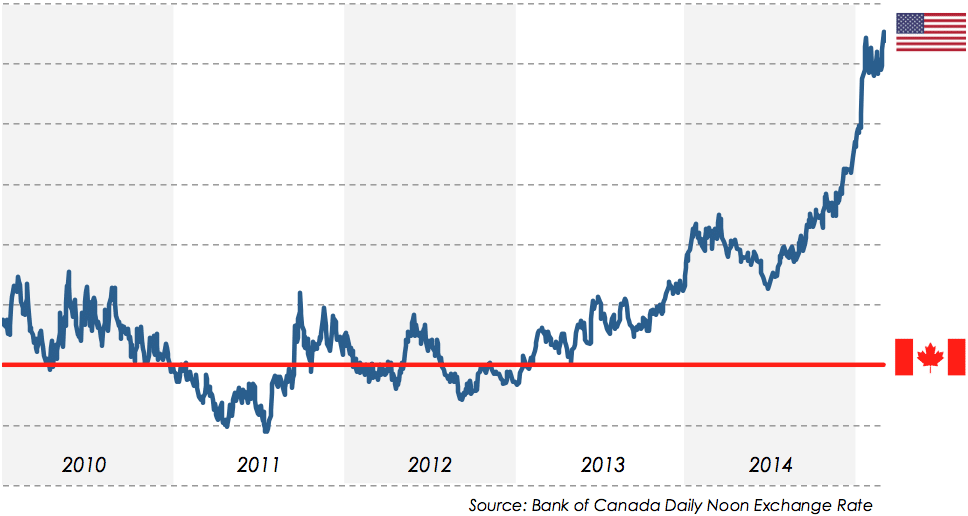

Understanding The Canadian Dollar's Recent Fluctuations

Table of Contents

Global Economic Factors Influencing the CAD

Impact of the US Dollar

The US dollar's strength significantly affects the CAD due to the close economic ties and high trade volume between the two countries. The CAD/USD exchange rate is heavily influenced by the relationship between the two currencies.

- Increased US interest rates: Higher interest rates in the US attract foreign investment, strengthening the USD and typically weakening the CAD. Recent increases by the Federal Reserve have demonstrably impacted the CAD/USD exchange rate.

- US economic growth: A robust US economy typically boosts the USD, putting downward pressure on the CAD. Strong US GDP growth often correlates with a weaker Canadian dollar.

- US dollar index (DXY): The DXY measures the USD against other major currencies. A rising DXY generally indicates a stronger USD and a weaker CAD. Monitoring the DXY is crucial for understanding CAD fluctuations.

Global Commodity Prices and their Effect

Canada is a major exporter of commodities, including oil, lumber, and minerals. Fluctuations in global commodity prices directly impact the CAD, making it a commodity-driven currency.

- Rising oil prices: Higher oil prices benefit Canada's economy, strengthening the CAD due to increased export revenues. The correlation between oil prices (Brent Crude, WTI) and the CAD is consistently observed.

- Lumber and other commodity prices: Fluctuations in lumber, potash, and other mineral prices also impact the CAD. A surge in demand for these resources tends to strengthen the Canadian dollar.

- Supply chain disruptions: Global supply chain issues can impact commodity prices and thus influence the CAD. Events like the COVID-19 pandemic have highlighted this vulnerability.

Global Economic Uncertainty and Risk Aversion

Periods of global uncertainty often lead investors to seek safe-haven assets, such as the US dollar or gold. This flight to safety can negatively impact commodity-based currencies like the CAD.

- Geopolitical events: Wars, political instability, and international conflicts can create uncertainty and weaken the CAD as investors move away from riskier assets. The war in Ukraine, for example, had a noticeable impact on the Canadian dollar.

- Global recessions: Recessions in major economies can dampen demand for commodities, leading to a weaker CAD. Concerns about a global recession often lead to decreased demand for Canadian exports.

- Market volatility: Increased market volatility and uncertainty generally result in a weaker CAD as investors seek stability in safer havens. Times of high market volatility usually see a decrease in the Canadian dollar's value.

Domestic Canadian Economic Factors

Bank of Canada Monetary Policy

The Bank of Canada's interest rate decisions significantly influence the CAD. Monetary policy directly impacts the exchange rate.

- Interest rate hikes: Raising interest rates typically strengthens the CAD by attracting foreign investment seeking higher returns. The Bank of Canada's recent actions regarding interest rates provide a good case study.

- Interest rate cuts: Conversely, lowering interest rates tends to weaken the CAD as investors may seek higher yields elsewhere. This can lead to capital outflow from Canada and a devaluation of the CAD.

- Quantitative easing: Monetary policy tools such as quantitative easing can also influence the CAD, impacting liquidity and exchange rates.

Canadian Economic Growth and Employment

Strong economic growth and low unemployment rates generally support a stronger CAD. Positive economic indicators boost investor confidence.

- GDP growth: A rising GDP indicates a healthy economy and typically strengthens the CAD. Sustained GDP growth is a positive sign for the Canadian dollar.

