Bank Of Canada's Monetary Policy: A Rosenberg Perspective

Table of Contents

Rosenberg's Critique of the Bank of Canada's Current Approach

David Rosenberg, a highly respected figure in economic analysis, often offers a contrarian perspective. While specifics change with market conditions, his general stance on the Bank of Canada's actions can frequently be characterized as cautiously critical, highlighting potential risks associated with aggressive interest rate hikes and the efficacy of current inflation targeting strategies.

-

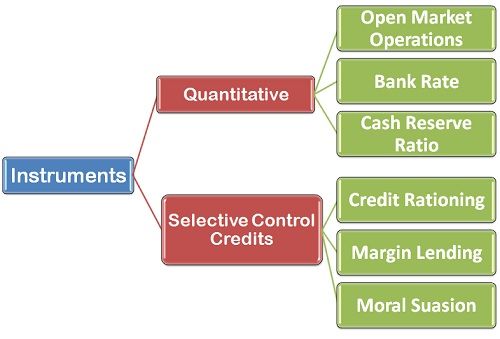

Specific criticisms of current interest rate policies: Rosenberg often scrutinizes the timing and magnitude of interest rate hikes, questioning whether they are proportionate to the economic situation and whether they risk triggering a sharper-than-anticipated recession. He meticulously analyzes the lagged effects of monetary policy, arguing that the full impact of rate adjustments might not be immediately apparent.

-

Concerns about inflation targeting methodology: He challenges the Bank of Canada's inflation targeting framework, arguing that focusing solely on a specific inflation target can overlook other crucial economic indicators and lead to unintended consequences. He might point out the limitations of using a single metric, suggesting a more nuanced approach incorporating other factors like employment levels and wage growth.

-

Analysis of the Bank of Canada's forecasts and their accuracy: Rosenberg frequently analyzes the Bank of Canada's economic forecasts, comparing them to historical data and evaluating their accuracy. He might highlight instances where the Bank's projections significantly deviated from actual economic outcomes, questioning the robustness of their models.

-

Discussion of potential unintended consequences of the Bank's actions: A key aspect of Rosenberg’s analysis is exploring the potential collateral damage of monetary policy decisions. This includes evaluating the impact on various sectors, such as the housing market, and assessing risks to financial stability. He emphasizes potential negative effects on small businesses and vulnerable populations.

-

Mention of any alternative strategies Rosenberg proposes: Instead of solely relying on interest rate hikes, Rosenberg may advocate for alternative strategies like targeted fiscal stimulus or other measures designed to address specific economic imbalances. These alternatives often aim to mitigate the potential negative consequences associated with aggressive monetary tightening.

Analyzing the Impact on the Canadian Economy

The Bank of Canada's monetary policy decisions significantly impact the Canadian economy's various sectors. Rosenberg's analysis usually highlights the ripple effects of interest rate changes.

-

Impact on consumer spending: Higher interest rates directly increase borrowing costs, potentially dampening consumer spending on big-ticket items like homes and vehicles. This reduced consumer demand can have knock-on effects across the economy.

-

Effect on business investment: Increased borrowing costs also discourage business investment, potentially slowing economic growth and job creation. Rosenberg's analysis often examines the impact on small and medium-sized enterprises (SMEs), which are often more sensitive to interest rate changes.

-

Influence on the Canadian dollar exchange rate: Monetary policy decisions can influence the Canadian dollar's value against other currencies. Higher interest rates, for instance, can attract foreign investment, leading to a stronger Canadian dollar. Rosenberg's insights often include considerations of the impact on Canada's trade balance.

-

Potential impact on different demographics within the Canadian population: Rosenberg's analysis usually accounts for the distributional effects of monetary policy, highlighting how interest rate changes can disproportionately affect certain demographic groups, such as those with higher levels of debt.

Rosenberg's Predictions and Outlook for the Canadian Economy

Predicting future interest rate movements and the overall economic outlook is inherently challenging. However, Rosenberg's analysis provides valuable insights.

-

Timeline for potential changes in monetary policy: Based on his interpretation of economic indicators and the Bank of Canada's actions, Rosenberg might offer a timeline for potential future interest rate changes—whether further increases, pauses, or even cuts.

