Canada's Fiscal Future: A Need For Responsible Liberal Policy

Table of Contents

Managing the National Debt and Deficit

Current Debt Levels and Projections

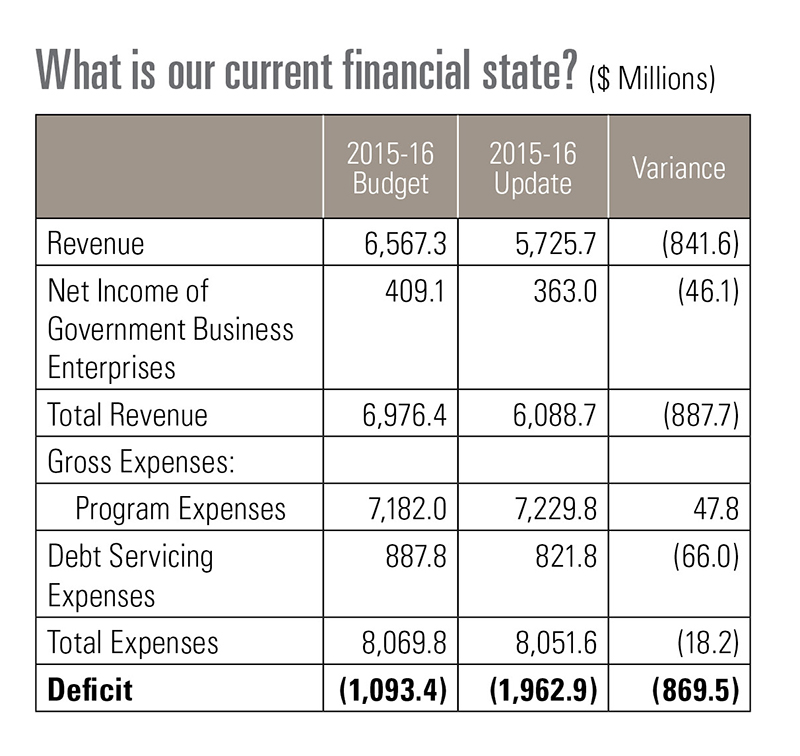

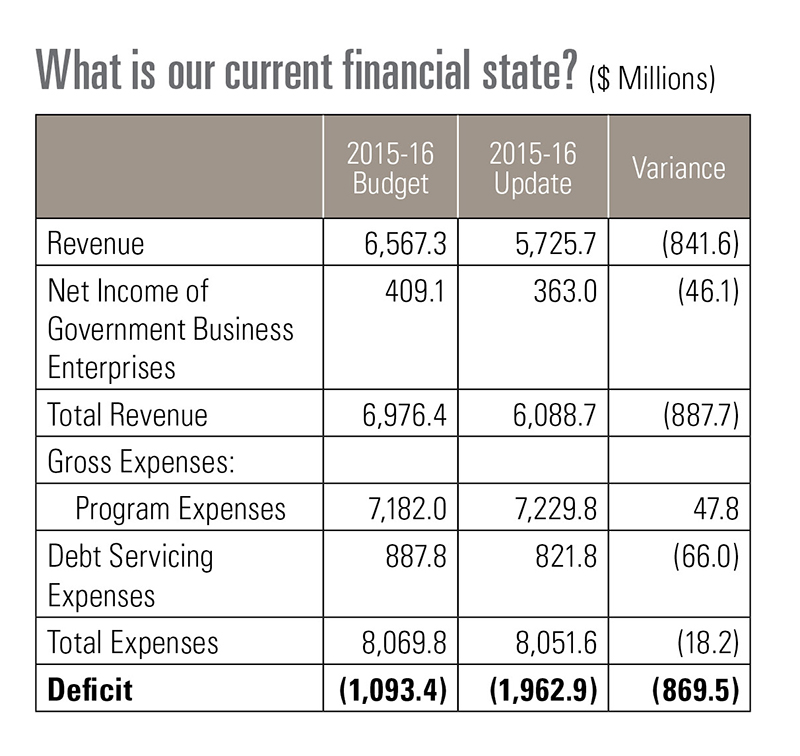

Canada's national debt, while manageable, is a significant concern. The debt-to-GDP ratio, a key indicator of fiscal health, needs careful monitoring and strategic management. According to Statistics Canada, [insert current debt-to-GDP ratio and link to source], this ratio is projected to [insert projected trajectory and link to source] under various economic scenarios. The aging population significantly impacts future projections, increasing demands on healthcare and pension systems.

- Current national debt figures: [Insert updated figures from Statistics Canada or the Parliamentary Budget Officer.]

- Projected debt growth under various economic scenarios: [Insert projections and link to reputable source. Highlight different scenarios – optimistic, pessimistic, and baseline.]

- Impact of aging population on healthcare costs and pensions: [Explain the demographic shift and its implications for government spending. Cite relevant reports.]

Strategies for Debt Reduction

Implementing a responsible liberal policy for debt reduction requires a multi-pronged approach. Simply cutting spending isn't sufficient; strategic investments are crucial.

- Targeted spending cuts (without compromising essential services): This involves identifying areas of inefficiency and waste within government programs while protecting essential social services like healthcare and education. A thorough review of government spending is needed, prioritizing effectiveness and value for money.

