Amundi Dow Jones Industrial Average UCITS ETF: Daily NAV Updates And Their Significance

Table of Contents

Daily NAV Calculation and Methodology for the Amundi Dow Jones Industrial Average UCITS ETF

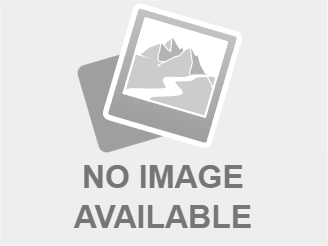

The daily NAV calculation for the Amundi Dow Jones Industrial Average UCITS ETF is a precise process that reflects the fund's underlying assets. It's essentially the total value of all the assets held by the ETF divided by the number of outstanding shares. This calculation takes several factors into account:

- The daily closing prices of the Dow Jones Industrial Average components: The ETF mirrors the performance of the DJIA, so the closing prices of its 30 constituent stocks directly influence the NAV. Any increase or decrease in these prices will directly impact the overall value of the fund.

- Currency conversion (if applicable): If the ETF holds assets denominated in currencies other than the base currency of the fund (usually EUR for UCITS ETFs), currency exchange rates play a vital role in determining the NAV. Fluctuations in exchange rates can lead to gains or losses even if the underlying assets remain stable.

- Fund expenses: Management fees, administrative expenses, and other operating costs are deducted from the overall asset value to calculate the net asset value.

- Accrued income: Any accrued dividends or interest earned from the underlying assets are added to the total asset value before dividing by the number of shares outstanding.

The fund manager and the custodian bank play crucial roles in ensuring the accuracy and transparency of the NAV calculation. The custodian bank holds the ETF's assets and verifies their values, while the fund manager oversees the entire process and ensures compliance with regulations.

Accessing and Interpreting Daily NAV Data for the Amundi Dow Jones Industrial Average UCITS ETF

Accessing the daily NAV data for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Several reputable sources provide this information:

- Amundi's official website: The fund's issuer, Amundi, typically publishes the daily NAV on its website, usually within a short period after the market close. This is generally the most reliable source.

- Financial data providers (e.g., Bloomberg, Refinitiv): Many financial data providers include ETF NAV information in their databases, offering a convenient way to access historical and current NAV data.

- Brokerage account statements: If you hold shares of the Amundi Dow Jones Industrial Average UCITS ETF through a brokerage account, your account statement will typically show the daily NAV.

Interpreting the NAV figures involves understanding that this represents the intrinsic value of a single share in the ETF. Comparing the NAV to the ETF's market price can reveal whether the ETF is trading at a premium or discount to its NAV. A premium indicates the market price is higher than the NAV, while a discount signifies the opposite.

Significance of Daily NAV for Investment Decisions

Monitoring daily NAV changes is essential for several reasons:

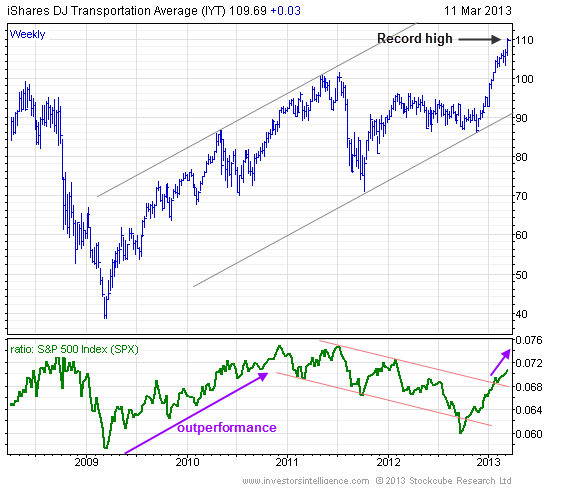

- Timing investment decisions: By tracking the NAV, investors can identify trends and potentially make more informed buy or sell decisions. A rising NAV, coupled with positive market sentiment, might suggest a good time to buy, while a declining NAV might signal a potential opportunity to sell or hold depending on individual investment strategies.

- Monitoring portfolio performance: NAV data is crucial for tracking the overall performance of your investment portfolio. Comparing the daily NAV changes against your initial investment helps to evaluate the success of your investment strategy.

- Assessing fund management efficiency: While not a direct measure, consistent underperformance relative to the benchmark index (the Dow Jones Industrial Average in this case) may indicate potential issues with the fund's management.

- Identifying potential arbitrage opportunities (for sophisticated investors): Large discrepancies between the market price and the NAV can create arbitrage opportunities for experienced investors.

The relationship between NAV and ETF pricing is key. While ideally they should be very close, market forces can cause temporary deviations.

Risks Associated with Amundi Dow Jones Industrial Average UCITS ETF and NAV Fluctuations

Investing in the Amundi Dow Jones Industrial Average UCITS ETF, like any investment, involves inherent risks:

- Market volatility risk: The NAV will fluctuate based on the performance of the Dow Jones Industrial Average, meaning market downturns can lead to significant NAV drops.

- Currency risk (if applicable): Fluctuations in exchange rates can impact the NAV, particularly if the underlying assets are denominated in different currencies.

- Underlying index risk: The ETF's performance is directly tied to the Dow Jones Industrial Average. Any negative developments affecting the index's components will negatively impact the NAV.

- Geopolitical risk: Global events such as political instability or economic crises can create market uncertainty and influence NAV fluctuations.

Conclusion: Daily NAV Updates: A Key to Successful Amundi Dow Jones Industrial Average UCITS ETF Investing

Regular monitoring of the Amundi Dow Jones Industrial Average UCITS ETF daily NAV is critical for making well-informed investment decisions. Understanding how the daily NAV is calculated and the factors influencing it, such as market fluctuations, currency exchange rates, and fund expenses, is vital. Remember to consider the NAV within the larger context of overall market conditions and your personal risk tolerance. By proactively monitoring your Amundi Dow Jones Industrial Average UCITS ETF daily NAV and using this data effectively, you can significantly enhance your investment strategies. To access the latest NAV information, visit the official Amundi website.

