BRB's Acquisition Of Banco Master: A Public-Private Fusion To Challenge Brazilian Banking Giants

Table of Contents

Understanding the Players: BRB and Banco Master

To understand the impact of this acquisition, we must first examine the key players involved.

BRB (Banco de Brasília): BRB, or Banco de Brasília, is a prominent bank in Brazil with a strong history rooted in the capital city. Its public ownership, backed by the government of Brasília, provides significant financial stability and a wide-reaching network. BRB's strengths lie in its established infrastructure, loyal customer base, and access to government resources. This provides a solid foundation for expansion and ambitious growth strategies. Key strengths include:

- Strong government backing and financial stability.

- Extensive branch network in Brasília and surrounding areas.

- Established customer base and brand recognition.

- Access to government initiatives and partnerships.

Banco Master: Banco Master, while smaller than BRB, occupies a specific niche in the market, often catering to a particular segment of clients or offering specialized financial products. This niche expertise can complement BRB's existing services. Understanding Banco Master's strengths and weaknesses is crucial to analyzing the acquisition's potential success. Important aspects to consider include:

- Specific market niche and target clientele.

- Existing technological infrastructure and capabilities.

- Strength of its client relationships and customer loyalty.

- Potential synergies with BRB's operations and services.

Synergies and Strategic Rationale: The acquisition's strategic rationale lies in the synergistic potential between the two banks. BRB gains access to Banco Master's specialized expertise and client base, while Banco Master benefits from BRB's extensive resources and established infrastructure. Expected synergies include:

- Expanded market reach and customer base.

- Access to new technologies and innovative financial products.

- Improved operational efficiency and cost savings.

- Strengthened competitive positioning in the Brazilian banking market.

The Public-Private Partnership Model: Advantages and Challenges

BRB's acquisition of Banco Master highlights the complexities and potential of the public-private partnership model in banking.

Advantages: This model offers several benefits:

- Increased capital injection and financial resources.

- Access to private sector expertise and innovation.

- Enhanced market reach and competitive advantage.

- Potential for technological advancements and improved services.

Challenges: However, public-private partnerships in banking also present challenges:

- Potential conflicts of interest between public and private objectives.

- Regulatory hurdles and compliance requirements.

- Potential for political influence and criticisms regarding transparency.

- Balancing the needs of public service with profit maximization.

Government Involvement: The Brazilian government's role in this acquisition is significant, and its influence will shape the future trajectory of both banks and potentially the entire banking sector. The government's involvement includes:

- Regulatory oversight and approval processes.

- Potential financial support and guarantees.

- Influence on strategic decisions and policy direction.

Impact on the Brazilian Banking Market: Competition and Consumer Effects

BRB's acquisition of Banco Master is poised to significantly impact the Brazilian banking market.

Increased Competition: The merger intensifies competition amongst established Brazilian banking giants, potentially leading to:

- Lower fees and more competitive interest rates.

- Improved customer service and broader access to financial services.

- Innovation in banking products and technologies.

Consumer Impact: Consumers could experience both benefits and potential drawbacks:

- Increased access to banking services and wider product choices.

- Potentially lower costs and more attractive interest rates.

- The need to adapt to new systems and processes.

Market Share and Growth: The acquisition is likely to increase BRB's market share significantly, impacting the overall competitive landscape and growth prospects within the Brazilian banking sector. This could lead to:

- Consolidation of the banking sector.

- New opportunities for smaller banks to specialize and thrive.

- Shift in market power dynamics.

Future Outlook: Sustainability and Long-Term Implications

The long-term success of this merger depends on several factors.

Long-Term Growth Strategy: BRB's post-acquisition strategy will determine its long-term sustainability. Key aspects include:

- Strategic expansion plans and market penetration strategies.

- Focus on innovation and technological advancements.

- Customer retention and acquisition strategies.

Technological Advancements: The merger can accelerate technological innovation within the Brazilian banking sector:

- Implementation of new digital banking solutions.

- Improved online and mobile banking services.

- Enhancements in data analytics and customer relationship management.

Regulatory Scrutiny and Compliance: BRB will face regulatory scrutiny to ensure compliance with Brazilian banking regulations. This includes:

- Maintaining transparency and ethical conduct.

- Meeting stringent capital requirements and financial stability standards.

- Adhering to all relevant consumer protection laws.

Conclusion: BRB's Acquisition of Banco Master – A Game Changer?

