Hong Kong's FX Peg: US Dollar Intervention After Two-Year Hiatus

Table of Contents

The Mechanics of Hong Kong's Currency Board System

Hong Kong operates under a currency board system, a unique arrangement that maintains a fixed exchange rate between the Hong Kong dollar and the US dollar. This system is the cornerstone of Hong Kong's monetary policy, ensuring stability and confidence in the local currency. The system's strength lies in its commitment to a fixed exchange rate, currently pegged at HKD 7.8 to USD 1. This peg is maintained through a variety of mechanisms, primarily managed by the HKMA.

The HKMA plays a central role in upholding the peg. Its primary responsibility is to ensure the full backing of Hong Kong dollar banknotes with US dollar reserves. This means that for every Hong Kong dollar in circulation, there is a corresponding amount of US dollars held in reserve. When market forces threaten the peg, the HKMA intervenes by buying or selling US dollars to maintain the fixed exchange rate. This intervention mechanism prevents significant fluctuations in the HKD's value against the USD. However, this commitment to the peg significantly limits the HKMA's flexibility in setting independent monetary policy.

- Fixed exchange rate of HKD 7.8 to USD 1. This provides certainty and predictability for businesses and investors.

- Full backing of Hong Kong dollar banknotes with US dollar reserves. This ensures the stability and credibility of the HKD.

- HKMA's role in buying or selling US dollars to maintain the peg. This is the core mechanism for managing the exchange rate.

- Limited flexibility in monetary policy. This constraint necessitates close monitoring of external factors.

Reasons Behind the Recent US Dollar Intervention

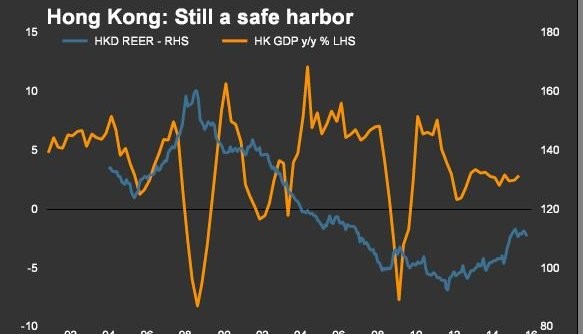

The HKMA's recent intervention was a response to market pressures that threatened to push the HKD below its lower bound of the permitted trading band. Several factors contributed to this pressure. Increased speculation against the HKD, fueled by global uncertainty and interest rate differentials, played a significant role. The widening gap between US interest rates and Hong Kong interest rates created an incentive for capital to flow out of Hong Kong, putting downward pressure on the HKD. This outflow of capital further intensified the pressure on the peg. Furthermore, global economic uncertainty and geopolitical risks in the region also contributed to capital flight, adding to the downward pressure on the HKD.

- Increased speculation against the HKD. Market participants betting against the peg.

- Impact of global interest rate differentials. Higher US interest rates attracted capital away from Hong Kong.

- Potential capital flight. Investors moving funds out of Hong Kong due to uncertainty.

- Geopolitical risks affecting the region. Broader global events impacting investor confidence.

Implications of the Intervention for the Hong Kong Dollar and Economy

The HKMA's intervention had immediate and foreseeable effects on the Hong Kong economy. In the short term, the intervention successfully strengthened the HKD, reinforcing confidence in the peg. However, this action also has implications for interest rates. To maintain the peg, the HKMA may need to adjust its interest rate policy, which could impact borrowing costs for businesses and consumers. The intervention’s long-term effects on the attractiveness of Hong Kong as a financial hub are also noteworthy. While the stability provided by the peg is a key attraction, the limited monetary policy flexibility might become a concern in the future.

- Strengthening of the HKD. Restoring the peg to its target level.

- Impact on interest rates in Hong Kong. Potential adjustments to align with US rates.

- Effects on borrowing costs for businesses. Increased or decreased costs depending on interest rate adjustments.

- Attractiveness of Hong Kong as a financial hub. The peg's stability remains a key factor, but monetary policy limitations might become a concern.

