Are High Stock Valuations A Concern? BofA Weighs In

Table of Contents

BofA's Stance on Current Market Valuations

BofA's assessment of current stock valuations is generally cautious. While acknowledging the strong performance of the market, they highlight potential risks associated with the current high levels. Their analysis suggests that certain sectors are significantly overvalued compared to historical averages and projected future earnings. They aren't necessarily predicting an immediate crash, but they urge investors to proceed with caution and adopt a more conservative approach.

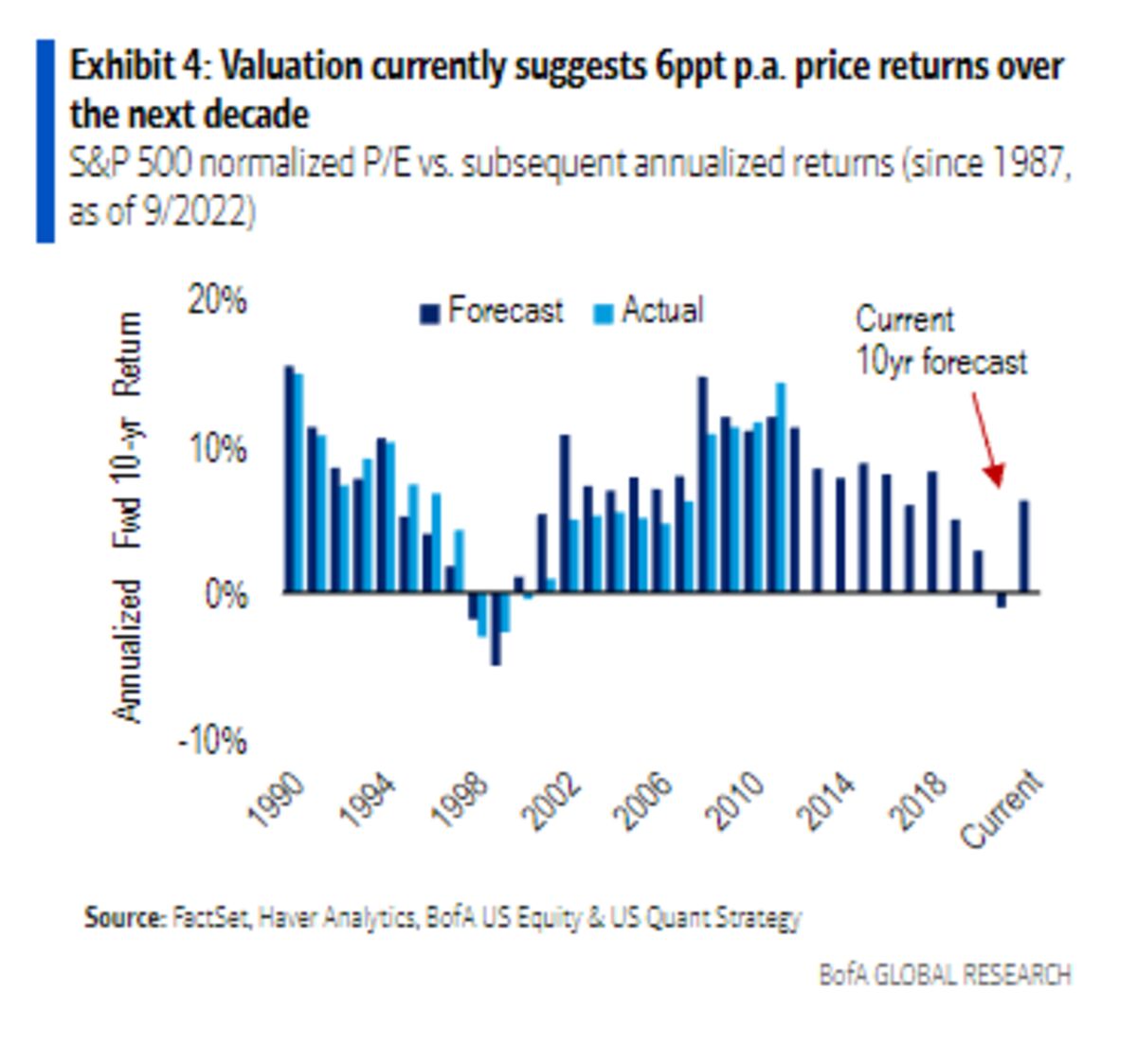

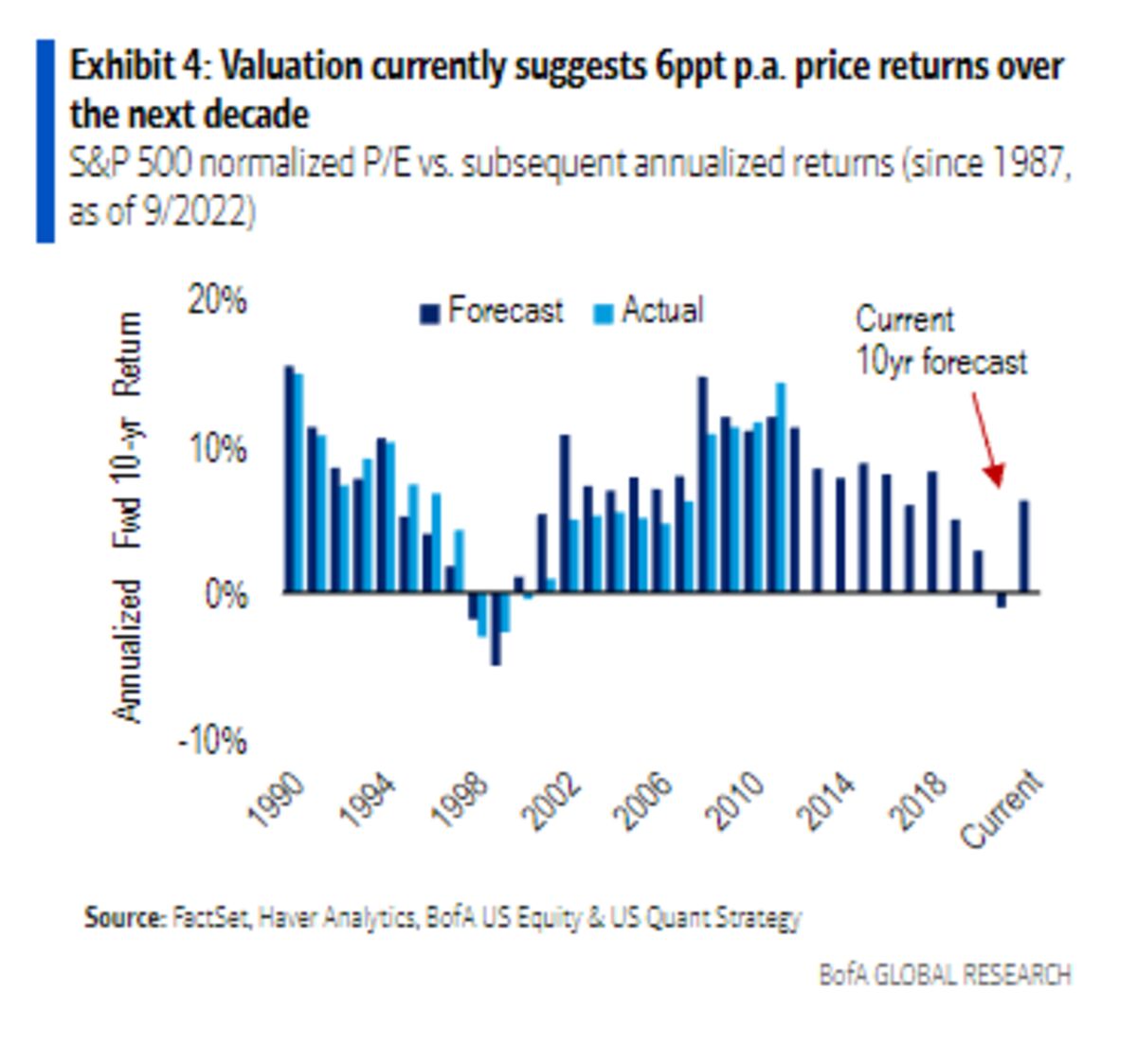

- Key indicators BofA uses to assess valuations: BofA employs a range of metrics, including the Price-to-Earnings ratio (P/E), the Shiller PE ratio (CAPE), and various discounted cash flow models, to analyze market valuations across different sectors.

- BofA's target price predictions: While specific target price predictions vary across sectors and individual stocks, BofA's reports generally suggest a more modest growth outlook than what's currently priced into the market. Their rationale often points to concerns about future earnings growth and the potential impact of rising interest rates.

- Overvalued and undervalued sectors: BofA's research frequently identifies specific sectors it considers overvalued (e.g., certain technology sub-sectors during periods of rapid growth) and others that appear undervalued (e.g., value stocks during periods of market uncertainty). These assessments are constantly updated and reflect changes in macroeconomic conditions.

