Analysis: BP CEO's Salary Reduced By 31%

Table of Contents

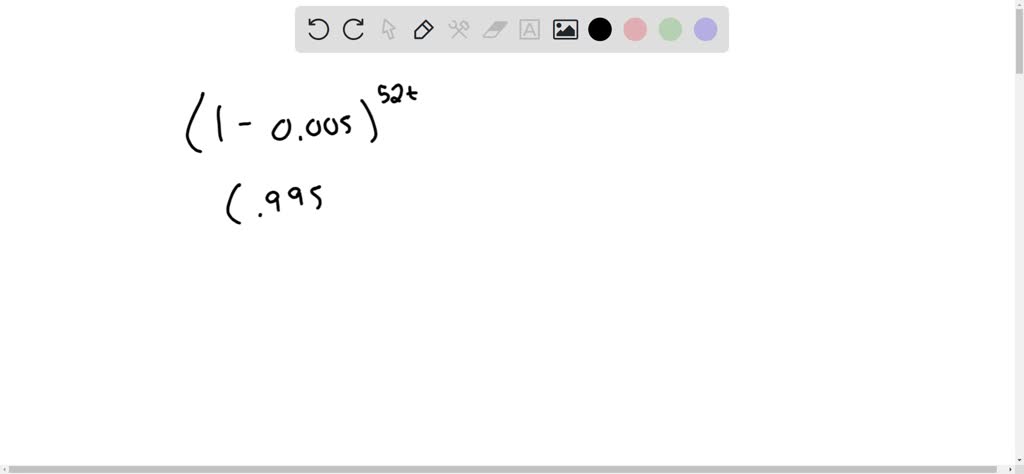

The 31% Reduction: A Detailed Look at the Figures

Bernard Looney's salary has been reduced by a substantial 31%, a move that translates to a significant monetary decrease. While precise figures may vary depending on the source and inclusion of bonuses, reports indicate a considerable drop in his annual compensation. Let's break down the key financial aspects:

- Previous annual salary: [Insert Previous Salary Amount - Source Needed]

- Current annual salary: [Insert Current Salary Amount - Source Needed]

- Total compensation reduction: [Insert Monetary Amount of Reduction - Calculate based on above] This represents a staggering 31% decrease in his total annual compensation package, excluding any potential bonuses or long-term incentive plans. Further clarification regarding the inclusion or exclusion of bonuses and stock options in these figures is needed for a complete understanding of the BP CEO's compensation package.

Potential Reasons Behind the Salary Cut

Several factors could explain this dramatic reduction in the BP CEO's salary. Analyzing these possibilities provides valuable insight into the current pressures facing the energy industry.

-

Company Performance: BP's recent financial performance likely played a crucial role. While specific profit margins and shareholder returns need to be examined, a less-than-stellar performance might have prompted the board to reduce executive compensation as a cost-cutting measure or to align executive pay more closely with company results.

-

Environmental, Social, and Governance (ESG) Factors: Increasing pressure from investors and activists focused on ESG factors is undeniable. The energy industry faces intense scrutiny regarding its environmental impact and ethical practices. A salary reduction could be interpreted as a response to this pressure, demonstrating a commitment to responsible corporate governance and potentially improving the company's ESG score. Any recent controversies or scandals impacting BP's image could have also influenced this decision.

-

Executive Pay Scrutiny: The move aligns with a broader trend of increasing scrutiny of excessive executive pay, particularly in large corporations. Public pressure and regulatory changes are pushing companies to justify high executive compensation packages.

-

Board Decisions: Ultimately, the decision to reduce the BP CEO's salary rested with the board of directors. Their rationale likely considered a combination of the factors outlined above, weighing financial performance, public perception, and long-term strategic goals.

Impact on BP's Stock and Investor Sentiment

The market's reaction to the news of the BP CEO's salary reduction is a key indicator of its impact. Did the stock price increase or decrease following the announcement? A positive response could suggest that investors view the move as a responsible and transparent approach to executive compensation. Conversely, a negative reaction might signal concerns about the underlying reasons for the pay cut, potentially indicating deeper issues within the company. Analysis of investor statements and press releases from BP is needed to fully understand the implications for investor confidence and future investment decisions. Further research into trading volumes surrounding the announcement is also necessary for a comprehensive analysis of market sentiment.

Comparison with Other Energy Company CEOs' Compensation

To understand the significance of Looney's salary cut, it's essential to compare it with the compensation packages of CEOs at comparable energy companies. A table summarizing the annual compensation of CEOs at Shell, ExxonMobil, and other major players would provide valuable context. [Insert table here comparing CEO salaries – data needed from reliable financial sources] This comparison will reveal whether the reduction places BP CEO's compensation at the lower, middle, or upper end of the spectrum, and whether this reflects a broader industry trend or a unique situation within BP.

Long-Term Implications for Executive Pay at BP

This 31% salary reduction could set a precedent for future executive compensation strategies at BP. Will this decision influence future CEO salary negotiations? Will it lead to a more moderate approach to executive pay across different levels of management? The long-term implications are complex and depend on many factors, including the company's financial performance and the prevailing public and investor sentiment regarding executive compensation. The move might signal a shift towards a more performance-based compensation model, potentially tying executive pay more closely to the company's overall success in achieving its sustainability and profitability goals.

Conclusion

The 31% reduction in BP CEO Bernard Looney's salary is a significant event with potentially far-reaching consequences. While the precise reasons remain multifaceted, the decision appears to be influenced by a combination of company performance, increasing ESG scrutiny, and a broader trend towards more responsible executive compensation. The market reaction and the long-term effects on BP's compensation structure and overall corporate governance remain to be seen. Stay updated on the latest analysis of BP CEO's salary and executive compensation trends by subscribing to our newsletter!

Featured Posts

-

David Walliams Departure From Britains Got Talent A Summary

May 21, 2025

David Walliams Departure From Britains Got Talent A Summary

May 21, 2025 -

Peppa Pig Welcomes A New Sibling A Guide To The Newborns Arrival

May 21, 2025

Peppa Pig Welcomes A New Sibling A Guide To The Newborns Arrival

May 21, 2025 -

Juergen Klopps Anfield Return Confirmed Before Season Finale

May 21, 2025

Juergen Klopps Anfield Return Confirmed Before Season Finale

May 21, 2025 -

Nouveau Service De Navette Gratuite Liaison La Haye Fouassiere Haute Goulaine

May 21, 2025

Nouveau Service De Navette Gratuite Liaison La Haye Fouassiere Haute Goulaine

May 21, 2025 -

Klopps Legacy A Boost For Hout Bay Fc

May 21, 2025

Klopps Legacy A Boost For Hout Bay Fc

May 21, 2025

Latest Posts

-

Current Conditions Late Season Snowfall In The Southern French Alps

May 21, 2025

Current Conditions Late Season Snowfall In The Southern French Alps

May 21, 2025 -

Your Guide To A Successful Screen Free Week Engaging Kids Without Screens

May 21, 2025

Your Guide To A Successful Screen Free Week Engaging Kids Without Screens

May 21, 2025 -

Southern France Weather Alert Heavy Snow In The Alps

May 21, 2025

Southern France Weather Alert Heavy Snow In The Alps

May 21, 2025 -

Southern French Alps Storm Brings Unexpected Late Season Snow

May 21, 2025

Southern French Alps Storm Brings Unexpected Late Season Snow

May 21, 2025 -

Screen Free Week With Kids Tips And Activities For A Smooth Transition

May 21, 2025

Screen Free Week With Kids Tips And Activities For A Smooth Transition

May 21, 2025