LVMH Shares Plunge 8.2%: Q1 Sales Disappoint

Table of Contents

Q1 Sales Figures Fall Short of Expectations

LVMH's Q1 2024 sales figures significantly missed analyst expectations, resulting in the substantial drop in LVMH shares. The reported revenue fell short by [insert specific percentage] compared to analyst projections and showed a [insert specific percentage] decrease compared to Q1 2023. This represents a considerable slowdown in growth compared to previous years.

- Specific figures: LVMH reported a revenue of [insert specific revenue number] for Q1 2024, a [insert percentage] decrease compared to [insert revenue number] in Q1 2023. This shortfall marks a significant deviation from the predicted revenue of [insert predicted revenue number].

- Analysis of the shortfall: The actual sales figures fell [insert number] percent below analyst consensus estimates, indicating a considerable market surprise and contributing significantly to the LVMH stock plunge.

- Comparison to previous quarters and years: This marks a sharp contrast to the robust growth experienced in previous years and even in the previous quarter of 2023, highlighting a potential shift in market dynamics.

- Underperforming regions/categories: Preliminary reports suggest weaker than expected performance in [mention specific geographic regions, e.g., Asia, Europe] and in specific product categories like [mention specific product categories, e.g., leather goods, watches].

Impact of Macroeconomic Factors on Luxury Spending

The disappointing Q1 sales results for LVMH are largely attributed to several significant macroeconomic headwinds impacting consumer spending, particularly in the luxury sector.

- Inflation's impact: Persistent high inflation has eroded consumer purchasing power globally, reducing discretionary spending, including on luxury goods. The rising cost of living makes high-ticket items like LVMH products less accessible to a wider segment of consumers.

- Recession fears: Growing fears of a potential global recession are causing consumers to become more cautious with their spending, opting to delay or forgo non-essential purchases, including luxury goods.

- Geopolitical uncertainty: The ongoing war in Ukraine and other geopolitical uncertainties have created economic instability and uncertainty, impacting global consumer confidence and affecting luxury spending patterns.

- Shifting consumer preferences: Some analysts suggest a potential shift in consumer preferences towards more accessible luxury options or experiences, impacting the demand for high-end LVMH products.

Analysis of LVMH's Strategic Response

In response to the declining sales, LVMH has yet to announce major sweeping strategic changes. However, the company’s communication to investors suggests a focus on navigating the current market challenges.

- Strategic response: While concrete details are still emerging, early indications point towards a focus on maintaining brand prestige and exploring more sustainable, long-term strategies rather than immediate drastic cost-cutting measures.

- Cost-cutting measures: While major cost-cutting measures haven't been publicly announced, internal efficiency improvements and targeted marketing adjustments are likely being considered.

- Addressing changing consumer landscape: LVMH is likely to emphasize its existing diverse portfolio of luxury brands, adapting its marketing and product offerings to better resonate with the changing consumer landscape and evolving preferences.

- Investor communication: LVMH's communication with investors will be crucial in regaining confidence. Transparency and a clearly articulated plan to address the challenges are essential for stabilizing the LVMH stock price.

Potential Long-Term Implications for LVMH and the Luxury Market

The 8.2% plunge in LVMH shares signals potential long-term implications for both the company and the broader luxury goods market.

- LVMH's market position: The current downturn could impact LVMH's long-term market position, potentially creating opportunities for competitors to gain ground.

- Luxury goods industry: The situation raises concerns about the overall resilience of the luxury goods industry in the face of macroeconomic challenges and shifts in consumer behavior.

- Market recovery and growth: The speed and extent of the market recovery will depend on several factors, including inflation levels, economic growth, and geopolitical stability.

- Competitive landscape: Competitors may capitalize on LVMH’s current challenges, potentially reshaping the competitive landscape within the luxury goods sector.

Conclusion

The 8.2% plunge in LVMH shares underscores the impact of disappointing Q1 sales figures, coupled with the influence of macroeconomic headwinds on the luxury goods market. While LVMH's strategic response remains to be fully revealed, the event highlights the vulnerability of even the most prominent luxury brands to broader economic forces and changing consumer behavior. The long-term implications for LVMH and the entire luxury sector warrant close monitoring. Understanding the factors influencing LVMH's performance is vital for making informed decisions regarding LVMH investments. Stay informed on the latest developments regarding LVMH stock and the luxury goods market. Follow [Your Website/Source] for continuous updates on LVMH shares and other crucial market insights.

