Bitcoin And Ethereum Options Expiration: Billions At Stake, Expect Market Swings

Table of Contents

Understanding Bitcoin and Ethereum Options Expiration

Bitcoin and Ethereum options are derivative contracts that give the buyer the right, but not the obligation, to buy (call option) or sell (put option) a specific amount of Bitcoin or Ethereum at a predetermined price (strike price) on or before a certain date (expiration date). These options play a vital role in both risk management and speculation within the cryptocurrency market. Options expiration marks the final day when these contracts can be exercised.

- Definition of options contracts (calls and puts): A call option grants the holder the right to buy the underlying asset (Bitcoin or Ethereum) at the strike price, while a put option grants the right to sell it at the strike price.

- How options are used for hedging and speculation: Traders use call options to hedge against potential price increases or speculate on upward price movements. Put options are used to hedge against price drops or speculate on downward movements.

- The mechanics of options expiration (assignment, settlement): At expiration, if an option is "in the money" (meaning it's profitable to exercise), the buyer can choose to exercise their right to buy or sell the underlying asset. The seller is then obligated to fulfill the contract. If the option is "out of the money," it expires worthless.

- The impact of open interest on price movements: Open interest, the total number of outstanding options contracts, significantly influences price volatility. High open interest suggests a substantial amount of potential buying or selling pressure around the expiration date.

Billions at Stake: The Scale of the Upcoming Expiration

The sheer volume of Bitcoin and Ethereum options contracts expiring simultaneously represents a considerable event with the potential to significantly impact market liquidity. The notional value of these expiring contracts often runs into the billions of dollars.

- Data on the total notional value of expiring options contracts: Specific figures vary depending on the platform and the time of the year, but reports consistently show billions of dollars’ worth of options expiring on a given date. Tracking these figures from reputable sources is crucial for gauging the potential impact.

- Comparison to previous expiration events and their market impact: Analyzing past expirations can offer insights into potential price movements. However, it's essential to remember that market conditions are constantly evolving.

- Potential for increased market depth and liquidity or conversely, illiquidity and slippage: A large number of expiring contracts can either boost liquidity, providing opportunities for traders, or conversely lead to illiquidity and increased slippage as traders scramble to execute trades.

Factors Influencing Price Volatility During Options Expiration

Several factors intertwine to influence price volatility around options expiration dates, creating a complex and challenging trading environment.

- Market sentiment and news events leading up to the expiration: Positive or negative news events, regulatory announcements, or overall market sentiment can significantly impact options prices and amplify volatility.

- The influence of large institutional investors and whale activity: Large institutional investors and "whales" (individuals with significant holdings) can significantly influence price movements through their trading activities.

- The role of algorithmic trading and automated strategies: Algorithmic trading and automated strategies can exacerbate volatility, potentially triggering cascading effects as algorithms react to price fluctuations.

- Potential for cascading effects and market manipulation: The complex interplay of these factors can lead to cascading effects, where one price movement triggers a chain reaction, and even potentially, market manipulation.

Predicting Market Movements: Challenges and Opportunities

Predicting precise price movements during periods of high volatility is extremely challenging, even for experienced traders. However, understanding these challenges also presents opportunities for skilled traders.

- Limitations of technical and fundamental analysis during high volatility periods: Traditional technical and fundamental analysis tools may be less reliable during periods of extreme volatility.

- The importance of risk management strategies and position sizing: Effective risk management, including stop-loss orders and careful position sizing, is crucial to mitigate potential losses.

- Potential trading strategies for exploiting temporary price dislocations: Skilled traders can potentially profit from temporary price dislocations caused by the expiration event, but this requires experience and careful planning.

Strategies for Navigating the Volatility

Navigating the volatility surrounding Bitcoin and Ethereum options expiration requires a proactive and informed approach.

- Risk management techniques (stop-loss orders, diversification): Employing stop-loss orders to limit potential losses and diversifying your portfolio across multiple assets are essential risk management strategies.

- Strategies for hedging positions against potential losses: Using options strategies such as protective puts can help hedge against potential losses in your Bitcoin or Ethereum holdings.

- Options strategies (e.g., covered calls, protective puts) to mitigate risk: Understanding and utilizing various options strategies allows for more sophisticated risk management.

- Importance of staying informed and monitoring market developments closely: Staying updated on market news and developments is crucial for making informed trading decisions.

Conclusion

The upcoming Bitcoin and Ethereum options expiration represents a significant event with the potential to cause substantial price swings in the cryptocurrency market. Understanding the factors at play and employing effective risk management strategies is crucial for navigating this period successfully. The sheer volume of contracts expiring underlines the importance of careful preparation and a thorough understanding of options trading mechanics.

Call to Action: Stay informed about the approaching Bitcoin and Ethereum options expiration. Implement robust risk management strategies, and learn more about options trading to effectively manage your crypto portfolio. Monitor the market closely and be prepared for potential volatility surrounding the Bitcoin and Ethereum options expiration. Don't underestimate the impact of this event on Bitcoin price and Ethereum price; prepare your trading strategy accordingly.

Featured Posts

-

Indias Deepest Strikes Into Pakistan In Over 50 Years Cnn Report

May 08, 2025

Indias Deepest Strikes Into Pakistan In Over 50 Years Cnn Report

May 08, 2025 -

Bitcoin Madenciliginde Yeni Bir Doenem Gelecege Bakis

May 08, 2025

Bitcoin Madenciliginde Yeni Bir Doenem Gelecege Bakis

May 08, 2025 -

Ahsans Call To Action Tech Adoption For A Globally Competitive Made In Pakistan

May 08, 2025

Ahsans Call To Action Tech Adoption For A Globally Competitive Made In Pakistan

May 08, 2025 -

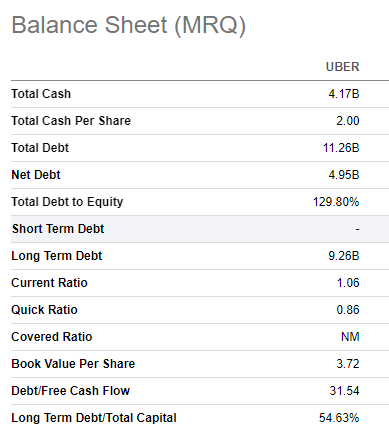

Uber Technologies Uber Investment Potential And Risks

May 08, 2025

Uber Technologies Uber Investment Potential And Risks

May 08, 2025 -

Wall Street Kurumlari Kriptoyu Nasil Kabul Ediyor

May 08, 2025

Wall Street Kurumlari Kriptoyu Nasil Kabul Ediyor

May 08, 2025