Apple Stock Analysis: Wedbush's Bullish Sentiment And Lowered Price Target

Table of Contents

Wedbush's Bullish Outlook on Apple Despite Price Target Reduction

Wedbush Securities maintains a positive outlook on Apple's long-term prospects, predicting continued growth and market dominance. Their bullish sentiment stems from several key factors indicative of Apple's robust financial health and innovative capacity. This positive perspective on Apple stock is noteworthy, given the current economic climate.

- Strong iPhone 14 Sales: The iPhone 14 series has exceeded initial sales expectations, demonstrating continued demand for Apple's flagship product. This sustained popularity signifies a strong foundation for future revenue streams.

- Booming Services Revenue: Apple's services segment, encompassing the App Store, Apple Music, iCloud, and other subscription offerings, continues to exhibit robust growth. This recurring revenue stream provides stability and resilience against economic downturns.

- Innovation Pipeline: Apple consistently invests heavily in research and development, fueling expectations for future groundbreaking products and services. This commitment to innovation positions Apple for continued market leadership.

- Market Dominance: Apple maintains a dominant market share in several key sectors, including smartphones, tablets, and wearables. This established market position provides a strong competitive advantage.

Understanding the Lowered Price Target for Apple Stock

Despite the bullish outlook, Wedbush has lowered its price target for Apple stock. This adjustment doesn't necessarily signal a bearish outlook but rather reflects a cautious approach considering current macroeconomic conditions and potential challenges.

- Macroeconomic Headwinds: Global inflation and the threat of a recession are impacting consumer spending, potentially affecting demand for high-priced electronics. This is a key consideration in any Apple stock analysis.

- Supply Chain Concerns: Ongoing supply chain disruptions and geopolitical uncertainties could impact Apple's production capabilities and overall profitability.

- Competitive Pressures: Increased competition in the smartphone and technology markets presents a challenge to Apple's dominance, necessitating continuous innovation and adaptation.

- Wedbush's Justification: Wedbush likely adjusted its price target to account for these potential risks, acknowledging the current economic environment without abandoning its fundamental belief in Apple's long-term potential.

Analyzing the Implications for Apple Stock Investors

Wedbush's report provides crucial insights for both current and prospective Apple stock investors. The nuanced perspective – bullish sentiment coupled with a price target reduction – calls for a balanced investment strategy.

- Long-Term Investment Opportunities: For long-term investors with a high risk tolerance, Apple stock remains an attractive option, given its history of growth and innovation. A buy-and-hold strategy could be beneficial.

- Market Volatility Risks: Current market volatility and macroeconomic uncertainty represent potential risks. Investors should carefully assess their risk tolerance before investing in Apple stock.

- Portfolio Diversification: Diversifying investments across different asset classes is crucial to mitigate risk. Over-reliance on any single stock, even a seemingly stable one like Apple, can be detrimental.

- Multiple Analyst Opinions: It's essential to consider the opinions of multiple analysts and conduct thorough independent research before making investment decisions. Don't rely solely on a single report.

Key Factors to Watch for Future Apple Stock Performance

Several key indicators will significantly influence Apple's future stock performance. Closely monitoring these factors is crucial for informed investment decisions.

- Upcoming Product Launches: New iPhone models, MacBooks, and other Apple products will play a vital role in shaping future sales and revenue.

- Quarterly Earnings Reports: Apple's financial performance, as reflected in quarterly earnings reports, provides direct insights into its financial health and growth trajectory.

- Macroeconomic Trends: Global economic conditions, including inflation, interest rates, and consumer spending, will directly impact demand for Apple products.

- Competitive Landscape: The actions and innovations of competitors will inevitably influence Apple's market share and overall performance.

Conclusion: Investing in Apple Stock: Weighing the Opportunities and Risks

Wedbush's report on Apple stock offers a nuanced perspective: a bullish outlook tempered by a lowered price target due to macroeconomic headwinds. This Apple stock analysis highlights the importance of considering both the long-term potential of Apple and the challenges posed by the current market environment. Investors should carefully weigh the opportunities and risks, diversify their portfolios, and conduct thorough research before making any investment decisions. Further your Apple stock analysis by staying informed about upcoming product releases, financial reports, and broader macroeconomic trends. Make well-informed investment choices based on your own risk tolerance and thorough due diligence.

