How Net Asset Value (NAV) Impacts Your Amundi Dow Jones Industrial Average UCITS ETF Investment

Table of Contents

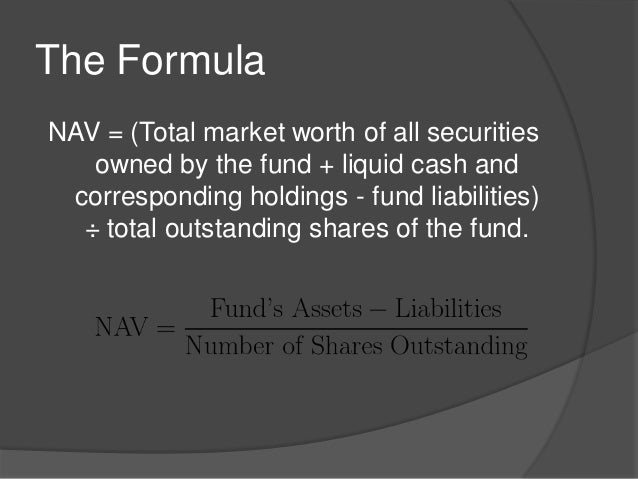

Net Asset Value (NAV) represents the value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. Think of it as the net worth of the ETF per share. For ETFs tracking an index like the Amundi Dow Jones Industrial Average UCITS ETF, the NAV reflects the collective value of the companies comprising the Dow Jones Industrial Average, adjusted for expenses and other factors. This article will explain how NAV fluctuations impact your investment in the Amundi Dow Jones Industrial Average UCITS ETF and how to monitor it effectively.

What is NAV and How is it Calculated for the Amundi Dow Jones Industrial Average UCITS ETF?

The NAV of an ETF like the Amundi Dow Jones Industrial Average UCITS ETF is calculated daily, typically at the end of the trading day. It's a straightforward calculation, but understanding its components is crucial. The process involves:

- Determining the market value of the underlying assets: This is the total value of all the stocks in the Dow Jones Industrial Average that the ETF holds, based on their closing prices on the relevant exchange.

- Subtracting liabilities: This includes any expenses, fees (like the ETF's expense ratio), and other obligations the fund has.

- Dividing by the number of outstanding shares: This gives the NAV per share, representing the net asset value of a single share of the ETF.

For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV is directly impacted by:

