Bitcoin Price Analysis: A Critical Juncture And What To Expect

Table of Contents

Recent Market Trends and Price Volatility

Bitcoin's recent price action has been characterized by significant volatility. We've seen periods of sharp increases followed by equally dramatic drops, reflecting the inherent risk and reward associated with cryptocurrency investment. Several factors contribute to this volatility:

-

Impact of regulatory announcements on Bitcoin price: Regulatory clarity (or lack thereof) in different jurisdictions significantly influences investor sentiment and trading activity. Positive regulatory developments tend to drive prices up, while negative news can trigger sell-offs. For example, announcements regarding cryptocurrency taxation or outright bans can dramatically impact Bitcoin price prediction models.

-

Influence of macroeconomic indicators (inflation, interest rates): Bitcoin is often viewed as a hedge against inflation. When inflation rises, investors may flock to Bitcoin as a store of value, pushing its price higher. Conversely, rising interest rates can make other investment options more attractive, potentially leading to a decline in Bitcoin's price.

-

Analysis of trading volume and market capitalization: High trading volume often indicates strong market interest, potentially signaling sustained price movements. Market capitalization, the total value of all Bitcoin in circulation, is another important indicator of the cryptocurrency's overall health and potential.

-

Mention of significant support and resistance levels: Technical analysts identify support and resistance levels on Bitcoin charts – price points where buying or selling pressure is expected to be strong. Breaks above resistance levels can signal upward momentum, while breaks below support levels can indicate downward pressure. Analyzing these levels is crucial for Bitcoin price prediction.

(Insert chart here showing recent Bitcoin price fluctuations)

Technical Analysis of Bitcoin's Chart

Technical analysis uses historical price and volume data to predict future price movements. Several indicators are commonly employed in Bitcoin price analysis:

-

Interpretation of key technical indicators: Moving averages (e.g., 50-day, 200-day) smooth out price fluctuations to identify trends. The Relative Strength Index (RSI) measures the momentum of price changes, identifying overbought or oversold conditions. The Moving Average Convergence Divergence (MACD) identifies changes in momentum by comparing two moving averages.

-

Identification of support and resistance levels based on technical analysis: As mentioned before, identifying these levels is crucial for timing entries and exits.

-

Discussion of potential price targets based on chart patterns: Chart patterns like head and shoulders, triangles, and flags can suggest potential future price movements.

-

Explanation of the limitations of technical analysis: Technical analysis is not foolproof. Unexpected news events or changes in market sentiment can invalidate technical predictions.

(Insert chart here showing Bitcoin's chart with key technical indicators overlaid)

Fundamental Analysis and Long-Term Outlook

Fundamental analysis focuses on the underlying factors affecting Bitcoin's long-term value. These include:

-

Discussion of Bitcoin's scarcity and its role in inflation hedging: Bitcoin's limited supply of 21 million coins makes it a potentially deflationary asset, attractive to those seeking to hedge against inflation.

-

Analysis of the growing adoption of Bitcoin by institutions: Increased institutional investment signals growing acceptance and legitimacy for Bitcoin, potentially supporting price growth.

-

Evaluation of the impact of technological advancements (e.g., Lightning Network): Technological upgrades that enhance Bitcoin's scalability and transaction speed can boost its adoption and value.

-

Assessment of the risks and opportunities associated with long-term Bitcoin investment: While Bitcoin offers significant potential for growth, it also carries substantial risk due to its volatility and regulatory uncertainty.

Factors Affecting Bitcoin Price in the Short Term

Short-term price movements are often driven by:

-

Analysis of news events that could cause price fluctuations: Positive news (e.g., regulatory approvals, partnerships) tends to boost the price, while negative news (e.g., security breaches, regulatory crackdowns) can trigger sell-offs.

-

Impact of social media sentiment on Bitcoin's price: Social media sentiment, especially from influential figures, can significantly influence market sentiment and price.

-

Discussion of the role of large investors ("whales") in market manipulation: Large holders of Bitcoin ("whales") can exert considerable influence on price movements through their buying and selling activities.

-

Strategies for managing risk in short-term Bitcoin investments: Short-term Bitcoin trading is highly risky. Employing risk management strategies such as stop-loss orders and diversification is crucial.

