Is BigBear.ai Holdings, Inc. (NYSE: BBAI) A Top Penny Stock To Watch?

Table of Contents

BigBear.ai's Business Model and Financial Performance

BigBear.ai (BBAI) operates in the rapidly expanding field of artificial intelligence (AI) and data analytics, providing advanced solutions to both government and commercial clients. Understanding its BBAI revenue streams and growth potential is crucial for any potential investor.

Revenue Streams and Growth Potential

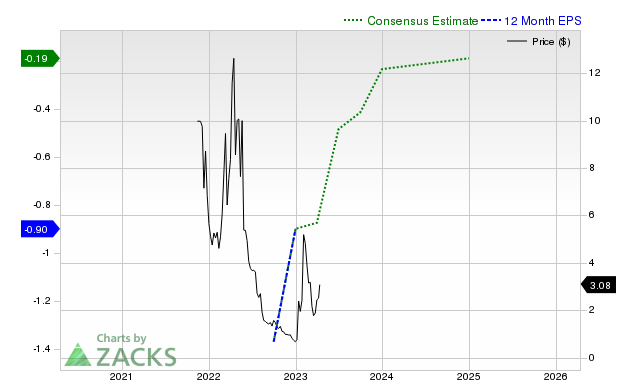

BBAI's revenue primarily stems from government contracts, particularly within the defense and intelligence sectors, and increasingly from commercial clients seeking sophisticated AI-driven solutions. Analyzing the BBAI revenue growth trajectory requires examining historical data and projected forecasts, which are readily available through financial news sources and SEC filings.

- Breakdown of revenue segments: A precise breakdown of revenue from government vs. commercial sources is vital for gauging diversification and long-term stability. This information can usually be found in the company's quarterly and annual reports.

- Analysis of year-over-year revenue growth: Examining the percentage change in BBAI revenue year-over-year provides insights into the company's growth rate and potential for future expansion. Look for consistent growth or signs of acceleration.

- Recent major contracts or partnerships: Landmark deals significantly impact BBAI's financial outlook. Identifying and analyzing these contracts provides a clearer picture of future revenue streams.

- Assessment of profitability (or lack thereof): BBAI’s profitability, or lack thereof, is critical. Look at metrics like gross margin, operating margin, and net income to understand its financial health.

Competitive Landscape and Market Position

The AI and data analytics sector is fiercely competitive. Understanding BBAI's market position relative to its rivals is essential.

Key Competitors and Market Share

BigBear.ai faces competition from established giants and emerging players in the AI and data analytics space. Identifying these key competitors and assessing BBAI's market share is crucial.

- List of key competitors (with brief descriptions): This list should include companies offering similar services and technologies to BBAI, highlighting their strengths and market presence.

- Discussion of BBAI's unique selling points (USP): What differentiates BBAI from its competitors? Are its AI algorithms superior? Does it possess unique access to data or specialized expertise? These are critical questions to answer.

- Analysis of BBAI's market share and growth potential relative to competitors: Analyzing BBAI's market share and its potential for growth compared to competitors will reveal its competitive strength and future prospects.

Risk Factors Associated with Investing in BBAI

Investing in BBAI, like any penny stock, involves significant risks. Thorough risk assessment is paramount.

Volatility and Penny Stock Risks

Penny stocks, by their nature, are highly volatile. Price swings can be dramatic, leading to substantial gains or losses in short periods.

Financial Risks and Company-Specific Risks

Beyond the inherent volatility of penny stocks, BBAI faces specific financial and operational risks.

- Explanation of high volatility and its implications for investors: Understand how price fluctuations can dramatically impact your investment.

- Discussion of BBAI's debt-to-equity ratio: A high debt-to-equity ratio suggests increased financial risk.

- Mention of any potential legal or regulatory issues: Legal battles or regulatory hurdles can severely impact the company's performance.

- Analysis of the company's management team and their track record: A strong and experienced management team is crucial for navigating the challenges of a volatile market.

