Saudi Wealth Fund Imposes One-Year Ban On PwC Advisory Services

Table of Contents

Reasons Behind the Saudi Wealth Fund's Ban on PwC

The exact reasons behind the Saudi Wealth Fund's decision to ban PwC's advisory services remain officially undisclosed. However, several potential factors contributing to this drastic measure have emerged through media reports and industry speculation. Understanding these potential reasons is crucial to assessing the long-term implications for both parties.

-

Potential Conflicts of Interest: The PIF engages in numerous complex investment transactions globally. A potential conflict of interest, where PwC’s advisory role conflicted with its other engagements, could have led to the ban. Transparency and avoidance of potential biases are paramount in managing a sovereign wealth fund of this magnitude. Further investigation is needed to confirm this possibility.

-

Allegations of Misconduct or Non-Compliance: Reports, while unsubstantiated at this time, suggest potential allegations of misconduct or failure to comply with regulatory requirements within PwC's dealings with the PIF. Such allegations, if proven, could severely damage PwC's reputation and justify the ban. This highlights the importance of stringent ethical standards within the advisory services industry, particularly when dealing with sovereign wealth funds.

-

Failure to Meet Contractual Obligations: The Saudi Wealth Fund may have found PwC deficient in meeting the terms of their contractual agreements. This could involve missed deadlines, inadequate service delivery, or a lack of responsiveness to the PIF's needs. Such breaches of contract would provide ample justification for the imposed ban.

-

Concerns Regarding the Quality of Services Provided: The PIF, responsible for managing vast sums of money, demands the highest standards of expertise and performance from its advisors. Concerns about the quality of services rendered by PwC, leading to suboptimal investment decisions or financial losses, could have prompted the ban. This underscores the PIF's commitment to securing optimal returns for its investments.

-

Review of PwC's auditing practices related to the PIF: The ban might be linked to a recent review of PwC's auditing practices in relation to the PIF's financial statements or investment activities. Discrepancies or concerns uncovered during this review could have triggered the decision to sever ties temporarily.

Impact of the Ban on the Saudi Wealth Fund (PIF)

The one-year ban on PwC's advisory services will undoubtedly have significant repercussions for the PIF, both in the short-term and long-term.

-

Disruption of Ongoing Projects: Several ongoing investment projects and strategic initiatives may experience disruptions due to the abrupt halt in PwC's involvement. This could lead to delays and increased costs in project completion.

-

Delays in Investment Decisions: The PIF's investment strategy relies heavily on expert advice. The absence of PwC's expertise will inevitably cause delays in making crucial investment decisions, potentially impacting the PIF's overall portfolio performance.

-

Need to Find Alternative Advisory Firms: The PIF will need to identify and onboard new advisory firms quickly, a process that requires considerable time and resources. This transition period may prove challenging and could lead to temporary inefficiencies.

-

Potential Increase in Costs and Time Associated with the Transition: Finding suitable replacements, negotiating new contracts, and transferring knowledge will incur significant costs and time, potentially impacting the PIF's overall budget and operational efficiency.

-

Impact on PIF's investment strategy and portfolio management: The PIF's diversified portfolio, spanning various sectors and geographies, relies on careful strategic planning and risk management. The absence of PwC's expertise could momentarily affect the PIF's ability to make optimal investment choices.

Impact of the Ban on PwC's Reputation and Business

The Saudi Wealth Fund's decision to ban PwC's advisory services carries significant consequences for the firm's global reputation and business operations.

-

Loss of a Significant Client: The PIF is a major player in global finance. Losing such a significant client deals a substantial blow to PwC's revenue and market standing.

-

Damage to PwC's Credibility and Brand Image: The ban negatively impacts PwC's credibility and brand image, potentially affecting its ability to attract and retain other high-profile clients. The news will likely fuel negative press coverage and scrutiny of PwC’s business practices.

-

Potential Impact on Future Contracts with Other Government Entities: The ban could trigger a domino effect, potentially jeopardizing PwC's chances of securing future contracts with other government entities and sovereign wealth funds globally.

-

Legal and Financial Ramifications for PwC: The ban could trigger legal and financial repercussions for PwC, depending on the underlying reasons and potential breaches of contract. Investigations and legal challenges could follow, impacting PwC's financial stability.

-

PwC's response to the ban: PwC's response to the ban will be crucial in mitigating the damage to its reputation. A transparent and comprehensive response addressing the reasons behind the ban and outlining steps taken to rectify any shortcomings is crucial.

Potential Future Implications and Alternatives for the Saudi Wealth Fund

The Saudi Wealth Fund's decision to ban PwC creates a need for the PIF to re-evaluate its advisory selection processes and explore alternative strategies for the future.

-

Selection of new advisory firms: The PIF will need a rigorous process to select new advisory firms, ensuring the highest standards of expertise, ethics, and compliance are met.

-

Internal restructuring of the PIF's advisory functions: The PIF might choose to bolster its internal advisory capabilities to reduce its dependence on external consultants.

-

Increased scrutiny of advisory services selection processes: The PIF is likely to increase scrutiny of its advisory services selection processes to avoid similar situations in the future. This may include more robust due diligence and background checks.

-

Strengthening regulatory frameworks related to the PIF's operations: The incident might prompt regulatory reforms related to the PIF's operations, enhancing transparency and accountability in its dealings with external advisors.

-

Global implications for similar situations involving sovereign wealth funds: This situation serves as a cautionary tale for other sovereign wealth funds globally, highlighting the importance of careful advisor selection and risk management.

