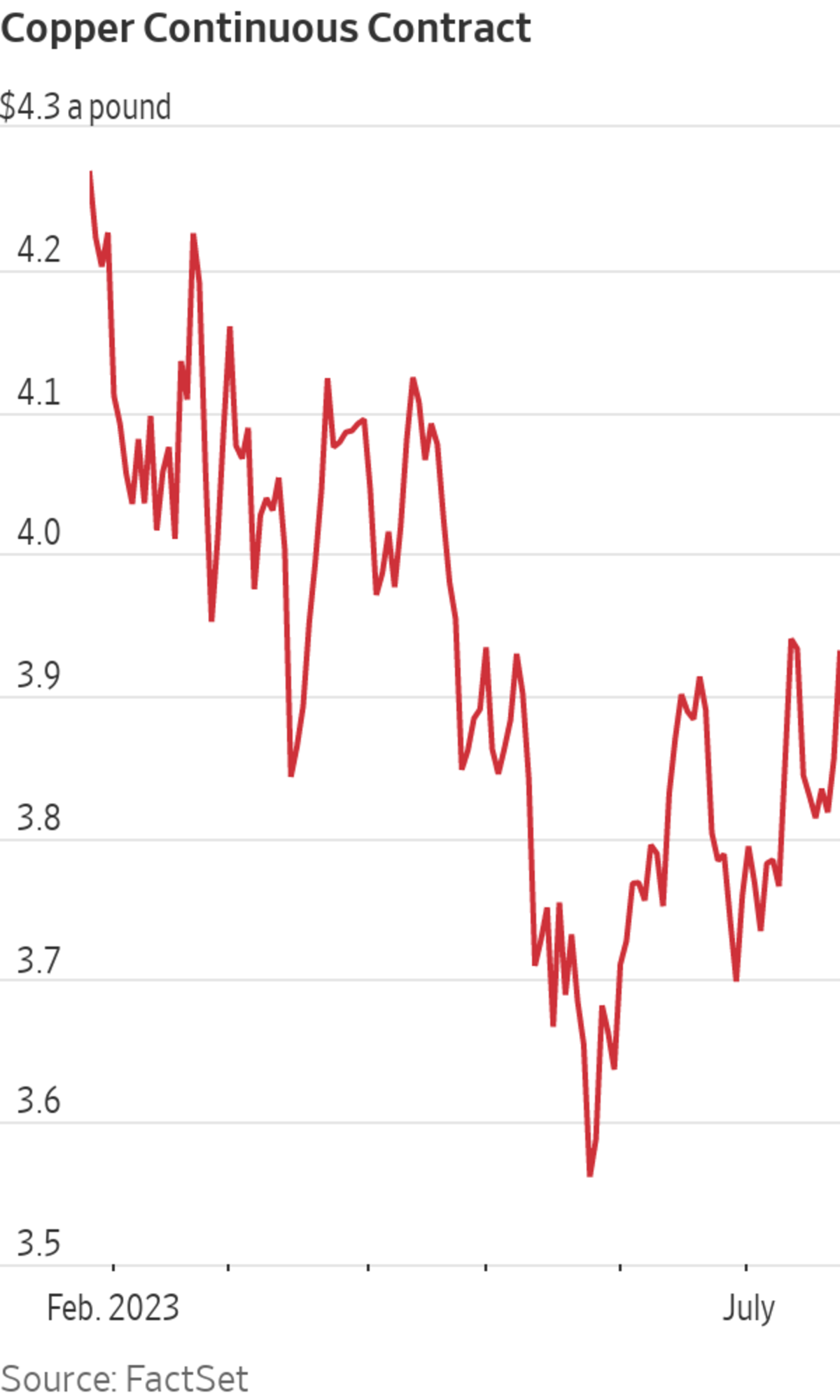

Impact Of China Us Trade Talks On Copper Market

May 06, 2025

Impact Of China Us Trade Talks On Copper Market

May 06, 2025 -

The Rise And Fall And Rise Of Us Manufacturing Under Trumps Tariffs

May 06, 2025

The Rise And Fall And Rise Of Us Manufacturing Under Trumps Tariffs

May 06, 2025

Latest Posts

-

Priyanka Chopras Early Career Her Mother Shares Insights On Industry Hardships

May 06, 2025

Priyanka Chopras Early Career Her Mother Shares Insights On Industry Hardships

May 06, 2025 -

When Is The Nike Hyperice Hyperboot Releasing A Look At Potential Launch Dates

May 06, 2025

When Is The Nike Hyperice Hyperboot Releasing A Look At Potential Launch Dates

May 06, 2025 -

Nikes New Fitness Line With Kim Kardashians Skims What To Expect

May 06, 2025

Nikes New Fitness Line With Kim Kardashians Skims What To Expect

May 06, 2025 -

Priyanka Chopras Mother Reveals Industry Challenges Faced By The Actress

May 06, 2025

Priyanka Chopras Mother Reveals Industry Challenges Faced By The Actress

May 06, 2025 -

The Future Of Fitness Nike And Skims Partner On New Brand

May 06, 2025

The Future Of Fitness Nike And Skims Partner On New Brand

May 06, 2025