Analysis Of BP's 31% Reduction In CEO Compensation

Table of Contents

Reasons Behind BP's CEO Pay Reduction

Several factors contributed to BP's decision to slash its CEO's compensation by 31%. These factors highlight the evolving landscape of corporate governance and the increasing influence of shareholder expectations.

Impact of Falling Oil Prices

Fluctuating oil prices significantly impact the profitability of oil and gas companies like BP. Recent years have seen periods of both high and low oil prices, affecting BP's financial performance.

- BP's Financial Performance: Analysis of BP's financial reports reveals a correlation between oil price volatility and profitability. Periods of low oil prices have inevitably impacted profit margins, influencing the decision to reduce executive compensation.

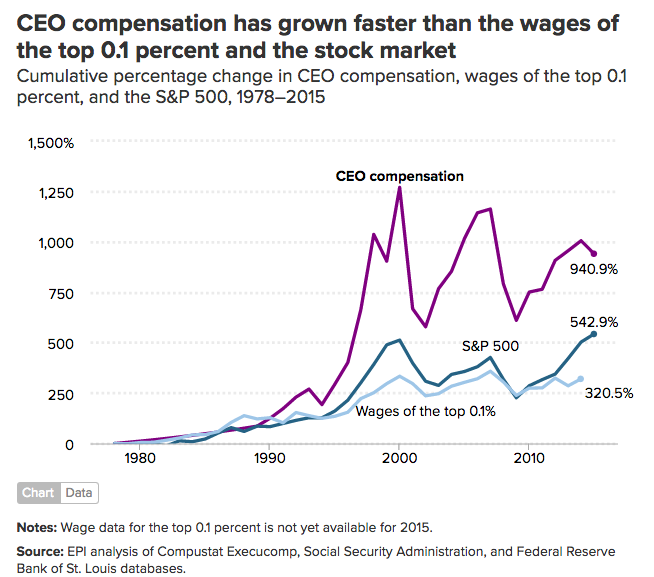

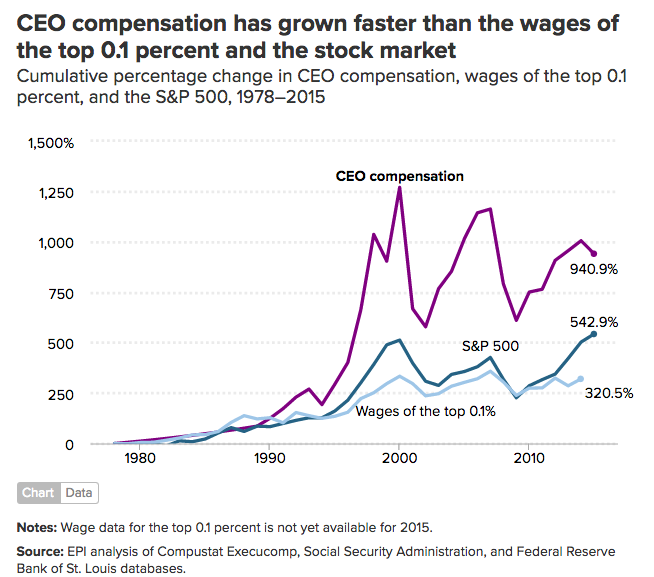

- Comparison to Previous Years and Industry Benchmarks: Comparing the CEO's compensation to previous years shows a marked reduction, reflecting the company's financial realities. Furthermore, a comparison with CEO compensation in similar companies within the oil and gas industry can shed light on the competitiveness of BP's executive pay structure.

- Profit Warnings and Financial Difficulties: While BP hasn't issued widespread profit warnings, the pressure to control costs and demonstrate fiscal responsibility in challenging market conditions played a role in the compensation decision.

Shareholder Activism and Pressure

Growing shareholder activism and pressure from institutional investors have become significant drivers in shaping corporate governance practices, including executive compensation.

- Shareholder Resolutions: Shareholder resolutions focusing on executive pay and its alignment with company performance have likely increased in recent years, adding pressure on BP's board to respond.

- Public Statements from Activist Investors: Public statements and engagement from activist investors often emphasize the need for responsible executive compensation practices, pushing companies towards greater transparency and accountability.

