Microsoft-Activision Merger: FTC's Appeal And The Future Of The Deal

Table of Contents

The FTC's Arguments Against the Merger

The FTC's core argument hinges on the assertion that the Microsoft-Activision merger would create an anti-competitive behemoth, stifling innovation and harming consumers. Their concerns span several key areas.

Anti-competitive Concerns

The FTC argues that the merger would significantly reduce competition, particularly within the console, cloud gaming, and subscription service markets. They believe this would lead to less choice for gamers and potentially higher prices.

- Reduced access to popular titles: The FTC is particularly concerned about the future of Activision Blizzard's popular franchises, such as Call of Duty, World of Warcraft, and Candy Crush, on competing platforms like PlayStation and Nintendo Switch. They fear Microsoft could make these titles exclusive to Xbox, limiting consumer choice.

- Stifled competition in cloud gaming: The FTC argues that Microsoft's acquisition of Activision Blizzard's considerable cloud gaming assets would give them an unfair advantage over competitors like Google Stadia and Amazon Luna.

- Xbox Game Pass dominance: The addition of Activision Blizzard's extensive game catalog to Xbox Game Pass could further consolidate Microsoft's dominance in the subscription gaming market, potentially driving out competitors. The FTC has presented evidence suggesting this could create a significant barrier to entry for new competitors.

Market Domination

The FTC's case rests on the assertion that the combined entity would hold an unassailable market position, leading to negative consequences for consumers.

- Increased market share: The FTC presented statistics demonstrating that the merger would significantly increase Microsoft's market share in various gaming sectors, potentially leading to monopolistic practices.

- Reduced innovation: Lack of competition could stifle innovation, as Microsoft would have less incentive to develop new and exciting gaming experiences. The FTC cited expert opinions supporting this claim.

- Higher prices and fewer choices: The FTC argued that a lack of competition could translate to higher prices for games and gaming services, as well as fewer choices for gamers.

Microsoft's Defense of the Merger

Microsoft counters the FTC's claims, arguing that the merger will ultimately benefit gamers and maintain fair competition.

Commitment to Competition

Microsoft has repeatedly emphasized its commitment to maintaining Call of Duty and other Activision Blizzard titles on multiple platforms, including PlayStation.

- Long-term contractual agreements: Microsoft has offered long-term contracts to keep Call of Duty on PlayStation, aiming to demonstrate its commitment to platform neutrality. They've publicly stated their intent to continue this practice.

- Expansion of Game Pass: Microsoft emphasizes that the merger will expand the breadth and depth of Xbox Game Pass, providing gamers with more value for their money.

- Increased innovation: Microsoft claims the merger will actually foster innovation by combining the talents and resources of both companies.

Benefits for Gamers

Microsoft highlights several benefits for gamers stemming from the merger.

- More games available on Game Pass: The addition of Activision Blizzard's vast game library significantly enhances the value proposition of Xbox Game Pass.

- Enhanced gaming experiences: Microsoft promises improved gaming experiences through technological advancements and cross-platform integration.

- Wider accessibility: Bringing Activision Blizzard's titles to more platforms and gaming services could increase accessibility for a larger gaming audience.

The Legal Battle and its Potential Outcomes

The FTC's appeal is currently underway, and the legal process has several possible outcomes.

The Appeal Process

The appeal process involves multiple stages, from the initial filing to potential court hearings and final rulings.

- Legal arguments: Both sides will present legal arguments and evidence before a panel of judges.

- Timeline: The legal process can take many months, even years, to complete.

- Potential outcomes: The appeal could either affirm the original ruling allowing the merger or reverse it, potentially leading to the deal being blocked. A settlement is also a possibility.

Impact on the Gaming Industry

The outcome of this legal battle could set significant precedents for future mergers and acquisitions in the tech industry.

- Regulatory scrutiny: The case may lead to increased regulatory scrutiny of mergers and acquisitions in the gaming sector and beyond.

- Pricing and distribution: The result will impact the pricing and distribution models of games, particularly concerning exclusive titles and subscription services.

- Innovation: The outcome will likely have a lasting impact on the pace and direction of innovation in the gaming industry.

Microsoft-Activision Merger: What's Next?