BRB's acquisition of Banco Master represents a significant development in the Brazilian banking sector. The public-private partnership model presents both advantages and challenges. While it promises increased competition, technological advancements, and broader access to financial services, potential regulatory hurdles and the need for transparency must be carefully addressed. The long-term impact will depend on BRB's strategic vision, its ability to integrate Banco Master effectively, and its commitment to delivering improved services to consumers. Stay informed about the ongoing developments related to BRB's Acquisition of Banco Master and its impact on Brazilian banking. Further research into the topic and discussion of its implications are crucial for understanding its ultimate effect on the Brazilian economy.

Featured Posts

-

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme Avrupa Piyasalari Guenluek Raporu 16 Nisan 2025

May 24, 2025

Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme Avrupa Piyasalari Guenluek Raporu 16 Nisan 2025

May 24, 2025 -

Planned M62 Closure Westbound Resurfacing Between Manchester And Warrington

May 24, 2025

Planned M62 Closure Westbound Resurfacing Between Manchester And Warrington

May 24, 2025 -

Mueze Sergilerinde Porsche 956 Nin Havada Asili Olmasinin Anlami

May 24, 2025

Mueze Sergilerinde Porsche 956 Nin Havada Asili Olmasinin Anlami

May 24, 2025 -

Frances National Rally Le Pens Sunday Demonstration Falls Short Of Expected Show Of Force

May 24, 2025

Frances National Rally Le Pens Sunday Demonstration Falls Short Of Expected Show Of Force

May 24, 2025

Latest Posts

-

How Alix Earle Became Gen Zs Top Influencer On Dancing With The Stars

May 24, 2025

How Alix Earle Became Gen Zs Top Influencer On Dancing With The Stars

May 24, 2025 -

The Nfls War On Butts How The Tush Push Won

May 24, 2025

The Nfls War On Butts How The Tush Push Won

May 24, 2025 -

The Nfls Tush Push A Celebratory History Of The Butt Focused Play

May 24, 2025

The Nfls Tush Push A Celebratory History Of The Butt Focused Play

May 24, 2025 -

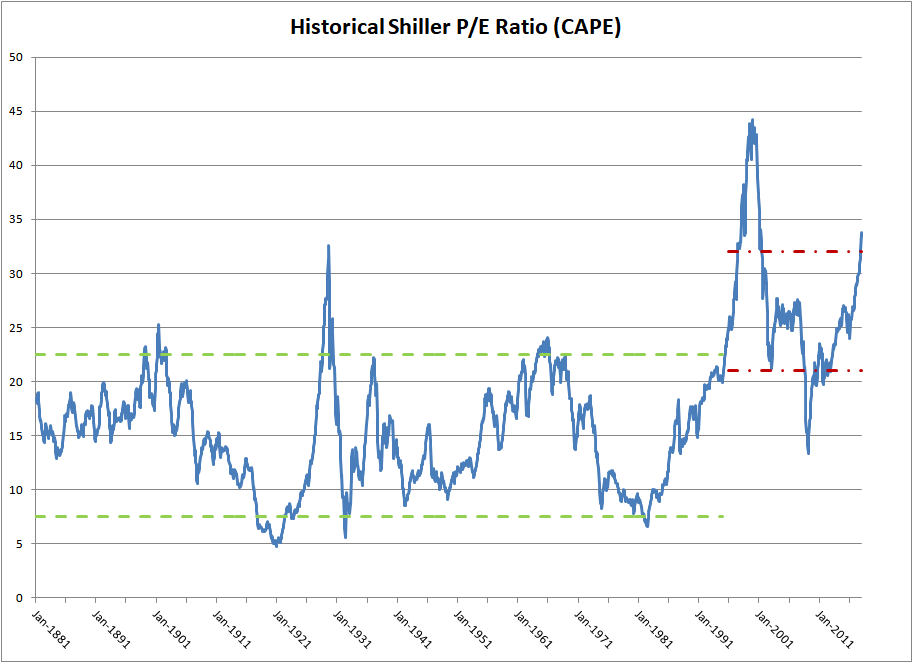

Should Investors Worry About High Stock Market Valuations Bof As Take

May 24, 2025

Should Investors Worry About High Stock Market Valuations Bof As Take

May 24, 2025 -

Bof As View Why Stretched Stock Market Valuations Shouldnt Deter Investors

May 24, 2025

Bof As View Why Stretched Stock Market Valuations Shouldnt Deter Investors

May 24, 2025