Amundi Dow Jones Industrial Average UCITS ETF: Factors Affecting Net Asset Value

Table of Contents

Market Performance of the Dow Jones Industrial Average

The most significant factor impacting the Amundi Dow Jones Industrial Average UCITS ETF's NAV is the performance of its underlying index: the Dow Jones Industrial Average. This index tracks the performance of 30 large, publicly-owned companies in the United States, representing a broad range of sectors in the American economy. Any movement in the Dow directly translates into a corresponding change in the ETF's NAV.

The Dow's performance, in turn, is influenced by a complex interplay of economic, geopolitical, and company-specific factors.

- Impact of positive and negative economic data releases: Positive economic news, such as strong job growth or increased consumer confidence, typically leads to a rise in the Dow and subsequently the ETF's NAV. Conversely, negative data releases can trigger declines.

- Effect of major geopolitical events (wars, trade disputes): Geopolitical instability, such as wars or trade disputes, can significantly impact market sentiment and lead to volatility in the Dow and the ETF's NAV.

- Influence of individual company earnings and announcements: Strong earnings reports and positive announcements from individual companies within the Dow can boost the index and the ETF's NAV, while disappointing results can have the opposite effect.

- Role of investor sentiment and market volatility: Overall investor sentiment and market volatility play a crucial role. Periods of high uncertainty can lead to increased volatility in the Dow and consequently affect the ETF's NAV. Understanding investor sentiment, often reflected in market indices and news reports, helps anticipate potential NAV fluctuations. This is crucial for long-term portfolio management.

Keywords: Dow Jones Industrial Average, index performance, economic indicators, geopolitical risks, company earnings, market volatility, investor sentiment

Currency Fluctuations

For ETFs holding assets in multiple currencies, exchange rate movements can significantly impact the NAV. The Amundi Dow Jones Industrial Average UCITS ETF, while primarily focused on US equities, may still be subject to currency fluctuations, especially if its base currency is different from the US dollar.

- Impact of USD/EUR exchange rate fluctuations (if applicable): If the ETF's base currency is the Euro (EUR), fluctuations in the USD/EUR exchange rate can impact the NAV calculated in Euros. A strengthening Euro against the dollar would generally increase the NAV in Euros, and vice-versa.

- Explanation of currency hedging and its impact on NAV stability: Many ETFs employ currency hedging strategies to mitigate exchange rate risk. These strategies aim to reduce the impact of currency fluctuations on the NAV, providing greater stability.

- Potential benefits and drawbacks of currency hedging strategies: While hedging can reduce volatility, it can also limit potential upside gains if the currency moves favorably. Understanding the ETF's hedging policy is crucial for investors.

Keywords: currency fluctuations, exchange rate risk, currency hedging, base currency, USD, EUR

Expense Ratio and Management Fees

The ETF's expense ratio and management fees directly affect the NAV over time. These costs are deducted from the assets under management (AUM), reducing the overall value available to investors. It's critical to consider these ongoing costs when evaluating ETF performance.

- Definition and calculation of the expense ratio: The expense ratio represents the annual cost of owning the ETF, expressed as a percentage of the assets under management.

- Impact of fees on long-term returns: Even small expense ratios can significantly impact long-term returns, compounding over time. Investors should compare expense ratios across similar ETFs to find the most cost-effective options.

- Comparison of expense ratios to similar ETFs: Before investing, compare the expense ratio of the Amundi Dow Jones Industrial Average UCITS ETF with those of competing ETFs tracking similar indices.

Keywords: expense ratio, management fees, asset under management, cost, fees, returns

Dividend Distributions

Dividend payouts from the underlying companies in the Dow Jones Industrial Average also influence the ETF's NAV.

- Impact of dividend payments on NAV before and after the ex-dividend date: Before the ex-dividend date, the NAV reflects the value of the upcoming dividend. After the ex-dividend date, the NAV is adjusted downward to account for the dividend payment.

- Reinvested dividends and their effect on growth: Many ETFs reinvest dividends, which contributes to the long-term growth of the ETF and its NAV.

Keywords: dividends, dividend payouts, ex-dividend date, dividend reinvestment

Conclusion: Monitoring the NAV of Your Amundi Dow Jones Industrial Average UCITS ETF Investment

Understanding the interplay of market performance, currency fluctuations, expense ratios, and dividend distributions is vital for monitoring the NAV of your Amundi Dow Jones Industrial Average UCITS ETF investment. Regularly reviewing these factors empowers you to make informed investment decisions and adjust your portfolio strategy as needed. Remember to consult your financial advisor for personalized guidance. Stay informed about market conditions and the factors affecting the value of your ETF investments to achieve your financial goals. Learn more about ETF investing and the Amundi Dow Jones Industrial Average UCITS ETF through reputable financial resources. Successful portfolio management involves diligent monitoring of your Amundi Dow Jones Industrial Average UCITS ETF's NAV. Keywords: Amundi Dow Jones Industrial Average UCITS ETF, NAV monitoring, investment decisions, informed investing, ETF investment, portfolio management

