Bitcoin Price Prediction: Analyst Spots Potential Rally Starting Zone (May 6, 2024)

Table of Contents

Analyst's Methodology and Bitcoin Price Prediction Rationale

This Bitcoin price prediction originates from [Analyst's Name or Source - e.g., leading crypto analyst Jane Doe at CryptoInsights], who employs a multifaceted approach combining technical analysis, on-chain metrics, and a consideration of fundamental market forces. Their methodology hinges on identifying key support levels, analyzing technical indicators, and observing significant on-chain activity.

-

Key Factors Contributing to the Predicted Rally:

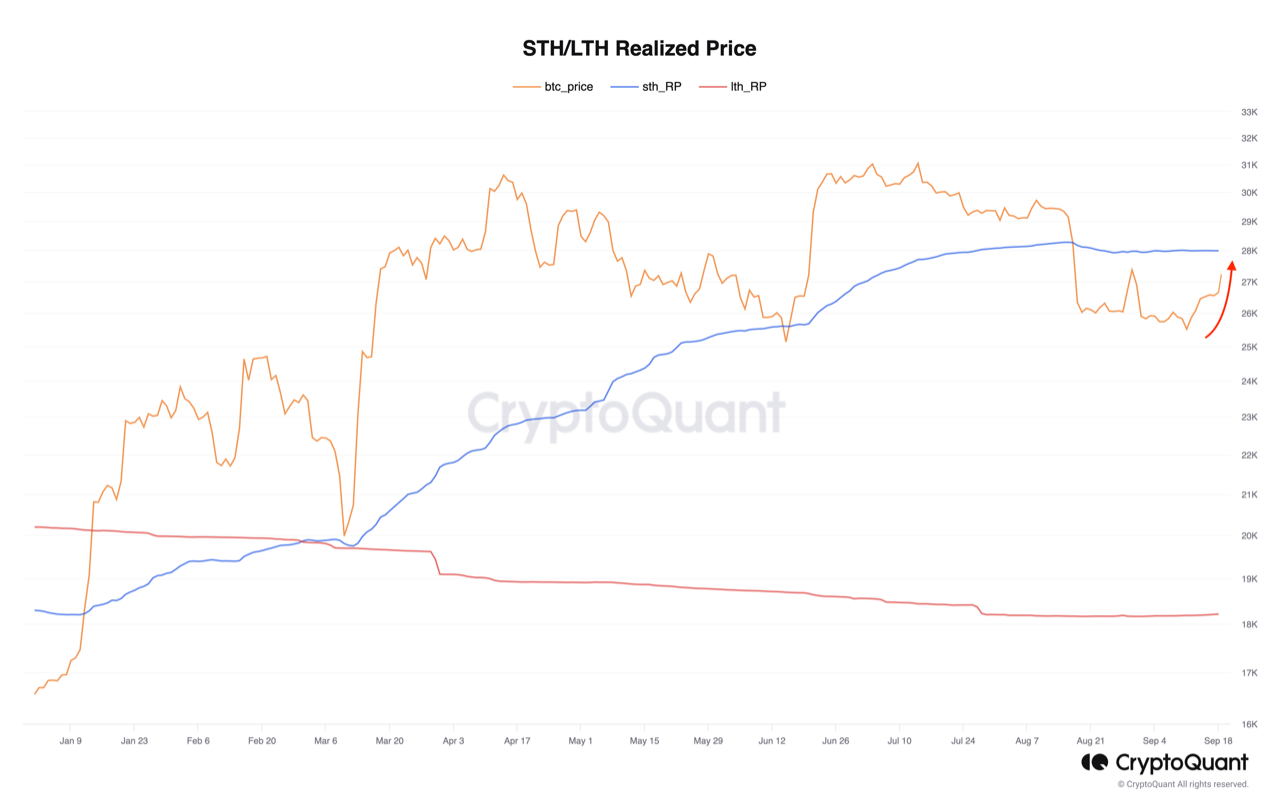

- Support Levels: The analyst has identified a crucial support level around $26,000, suggesting that a sustained break above this level could trigger a significant upward movement. They cite historical price action and order book analysis to substantiate this claim.