- ESG Factors in Investment Decisions: The growing importance of ESG factors in investment decisions means investors are increasingly scrutinizing companies' environmental, social, and governance performance, including executive compensation policies.

Focus on Sustainability and ESG Goals

BP's commitment to its sustainability targets and ESG goals likely influenced the decision to reduce CEO pay. Aligning executive compensation with these goals reinforces accountability and signals a commitment to long-term value creation.

- BP's Sustainability Targets and Initiatives: BP has publicly stated ambitious sustainability targets, including reductions in carbon emissions. Linking executive compensation to the achievement of these targets demonstrates a commitment to these goals.

- Accountability and Investor Attraction: Aligning executive pay with sustainability targets improves accountability and attracts investors who prioritize ESG factors. This approach can also lead to improved company performance in sustainability metrics.

- Performance Metrics and CEO Compensation: The reduction in CEO compensation could be tied to specific performance metrics related to sustainability, creating a direct link between environmental performance and executive rewards.

Implications of the 31% CEO Pay Cut for BP

The 31% reduction in BP's CEO compensation has several implications for the company, its employees, and its overall image.

Impact on Employee Morale and Company Culture

The pay cut could impact employee morale and perceptions of fairness within the company.

- Increased Employee Engagement or Resentment: How the pay cut is communicated to employees will significantly influence their response. Transparent communication emphasizing shared responsibility during challenging times could improve morale; otherwise, resentment could arise.

- Impact on Other Executive and Employee Compensation: The decision to reduce the CEO's pay may influence other executive compensation packages and potentially trigger discussions about broader compensation adjustments for employees.

Attracting and Retaining Top Talent

Lower CEO compensation might affect BP's ability to attract and retain top talent.

- Competitive Compensation within the Oil and Gas Industry: BP will need to maintain competitive compensation packages to attract and retain skilled professionals, considering benefits and other compensation factors beyond base salary.

- Company Reputation and Attracting Skilled Employees: The pay cut, if perceived positively, could enhance BP's reputation as a responsible and socially conscious company, attracting employees who value these attributes.

Signal to the Market and Investors

The pay cut sends a message to the market and investors regarding corporate governance and financial responsibility.

- Stock Market Reaction: The stock market's reaction to the announcement will provide insights into investor sentiment regarding BP's approach to executive compensation.

- Impact on Investor Confidence: Investors often interpret executive compensation decisions as a reflection of management's priorities and commitment to responsible governance.

- Improvements in BP's ESG Ratings: The pay cut could positively influence BP's ESG ratings, reflecting investors’ growing consideration of ESG factors in their investment decisions.

Conclusion

BP's 31% reduction in CEO compensation reflects a complex interplay of economic realities, shareholder pressure, and a growing focus on ESG factors. While the impact on employee morale and talent acquisition remains to be seen, the decision signals a commitment to responsible corporate governance and potentially enhances investor confidence. The long-term effects of this change on BP's performance will require further observation. Stay updated on the latest developments in BP's commitment to responsible executive compensation and ESG initiatives. Learn more about the impact of shareholder activism on executive pay in the energy sector.