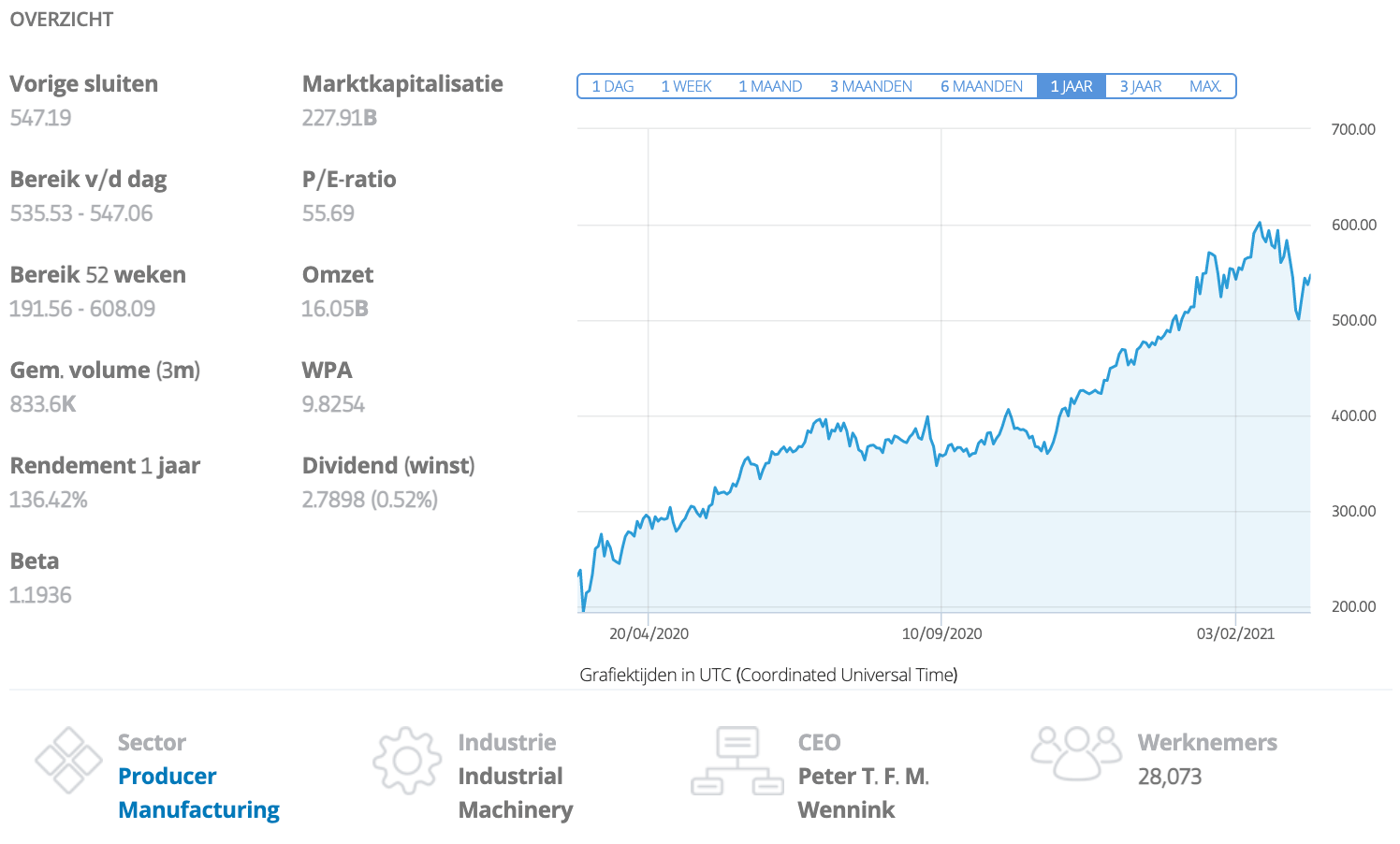

- Market performance of the Dow Jones Industrial Average: If the Dow rises, the NAV generally rises; if the Dow falls, the NAV typically falls.

- Currency fluctuations: Since the Dow includes companies from different countries, currency exchange rates can affect the NAV, especially if the ETF is denominated in a currency different from the base currency of the underlying assets.

- Expense ratio of the ETF: The fund's ongoing expenses reduce the NAV. This is a small, but consistent deduction.

- Dividend distributions: When the underlying companies pay dividends, the ETF receives these and distributes them to its shareholders, which slightly reduces the NAV.

How NAV Fluctuations Affect Your Amundi Dow Jones Industrial Average UCITS ETF Investment

The NAV is directly linked to the value of your Amundi Dow Jones Industrial Average UCITS ETF investment. Daily NAV changes directly impact your portfolio's worth.

- Rising NAV: A rising NAV signifies that the value of your investment is increasing. This is generally positive, reflecting good performance by the underlying companies in the Dow Jones Industrial Average.

- Falling NAV: A falling NAV doesn't automatically mean a loss. While it indicates a decrease in the current value of your holdings, the long-term value of your investment depends on your strategy (buy and hold). Remember, reinvesting dividends can mitigate losses during periods of falling NAV.

- Stable NAV: A period of stable NAV suggests relative market stability and potentially low volatility for the underlying assets.

Monitoring Your Amundi Dow Jones Industrial Average UCITS ETF NAV Effectively

Regularly monitoring your Amundi Dow Jones Industrial Average UCITS ETF's NAV is a crucial aspect of effective investment management. You can find this information daily from various sources:

- Amundi's official website: This is the primary source for accurate and up-to-date information.

- Financial data providers: Sites like Bloomberg, Yahoo Finance, and Google Finance often provide NAV data for ETFs.

- Your brokerage account: Your online brokerage account will usually display the current NAV of your holdings.

It’s important to remember the difference between the NAV and the market price you might see. The market price fluctuates throughout the trading day due to supply and demand, while the NAV is calculated only once daily. There may be a small difference between them (bid-ask spread).

NAV and Investment Decisions: Buying and Selling your Amundi Dow Jones Industrial Average UCITS ETF

While the "buy low, sell high" principle is appealing, using NAV alone to time the market is risky. Short-term NAV fluctuations shouldn't dictate your investment strategy. However, understanding NAV helps inform long-term decisions:

- Strategic asset allocation: NAV monitoring helps you assess whether your ETF allocation aligns with your overall investment strategy.

- Risk tolerance: Your comfort level with volatility impacts how you react to NAV changes. A higher risk tolerance might mean you hold through short-term dips in NAV.

- Avoiding emotional decision-making: Don't panic-sell based on short-term NAV declines. Stick to your long-term investment plan.

