MicroStrategy Vs Bitcoin Investment: A 2025 Outlook

Table of Contents

MicroStrategy's Bitcoin Strategy: A Deep Dive

MicroStrategy's bold Bitcoin bet has made it a case study in corporate cryptocurrency adoption. Understanding their approach is crucial to evaluating its potential success or failure.

MicroStrategy's Rationale: Why such a large Bitcoin investment?

MicroStrategy's decision to amass a significant Bitcoin treasury stems from its belief in Bitcoin's long-term value proposition. They view Bitcoin as a superior inflation hedge compared to traditional assets like gold and as a store of value in a world of increasingly inflationary fiat currencies. Michael Saylor, MicroStrategy's CEO, has been a vocal advocate for Bitcoin, publicly championing its potential and influencing the company's strategy.

- Inflation Hedge: Protecting against the erosion of purchasing power due to inflation.

- Store of Value: A long-term asset expected to retain or appreciate in value.

- Technological Innovation: Belief in the underlying blockchain technology and its future potential.

- Limited Supply: The fixed supply of 21 million Bitcoin creates inherent scarcity.

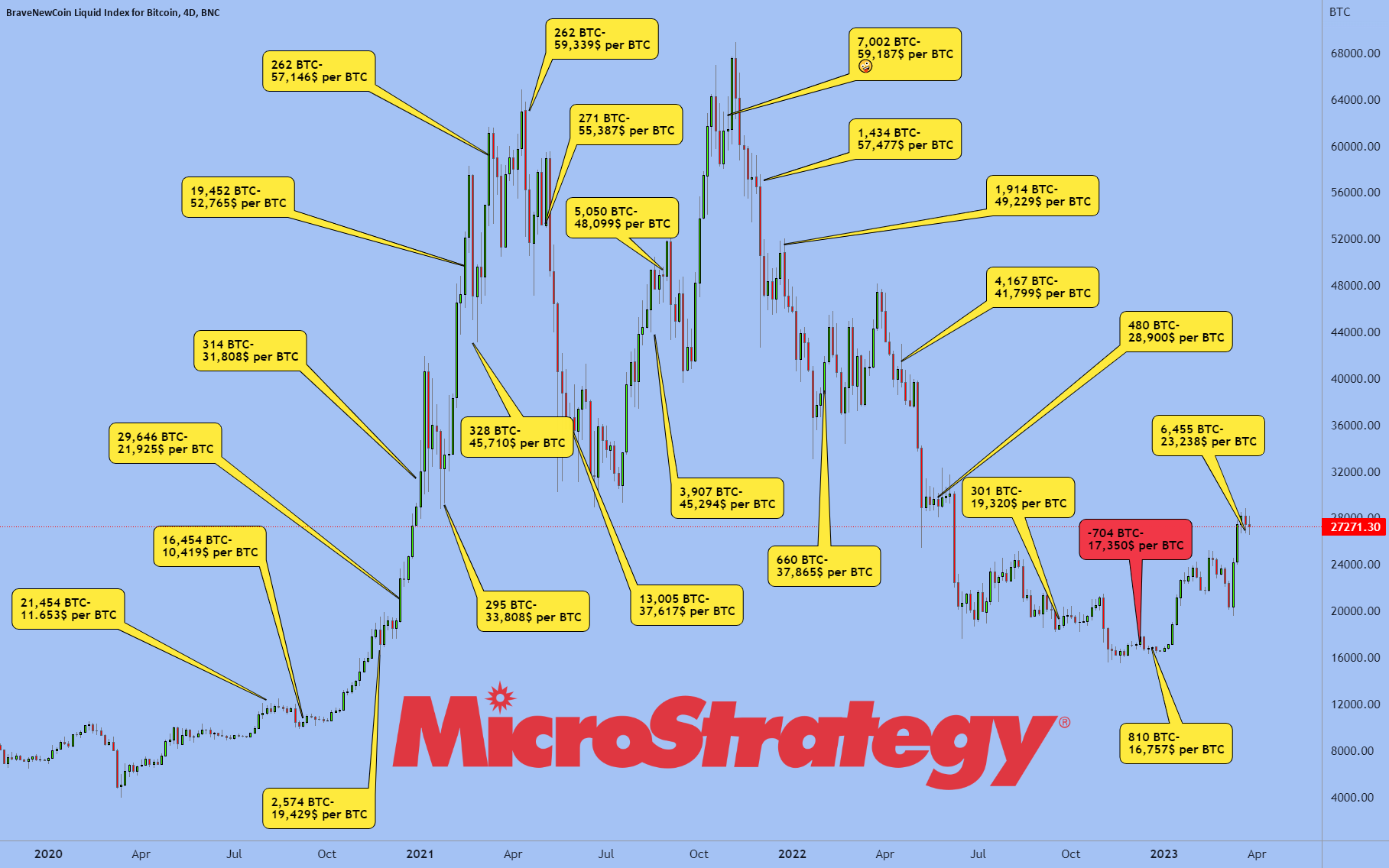

MicroStrategy's Bitcoin Holdings and Performance (2025 Projection)

As of [Insert Date], MicroStrategy holds approximately [Insert Number] Bitcoin, representing a substantial portion of their overall assets. Predicting Bitcoin's price in 2025 is inherently speculative, but several scenarios are possible:

- Bullish Scenario: Bitcoin reaches $[Price], significantly increasing MicroStrategy's holdings' value. This would likely justify their strategy.

- Bearish Scenario: Bitcoin falls to $[Price], resulting in substantial losses for MicroStrategy. This would raise questions about the wisdom of such a concentrated investment.