Featured Posts

-

Viral Video Cubs Fans Lady And The Tramp Hot Dog Recreation

May 22, 2025

Viral Video Cubs Fans Lady And The Tramp Hot Dog Recreation

May 22, 2025 -

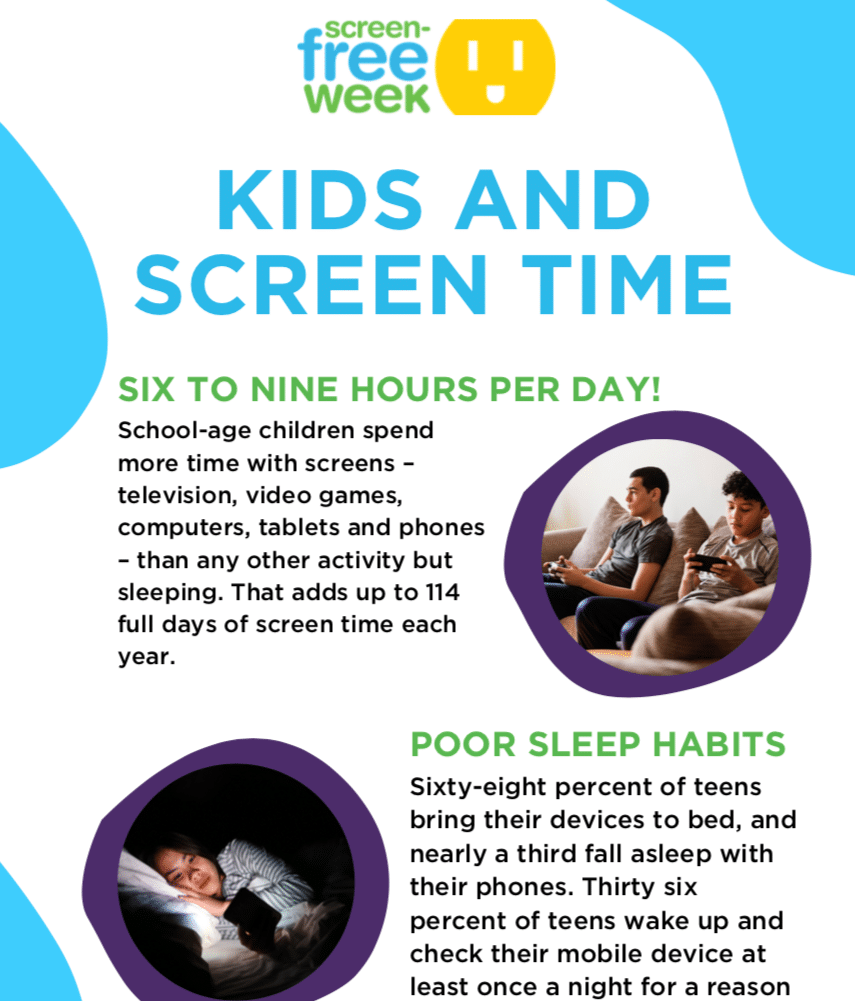

A Screen Free Week With Kids A Practical Guide

May 22, 2025

A Screen Free Week With Kids A Practical Guide

May 22, 2025 -

Tory Wifes Jail Sentence Stands After Anti Migrant Remarks In Southport

May 22, 2025

Tory Wifes Jail Sentence Stands After Anti Migrant Remarks In Southport

May 22, 2025 -

Aims Groups New Partnership With The World Trading Tournament Wtt

May 22, 2025

Aims Groups New Partnership With The World Trading Tournament Wtt

May 22, 2025 -

Vybz Kartel Opens Up Skin Bleaching And The Battle For Self Acceptance

May 22, 2025

Vybz Kartel Opens Up Skin Bleaching And The Battle For Self Acceptance

May 22, 2025

Latest Posts

-

Naybilshi Finansovi Kompaniyi Ukrayini U 2024 Rotsi Dokhodi Ta Analiz Rinku

May 22, 2025

Naybilshi Finansovi Kompaniyi Ukrayini U 2024 Rotsi Dokhodi Ta Analiz Rinku

May 22, 2025 -

Finansoviy Reyting 2024 Uspikh Credit Kasa Finako Ukrfinzhitlo Atlani Ta Credit Plus

May 22, 2025

Finansoviy Reyting 2024 Uspikh Credit Kasa Finako Ukrfinzhitlo Atlani Ta Credit Plus

May 22, 2025 -

Credit Kasa Finako Ukrfinzhitlo Atlana Credit Plus Analiz Lideriv Finansovogo Rinku Ukrayini Za 2024 Rik

May 22, 2025

Credit Kasa Finako Ukrfinzhitlo Atlana Credit Plus Analiz Lideriv Finansovogo Rinku Ukrayini Za 2024 Rik

May 22, 2025 -

Analysis Of Ing Groups 2024 Annual Report Form 20 F

May 22, 2025

Analysis Of Ing Groups 2024 Annual Report Form 20 F

May 22, 2025 -

Ings 2024 Annual Report Key Highlights From Form 20 F

May 22, 2025

Ings 2024 Annual Report Key Highlights From Form 20 F

May 22, 2025