Analysis: Recent Gains In Chinese Stocks Listed In Hong Kong

Table of Contents

Macroeconomic Factors Fueling the Rally

Several macroeconomic factors have contributed to the recent rally in Chinese stocks listed in Hong Kong. These gains aren't isolated incidents but rather a reflection of broader positive shifts in the Chinese economy and global markets.

-

Supportive Government Policies: The Chinese government has implemented several policies aimed at stimulating economic growth and easing the burden on businesses. These include:

- Stimulus packages: Significant fiscal stimulus packages have been rolled out to boost infrastructure spending and support struggling industries, injecting much-needed capital into the economy and benefiting listed companies.

- Regulatory reforms: Easing of regulatory burdens on businesses, particularly in technology and other key sectors, has increased investor confidence and encouraged further investment. This streamlining of regulations has improved operational efficiency for many companies.

- Infrastructure spending: Massive investments in infrastructure projects across China are creating significant demand for goods and services, driving growth in related sectors and boosting the overall economy. This infrastructure push fuels demand from construction, manufacturing, and logistics companies listed in Hong Kong.

-

Global Economic Recovery: The global economic recovery has also played a significant role. Increased global demand for Chinese goods and a strengthening of international trade relationships have positively impacted the performance of many Chinese companies.

- Increased global demand: As global economies recover, demand for Chinese manufactured goods, technology products, and consumer staples has risen significantly.

- Strengthening international trade: Improved international trade relationships, while still facing challenges, have created a more favorable environment for Chinese exports, benefiting companies listed on the Hong Kong exchange.

- Positive investor sentiment: A generally positive global investor sentiment towards emerging markets has led to increased investment in Chinese stocks, further fueling the rally. This positive sentiment reflects a growing belief in the long-term growth potential of the Chinese economy.

Sector-Specific Performance Analysis

While the overall market has seen gains, certain sectors within the Chinese stocks listed in Hong Kong have significantly outperformed others.

-

Top-Performing Sectors: Several sectors have experienced exceptional growth:

- Technology: The technology sector has seen substantial gains driven by innovation, government support, and the increasing adoption of technology across various aspects of Chinese life. This includes companies focused on fintech, e-commerce, and AI.

- Energy: The energy sector has benefited from rising global energy prices, leading to increased profits for energy producers and related businesses. This reflects global demand and geopolitical factors influencing supply chains.

- Consumer Staples: Consumer staples companies have displayed resilience amidst economic fluctuations, demonstrating the consistent demand for essential goods and services within China's growing middle class.

-

Reasons for Strong Performance: The strong performance of these sectors is attributable to several factors:

- Technological advancements: Rapid technological advancements and increased adoption are driving significant growth in the technology sector, impacting companies from software to hardware.

- Geopolitical factors: Geopolitical factors influencing energy supplies and pricing have created favorable conditions for energy companies.

- Rising middle class: The expansion of China's middle class is fueling robust consumer spending, supporting the growth of consumer staples companies and related businesses.

Individual Stock Performance and Analysis

Examining individual stocks provides further insights into this market trend. Let's consider three prominent examples:

-

Tencent (0700.HK): Tencent's growth is fueled by its dominance in the gaming and fintech sectors, benefiting from the increasing adoption of mobile payments and online gaming in China. Their diversification and strong foothold in the digital market contribute to their robust performance.

-

Alibaba (9988.HK): Alibaba's continued success is attributed to its e-commerce dominance and the expanding cloud computing sector. Their strong brand recognition and extensive market reach within China and globally are crucial factors in their success.

-

Meituan (3690.HK): Meituan, a leading provider of on-demand services in China, benefits from the rise in online food delivery, local services, and travel booking, reflecting the increasing use of online platforms and a growing consumer preference for convenience.

Investor Sentiment and Market Volatility

The recent gains in Chinese stocks Hong Kong are also a reflection of evolving investor sentiment.

-

Shifts in Investor Sentiment:

- Increased foreign investment: We've seen a significant increase in foreign investment inflows into Chinese stocks, indicating a growing confidence in the long-term prospects of the Chinese economy.

- Growing confidence: Investor confidence has risen due to the government's supportive policies and the strong performance of key sectors.

