31% Decrease In BP Chief Executive's Remuneration

Table of Contents

The Details of the Pay Cut

BP's CEO, [Insert CEO's Name], experienced a substantial reduction in their compensation package for [Year]. The exact figure represents a decrease of [Insert Exact Monetary Amount], which translates to a 31% reduction from the previous year's compensation of [Insert Previous Year's Compensation Amount]. BP cited several factors contributing to this decision:

- Decreased profitability due to fluctuating oil prices: The volatile nature of the oil and gas market significantly impacted BP's financial performance in [Year], necessitating cost-cutting measures across the board, including executive compensation. [Insert citation to a relevant financial report or news article].

- Shareholder activism advocating for lower executive compensation: Growing pressure from shareholders concerned about executive pay levels relative to company performance led to calls for a reduction in BP's top executive salaries. This pressure, often exerted through shareholder resolutions and engagement with the board, played a significant role in the decision. [Insert citation to news articles or shareholder statements].

- Strategic refocusing and cost optimization initiatives: BP implemented a company-wide cost-optimization strategy, affecting all departments, including executive remuneration. This move aimed to enhance operational efficiency and ensure the company's long-term financial stability. [Insert citation to BP's official statements or press releases].

Impact on Shareholder Sentiment and Stock Price

The market reacted relatively positively to the news of the BP CEO's pay cut. While there wasn't a dramatic surge in the stock price, analysts observed a [mention increase/decrease/no significant change] in BP's stock value following the announcement. [Insert data on stock price changes and cite source]. This suggests that shareholders viewed the move as a step towards improved corporate governance and responsible management of resources.

- Positive market response, indicating approval of cost-cutting measures: The reduction in executive compensation signaled to investors a commitment to fiscal responsibility and cost-efficiency.

- Analyst commentary on the long-term impact on executive motivation: Some analysts expressed concerns about the potential impact of the pay cut on the CEO's motivation and the ability to attract and retain top talent. However, this perspective was countered by others who argued that aligning executive pay with company performance is crucial for long-term success. [Insert citations to relevant analyst reports].

Comparison with Other Oil and Gas CEOs' Compensation

To contextualize the BP CEO's new compensation package, it's essential to compare it with that of other chief executives in the oil and gas industry. [Insert a table comparing the CEO compensation of BP with other major oil and gas companies like ExxonMobil, Shell, Chevron etc. Include data on base salary, bonuses, stock options, etc. Cite your sources meticulously. Consider adding a visual aid such as a bar chart for easier comparison.].

- Comparison with ExxonMobil CEO's salary: [Insert comparison details and analysis].

- Analysis of average CEO compensation within the sector: [Insert analysis of the BP CEO's compensation relative to the average in the sector].

Long-Term Implications of the Pay Cut

The 31% reduction in the BP CEO's remuneration carries significant long-term implications for the company. While it demonstrates a commitment to shareholder value and responsible corporate governance, it also raises questions about the potential impact on employee morale, talent acquisition, and retention.

- Potential impact on employee motivation and retention strategies: A significant pay cut at the top could potentially affect employee morale and lead to concerns about future compensation adjustments. BP will need to carefully consider its employee compensation and benefits strategies to mitigate any negative impact.

- Discussion on the implications for corporate social responsibility: The move can be interpreted as a positive step towards corporate social responsibility, demonstrating a commitment to fairness and transparency. However, it is crucial to ensure that cost-cutting measures do not compromise the company's ethical standards and social commitments.

Conclusion: Understanding the Significance of the BP CEO's 31% Remuneration Decrease

The 31% reduction in BP's CEO's remuneration is a significant event, reflecting a confluence of factors including fluctuating oil prices, shareholder activism, and a company-wide cost optimization strategy. The market's relatively positive response suggests that investors generally approve of the move towards greater fiscal responsibility and improved corporate governance. However, the long-term implications for employee morale, talent retention, and the overall corporate culture remain to be seen. What are your thoughts on this significant decrease in BP CEO remuneration? Share your insights in the comments below! Stay updated on the latest developments in BP's executive compensation by subscribing to our newsletter. Further reading on related topics can be found at [insert links to relevant articles or websites].