Featured Posts

-

Annie Kilners Social Media Posts Spark Controversy After Kyle Walkers Night Out

May 25, 2025

Annie Kilners Social Media Posts Spark Controversy After Kyle Walkers Night Out

May 25, 2025 -

Flash Flood Watch Take Action Now In Hampshire And Worcester Counties

May 25, 2025

Flash Flood Watch Take Action Now In Hampshire And Worcester Counties

May 25, 2025 -

Lauryn Goodmans Italy Move The Truth Behind The Kyle Walker Transfer Speculation

May 25, 2025

Lauryn Goodmans Italy Move The Truth Behind The Kyle Walker Transfer Speculation

May 25, 2025 -

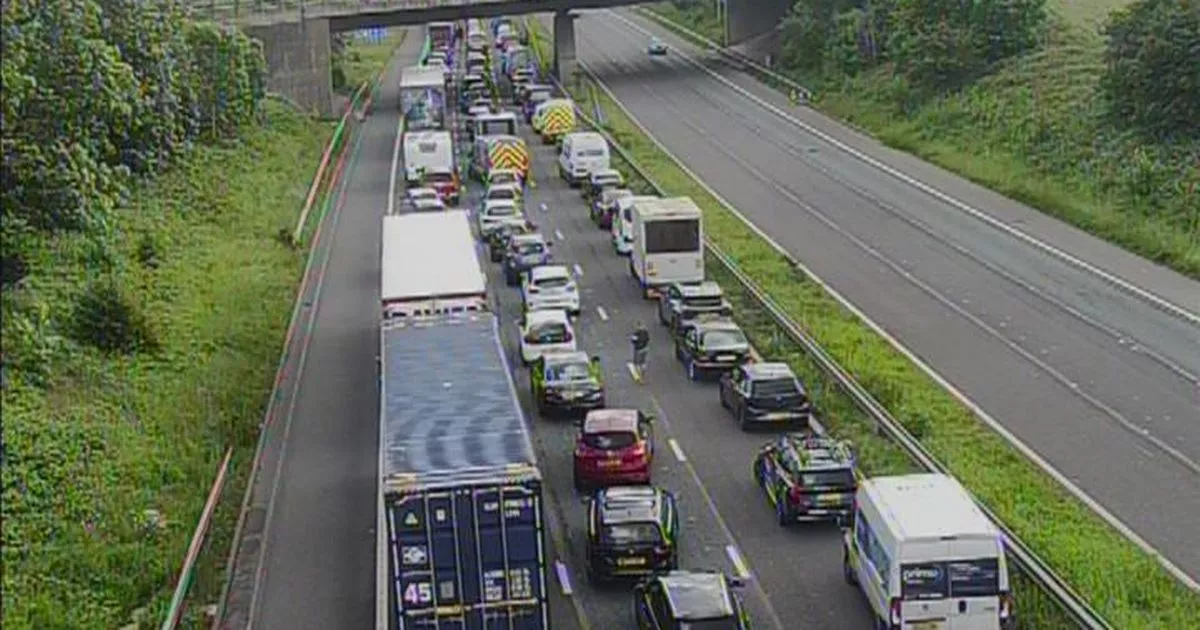

M56 Crash Live Traffic Updates And Long Delays

May 25, 2025

M56 Crash Live Traffic Updates And Long Delays

May 25, 2025 -

Autovasarlas Porsche 911 Extrak 80 Millio Forintert

May 25, 2025

Autovasarlas Porsche 911 Extrak 80 Millio Forintert

May 25, 2025

Latest Posts

-

Claire Williams And George Russell A Complex Professional Relationship

May 25, 2025

Claire Williams And George Russell A Complex Professional Relationship

May 25, 2025 -

The Impact Of Claire Williams Decisions On George Russells Career

May 25, 2025

The Impact Of Claire Williams Decisions On George Russells Career

May 25, 2025 -

Baltimore Sun Reports Death Of Prominent Maryland Attorney George L Russell Jr

May 25, 2025

Baltimore Sun Reports Death Of Prominent Maryland Attorney George L Russell Jr

May 25, 2025 -

Wolff Speaks More Hints On Russells Long Term Future With Mercedes

May 25, 2025

Wolff Speaks More Hints On Russells Long Term Future With Mercedes

May 25, 2025 -

George Russells Mercedes Future Wolff Drops Another Clue

May 25, 2025

George Russells Mercedes Future Wolff Drops Another Clue

May 25, 2025