April 23 Oil Market Report: Prices, News, And Analysis

Table of Contents

Crude Oil Price Movements on April 23rd

Benchmark Crude Oil Prices (WTI & Brent)

The day opened with West Texas Intermediate (WTI) crude oil trading at $76.50 per barrel and Brent crude at $81.80 per barrel. Throughout the day, prices experienced significant volatility. WTI reached a high of $78.20 and a low of $75.00 before closing at $77.00. Brent crude saw a similar pattern, reaching a high of $83.50 and a low of $80.50, eventually closing at $82.20.

[Insert chart visualizing WTI and Brent price movements throughout April 23rd here]

Factors Influencing Price Changes

Several factors contributed to the price fluctuations observed on April 23rd:

- Geopolitical Events: The aforementioned sanctions imposed on a key oil producer significantly impacted market sentiment, leading to immediate price increases. Concerns about potential supply disruptions further fueled price volatility.

- OPEC+ Decisions: While no formal OPEC+ meeting occurred on this date, market participants closely monitored statements from various member nations regarding potential production adjustments, which influenced trading activity.

- Global Demand Forecasts: Positive economic indicators from major consuming nations, indicating robust growth and increased energy demand, contributed to the upward pressure on oil prices.

- US Dollar Strength: A strengthening US dollar, making oil more expensive for buyers using other currencies, also played a role in price fluctuations.

- Inventory Levels: Reports on declining US crude oil inventories added to the bullish sentiment, contributing to higher prices.

Price Volatility and Predictions

The April 23rd oil market exhibited considerable price volatility, driven by the confluence of geopolitical risks and evolving supply-demand dynamics. Trading volume was unusually high, reflecting the heightened market uncertainty. The short-term outlook remains uncertain, with the potential for further price swings dependent on the unfolding geopolitical situation and upcoming economic data releases. Market sentiment is currently cautious, but bullish sentiment could prevail if supply disruptions prove more significant than anticipated.

Key News and Events Affecting the Oil Market on April 23rd

Major Headlines

Several significant news events impacted the oil market on April 23rd:

- Sanctions Announcement: The imposition of sanctions on the aforementioned oil-producing nation dominated headlines, causing immediate market reactions.

- EIA Inventory Report: The Energy Information Administration (EIA) released its weekly report on US crude oil inventories, showing a larger-than-expected decline, further bolstering prices.

- Major Oil Company Earnings Call: A major oil company's earnings call revealed increased production targets, which initially caused a slight dip in prices before recovering due to the geopolitical events.

Impact Analysis

The sanctions announcement was the primary driver of price increases on April 23rd. The EIA report amplified the bullish sentiment, while the oil company's announcement had a more muted, temporary effect. The overall impact was a significant increase in both WTI and Brent crude prices, driven by concerns over potential supply disruptions and strong global demand.