The Future of Hong Kong's Currency Peg

The long-term sustainability of Hong Kong's currency peg remains a subject of ongoing debate. While the system has served Hong Kong well for decades, several potential challenges could threaten its viability. These include further escalation of geopolitical risks, unexpected shifts in global capital flows, and the persistent divergence of monetary policies between the US and Hong Kong. A review of the currency board system itself, possibly involving adjustments to its mechanisms, could become necessary to ensure its long-term effectiveness. Alternative scenarios, such as a managed float or a re-pegging to another currency, remain possibilities, though highly unlikely in the near future.

- Potential future challenges to the peg. Geopolitical risks, capital flow fluctuations, and monetary policy divergence.

- Review of the currency board system. Potential adjustments to enhance its resilience.

- Potential adjustments to the system. Minor modifications or more significant reforms could be considered.

- Long-term viability of the peg. The peg’s future will depend on effective management of the system and adaptability to evolving circumstances.

Conclusion

The HKMA's recent US dollar intervention serves as a reminder of the complexities and importance of Hong Kong's FX peg. The intervention, driven by market pressures stemming from global economic uncertainties and interest rate differentials, highlights the constant vigilance required to maintain the peg's stability. Understanding the mechanics of Hong Kong's currency board system and the HKMA's role in managing it is crucial for navigating the intricacies of the Hong Kong dollar. Stay updated on future interventions in Hong Kong's FX market, follow the HKMA's monetary policy announcements related to the Hong Kong dollar peg, and learn more about the complexities of Hong Kong's currency board system and its implications for investors. The long-term sustainability of Hong Kong's FX peg will depend on continued skillful management and adaptation to the ever-changing global landscape.

Featured Posts

-

53 Year Sentence For Hate Crime Attack On Palestinian American Boy And Mother

May 05, 2025

53 Year Sentence For Hate Crime Attack On Palestinian American Boy And Mother

May 05, 2025 -

What Happened In Two Days At A Wild Crypto Party

May 05, 2025

What Happened In Two Days At A Wild Crypto Party

May 05, 2025 -

Anchor Brewing Companys Legacy Ends 127 Years Of Brewing History Concludes

May 05, 2025

Anchor Brewing Companys Legacy Ends 127 Years Of Brewing History Concludes

May 05, 2025 -

Nhl Com Q And A Wolf On Calgary Flames Season Playoff Outlook And Calder Race

May 05, 2025

Nhl Com Q And A Wolf On Calgary Flames Season Playoff Outlook And Calder Race

May 05, 2025 -

A Wild Crypto Party Two Days Of Crypto Chaos

May 05, 2025

A Wild Crypto Party Two Days Of Crypto Chaos

May 05, 2025

Latest Posts

-

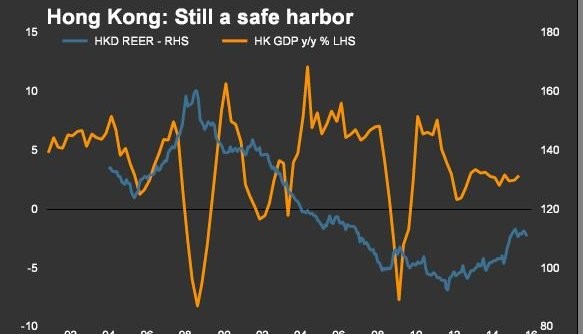

Nhl Standings Update Key Games To Watch On Showdown Saturday

May 05, 2025

Nhl Standings Update Key Games To Watch On Showdown Saturday

May 05, 2025 -

Navigating The First Round Of The Nhl Playoffs

May 05, 2025

Navigating The First Round Of The Nhl Playoffs

May 05, 2025 -

Nhl News Florida Panthers Stage Comeback Win Avalanche Suffer Heavy Loss

May 05, 2025

Nhl News Florida Panthers Stage Comeback Win Avalanche Suffer Heavy Loss

May 05, 2025 -

Nhl Playoff Race Heats Up Showdown Saturdays Key Matchups And Standings Implications

May 05, 2025

Nhl Playoff Race Heats Up Showdown Saturdays Key Matchups And Standings Implications

May 05, 2025 -

Nhl Stanley Cup Playoffs A Look At The First Round

May 05, 2025

Nhl Stanley Cup Playoffs A Look At The First Round

May 05, 2025