Featured Posts

-

Demnas Design Philosophy And Its Application At Gucci

May 25, 2025

Demnas Design Philosophy And Its Application At Gucci

May 25, 2025 -

Escape To The Country Finding Your Perfect Rural Haven

May 25, 2025

Escape To The Country Finding Your Perfect Rural Haven

May 25, 2025 -

Ces Unveiled Europe Nouveautes Technologiques A Amsterdam

May 25, 2025

Ces Unveiled Europe Nouveautes Technologiques A Amsterdam

May 25, 2025 -

How Net Asset Value Nav Impacts Your Amundi Dow Jones Industrial Average Ucits Etf Investment

May 25, 2025

How Net Asset Value Nav Impacts Your Amundi Dow Jones Industrial Average Ucits Etf Investment

May 25, 2025 -

Evroviziya Kde E Sega Konchita Vurst I Kak Izglezhda

May 25, 2025

Evroviziya Kde E Sega Konchita Vurst I Kak Izglezhda

May 25, 2025

Latest Posts

-

Addressing Environmental Concerns Rio Tintos Response To Pilbara Criticism

May 25, 2025

Addressing Environmental Concerns Rio Tintos Response To Pilbara Criticism

May 25, 2025 -

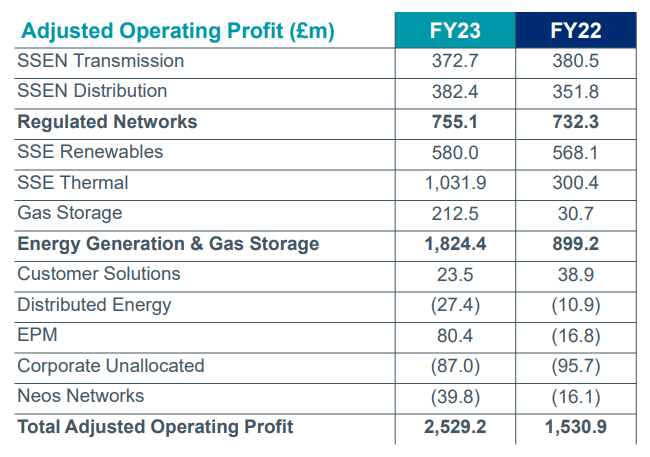

3 Billion Slash To Sse Spending Details Of The Revised Plan

May 25, 2025

3 Billion Slash To Sse Spending Details Of The Revised Plan

May 25, 2025 -

The China Market And Its Implications For Bmw Porsche And Competitors

May 25, 2025

The China Market And Its Implications For Bmw Porsche And Competitors

May 25, 2025 -

Sses 3 Billion Spending Cut A Response To Economic Slowdown

May 25, 2025

Sses 3 Billion Spending Cut A Response To Economic Slowdown

May 25, 2025 -

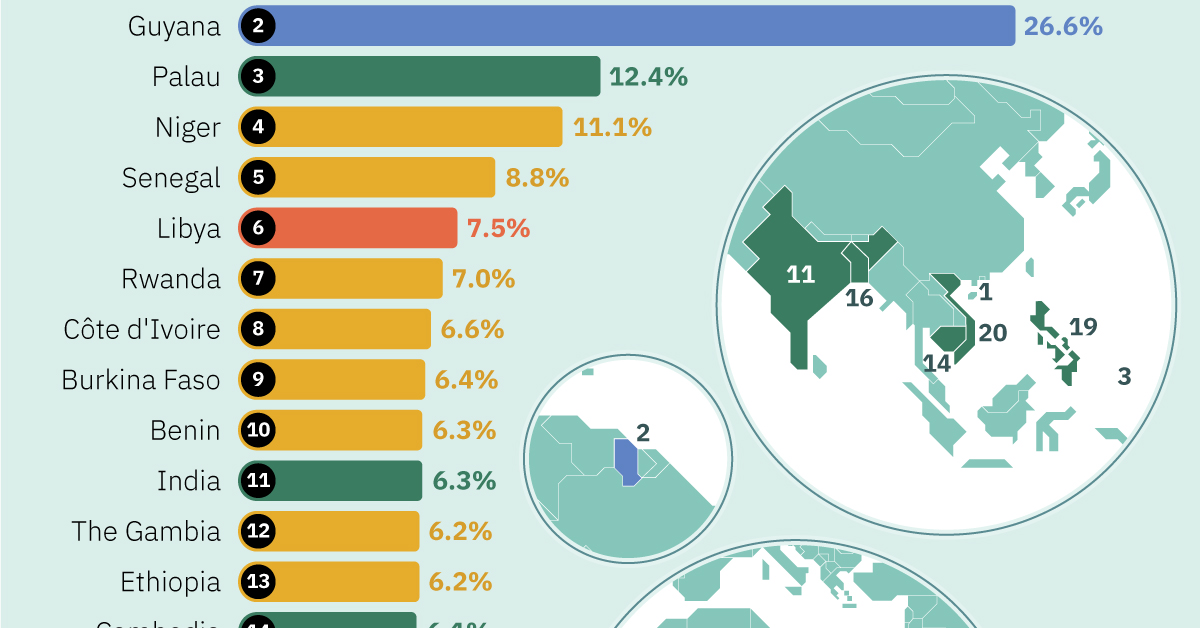

The Countrys Fastest Growing Business Markets A Geographic Analysis

May 25, 2025

The Countrys Fastest Growing Business Markets A Geographic Analysis

May 25, 2025