Featured Posts

-

Southern French Alps Weather Storm Brings Unexpected Late Snow

May 21, 2025

Southern French Alps Weather Storm Brings Unexpected Late Snow

May 21, 2025 -

Significant Reduction In Bp Chief Executives Pay 31

May 21, 2025

Significant Reduction In Bp Chief Executives Pay 31

May 21, 2025 -

Southport Attack Councillors Wifes Appeal Fails Following Social Media Outburst

May 21, 2025

Southport Attack Councillors Wifes Appeal Fails Following Social Media Outburst

May 21, 2025 -

Bp Executive Pay 31 Reduction Reported

May 21, 2025

Bp Executive Pay 31 Reduction Reported

May 21, 2025 -

Understanding The Name Of Peppa Pigs New Baby Sister

May 21, 2025

Understanding The Name Of Peppa Pigs New Baby Sister

May 21, 2025

Latest Posts

-

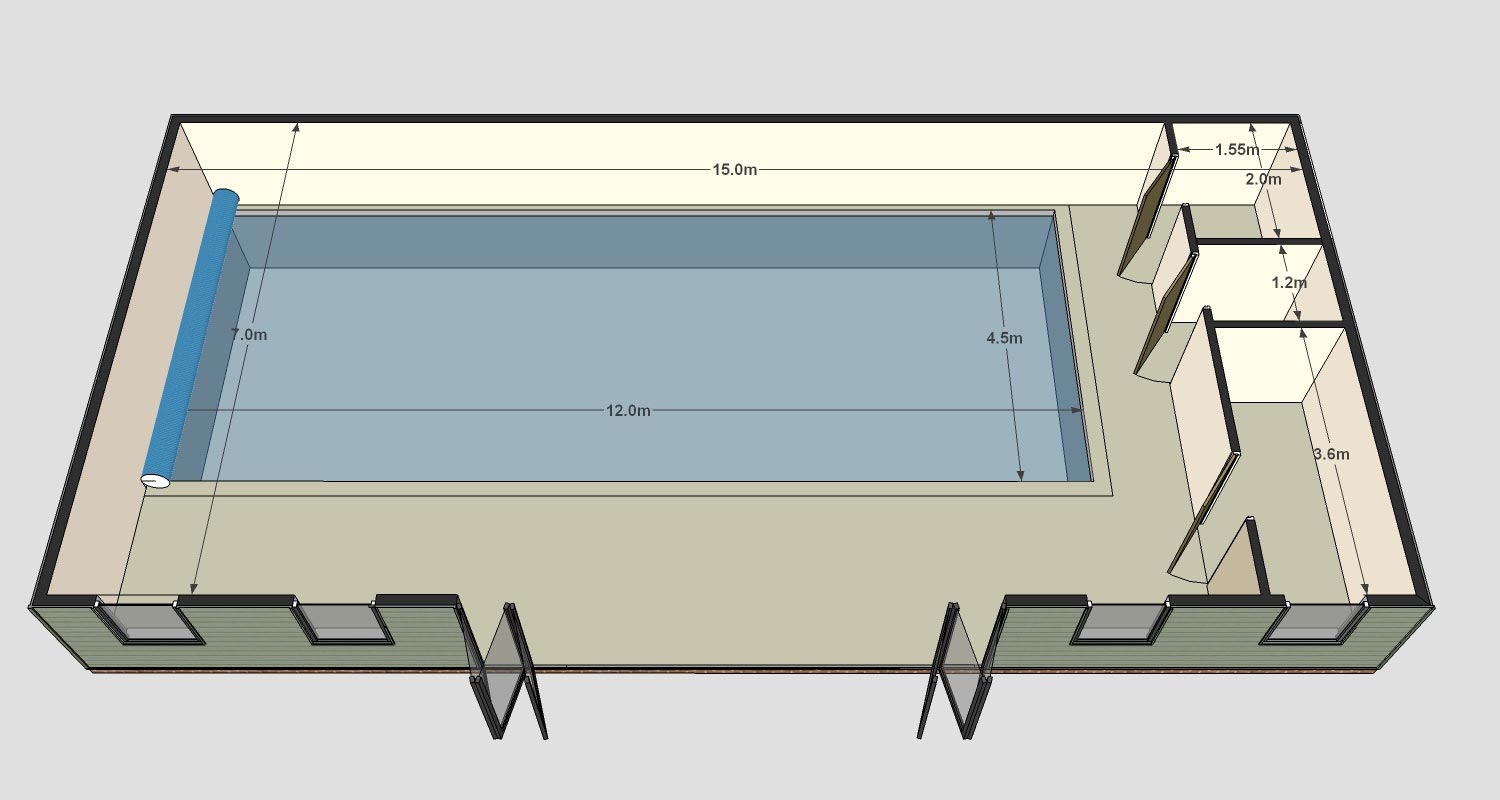

New Olympic Swimming Site To Be Centrepiece Of Nices Aquatic Development

May 21, 2025

New Olympic Swimming Site To Be Centrepiece Of Nices Aquatic Development

May 21, 2025 -

Nice Unveils Plans For New Olympic Sized Swimming Pool Complex

May 21, 2025

Nice Unveils Plans For New Olympic Sized Swimming Pool Complex

May 21, 2025 -

Nices Ambitious Olympic Swimming Pool Plan A New Aquatic Centre

May 21, 2025

Nices Ambitious Olympic Swimming Pool Plan A New Aquatic Centre

May 21, 2025 -

Current Conditions Late Season Snowfall In The Southern French Alps

May 21, 2025

Current Conditions Late Season Snowfall In The Southern French Alps

May 21, 2025 -

Your Guide To A Successful Screen Free Week Engaging Kids Without Screens

May 21, 2025

Your Guide To A Successful Screen Free Week Engaging Kids Without Screens

May 21, 2025