Diminishing Returns For Westpac (WBC): The Impact Of Shrinking Margins

Table of Contents

Analysis of Westpac's Net Interest Margin (NIM) Decline

Factors Contributing to NIM Compression

Westpac's shrinking margins are a result of several interconnected factors impacting its net interest margin. These include:

- Intensified Competition: The Australian banking sector is highly competitive, with major players like the Commonwealth Bank, ANZ, and NAB vying for market share. This fierce competition leads to pressure on lending rates and deposit rates, squeezing NIMs.

- Rise of Fintech Disruptors: The emergence of fintech companies and digital banking solutions offers consumers alternative financial services, often with lower fees and greater convenience. This increased competition further erodes Westpac's traditional revenue streams.

- Regulatory Burden: Stringent regulatory changes and increased compliance costs significantly impact profitability. Banks are required to allocate substantial resources to meet these requirements, putting pressure on margins.

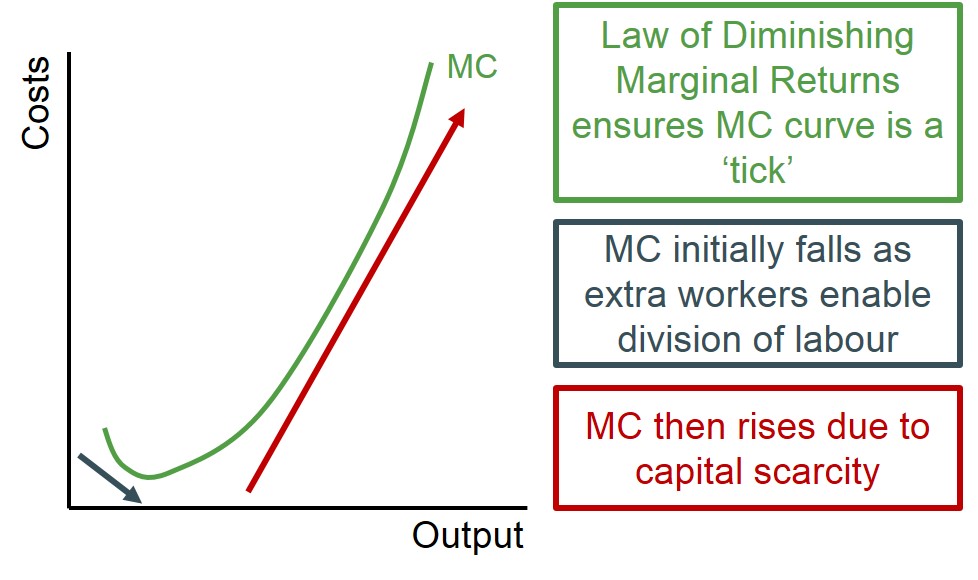

- Low Interest Rate Environment: The prolonged period of low interest rates implemented by the Reserve Bank of Australia has directly impacted lending profitability. Lower interest rates translate to reduced returns on loans, directly affecting the NIM.

- Escalating Operational Costs: Rising operational costs, including technology investments, staffing expenses, and infrastructure upgrades, also contribute to the compression of Westpac's NIM.

Impact of NIM Decline on Revenue

The reduction in Westpac's NIM has had a direct and substantial impact on its overall revenue. While precise figures fluctuate quarterly, a sustained decrease in NIM translates to a lower return on assets and reduced overall profitability. For instance, a 0.1% decrease in NIM can significantly impact overall revenue given the scale of Westpac's operations. The potential for further NIM compression poses a considerable risk to future revenue generation, requiring proactive strategic responses from the bank. A strong correlation exists between NIM and Westpac's share price, with declining NIMs often leading to downward pressure on the stock.

The Impact on Westpac's Profitability and Shareholder Returns

Decreased Earnings Per Share (EPS)

Shrinking margins directly translate to a decline in Westpac's earnings per share (EPS). Lower profitability means less profit is available to be distributed among shareholders. Analyzing the trend of Westpac's EPS over the past few years reveals a clear downward trajectory, lagging behind the performance of some competitors. This decreased EPS negatively impacts investor returns and can affect the overall market valuation of the bank.