Conclusion

This Bitcoin Price Analysis reveals that Bitcoin is at a critical juncture, influenced by a complex interplay of market trends, technical indicators, fundamental factors, and short-term events. While technical analysis can provide insights into short-term price movements, fundamental analysis is crucial for assessing Bitcoin's long-term potential. The volatility inherent in the cryptocurrency market necessitates careful risk management.

Key Takeaways: Bitcoin's price is highly volatile and influenced by a multitude of factors, including regulatory developments, macroeconomic conditions, technical indicators, and market sentiment. Both short-term and long-term perspectives are essential for making informed investment decisions. Understanding these factors is critical for navigating the Bitcoin market effectively.

Call to Action: Continue your Bitcoin price analysis research. Stay informed on the latest Bitcoin price analysis and market trends by regularly consulting reliable sources. Deepen your understanding of Bitcoin price analysis to make sound investment choices. [Link to a reliable Bitcoin price tracking website]

Featured Posts

-

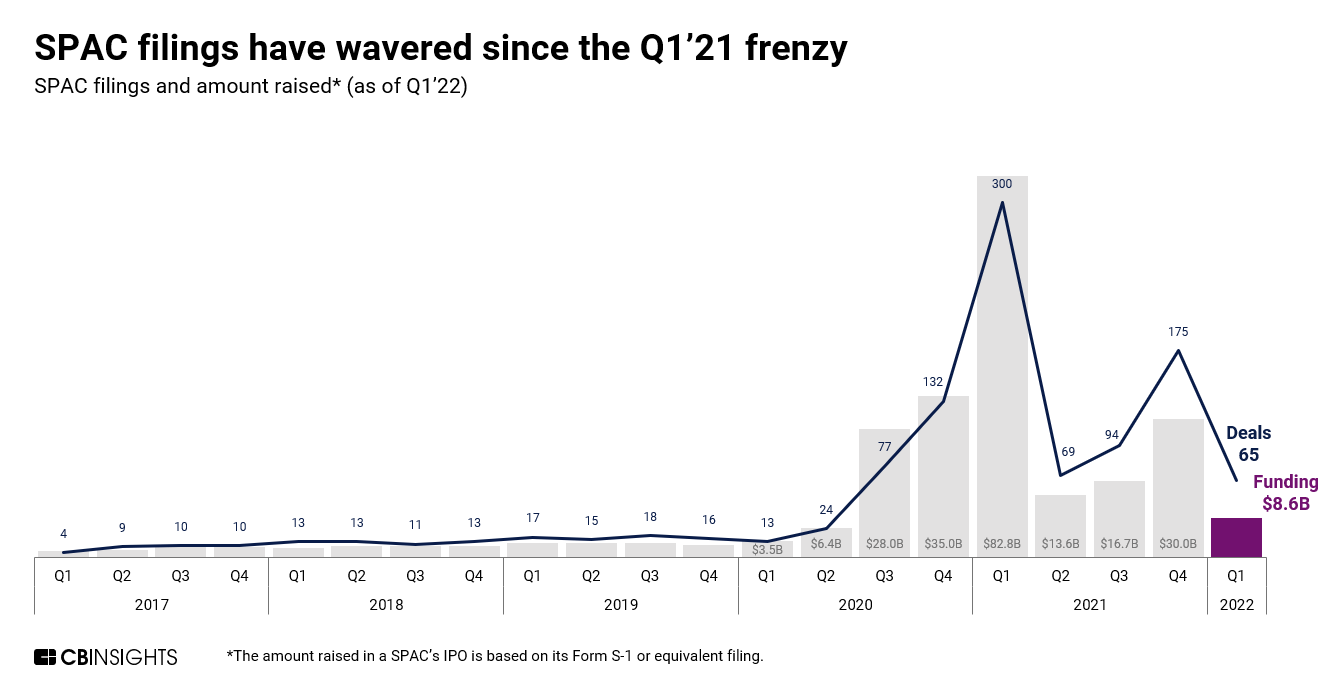

Spac Stock Frenzy Is This The Next Micro Strategy

May 08, 2025

Spac Stock Frenzy Is This The Next Micro Strategy

May 08, 2025 -

Recent Ethereum Price Performance And Future Outlook

May 08, 2025

Recent Ethereum Price Performance And Future Outlook

May 08, 2025 -

Rogue One Star Reveals Thoughts On Beloved Character

May 08, 2025

Rogue One Star Reveals Thoughts On Beloved Character

May 08, 2025 -

Complete List Of Ps Plus Premium And Extra Games For March 2024

May 08, 2025

Complete List Of Ps Plus Premium And Extra Games For March 2024

May 08, 2025 -

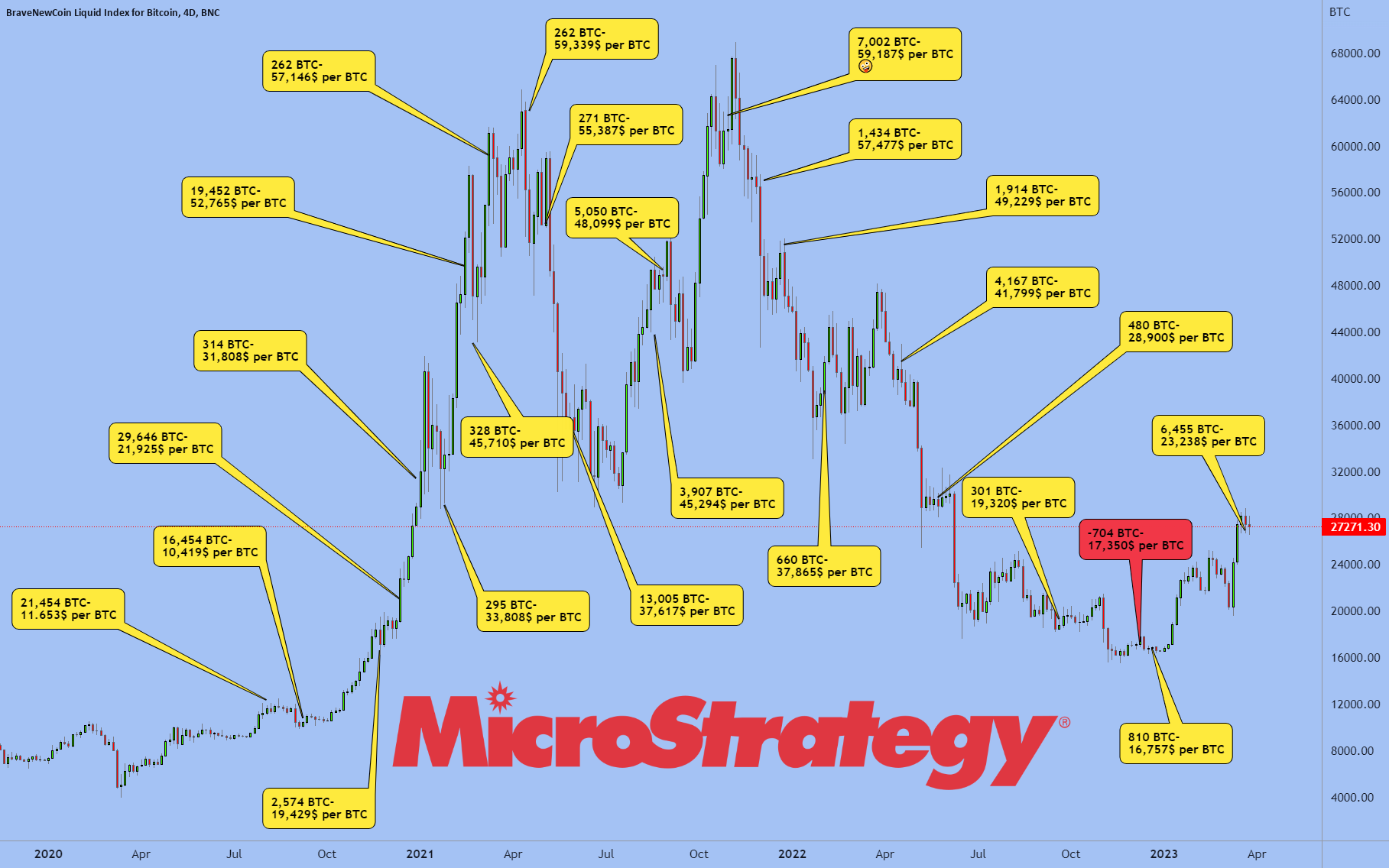

Micro Strategy Vs Bitcoin Investment A 2025 Outlook

May 08, 2025

Micro Strategy Vs Bitcoin Investment A 2025 Outlook

May 08, 2025