Conclusion: Mastering Net Asset Value (NAV) for Optimal Amundi Dow Jones Industrial Average UCITS ETF Returns

Understanding Net Asset Value is key to successfully managing your Amundi Dow Jones Industrial Average UCITS ETF investment. While daily NAV fluctuations are normal, consistent monitoring allows you to assess your portfolio's performance and make informed decisions aligned with your investment strategy and risk tolerance. Don't let short-term NAV dips derail your long-term goals.

Start monitoring your Amundi Dow Jones Industrial Average UCITS ETF's Net Asset Value (NAV) today to optimize your investment strategy and achieve your financial goals!

Featured Posts

-

Konchita Vurst Dnes Neveroyatna Transformatsiya Sled Pobedata Na Evroviziya

May 25, 2025

Konchita Vurst Dnes Neveroyatna Transformatsiya Sled Pobedata Na Evroviziya

May 25, 2025 -

Glastonbury 2025 Olivia Rodrigo And The 1975 Join The Lineup

May 25, 2025

Glastonbury 2025 Olivia Rodrigo And The 1975 Join The Lineup

May 25, 2025 -

Top 10 Uomini Piu Ricchi Del Mondo Secondo Forbes 2025

May 25, 2025

Top 10 Uomini Piu Ricchi Del Mondo Secondo Forbes 2025

May 25, 2025 -

Avrupa Piyasalarinda Karisik Bir Guen Analiz Ve Degerlendirme

May 25, 2025

Avrupa Piyasalarinda Karisik Bir Guen Analiz Ve Degerlendirme

May 25, 2025 -

Frankfurt Stock Exchange Dax Holds Following Record Run

May 25, 2025

Frankfurt Stock Exchange Dax Holds Following Record Run

May 25, 2025

Latest Posts

-

Amsterdam Stock Market 7 Initial Plunge Reflects Trade War Anxiety

May 25, 2025

Amsterdam Stock Market 7 Initial Plunge Reflects Trade War Anxiety

May 25, 2025 -

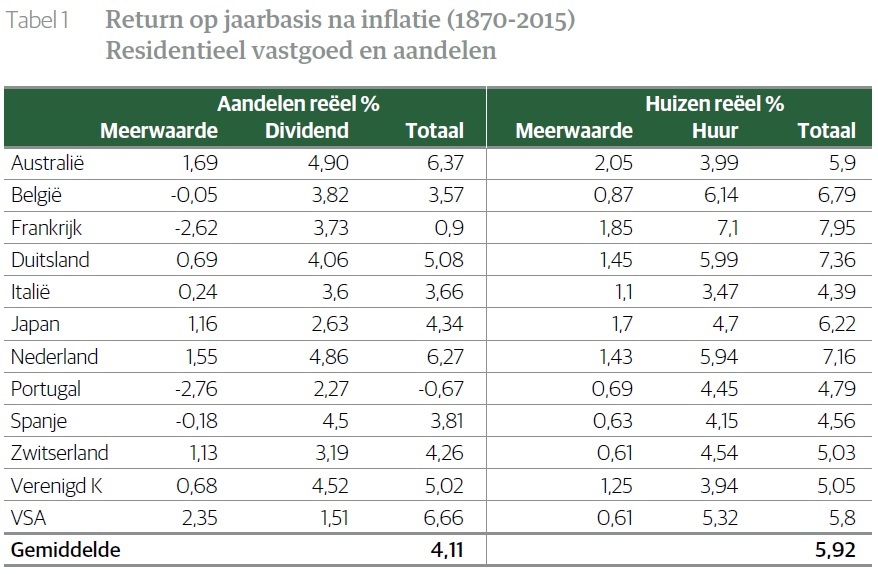

Voorspelling Toekomst Van Europese Aandelen Versus Wall Street

May 25, 2025

Voorspelling Toekomst Van Europese Aandelen Versus Wall Street

May 25, 2025 -

Gryozy Lyubvi Ili Ilicha V Gazete Trud Analiz Syuzheta

May 25, 2025

Gryozy Lyubvi Ili Ilicha V Gazete Trud Analiz Syuzheta

May 25, 2025 -

7 Drop In Amsterdam Stock Market Trade War Uncertainty

May 25, 2025

7 Drop In Amsterdam Stock Market Trade War Uncertainty

May 25, 2025 -

Krijgt De Recente Marktdraai Tussen Europese En Amerikaanse Aandelen Een Vervolg

May 25, 2025

Krijgt De Recente Marktdraai Tussen Europese En Amerikaanse Aandelen Een Vervolg

May 25, 2025