- Neutral Scenario: Bitcoin remains around its current price or experiences moderate growth, resulting in a less dramatic impact on MicroStrategy's investment.

These scenarios illustrate the high-risk, high-reward nature of MicroStrategy's approach.

Risks and Rewards of MicroStrategy's Approach

MicroStrategy's strategy isn't without risk.

- Volatility Risk: Bitcoin's price is notoriously volatile, exposing MicroStrategy to significant losses during market downturns.

- Regulatory Uncertainty: Changes in government regulations concerning cryptocurrencies could negatively impact the value of Bitcoin.

- Security Risks: The risk of hacking or loss of Bitcoin holdings, although mitigated by professional storage solutions, remains.

However, the potential rewards are substantial. If Bitcoin appreciates as anticipated, MicroStrategy's investment could generate massive returns. This contrasts with a more diversified portfolio, which might offer lower returns but significantly lower risk.

Individual Bitcoin Investment Strategies: Diversification and Risk Management

Unlike MicroStrategy, individual investors have the flexibility to manage risk through diversification and strategic investment approaches.

Diversification: The Importance of a Balanced Portfolio

For individual investors, diversification is paramount. Unlike MicroStrategy's concentrated Bitcoin bet, a diversified portfolio spreads risk across various asset classes, reducing the impact of any single asset's underperformance.

- Stocks: Equities provide exposure to company growth.

- Bonds: Fixed-income investments offer stability and income.

- Real Estate: Tangible assets can provide diversification and potential appreciation.

- Alternative Investments: Hedge funds, commodities, or other assets offer further risk mitigation.

Dollar-Cost Averaging (DCA) vs Lump Sum Investment

Two primary approaches exist for Bitcoin investment:

- Dollar-Cost Averaging (DCA): Investing a fixed amount regularly regardless of price fluctuations. This mitigates the risk of investing a lump sum at a market peak.

- Lump Sum Investment: Investing a significant amount at once, maximizing potential gains if the market rises. This strategy carries higher risk.

Choosing the best approach depends on individual risk tolerance and market outlook.

Risk Management for Individual Bitcoin Investors

Responsible Bitcoin investment includes effective risk management:

- Determine Risk Tolerance: Understand your capacity for loss before investing.

- Set Stop-Loss Orders: Automatically sell Bitcoin if the price falls below a predetermined level.

- Diversify Your Portfolio: Don't put all your eggs in one basket.

- Only Invest What You Can Afford to Lose: Never invest money you need for essential expenses.

Comparing MicroStrategy's Model to Individual Investment Approaches in 2025

Analyzing potential 2025 scenarios illuminates the differences in risk and reward profiles.

Scenario Analysis: Bull, Bear, and Neutral Market Outcomes

Visual representations (charts and graphs) would be highly beneficial here to illustrate the impact of different Bitcoin price scenarios on both MicroStrategy and diversified portfolios. The scenarios would look something like this:

- Bull Market: A significant price increase would greatly benefit MicroStrategy but also provide substantial gains for diversified portfolios holding even a small percentage in Bitcoin.

- Bear Market: A significant price drop would severely impact MicroStrategy while diversified portfolios would experience a smaller negative impact due to their spread of assets.

- Neutral Market: Stable or moderate growth would yield modest returns for both, with MicroStrategy's concentrated holdings potentially offering slightly higher returns but with much higher risk.

Long-Term Implications and Considerations

The long-term outlook for Bitcoin is a subject of ongoing debate. Factors influencing its future price include:

- Increased Adoption: Wider acceptance by businesses and individuals could drive price appreciation.

- Regulatory Clarity: Clearer regulatory frameworks could foster stability and growth.

- Technological Advancements: Developments in the Bitcoin ecosystem could enhance its functionality and appeal.

- Competition: The emergence of alternative cryptocurrencies could impact Bitcoin's dominance.

Conclusion: MicroStrategy vs Bitcoin Investment: Making Informed Decisions in 2025

MicroStrategy's all-in Bitcoin strategy and individual investment approaches offer contrasting risk-reward profiles. MicroStrategy's concentrated bet could yield massive returns, but it carries substantial risk. Individual investors, on the other hand, can leverage diversification and risk management techniques to mitigate losses. By carefully considering your risk tolerance, financial goals, and the potential scenarios outlined above, you can make informed decisions about your own "MicroStrategy vs Bitcoin Investment" strategy for 2025 and beyond. Conduct thorough research and tailor your approach to your individual circumstances for a successful investment journey.

Featured Posts

-

Leveraging Technology Ahsans Plan To Enhance Made In Pakistan S Global Competitiveness

May 08, 2025

Leveraging Technology Ahsans Plan To Enhance Made In Pakistan S Global Competitiveness

May 08, 2025 -

Find The Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 08, 2025

Find The Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 08, 2025 -

Bitcoin Fiyat Endeksi Canli Veriler Ve Grafikler

May 08, 2025

Bitcoin Fiyat Endeksi Canli Veriler Ve Grafikler

May 08, 2025 -

Lahwr Myn Gwsht Ky Qymtwn Ka Bhran Shhrywn Ky Mshklat Awr Mmknh Hl

May 08, 2025

Lahwr Myn Gwsht Ky Qymtwn Ka Bhran Shhrywn Ky Mshklat Awr Mmknh Hl

May 08, 2025 -

Greenland A New Geopolitical Battleground Between The Us And China

May 08, 2025

Greenland A New Geopolitical Battleground Between The Us And China

May 08, 2025