BigBear.ai Holdings, Inc.: Securities Lawsuit Filed

Table of Contents

Details of the Securities Lawsuit Against BigBear.ai

The lawsuit alleges that BigBear.ai Holdings, Inc. engaged in securities fraud by making misleading statements and omitting material facts in its public disclosures. These alleged misrepresentations, according to the plaintiff(s), artificially inflated the BBAI stock price, causing investors to suffer financial losses. The plaintiff(s), represented by [Law Firm Name], filed the lawsuit in the [Court Name] on [Date]. The lawsuit seeks unspecified damages on behalf of a class of investors who purchased BigBear.ai stock during a specified period.

- Alleged Misleading Statements: The lawsuit specifically points to [insert specific examples of alleged misleading statements or omissions, e.g., exaggerated claims about the company's technology, revenue projections that were later revised downwards, failure to disclose material risks].

- Key Dates: The lawsuit was filed on [Filing Date]. Important deadlines include [mention key deadlines, e.g., the deadline for class members to opt-in, the date for the defendant's response].

- Summary of Plaintiff's Claims: The plaintiffs claim that they relied on BigBear.ai's misleading statements when purchasing the stock and suffered significant financial losses as a result. They contend that the company violated federal securities laws, including [mention specific laws, e.g., Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5].

BigBear.ai Holdings, Inc.'s Response to the Lawsuit

BigBear.ai has issued a statement [link to official press release or SEC filing if available] responding to the allegations. The company [summarize the company's response, e.g., denies the allegations, asserts its statements were accurate, plans to vigorously defend itself]. They have [mention any actions taken, e.g., launched an internal investigation, retained legal counsel].

- Key Quotes: "[Insert relevant quotes from BigBear.ai's official statement]."

- Official Documents: [Provide links to relevant SEC filings and press releases].

- Defense Strategy Analysis: [Offer a brief analysis of BigBear.ai's likely defense strategy, based on available information].

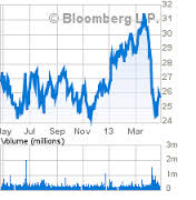

Impact on BigBear.ai Stock Price and Investor Sentiment

The lawsuit's announcement has had a noticeable impact on BBAI's stock price. [Include a chart or graph showing stock price fluctuations before, during, and after the lawsuit announcement, if possible]. Investor sentiment appears to be [describe investor sentiment, e.g., negative, cautious, uncertain], with some investors selling their shares while others remain on the sidelines. The short-term impact has been [describe the short-term impact, e.g., a significant drop in stock price], while the long-term effects remain to be seen and depend heavily on the outcome of the litigation.

- Stock Price Fluctuations: BBAI's stock price dropped by [percentage] on [date] following the lawsuit announcement.

- Analyst Ratings: [Summarize any changes in analyst ratings and recommendations following the lawsuit].

- Investor Reactions: [Mention any significant discussions or reactions from investors on financial news websites or forums].

Legal Implications and Potential Outcomes

The lawsuit carries significant legal implications for BigBear.ai and its executives. Potential outcomes include a settlement, dismissal, or trial. If found liable, the company could face substantial penalties and fines, impacting its financial stability and reputation. The process of class action lawsuits involves [briefly explain the process, including stages like discovery, motion practice, and trial].

- Potential Penalties: Potential penalties could include monetary fines, restitution to investors, and legal fees.

- Timeline: The legal proceedings are expected to take [estimated timeframe].

- Expert Opinion: [If possible, include insights from legal experts on the likely outcome of the lawsuit].

Conclusion: The BigBear.ai Securities Lawsuit: Next Steps for Investors

The securities lawsuit against BigBear.ai Holdings, Inc. presents a complex situation with significant implications for investors. The allegations of securities fraud, the company's response, and the potential impact on BBAI stock price all require careful consideration. Staying informed about the ongoing legal proceedings is crucial. Investors should monitor the stock price, consult with a financial advisor, and understand their rights as shareholders. Keep abreast of further developments in the BigBear.ai Holdings, Inc. securities lawsuit and related BBAI stock news to make informed investment decisions. For more information on investor rights in securities litigation, consult [link to a relevant resource or legal information].

Featured Posts

-

Friisin Avauskokoonpano Kamara Ja Pukki Vaihtopenkillae

May 20, 2025

Friisin Avauskokoonpano Kamara Ja Pukki Vaihtopenkillae

May 20, 2025 -

Solve The Nyt Mini Crossword March 16 2025 Answers And Hints

May 20, 2025

Solve The Nyt Mini Crossword March 16 2025 Answers And Hints

May 20, 2025 -

Nyt Mini Crossword May 9th Answers

May 20, 2025

Nyt Mini Crossword May 9th Answers

May 20, 2025 -

Investigation Launched Into Alleged Racial Slurs Targeting Angel Reese In Wnba

May 20, 2025

Investigation Launched Into Alleged Racial Slurs Targeting Angel Reese In Wnba

May 20, 2025 -

Jennifer Lawrence Opaet Mamou Potvrdene Druhe Dieta

May 20, 2025

Jennifer Lawrence Opaet Mamou Potvrdene Druhe Dieta

May 20, 2025

Latest Posts

-

31 Decrease In Bp Chief Executives Remuneration

May 21, 2025

31 Decrease In Bp Chief Executives Remuneration

May 21, 2025 -

The Goldbergs Everything You Need To Know About The Characters And Storylines

May 21, 2025

The Goldbergs Everything You Need To Know About The Characters And Storylines

May 21, 2025 -

The Goldbergs The Shows Impact On Popular Culture

May 21, 2025

The Goldbergs The Shows Impact On Popular Culture

May 21, 2025 -

Bp Chief Executives Salary Falls By 31 Percent

May 21, 2025

Bp Chief Executives Salary Falls By 31 Percent

May 21, 2025 -

Analysis Bp Ceos Salary Reduced By 31

May 21, 2025

Analysis Bp Ceos Salary Reduced By 31

May 21, 2025