BigBear.ai Holdings (BBAI): Reasons Behind The 2025 Stock Plunge

Table of Contents

Financial Performance and Missed Earnings Expectations

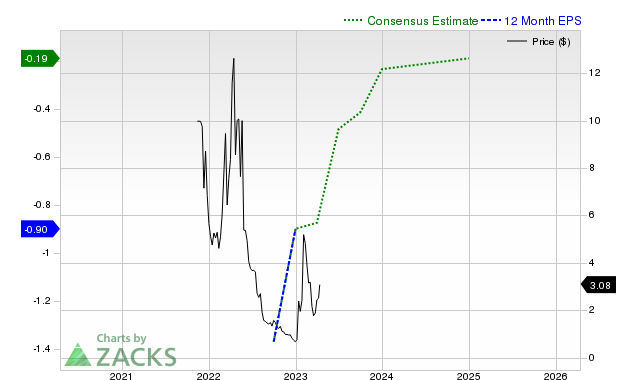

BigBear.ai's financial reports leading up to 2025 revealed a troubling trend of declining profitability and missed revenue projections. This played a significant role in the subsequent BBAI stock plunge. The company consistently failed to meet analysts' expectations, eroding investor confidence.

- BBAI Revenue: A significant decrease in year-over-year revenue growth was observed, failing to keep pace with the projected growth in the AI sector.

- BBAI Profitability: Net income sharply decreased, culminating in substantial losses in the lead-up to the 2025 crash. Earnings per share (EPS) also showed a consistent downward trajectory.

- BBAI Earnings Report: Consecutive disappointing earnings reports contributed to a negative narrative surrounding the company's financial health. These reports consistently highlighted widening gaps between projected and actual performance.

- BBAI Financial Results: Overall, the BBAI financial results painted a picture of a company struggling to achieve sustainable growth and profitability. This financial instability directly impacted investor confidence and fueled the stock's decline.

Impact of Broader Market Conditions and Economic Downturn

The BigBear.ai (BBAI) stock plunge didn't occur in isolation. 2025 presented a challenging macroeconomic environment that significantly impacted the technology sector, and particularly AI companies.

- BBAI Market Conditions: The overall market sentiment shifted negatively due to rising interest rates and persistent inflation. This led to a flight from riskier investments, including many technology stocks.

- BBAI Economic Impact: The economic downturn created a more risk-averse investment landscape, forcing investors to reassess their holdings. Companies with uncertain growth prospects, like BigBear.ai at the time, were particularly vulnerable.

- AI Stock Market: The broader AI stock market also experienced a correction, as investor enthusiasm cooled following a period of rapid growth and inflated valuations. This broader trend exacerbated the decline of BBAI.

- Technology Sector Downturn: The tech sector as a whole experienced a slowdown in growth, impacting investor confidence across the board. BigBear.ai, being a technology company, was inevitably affected by this wider downturn.

Company Strategy and Execution Challenges

BigBear.ai's strategic decisions and execution played a crucial role in the BBAI stock plunge. Several internal factors contributed to the company's weakening position.

- BBAI Strategy: The company's strategic direction appeared unclear to investors, leading to uncertainty and reduced confidence. There may have been a lack of a cohesive, long-term vision.

- BBAI Leadership: Potential leadership changes or internal conflicts might have further destabilized the company and hindered its ability to adapt to the changing market conditions.

- BBAI Product Development: Delays or failures in product development could have prevented BigBear.ai from capitalizing on emerging market opportunities and maintaining its competitive edge.

- BBAI Market Penetration: Difficulties in market penetration, such as challenges in selling their products or services, could have contributed to the financial struggles and subsequent stock decline.

Investor Sentiment and Analyst Ratings

The changing investor sentiment and analyst ratings significantly impacted the BBAI stock price leading up to and during the plunge.

- BBAI Investor Sentiment: As the company's financial performance deteriorated and strategic challenges mounted, investor sentiment turned sharply negative. This led to a significant sell-off.

- BBAI Analyst Ratings: Many analysts downgraded their ratings on BigBear.ai stock, reflecting a loss of confidence in the company's future prospects. This further fueled the downward pressure on the stock price.