Featured Posts

-

Lvmh Shares Plunge 8 2 Q1 Sales Disappoint

May 25, 2025

Lvmh Shares Plunge 8 2 Q1 Sales Disappoint

May 25, 2025 -

Serious M56 Motorway Collision Car Overturn And Casualty Treatment

May 25, 2025

Serious M56 Motorway Collision Car Overturn And Casualty Treatment

May 25, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Factors Affecting Net Asset Value

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf Factors Affecting Net Asset Value

May 25, 2025 -

Open Ais 2024 Event Easier Voice Assistant Creation Tools Unveiled

May 25, 2025

Open Ais 2024 Event Easier Voice Assistant Creation Tools Unveiled

May 25, 2025 -

Ronan Farrow And Mia Farrow A Potential Career Resurgence

May 25, 2025

Ronan Farrow And Mia Farrow A Potential Career Resurgence

May 25, 2025

Latest Posts

-

Flash Flood Watch Take Action Now In Hampshire And Worcester Counties

May 25, 2025

Flash Flood Watch Take Action Now In Hampshire And Worcester Counties

May 25, 2025 -

Severe Thunderstorms Bring Flash Flood Warning To Hampshire And Worcester

May 25, 2025

Severe Thunderstorms Bring Flash Flood Warning To Hampshire And Worcester

May 25, 2025 -

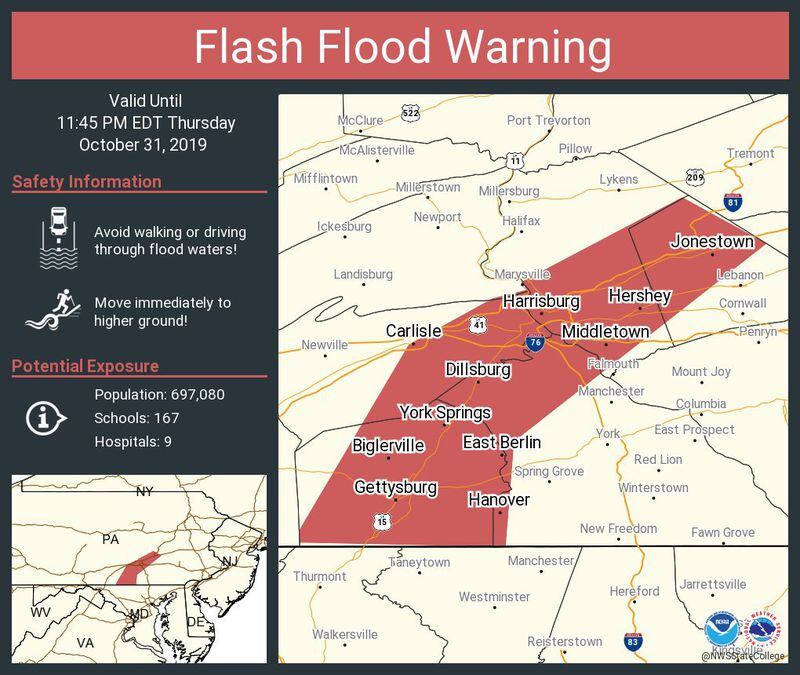

Urgent Flash Flood Warning Issued For Parts Of Pennsylvania

May 25, 2025

Urgent Flash Flood Warning Issued For Parts Of Pennsylvania

May 25, 2025 -

Flash Flood Warning Hampshire And Worcester Counties Thursday Night

May 25, 2025

Flash Flood Warning Hampshire And Worcester Counties Thursday Night

May 25, 2025 -

Pennsylvania Flash Flood Warning Extended To Thursday Morning

May 25, 2025

Pennsylvania Flash Flood Warning Extended To Thursday Morning

May 25, 2025