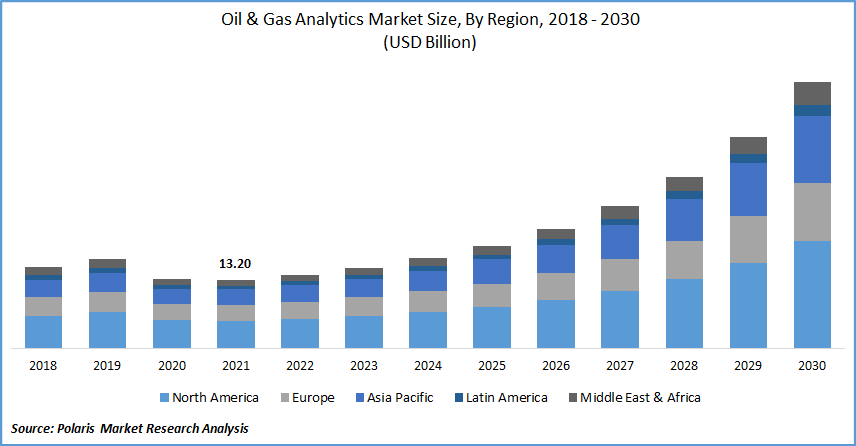

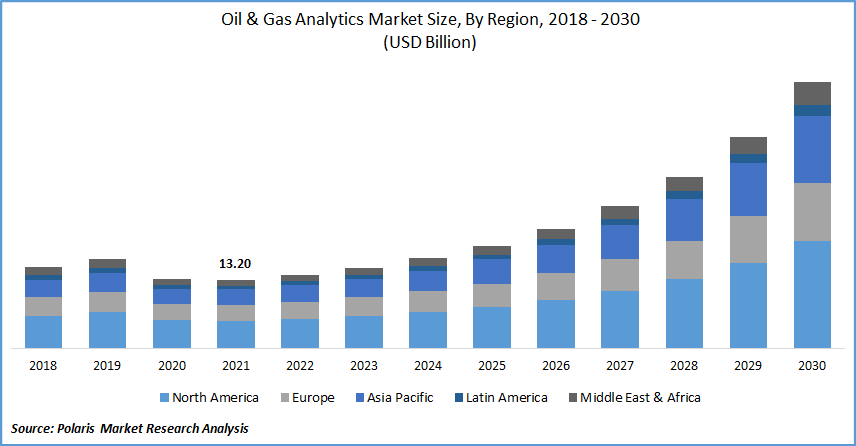

Oil Market Analysis for April 23rd

Supply and Demand Dynamics

The current oil market is characterized by a relatively tight balance between supply and demand. While global demand remains strong, driven by economic recovery in several regions, concerns about potential supply disruptions due to geopolitical instability are creating uncertainty. Seasonal factors, such as increased demand for gasoline during the spring driving season, are also impacting the market.

Market Sentiment and Investor Behavior

Market sentiment on April 23rd was largely driven by the geopolitical news. Initially, uncertainty prevailed, leading to increased volatility. However, as the day progressed and the implications of the sanctions became clearer, a more bullish sentiment emerged, reflecting investors' concerns about potential supply shortages. Trading activity remained high throughout the day.

Technical Analysis (Optional)

A brief look at technical indicators showed that WTI and Brent crude prices had broken through key resistance levels, suggesting further upward momentum in the short term. Moving averages also pointed towards a bullish trend. (Note: This section would include specific technical chart analysis if included).

Conclusion: Recap and Future Outlook for the Oil Market

The April 23rd oil market experienced significant price increases primarily due to the unexpected sanctions imposed on a major oil-producing nation. This event, combined with strong global demand and declining inventories, created a bullish market sentiment. The impact of these events could be felt for several weeks and even months, depending on the resolution of the geopolitical situation.

The short-term outlook for oil prices remains uncertain, with the potential for further price volatility. Continuous monitoring of geopolitical events, OPEC+ decisions, and economic indicators is crucial for understanding future market movements. For further in-depth analysis of the oil market, check back tomorrow for our updated report. Stay informed about daily oil market fluctuations with our daily oil market reports. Subscribe today for continuous oil market analysis!

Featured Posts

-

2024 Open Ai Developer Event Highlights New Tools For Voice Assistant Creation

Apr 24, 2025

2024 Open Ai Developer Event Highlights New Tools For Voice Assistant Creation

Apr 24, 2025 -

Bof As View Understanding And Addressing Elevated Stock Market Valuations

Apr 24, 2025

Bof As View Understanding And Addressing Elevated Stock Market Valuations

Apr 24, 2025 -

Loss Of Independence 60 Minutes Executive Producer Steps Down Following Trump Lawsuit

Apr 24, 2025

Loss Of Independence 60 Minutes Executive Producer Steps Down Following Trump Lawsuit

Apr 24, 2025 -

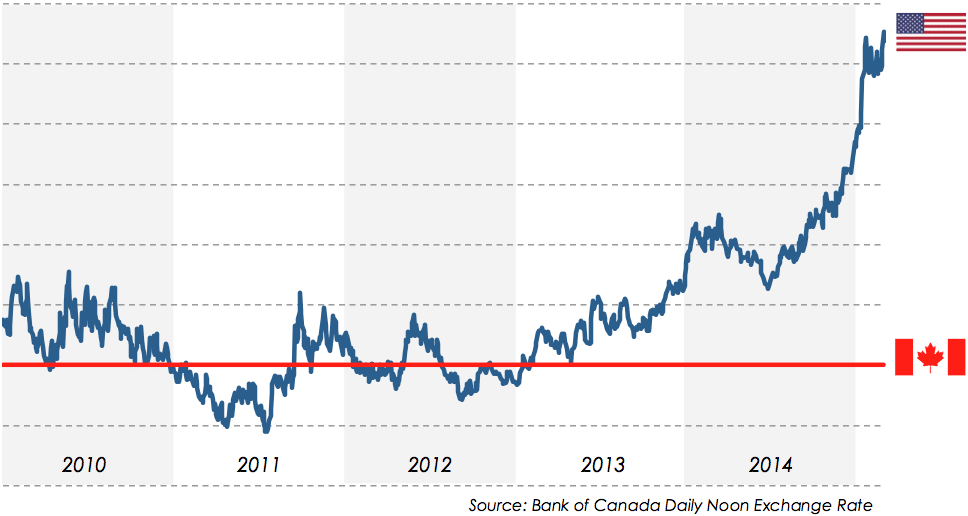

Understanding The Canadian Dollars Recent Fluctuations

Apr 24, 2025

Understanding The Canadian Dollars Recent Fluctuations

Apr 24, 2025 -

Tesla Space X And The Epa How Elon Musk And Doge Changed The Narrative

Apr 24, 2025

Tesla Space X And The Epa How Elon Musk And Doge Changed The Narrative

Apr 24, 2025