Factors Contributing to High Stock Valuations

Several macroeconomic factors have contributed to the current environment of high stock valuations. Understanding these factors is crucial for interpreting BofA's analysis and forming your own investment strategy.

- Low interest rates: Historically low interest rates have made it cheaper for companies to borrow money, fueling investment and potentially boosting stock prices. Simultaneously, low rates reduce the attractiveness of bonds, pushing investors towards riskier assets like stocks.

- Quantitative easing (QE): Central banks' QE programs have injected significant liquidity into the market, further driving up asset prices, including stocks. This increased liquidity can inflate asset bubbles and make it difficult to accurately assess intrinsic value.

- Strong corporate earnings (or weak earnings growth): While strong corporate earnings can justify high valuations, it's important to note that in some periods, high valuations may not be fully supported by earnings growth. BofA analyzes the relationship between earnings growth and valuations to assess whether the market is pricing in overly optimistic future prospects.

- Investor sentiment and speculation: Investor sentiment and speculation play a significant role in driving stock prices. Periods of optimism and FOMO (fear of missing out) can lead to inflated valuations, regardless of underlying fundamentals.

The Role of Inflation in Stock Valuations

Inflation significantly impacts stock valuations. BofA closely monitors inflation data and its potential effects on corporate profits and investor expectations.

- Inflation's effect on discount rates: Higher inflation generally leads to higher discount rates used in valuation models. This reduces the present value of future earnings, potentially dampening stock prices.

- BofA's inflation predictions and implications: BofA's economists regularly forecast inflation rates and analyze their implications for the stock market. Their predictions influence their overall assessment of market valuations and the risks associated with high stock prices.

- Inflation and market correction: High and unexpected inflation can trigger a market correction as investors reassess the value of stocks in light of reduced purchasing power and higher interest rates.

Potential Risks Associated with High Stock Valuations

BofA's analysis highlights several risks associated with the current environment of high stock valuations. Investors need to be aware of these potential downsides.

- Market correction or crash: High valuations often precede market corrections or even crashes. BofA considers the likelihood of such events, factoring in the level of overvaluation and other market indicators.

- Increased volatility and market uncertainty: High valuations often lead to increased market volatility as investors become more sensitive to news and events that could trigger price swings.

- Lower future returns: Stocks purchased at high valuations may offer lower returns compared to those purchased at lower valuations. BofA emphasizes the importance of assessing long-term return potential within the context of current valuations.

- Sector-specific risks: BofA identifies specific sectors that may be particularly vulnerable to a market correction due to their high valuations or exposure to certain economic risks.

Investment Strategies in a High-Valuation Environment

Given their assessment of high stock valuations, BofA recommends a cautious and diversified investment approach.

- Diversification: BofA stresses the importance of diversification across different asset classes to mitigate risk.

- Asset class recommendations: BofA may suggest allocating a portion of your portfolio to asset classes less correlated with stocks, such as bonds, real estate, or alternative investments.

- Risk management strategies: Strategies like hedging and stop-loss orders can help limit potential losses in a volatile market.

- Long-term investing: BofA generally advocates for long-term investing strategies over short-term trading in navigating high-valuation environments.

Conclusion: Navigating the Challenges of High Stock Valuations

BofA's analysis reveals that while the market may appear strong, high stock valuations present significant risks. Understanding these risks and incorporating a diversified, long-term strategy is crucial. The potential for a market correction or lower future returns should not be ignored. BofA's insights provide valuable guidance for navigating this complex market landscape. Dive deeper into BofA's analysis on high stock valuations to develop a well-informed investment strategy and make sound investment choices.

Featured Posts

-

Analyzing The Grand Theft Auto Vi Trailer A Frame By Frame Review

May 05, 2025

Analyzing The Grand Theft Auto Vi Trailer A Frame By Frame Review

May 05, 2025 -

Microsoft Activision Merger Ftcs Appeal And The Future Of The Deal

May 05, 2025

Microsoft Activision Merger Ftcs Appeal And The Future Of The Deal

May 05, 2025 -

Chinas Automotive Market Bmw And Porsches Experience And Implications For Competitors

May 05, 2025

Chinas Automotive Market Bmw And Porsches Experience And Implications For Competitors

May 05, 2025 -

Ray Epps Sues Fox News For Defamation January 6th Falsehoods At The Center Of The Case

May 05, 2025

Ray Epps Sues Fox News For Defamation January 6th Falsehoods At The Center Of The Case

