Analyzing The Recent Ethereum Price Surge: A Bullish Market?

Table of Contents

Analyzing the Factors Driving the Ethereum Price Surge

Several key factors have converged to propel the recent Ethereum price surge. Understanding these drivers is crucial to predicting the future trajectory of ETH's price.

Increased Institutional Adoption

Institutional investors are increasingly recognizing Ethereum's potential, leading to a significant influx of capital. This institutional Ethereum investment is a major catalyst for the current price surge.

- Grayscale Investments: A prominent player in the crypto market, Grayscale has substantially increased its holdings of Ethereum.

- MicroStrategy: While primarily known for its Bitcoin investments, MicroStrategy has also shown interest in Ethereum, indicating a broader shift in institutional attitudes.

- BlackRock's ETF Filing: The filing of a spot Bitcoin ETF application by BlackRock, while focused on Bitcoin, has positive spillover effects for the entire crypto market, including Ethereum. This signifies a growing acceptance of cryptocurrencies by major financial institutions. This increased acceptance significantly impacts Ethereum institutional adoption.

This growing corporate Ethereum adoption signifies a maturation of the cryptocurrency market and signals increased confidence in Ethereum's long-term viability.

The Growing DeFi Ecosystem

The explosive growth of the decentralized finance (DeFi) ecosystem built on Ethereum is another significant contributor to the Ethereum price surge. The Ethereum DeFi sector continues to innovate and expand, driving demand for ETH.

- Aave and Compound: Leading DeFi lending and borrowing platforms built on Ethereum have seen massive growth in Total Value Locked (TVL), indicating a thriving DeFi ecosystem.

- Uniswap and SushiSwap: Decentralized exchanges (DEXs) on Ethereum have facilitated billions of dollars in trading volume, further fueling demand for ETH.

- Yield Farming and Staking: The popularity of yield farming and staking on Ethereum networks has increased demand for ETH, boosting its price.

This DeFi ecosystem growth is intertwined with the Ethereum price, creating a positive feedback loop where increased price attracts more users and developers, further expanding the ecosystem and driving demand. The resulting Ethereum DeFi adoption fuels the price surge.

Ethereum 2.0 and Network Upgrades

The ongoing development and implementation of Ethereum 2.0 and other network upgrades are steadily improving the network's scalability, security, and efficiency. These improvements directly influence the Ethereum price.

- Sharding: The implementation of sharding will significantly increase Ethereum's transaction throughput, reducing congestion and fees.

- Improved Security: Upgrades enhance the network's security, making it more resistant to attacks and reducing the risk for users.

- Reduced Energy Consumption: Ethereum's shift to a proof-of-stake consensus mechanism is making the network significantly more energy-efficient.

These Ethereum network upgrades are addressing previously limiting factors, making Ethereum a more attractive platform for developers and users alike. The resulting improvement in scalability and transaction speed impacts the Ethereum 2.0 price impact positively.

Macroeconomic Factors and Market Sentiment

Broader macroeconomic trends and overall market sentiment also play a role in the Ethereum price surge.

- Inflation Concerns: High inflation rates globally have led some investors to seek alternative assets, including cryptocurrencies like Ethereum, as hedges against inflation.

- Interest Rate Hikes: While interest rate hikes generally negatively impact risk assets, the sustained interest in Ethereum suggests its inherent value is overcoming macroeconomic headwinds.

- Risk Appetite: Increased risk appetite in the broader financial markets often translates into higher demand for cryptocurrencies like Ethereum.

Understanding these macroeconomic factors influencing the Ethereum market sentiment is vital for a comprehensive analysis of the current price surge.

Assessing the Sustainability of the Bullish Trend

While the factors discussed above paint a bullish picture, it's important to acknowledge potential risks and challenges.

Potential Risks and Challenges

Several factors could negatively impact Ethereum's price and the sustainability of the current bullish trend.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains uncertain in many jurisdictions, posing a potential threat to Ethereum's price.

- Competition from Other Cryptocurrencies: Ethereum faces competition from other blockchain platforms and smart contract networks, which could affect its market share and price.

- Security Vulnerabilities: While Ethereum has made significant strides in security, vulnerabilities always exist, and any major security breach could negatively affect investor confidence and price.

Careful consideration of these Ethereum price volatility factors and Ethereum regulatory risks is crucial.