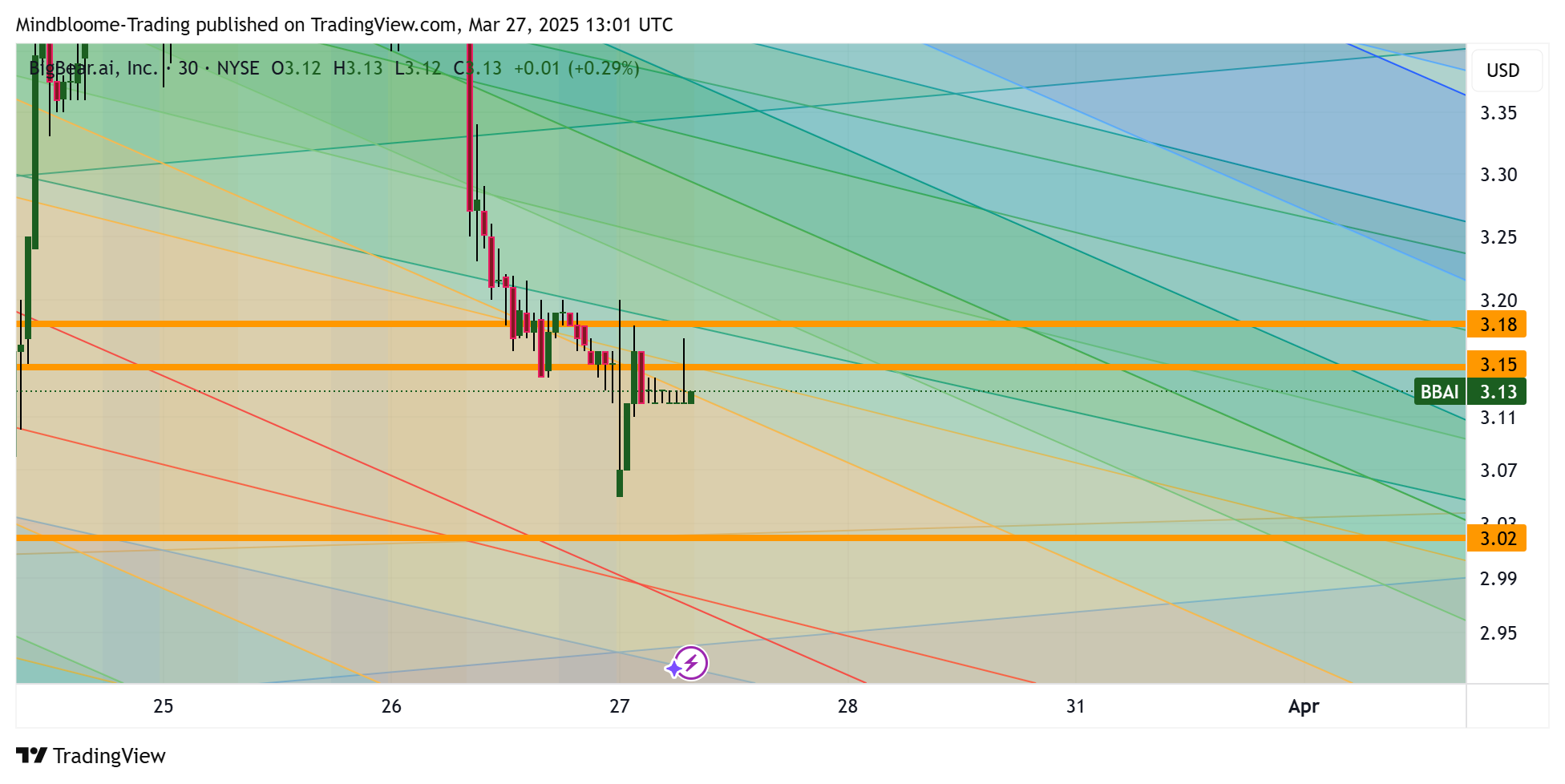

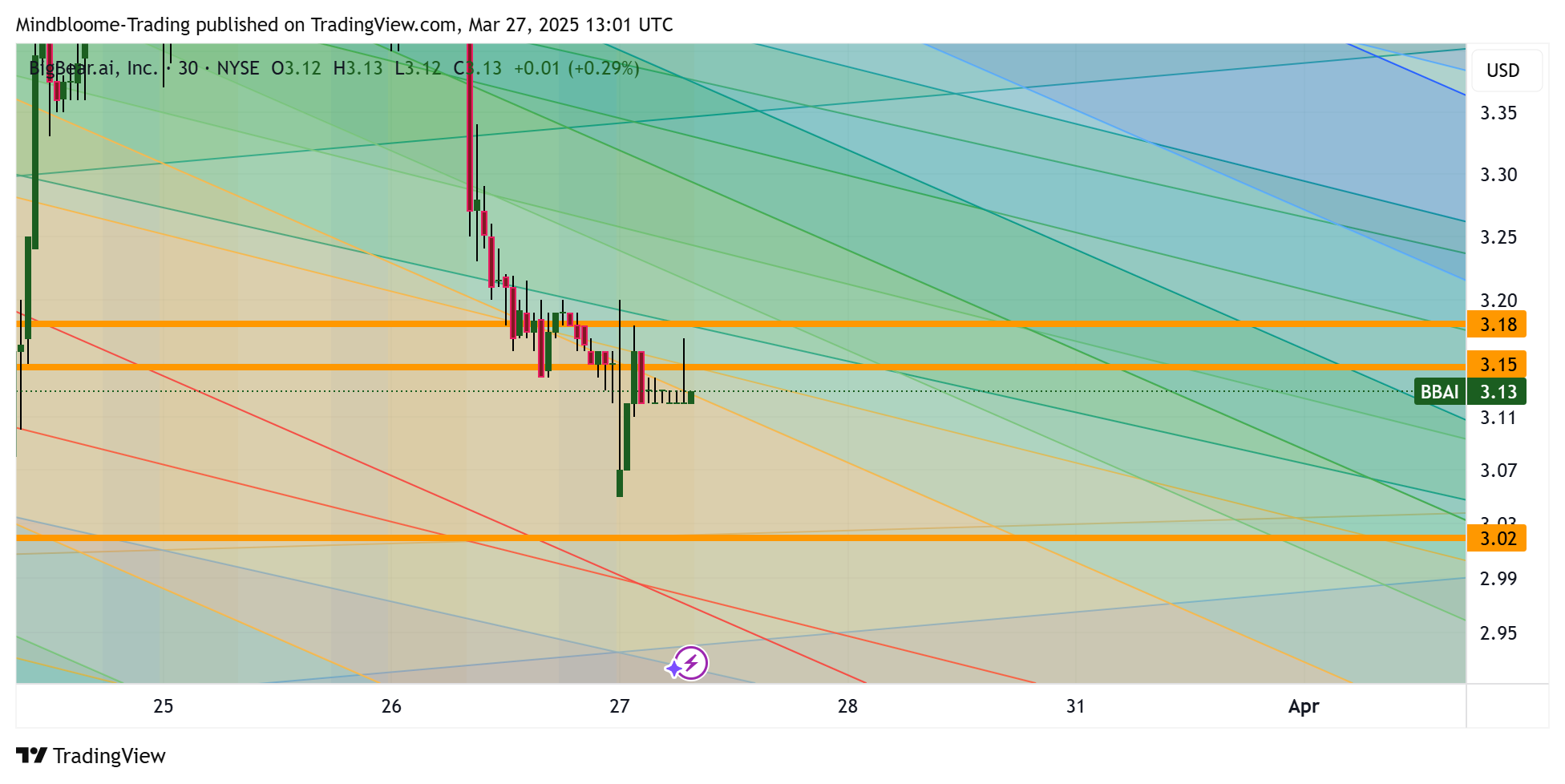

Technical Analysis and Chart Patterns (Optional)

(Note: This section is optional and should be included only if supported by credible data and analysis.) Analyzing BBAI's stock chart patterns may offer insights into potential future price movements. However, this should be viewed as one factor among many and not a sole basis for investment decisions.

Conclusion

BigBear.ai presents a compelling opportunity in the rapidly growing AI and data analytics sector. However, its status as a penny stock brings substantial risk. While its potential revenue streams and government contracts are attractive, the volatility inherent in penny stocks and the competitive landscape necessitate a cautious approach. The company's financial health and management team's experience need thorough evaluation.

Ultimately, deciding whether BigBear.ai is a worthwhile addition to your penny stock portfolio requires careful research and consideration of your individual risk tolerance. Remember that this analysis is not financial advice. Conduct your own thorough due diligence before investing in BBAI or any other penny stock. Investing in penny stocks like BBAI carries substantial risk, and you could lose your entire investment.

Featured Posts

-

Gross Law Firm Representing Investors In Big Bear Ai Bbai Stock

May 20, 2025

Gross Law Firm Representing Investors In Big Bear Ai Bbai Stock

May 20, 2025 -

The Fallout Mass Layoffs And The Fate Of An Abc News Show