The FTC's appeal presents a significant hurdle for the Microsoft-Activision merger. The FTC's concerns about anti-competitive practices are substantial, while Microsoft’s arguments about enhanced competition and consumer benefits remain strong. The ultimate outcome remains uncertain, but the appeal process will be closely scrutinized for its impact on the future of the gaming industry. The legal battle's resolution will undoubtedly set precedents for future mergers in the tech sector, influencing how regulators view similar acquisitions. Stay informed about developments in the Microsoft-Activision deal, the Activision Blizzard merger, and the future of the Microsoft-Activision acquisition by following reputable news sources and engaging in informed discussions. The future of this pivotal deal, and the gaming landscape itself, hangs in the balance.

Featured Posts

-

Extreme Price Hike At And T Challenges Broadcoms V Mware Acquisition Plan

May 05, 2025

Extreme Price Hike At And T Challenges Broadcoms V Mware Acquisition Plan

May 05, 2025 -

Examining The Reported Conflict Between Blake Lively And Anna Kendrick

May 05, 2025

Examining The Reported Conflict Between Blake Lively And Anna Kendrick

May 05, 2025 -

Cuomos 3 Million Nuclear Startup Investment Unrevealed Stock Options

May 05, 2025

Cuomos 3 Million Nuclear Startup Investment Unrevealed Stock Options

May 05, 2025 -

Verstappens New Role Horners Jocular Observation

May 05, 2025

Verstappens New Role Horners Jocular Observation

May 05, 2025 -

Cocaines Global Surge The Role Of Potent Powder And Narco Submarines

May 05, 2025

Cocaines Global Surge The Role Of Potent Powder And Narco Submarines

May 05, 2025

Latest Posts

-

Ufc 314 Results Who Won And Lost At Volkanovski Vs Lopes

May 05, 2025

Ufc 314 Results Who Won And Lost At Volkanovski Vs Lopes

May 05, 2025 -

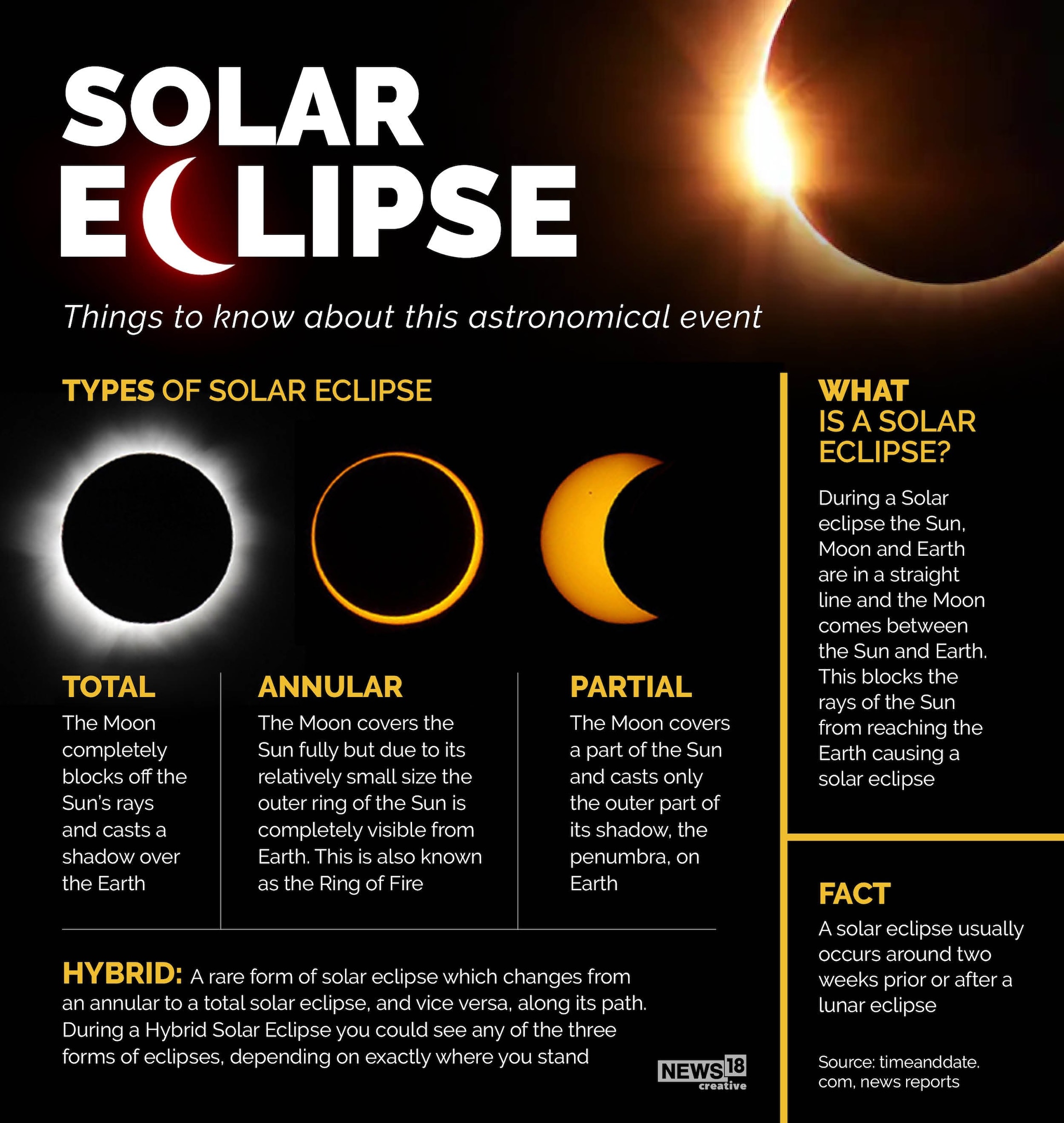

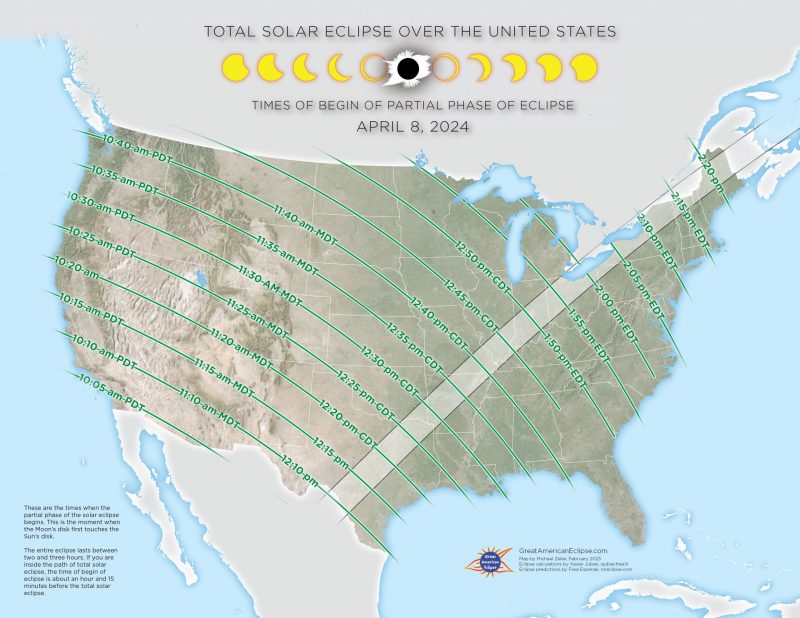

Partial Solar Eclipse Over Nyc This Saturday Time And Viewing Information

May 05, 2025

Partial Solar Eclipse Over Nyc This Saturday Time And Viewing Information

May 05, 2025 -

Ufc 314 Complete Fight Card Results Volkanovski Vs Lopes Breakdown

May 05, 2025

Ufc 314 Complete Fight Card Results Volkanovski Vs Lopes Breakdown

May 05, 2025 -

Saturdays Partial Solar Eclipse In New York City What Time And How To Watch

May 05, 2025

Saturdays Partial Solar Eclipse In New York City What Time And How To Watch

May 05, 2025 -

Nyc Partial Solar Eclipse On Saturday Timing And Safe Viewing

May 05, 2025

Nyc Partial Solar Eclipse On Saturday Timing And Safe Viewing

May 05, 2025