- Revenue generation through tax reform (fair and efficient taxation): A fair and efficient tax system is essential. This could involve adjustments to tax brackets, addressing tax loopholes, or exploring new revenue streams while ensuring fairness and progressivity.

- Economic growth initiatives to increase tax revenue: Stimulating economic growth through investments in infrastructure, innovation, and education will naturally increase tax revenue. A responsible liberal policy would prioritize job creation and increased productivity.

- Prioritization of investments in infrastructure and human capital: Investments in modern infrastructure and human capital (education and skills training) are crucial for long-term economic growth, leading to increased tax revenue and a stronger economy.

Investing in Sustainable Economic Growth

Diversifying the Canadian Economy

Reducing reliance on specific sectors, particularly natural resources, is vital for long-term economic stability. A responsible liberal policy emphasizes diversification.

- Investing in renewable energy and green technology: Canada has enormous potential in renewable energy and green technologies. Government investment in research, development, and infrastructure can create jobs and reduce reliance on fossil fuels.

- Supporting innovation and technological advancements: Investing in research and development, particularly in emerging technologies like artificial intelligence and biotechnology, is critical for future economic growth and competitiveness.

- Fostering entrepreneurship and small business growth: Small and medium-sized enterprises (SMEs) are the backbone of the Canadian economy. A responsible liberal policy supports their growth through access to capital, mentorship programs, and reduced bureaucratic barriers.

- Strategic trade agreements to expand market access: Negotiating and maintaining strategic trade agreements with international partners opens up new markets for Canadian goods and services, boosting economic growth.

Addressing Climate Change

Climate change presents both risks and opportunities. A responsible liberal policy integrates climate action into fiscal planning.

- Investments in green infrastructure and clean energy: Investing in renewable energy infrastructure, public transit, and energy-efficient buildings creates jobs and reduces carbon emissions.

- Carbon pricing mechanisms and their impact on the budget: While carbon pricing can generate revenue, its impact on household budgets needs careful consideration and mitigation strategies through rebates or other measures.

- Incentives for businesses to adopt sustainable practices: Providing tax incentives and grants for businesses adopting sustainable practices encourages innovation and reduces environmental impact.

- International collaboration on climate action: Working with international partners on climate action is essential for global climate stability and securing Canada's economic interests.

Strengthening Social Safety Nets

Affordable Healthcare and Education

Maintaining access to affordable and high-quality healthcare and education is crucial for social well-being and economic productivity. A responsible liberal policy balances affordability and quality.

- Strategies for controlling healthcare costs while ensuring quality care: This requires innovative approaches to healthcare delivery, focusing on preventative care and efficient resource allocation.

- Investments in education and skills development to increase workforce productivity: Investing in education and skills training equips Canadians with the skills needed for the jobs of the future, boosting productivity and economic growth.

- Addressing the rising cost of post-secondary education: Finding sustainable solutions to make post-secondary education more affordable, such as expanding grants and bursaries, is vital for social mobility and a skilled workforce.

Social Assistance Programs

Social safety nets are crucial for reducing inequality and supporting vulnerable populations. A responsible liberal policy ensures these programs are effective and efficient.

- Targeted assistance programs for low-income families and individuals: These programs should be designed to effectively address poverty and provide support to those most in need.

- Strategies to ensure program effectiveness and efficiency: Regular program evaluations and adjustments are necessary to ensure programs are achieving their goals and delivering value for money.

- Addressing the challenges of poverty and inequality: A multi-faceted approach is needed, addressing the root causes of poverty and inequality through education, job training, affordable housing, and other initiatives.

Conclusion

This article has highlighted the crucial need for a responsible liberal policy approach to address Canada's fiscal future. Successfully navigating the challenges ahead requires a balanced strategy that prioritizes both fiscal sustainability and social well-being. By strategically managing the national debt, fostering sustainable economic growth, and strengthening social safety nets, Canada can build a more prosperous and equitable future for all its citizens. To learn more about specific policy proposals and engage in the discussion, visit [link to relevant government website or think tank]. Let's work together to build a stronger future through a responsible liberal policy for Canada.

Featured Posts

-

William Watsons Advice Examining The Liberal Platform Before Election Day

Apr 24, 2025

William Watsons Advice Examining The Liberal Platform Before Election Day

Apr 24, 2025 -

White House Reports Fewer Apprehensions Along The U S Canada Border

Apr 24, 2025

White House Reports Fewer Apprehensions Along The U S Canada Border

Apr 24, 2025 -

Epa Crackdown On Tesla And Space X Elon Musk And Doges Response

Apr 24, 2025

Epa Crackdown On Tesla And Space X Elon Musk And Doges Response

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Hopes Double Shocker Liams Promise To Steffy And Lunas Bold Move

Apr 24, 2025

The Bold And The Beautiful Spoilers Hopes Double Shocker Liams Promise To Steffy And Lunas Bold Move

Apr 24, 2025 -

Vote Liberal Review Their Platform First A Critical Analysis

Apr 24, 2025

Vote Liberal Review Their Platform First A Critical Analysis

Apr 24, 2025