May 20, 2025

The Fallout Mass Layoffs And The Fate Of An Abc News Show

May 20, 2025 -

Analyzing Trumps Aerospace Deals Substance Vs Spectacle

May 20, 2025

Analyzing Trumps Aerospace Deals Substance Vs Spectacle

May 20, 2025 -

O Giakoymakis Kai I Istoriki Prokrisi Tis Kroyz Azoyl Ston Teliko Toy Champions League

May 20, 2025

O Giakoymakis Kai I Istoriki Prokrisi Tis Kroyz Azoyl Ston Teliko Toy Champions League

May 20, 2025 -

Suki Waterhouses Sideboob Baring Tuxedo Dress At The 2025 Met Gala

May 20, 2025

Suki Waterhouses Sideboob Baring Tuxedo Dress At The 2025 Met Gala

May 20, 2025

Latest Posts

-

Controversial Comments Rock Saskatchewan Political Panel Following Federal Leaders Visit

May 21, 2025

Controversial Comments Rock Saskatchewan Political Panel Following Federal Leaders Visit

May 21, 2025 -

Financial Times Reports Bp Ceos Ambitious Valuation Target No Us Listing

May 21, 2025

Financial Times Reports Bp Ceos Ambitious Valuation Target No Us Listing

May 21, 2025 -

Saskatchewans Path Political Panel Discussion On Western Canadian Separation

May 21, 2025

Saskatchewans Path Political Panel Discussion On Western Canadian Separation

May 21, 2025 -

Saskatchewan Political Panel Reacts To Federal Leaders Redneck Comments

May 21, 2025

Saskatchewan Political Panel Reacts To Federal Leaders Redneck Comments

May 21, 2025 -

The Goldbergs Why The Show Remains Relevant Today

May 21, 2025

The Goldbergs Why The Show Remains Relevant Today

May 21, 2025