-

Rosenberg's assessment of long-term economic prospects: His perspective on long-term economic prospects considers factors such as productivity growth, demographic shifts, and technological advancements.

-

Potential risks and opportunities for investors: Rosenberg's analysis is often valuable for investors, as it outlines potential risks and opportunities arising from the Bank of Canada's monetary policy and the broader economic outlook.

-

Comparison of Rosenberg's outlook with other economic forecasts: It's crucial to compare Rosenberg's predictions with those of other economists and forecasters to gain a comprehensive understanding of the range of potential outcomes.

Alternative Perspectives and Counterarguments

It's important to acknowledge that Rosenberg's views are not universally accepted. Alternative perspectives exist regarding the Bank of Canada's policies.

-

Summarize differing viewpoints on inflation and economic growth: Some economists might argue that the Bank of Canada's current approach is necessary to control inflation effectively and prevent a wage-price spiral, even if it means accepting a period of slower economic growth.

-

Highlight alternative approaches to monetary policy: Other economists might suggest different approaches, such as focusing on alternative indicators beyond inflation targets or employing unconventional monetary policy tools.

-

Discuss the limitations and potential biases in different analyses: All economic analyses, including Rosenberg's, are subject to limitations and potential biases. Recognizing these limitations is crucial for critical evaluation.

Conclusion: Navigating the Bank of Canada's Monetary Policy Landscape with Rosenberg's Insights

Understanding the Bank of Canada's monetary policy is vital for investors and businesses. David Rosenberg’s contrarian perspective provides a valuable counterpoint to the official narrative, highlighting potential risks and offering alternative interpretations of economic data. By considering his analysis alongside other viewpoints, you can form a more comprehensive understanding of the current economic climate and make more informed investment decisions. Stay informed about Bank of Canada monetary policy updates and continue to research Rosenberg's economic insights to navigate the complexities of the Canadian economic landscape effectively. Understanding the nuances of the Bank of Canada's monetary policy, informed by perspectives like Rosenberg's, is crucial for making sound financial decisions.

Featured Posts

-

Verso La Parita Sul Lavoro Analisi Della Situazione Attuale E Prospettive Di Miglioramento

Apr 29, 2025

Verso La Parita Sul Lavoro Analisi Della Situazione Attuale E Prospettive Di Miglioramento

Apr 29, 2025 -

We Now Know How Ai Thinks And Its Barely Thinking At All

Apr 29, 2025

We Now Know How Ai Thinks And Its Barely Thinking At All

Apr 29, 2025 -

1 33 Mln Zl Za Porsche 911 Hit Sprzedazy W Polsce

Apr 29, 2025

1 33 Mln Zl Za Porsche 911 Hit Sprzedazy W Polsce

Apr 29, 2025 -

New Business Hot Spots Across The Nation An Interactive Map

Apr 29, 2025

New Business Hot Spots Across The Nation An Interactive Map

Apr 29, 2025 -

Review One Plus 13 R A Practical Alternative To The Pixel 9a

Apr 29, 2025

Review One Plus 13 R A Practical Alternative To The Pixel 9a

Apr 29, 2025

Latest Posts

-

Parita Sul Posto Di Lavoro Una Battaglia Ancora Da Combattere

Apr 29, 2025

Parita Sul Posto Di Lavoro Una Battaglia Ancora Da Combattere

Apr 29, 2025 -

Verso La Parita Sul Lavoro Analisi Della Situazione Attuale E Prospettive Di Miglioramento

Apr 29, 2025

Verso La Parita Sul Lavoro Analisi Della Situazione Attuale E Prospettive Di Miglioramento

Apr 29, 2025 -

Lavoro E Parita Progressi Lenti Ma Costanti

Apr 29, 2025

Lavoro E Parita Progressi Lenti Ma Costanti

Apr 29, 2025 -

Saudi Wealth Fund Imposes One Year Ban On Pw C Advisory Services

Apr 29, 2025

Saudi Wealth Fund Imposes One Year Ban On Pw C Advisory Services

Apr 29, 2025 -

Parita Di Genere Sul Lavoro La Situazione Attuale E Le Prospettive Future

Apr 29, 2025

Parita Di Genere Sul Lavoro La Situazione Attuale E Le Prospettive Future

Apr 29, 2025