- Technical Indicators: Technical indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and various moving averages (e.g., 50-day, 200-day) are showing signs of bullish momentum, supporting the prediction of a rally. Specifically, a bullish crossover on the 50-day and 200-day moving averages is cited as a key signal.

- On-Chain Data: Analysis of on-chain data, such as the accumulation trend of Bitcoin whales and the behavior of Bitcoin miners, indicates a potential build-up of buying pressure. High miner accumulation suggests strong conviction in the future price of Bitcoin.

-

Limitations and Uncertainties: It's crucial to acknowledge that any Bitcoin price prediction carries inherent uncertainty. The analyst acknowledges that unforeseen events, such as major regulatory changes or significant macroeconomic shifts, could impact the predicted rally. External factors always play a role in Bitcoin price fluctuations.

Exploring the Potential Bitcoin Rally Starting Zone

The analyst has identified the price range between $26,000 and $28,000 as the potential rally starting zone. A sustained break above this range is viewed as a strong confirmation signal.

[Insert Chart Here - clearly illustrating the $26,000 - $28,000 zone]

- Potential Price Targets:

- Short-Term (1-3 months): $32,000 - $35,000

- Mid-Term (6-12 months): $40,000 - $45,000

- Long-Term (12+ months): $50,000+ (dependent on various market factors)

Factors that Could Influence the Bitcoin Price Prediction

Several factors could influence the accuracy of this Bitcoin price prediction:

- Macroeconomic Factors: Inflation rates, interest rate decisions by central banks, and overall global economic stability significantly impact Bitcoin's price. High inflation could drive investors towards Bitcoin as a hedge against inflation.

- Bitcoin Adoption and Institutional Investment: Increased adoption by mainstream businesses and continued institutional investment will likely drive up demand and consequently the price.

- Potential Risks and Downside Scenarios:

- Regulatory Crackdown: Stringent government regulations could dampen investor enthusiasm and negatively impact the price.

- Market Corrections: The cryptocurrency market is known for its volatility. Sharp corrections are possible, potentially delaying or negating the predicted rally.

- Geopolitical Events: Unexpected geopolitical events can trigger market uncertainty and lead to price drops.

Comparing This Bitcoin Price Prediction with Other Analyses

Other analysts have offered varying Bitcoin price predictions. Some are more bullish, forecasting significantly higher prices within the next year. Others are more cautious, citing potential headwinds and predicting more modest gains or even potential downturns. [Link to Source A], [Link to Source B] offer contrasting perspectives. It’s important to consider a range of opinions when forming your own outlook.

Conclusion: Bitcoin Price Prediction and Investment Strategies

This analysis highlights a potential Bitcoin price rally starting zone, identified by [Analyst's Name or Source] around $26,000 - $28,000. While the analyst's methodology offers valuable insights, it's crucial to remember the inherent uncertainty in any Bitcoin price prediction. Macroeconomic factors, regulatory changes, and market sentiment can significantly impact the outcome. Both potential upside and downside scenarios must be considered.

While this Bitcoin price prediction offers valuable insight, remember to always conduct thorough due diligence before making any investment decisions. Stay informed about the latest developments in Bitcoin price prediction and market trends to make informed choices aligned with your risk tolerance. Understanding the nuances of Bitcoin price prediction is crucial for navigating this dynamic market.

Featured Posts

-

Bitcoin Guencel Degeri Son Dakika Haberleri Ve Gelismeler

May 08, 2025

Bitcoin Guencel Degeri Son Dakika Haberleri Ve Gelismeler

May 08, 2025 -

Analyzing The Recent Ethereum Price Surge A Bullish Market

May 08, 2025

Analyzing The Recent Ethereum Price Surge A Bullish Market

May 08, 2025 -

Cowherds Persistent Attacks On Jayson Tatum

May 08, 2025

Cowherds Persistent Attacks On Jayson Tatum

May 08, 2025 -

Sarkisian Provides Injury Update On Texas Longhorns Spring Practice

May 08, 2025

Sarkisian Provides Injury Update On Texas Longhorns Spring Practice

May 08, 2025 -

Bitcoin And Ethereum Options Expiration Billions At Stake Expect Market Swings

May 08, 2025

Bitcoin And Ethereum Options Expiration Billions At Stake Expect Market Swings

May 08, 2025