Reduced Dividend Payouts

As profitability diminishes, Westpac may be forced to reduce dividend payouts to shareholders. Lower dividend payments can negatively impact investor sentiment and lead to a sell-off of shares, further impacting the share price. The decision to reduce dividends is a critical one, balancing the needs of shareholders with the requirement for the bank to maintain a strong capital position.

Strategic Responses to Diminishing Returns

Westpac is actively implementing strategies to mitigate the impact of shrinking margins. These include:

- Cost-Cutting Measures: Streamlining operations, reducing redundancies, and optimizing resource allocation are vital strategies to improve efficiency and reduce expenses.

- Market Diversification: Expanding into new market segments and exploring new revenue streams helps to reduce reliance on traditional lending activities.

- Digital Transformation: Investing in technology and enhancing digital platforms improves operational efficiency, customer experience, and cost management.

The effectiveness of these strategies will be crucial in determining Westpac's future profitability and ability to compete in a challenging market environment.

Future Outlook for Westpac and Its Margins

Projected NIM Trends

Industry analysts offer varied projections regarding Westpac's future NIM. Some predict a continued, albeit gradual, decline, while others foresee a stabilization or even slight improvement depending on macroeconomic factors and the success of Westpac's strategic initiatives. Potential risks include further interest rate cuts, heightened competition, and unforeseen economic downturns. Opportunities for improvement, however, exist in enhancing operational efficiency and expanding into higher-margin segments.

Opportunities for Improvement

Westpac can improve profitability by:

- Operational Efficiency: Optimizing processes, reducing overhead, and implementing advanced technologies can significantly impact costs.

- Targeted Marketing Campaigns: Reaching specific customer segments with tailored products and services can improve revenue generation.

- Strategic Partnerships: Collaborating with other businesses can open up new revenue streams and enhance the customer value proposition.

Investor Implications

Investors considering Westpac should carefully weigh the current challenges related to Westpac shrinking margins against the bank's ongoing strategic initiatives. Monitoring key financial indicators like NIM, EPS, and dividend payouts is crucial for making informed investment decisions.

Conclusion: Navigating the Challenges of Westpac Shrinking Margins

Westpac shrinking margins present a significant challenge to the bank's financial performance. Intensified competition, regulatory pressures, and a low-interest-rate environment have all contributed to the decline in profitability. While Westpac is actively implementing strategies to mitigate these challenges, investors need to carefully consider the risks and opportunities involved. Staying informed about Westpac's performance, monitoring key financial indicators, and following financial news for updates on the Australian banking sector is crucial for understanding the ongoing implications of Westpac shrinking margins and making sound investment choices. Maintain vigilance in tracking NIM and EPS to make the most informed investment decisions regarding Westpac.