- Market volatility analysis: While the market has seen significant gains, volatility remains a factor to consider when making investment decisions.

-

Impact of Geopolitical Factors and Global Market Trends:

- US-China relations: The evolving relationship between the US and China continues to impact market sentiment, introducing periods of uncertainty.

- Global inflation and interest rates: Global inflation and interest rate hikes have impacted investor sentiment across all markets and present additional risk factors.

- Supply chain disruptions: Ongoing global supply chain disruptions can influence the performance of certain sectors more than others, demanding a thorough analysis before investing.

Conclusion

The recent surge in Chinese stocks listed in Hong Kong reflects a confluence of factors, from supportive government policies and sector-specific growth to improving investor sentiment. While volatility remains a factor, the positive trends suggest a promising outlook for investors interested in this dynamic market. Understanding the macroeconomic environment, sector performance, and individual stock characteristics is crucial for navigating the opportunities and risks associated with investing in Chinese stocks Hong Kong. Conduct thorough research and consider your risk tolerance before making any investment decisions. Further analysis of specific sectors and companies is encouraged to fully grasp the potential of this growing market. Stay informed on the latest developments in Chinese stocks in Hong Kong to make well-informed investment choices.

Featured Posts

-

Chinese Stocks Strong Performance In Hong Kong

Apr 24, 2025

Chinese Stocks Strong Performance In Hong Kong

Apr 24, 2025 -

Pope Francis Impact Global Reach And Internal Conflicts

Apr 24, 2025

Pope Francis Impact Global Reach And Internal Conflicts

Apr 24, 2025 -

Los Angeles Wildfires The Rise Of Disaster Betting And Its Implications

Apr 24, 2025

Los Angeles Wildfires The Rise Of Disaster Betting And Its Implications

Apr 24, 2025 -

Ohio Derailment Aftermath Toxic Chemical Contamination In Buildings For Months

Apr 24, 2025

Ohio Derailment Aftermath Toxic Chemical Contamination In Buildings For Months

Apr 24, 2025 -

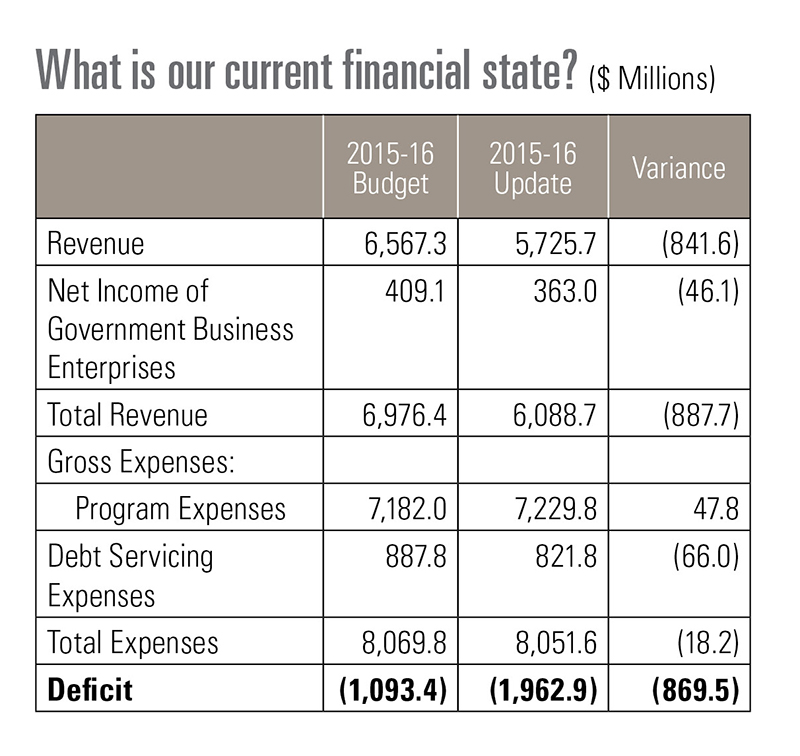

Canadas Fiscal Future A Need For Responsible Liberal Policy

Apr 24, 2025

Canadas Fiscal Future A Need For Responsible Liberal Policy

Apr 24, 2025