Conclusion

The Saudi Wealth Fund's decision to impose a one-year ban on PwC advisory services is a landmark event with far-reaching consequences. The potential reasons for the ban, ranging from conflicts of interest to concerns regarding service quality, highlight the critical need for transparency and accountability in the relationship between sovereign wealth funds and their advisors. The impact on both the PIF and PwC is significant, prompting a reassessment of operational strategies and risk management procedures. The PIF's need to find alternative advisory solutions, along with PwC's efforts to repair its reputation, will shape the future landscape of their relationship and similar engagements globally. Stay tuned for updates and further analysis on this developing story, and continue to monitor the evolving landscape of the Saudi Wealth Fund and its partnerships. Understand the implications of this ban and the future of Saudi Wealth Fund advisory services.

Featured Posts

-

Alejandro Tabilo Triumphs Over Novak Djokovic At Monte Carlo

Apr 29, 2025

Alejandro Tabilo Triumphs Over Novak Djokovic At Monte Carlo

Apr 29, 2025 -

How You Tube Became A Go To Platform For Older Viewers

Apr 29, 2025

How You Tube Became A Go To Platform For Older Viewers

Apr 29, 2025 -

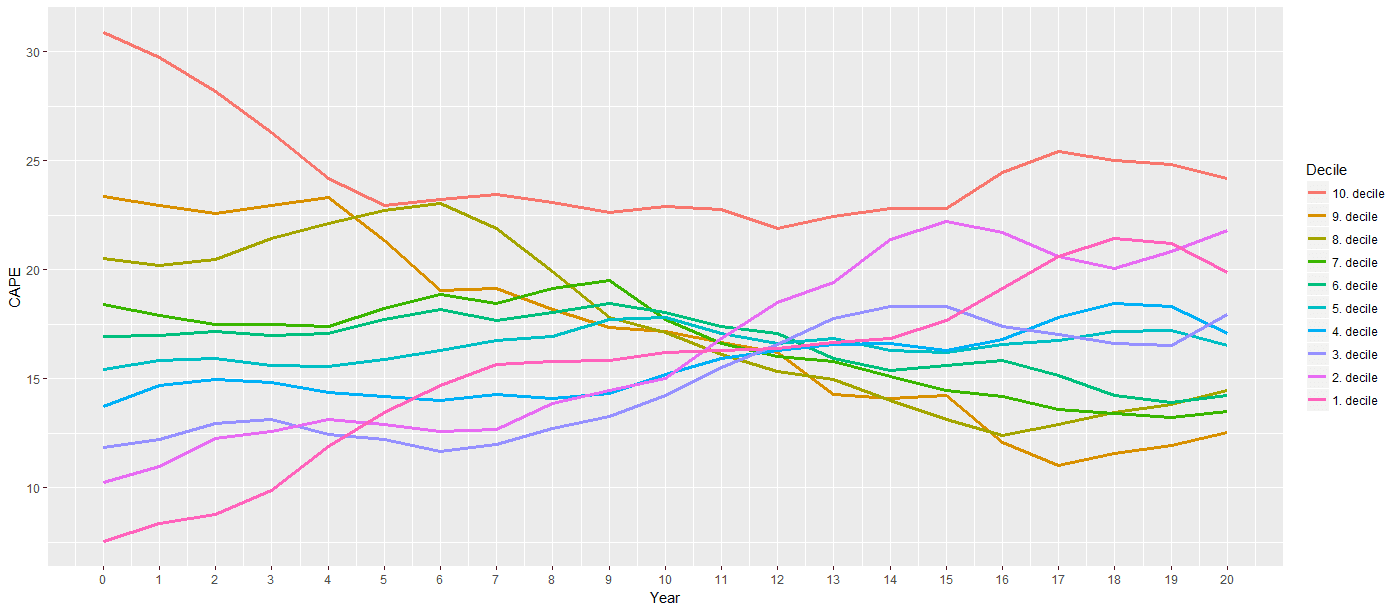

Understanding High Stock Market Valuations Bof As Investor Guidance

Apr 29, 2025

Understanding High Stock Market Valuations Bof As Investor Guidance

Apr 29, 2025 -

Nyt Strands February 25 2025 Clues Answers And Spangram Solution

Apr 29, 2025

Nyt Strands February 25 2025 Clues Answers And Spangram Solution

Apr 29, 2025 -

Is Kuxius Solid State Power Bank Worth The Price A Detailed Review

Apr 29, 2025

Is Kuxius Solid State Power Bank Worth The Price A Detailed Review

Apr 29, 2025

Latest Posts

-

Understanding The Surge In Adhd Cases Among Young Adults At Aiims

Apr 29, 2025

Understanding The Surge In Adhd Cases Among Young Adults At Aiims

Apr 29, 2025 -

Aiims A Growing Trend Of Adhd Diagnoses Among Young Patients

Apr 29, 2025

Aiims A Growing Trend Of Adhd Diagnoses Among Young Patients

Apr 29, 2025 -

Increase In Adhd Diagnoses At Aiims Investigating Environmental And Genetic Influences

Apr 29, 2025

Increase In Adhd Diagnoses At Aiims Investigating Environmental And Genetic Influences

Apr 29, 2025 -

Adhd In Young People Aiims Data Reveals A Growing Concern

Apr 29, 2025

Adhd In Young People Aiims Data Reveals A Growing Concern

Apr 29, 2025 -

The Rise Of Adhd Among Young Adults A Case Study From Aiims Opd

Apr 29, 2025

The Rise Of Adhd Among Young Adults A Case Study From Aiims Opd

Apr 29, 2025