May 05, 2025 -

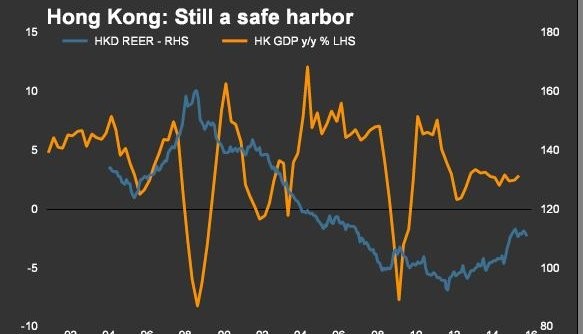

Hong Kongs Fx Peg Us Dollar Intervention After Two Year Hiatus

May 05, 2025

Hong Kongs Fx Peg Us Dollar Intervention After Two Year Hiatus

May 05, 2025

Latest Posts

-

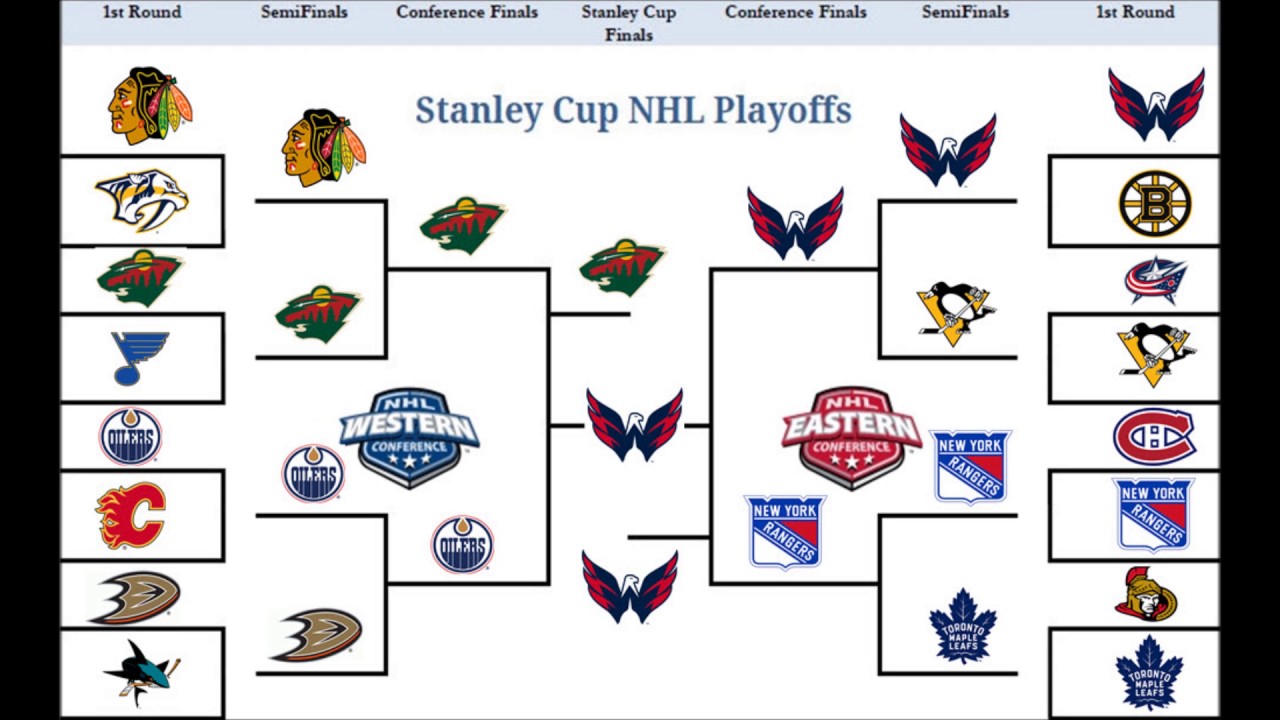

Nhl Stanley Cup Playoffs A Look At The First Round

May 05, 2025

Nhl Stanley Cup Playoffs A Look At The First Round

May 05, 2025 -

Will The Oilers Rebound Against The Canadiens A Morning Coffee Analysis

May 05, 2025

Will The Oilers Rebound Against The Canadiens A Morning Coffee Analysis

May 05, 2025 -

Showdown Saturday A Look At The Nhl Playoff Standings

May 05, 2025

Showdown Saturday A Look At The Nhl Playoff Standings

May 05, 2025 -

First Round Nhl Playoffs Key Factors And Predictions

May 05, 2025

First Round Nhl Playoffs Key Factors And Predictions

May 05, 2025 -

Nhl Recap Panthers Rally Avalanche Crushed By Johnston And Rantanen

May 05, 2025

Nhl Recap Panthers Rally Avalanche Crushed By Johnston And Rantanen

May 05, 2025