- BBAI Stock Price Prediction: Negative predictions from financial analysts contributed to the overall negative sentiment surrounding the stock, further driving down its value.

- BBAI Investment Advice: Investment advice shifted from "buy" or "hold" to "sell" as the risks associated with the company became increasingly apparent.

Understanding and Learning from the BigBear.ai (BBAI) Stock Plunge

The BigBear.ai (BBAI) stock plunge of 2025 resulted from a confluence of factors: disappointing financial performance, unfavorable macroeconomic conditions, internal strategic challenges, and a subsequent shift in investor sentiment and analyst ratings. This event underscores the importance of diligent financial analysis, understanding broader market trends, and assessing a company's strategic direction before investing. Understanding the reasons behind the BigBear.ai (BBAI) stock plunge is crucial for informed investment decisions. Continue your research into BBAI and similar AI stocks to make well-informed choices. Analyzing such events helps investors better navigate the complexities of the AI sector and make more strategic investments.

Featured Posts

-

F1 Hamilton Och Leclercs Diskvalificeringar Nyheter Och Reaktioner

May 20, 2025

F1 Hamilton Och Leclercs Diskvalificeringar Nyheter Och Reaktioner

May 20, 2025 -

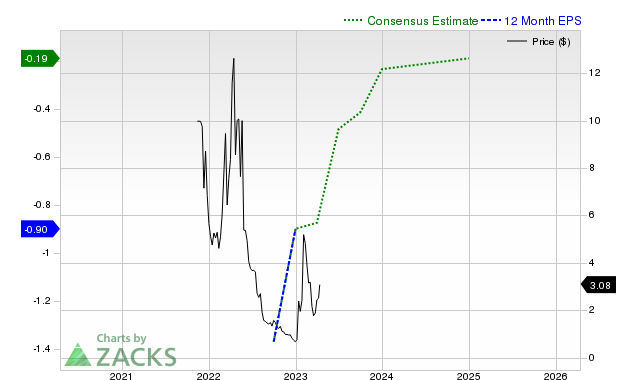

Solving The Nyt Mini Crosswords Marvel Avengers Clue May 1 2024

May 20, 2025

Solving The Nyt Mini Crosswords Marvel Avengers Clue May 1 2024

May 20, 2025 -

Uk Households Urgent Action Needed On New Hmrc Letters

May 20, 2025

Uk Households Urgent Action Needed On New Hmrc Letters

May 20, 2025 -

F1 Kaos Hamilton Och Leclerc Diskvalificerade

May 20, 2025

F1 Kaos Hamilton Och Leclerc Diskvalificerade

May 20, 2025 -

Benjamin Kaellman Huuhkajien Uusi Maalintekijae

May 20, 2025

Benjamin Kaellman Huuhkajien Uusi Maalintekijae

May 20, 2025

Latest Posts

-

Me Thlatht Laebyn Jdd Qaymt Bwtshytynw Lmntkhb Amryka

May 21, 2025

Me Thlatht Laebyn Jdd Qaymt Bwtshytynw Lmntkhb Amryka

May 21, 2025 -

Almdrb Bwtshytynw Ydyf Thlatht Njwm Ila Tshkylt Mntkhb Amryka

May 21, 2025

Almdrb Bwtshytynw Ydyf Thlatht Njwm Ila Tshkylt Mntkhb Amryka

May 21, 2025 -

Athena Calderone Celebrates A Milestone In Rome A Look At The Extravagant Event

May 21, 2025

Athena Calderone Celebrates A Milestone In Rome A Look At The Extravagant Event

May 21, 2025 -

Qaymt Mntkhb Amryka Ttdmn Thlath Asmae Jdydt Tht Qyadt Bwtshytynw

May 21, 2025

Qaymt Mntkhb Amryka Ttdmn Thlath Asmae Jdydt Tht Qyadt Bwtshytynw

May 21, 2025 -

Designer Athena Calderones Lavish Roman Milestone Celebration

May 21, 2025

Designer Athena Calderones Lavish Roman Milestone Celebration

May 21, 2025