Featured Posts

-

Nintendos Action Ryujinx Switch Emulator Development Ends

May 06, 2025

Nintendos Action Ryujinx Switch Emulator Development Ends

May 06, 2025 -

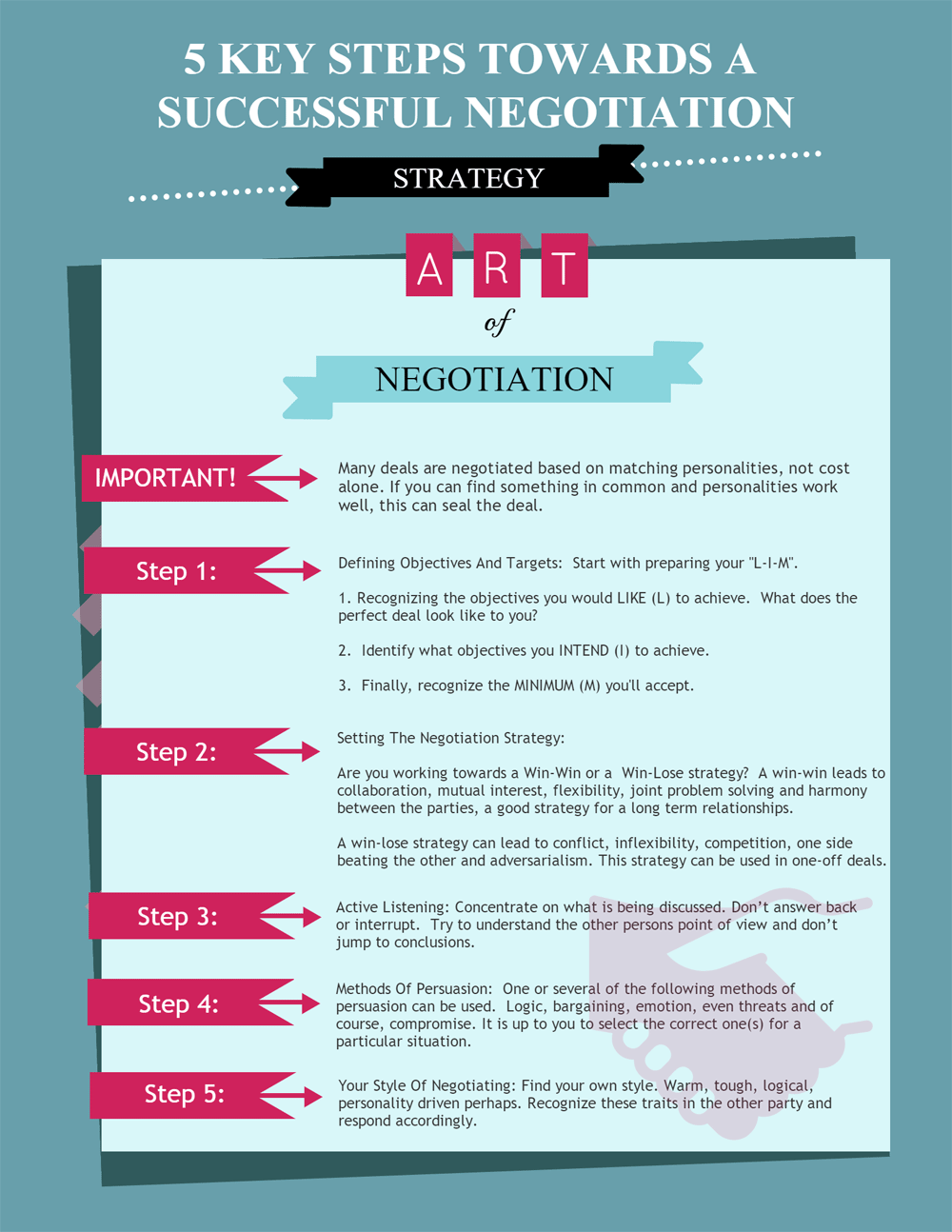

Trumps Negotiation Style Winning Strategies And Pitfalls To Avoid

May 06, 2025

Trumps Negotiation Style Winning Strategies And Pitfalls To Avoid

May 06, 2025 -

Buffetts Apple Investment What We Can Learn About Successful Stock Picking

May 06, 2025

Buffetts Apple Investment What We Can Learn About Successful Stock Picking

May 06, 2025 -

Hos Kokmuyor Ama Itibari Zedelemedi Basari Oeykuesue

May 06, 2025

Hos Kokmuyor Ama Itibari Zedelemedi Basari Oeykuesue

May 06, 2025 -

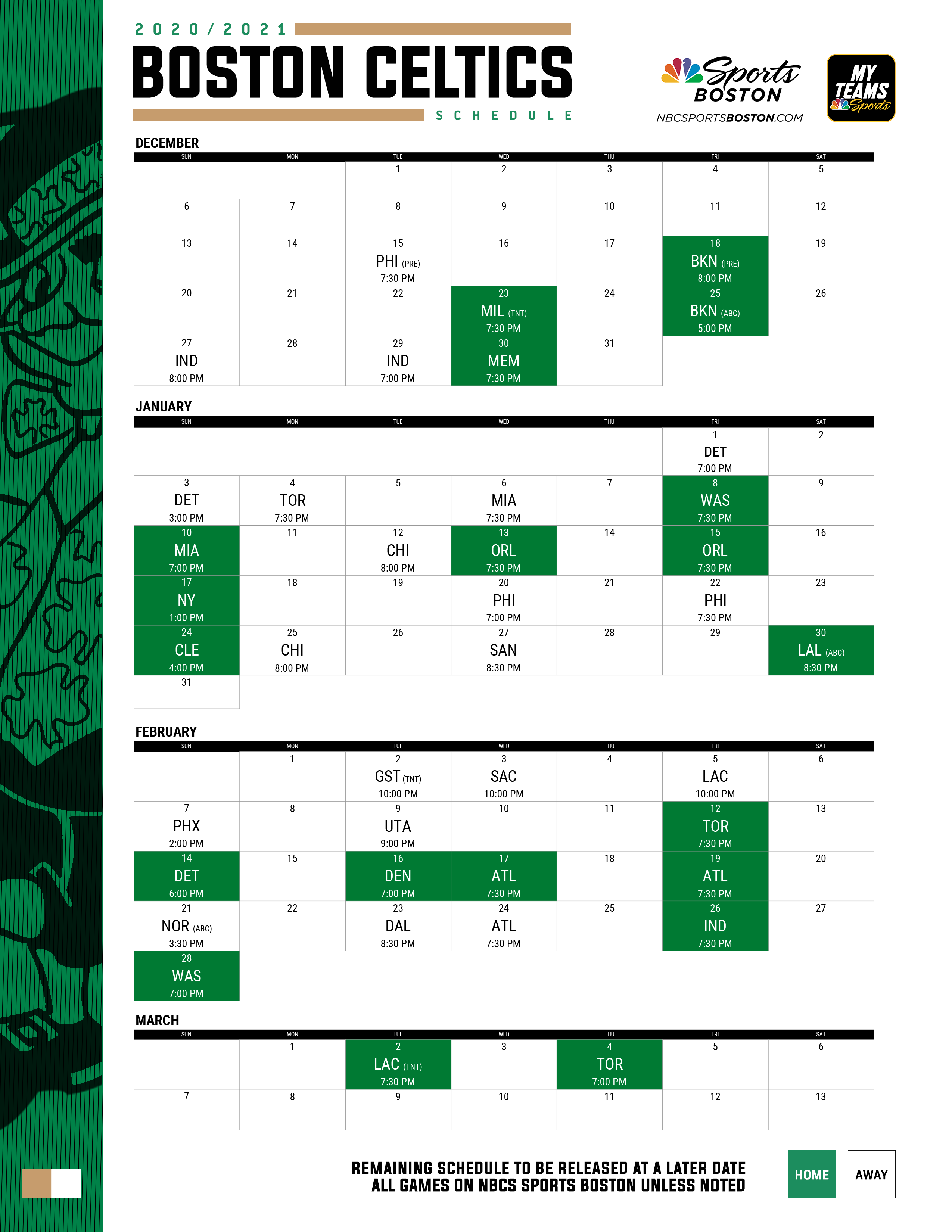

Celtics Vs Magic Playoff Schedule Full Dates And Times

May 06, 2025

Celtics Vs Magic Playoff Schedule Full Dates And Times

May 06, 2025

Latest Posts

-

Unexpected Snl Guest Sabrina Carpenter And A Fun Size Friend

May 06, 2025

Unexpected Snl Guest Sabrina Carpenter And A Fun Size Friend

May 06, 2025 -

Snl Sabrina Carpenter Teams Up With Fun Size Castmate

May 06, 2025

Snl Sabrina Carpenter Teams Up With Fun Size Castmate

May 06, 2025 -

Unexpected Snl Appearance Sabrina Carpenter And A Familiar Face

May 06, 2025

Unexpected Snl Appearance Sabrina Carpenter And A Familiar Face

May 06, 2025 -

Sabrina Carpenter Joins Quinta Brunson For A Hilarious Snl Moment

May 06, 2025

Sabrina Carpenter Joins Quinta Brunson For A Hilarious Snl Moment

May 06, 2025 -

Sabrina Carpenters Surprise Snl Cameo Quinta Brunsons Short Monologue

May 06, 2025

Sabrina Carpenters Surprise Snl Cameo Quinta Brunsons Short Monologue

May 06, 2025