Long-Term Growth Projections

Despite these risks, many analysts predict strong long-term growth for Ethereum.

- Continued DeFi Growth: The continued expansion of the DeFi ecosystem is expected to drive demand for Ethereum.

- Enterprise Adoption: Increased adoption by enterprises could significantly boost Ethereum's price.

- NFT Market Growth: Non-Fungible Tokens (NFTs) built on Ethereum are likely to continue growing, driving further demand.

Many experts believe Ethereum's innovative technology and strong community will sustain its long-term growth, making Ethereum price prediction positive for the foreseeable future. The Ethereum future outlook appears strong.

Conclusion

The recent Ethereum price surge is driven by a confluence of factors, including increased institutional adoption, the thriving DeFi ecosystem, ongoing network upgrades, and favorable macroeconomic conditions. While potential risks exist, the strong fundamentals of Ethereum, coupled with its continued development and growing adoption, suggest that the current surge could be indicative of a sustained bullish market. However, this is not a guarantee.

Continue monitoring the Ethereum price surge and stay updated on the latest developments in the Ethereum ecosystem. Thorough research and understanding of the factors influencing the price are key to making informed investment decisions. Regularly review the news and analysis surrounding Ethereum's price and developments.

Featured Posts

-

Analysis Trump Medias Partnership With Crypto Com And Its Effect On Cro

May 08, 2025

Analysis Trump Medias Partnership With Crypto Com And Its Effect On Cro

May 08, 2025 -

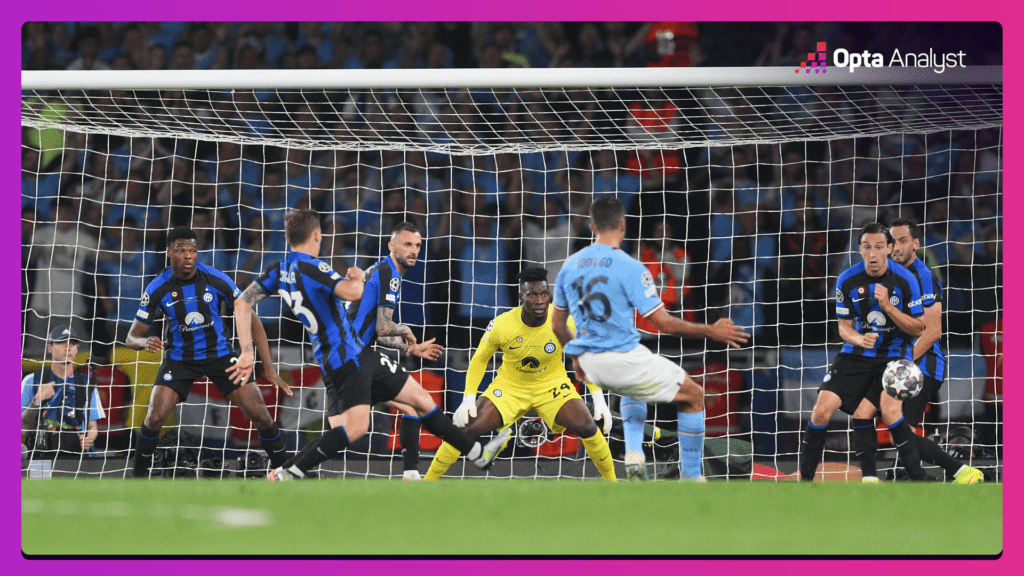

Champions League Inter Milans Impressive Win Against Bayern Munich

May 08, 2025

Champions League Inter Milans Impressive Win Against Bayern Munich

May 08, 2025 -

Boeing Faces Antisemitism Probe At Seattle Campus

May 08, 2025

Boeing Faces Antisemitism Probe At Seattle Campus

May 08, 2025 -

Gjranwalh Dyrynh Dshmny Fayrng Ka Waqeh 5 Afrad Hlak Mlzm Hlak

May 08, 2025

Gjranwalh Dyrynh Dshmny Fayrng Ka Waqeh 5 Afrad Hlak Mlzm Hlak

May 08, 2025 -

Uber Auto Payments Understanding The Changes And Alternatives To Cash

May 08, 2025

Uber Auto Payments Understanding The Changes And Alternatives To Cash

May 08, 2025