Featured Posts

-

Apple Stock Q2 Results Analysis And Investor Outlook

May 25, 2025

Apple Stock Q2 Results Analysis And Investor Outlook

May 25, 2025 -

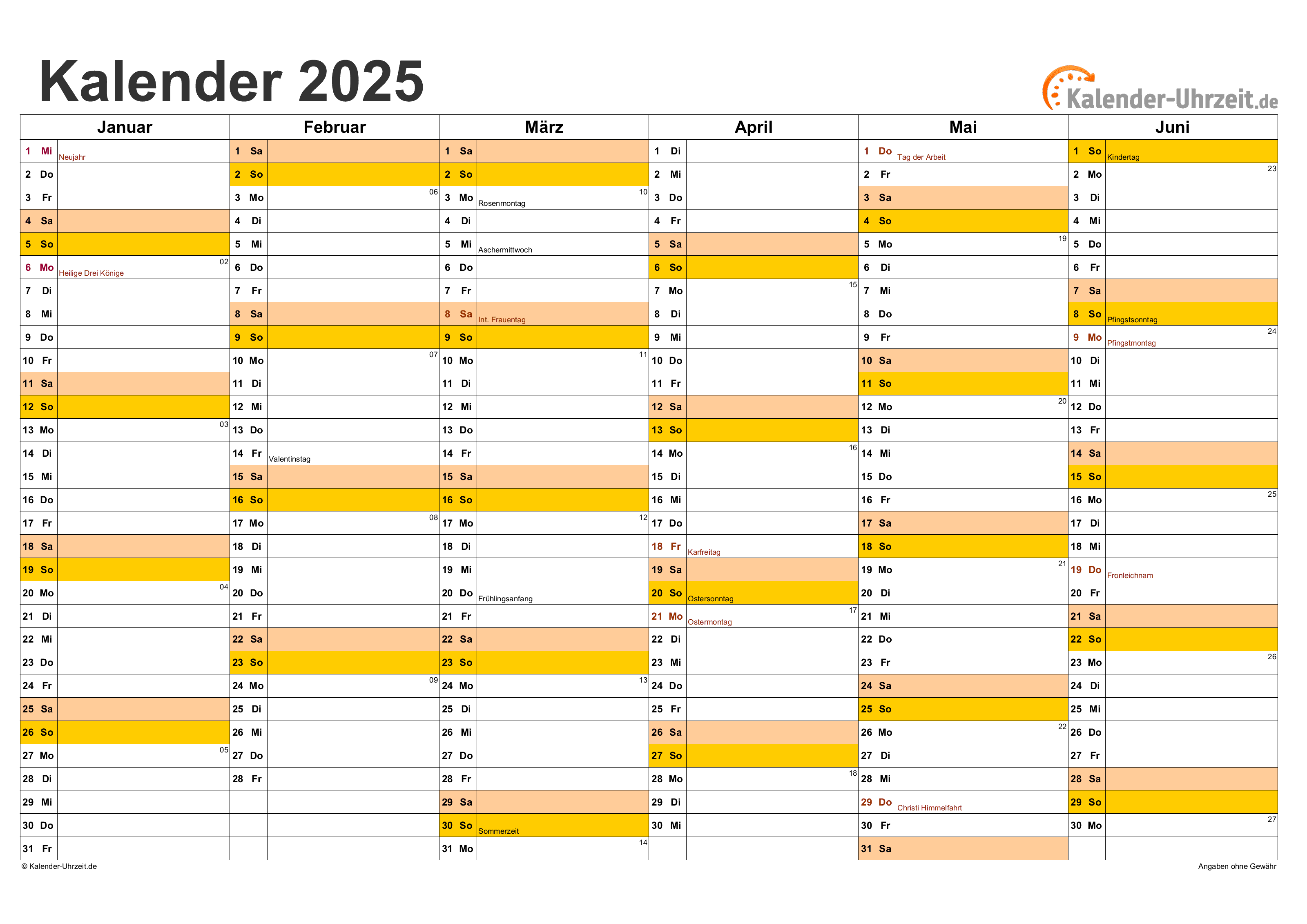

Aktien Frankfurt Eroeffnung Dax Rueckgang Am 21 Maerz 2025 Faelligkeitstermin An Den Terminmaerkten

May 25, 2025

Aktien Frankfurt Eroeffnung Dax Rueckgang Am 21 Maerz 2025 Faelligkeitstermin An Den Terminmaerkten

May 25, 2025 -

Escape To The Country Balancing Rural Life And Modern Convenience

May 25, 2025

Escape To The Country Balancing Rural Life And Modern Convenience

May 25, 2025 -

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist What You Need To Know

May 25, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist What You Need To Know

May 25, 2025 -

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 25, 2025

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025

Farrows Plea Hold Trump Accountable For Deporting Venezuelan Gang Members

May 25, 2025 -

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025

Mia Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 25, 2025 -

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025

Actress Mia Farrow Trump Should Face Charges For Venezuelan Deportation Actions

May 25, 2025 -

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025

The Fall From Grace 17 Celebrities Who Lost Everything Instantly

May 25, 2025