- Employment figures: Low unemployment rates suggest a strong labor market, reinforcing a positive economic outlook and supporting the CAD. Employment data is closely watched to predict future CAD movements.

- Consumer confidence: High consumer confidence indicates strong domestic demand, contributing to a stronger CAD. This signifies a healthy economy and positive future prospects for the Canadian dollar.

Government Fiscal Policy and its Influence

Government spending and budget decisions can influence investor confidence and, subsequently, the CAD. Fiscal policy's impact is less direct than monetary policy, but still important.

- Budget deficits: Large budget deficits can raise concerns about the country's debt levels, potentially weakening the CAD. The government's fiscal management significantly influences the Canadian dollar's valuation.

- Tax changes: Changes in tax policy can affect investor sentiment and the overall economic climate, impacting the CAD. Tax policies can either attract or repel foreign investments.

- Government spending on infrastructure: Increased government spending on infrastructure projects can boost economic growth, potentially strengthening the CAD. Public investments signal confidence in the economy and strengthen the Canadian dollar.

Predicting Future Canadian Dollar Fluctuations

Analyzing Current Economic Indicators

Monitoring key economic indicators is essential for predicting future CAD movements. A thorough analysis is crucial for forecasting.

- Inflation: High inflation can weaken the CAD as it erodes purchasing power. Inflation rates are a key factor in determining the value of the Canadian dollar.

- Interest rates: Interest rate differentials between Canada and other countries significantly affect the CAD. Interest rate changes are among the most important factors to consider.

- Unemployment: Low unemployment typically strengthens the CAD, while high unemployment weakens it. Employment levels affect investor confidence and thus, the value of the Canadian dollar.

- GDP growth: Strong GDP growth usually supports a stronger CAD. A country's economic output is a key indicator for the Canadian dollar's future.

- Commodity prices: Fluctuations in commodity prices directly impact the CAD, given Canada's reliance on commodity exports. Commodity price changes have a direct impact on the Canadian dollar's value.

Understanding Market Sentiment and Investor Behaviour

Market sentiment and investor behaviour play a significant role in influencing the CAD. Understanding market psychology is key.

- News events: Major news events, both domestic and international, can significantly impact the CAD. Sudden changes in the global economy also influence the Canadian dollar's valuation.

- Political developments: Political stability and policy changes within Canada and globally can influence investor confidence and the CAD. Political risk is another important factor to consider.

- Technical analysis: Technical analysts use charts and patterns to predict future CAD movements. Chart patterns provide clues about potential price changes.

- Fundamental analysis: Fundamental analysis focuses on economic indicators and company performance to assess the CAD's value. Fundamental analysis provides a long-term perspective.

The Limitations of Forecasting

It's crucial to acknowledge the inherent uncertainty in currency markets and the limitations of any prediction. Unforeseen events can significantly impact the CAD.

- Unforeseen global crises: Unexpected global events, such as pandemics or major geopolitical shifts, can dramatically affect the CAD. Black swan events can cause unpredictable shifts in the Canadian dollar's value.

- Sudden shifts in policy: Unexpected changes in monetary or fiscal policy can cause significant volatility in the CAD. Policy shifts can affect investor confidence and therefore the Canadian dollar's valuation.

- Speculative trading: Speculative trading can amplify short-term fluctuations in the CAD. Speculation can either push the value of the Canadian dollar higher or lower.

Conclusion

Understanding the Canadian dollar's recent fluctuations requires considering a complex interplay of global and domestic factors. From the influence of the US dollar and commodity prices to the Bank of Canada's monetary policy and domestic economic conditions, multiple elements contribute to the CAD's volatility. While predicting future movements with certainty is impossible, analyzing key economic indicators and understanding market sentiment can offer valuable insights. Staying informed about Canadian Dollar Fluctuations is essential for navigating the complexities of international finance and making informed decisions. Continue to monitor these factors and consult financial professionals for personalized advice concerning your investment strategies related to the Canadian Dollar's value and to better understand CAD fluctuations.

Featured Posts

-

The Bold And The Beautiful April 16th Recap Hopes Concerns And Bridgets Revelation

Apr 24, 2025

The Bold And The Beautiful April 16th Recap Hopes Concerns And Bridgets Revelation

Apr 24, 2025 -

The Bold And The Beautiful Recap April 3 Liam Collapses Following Major Fight With Bill

Apr 24, 2025

The Bold And The Beautiful Recap April 3 Liam Collapses Following Major Fight With Bill

Apr 24, 2025 -

India Market Update Tailwinds Driving Niftys Upward Momentum

Apr 24, 2025

India Market Update Tailwinds Driving Niftys Upward Momentum

Apr 24, 2025 -

Miami Steakhouse John Travoltas Pulp Fiction Culinary Experience Video

Apr 24, 2025

Miami Steakhouse John Travoltas Pulp Fiction Culinary Experience Video

Apr 24, 2025 -

Is Instagrams New Video Editor A Tik Tok Killer

Apr 24, 2025

Is Instagrams New Video Editor A Tik Tok Killer

Apr 24, 2025