Amundi Dow Jones Industrial Average UCITS ETF: A Deep Dive Into Net Asset Value

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the value of an ETF's underlying assets minus its liabilities, per share. For ETF investors, understanding NAV is paramount because it reflects the true intrinsic worth of your investment. Unlike the market price, which can fluctuate throughout the trading day, the NAV is calculated at the end of each trading day, providing a more accurate picture of the ETF's value at a specific point in time.

- NAV calculation: The NAV is calculated by taking the total market value of all the assets held within the ETF (stocks, bonds, etc.) and subtracting any liabilities (expenses, debts). This total is then divided by the number of outstanding shares to arrive at the NAV per share.

- Daily NAV calculation process for the Amundi DJIA UCITS ETF: Amundi, the fund manager, calculates the NAV daily using the closing prices of the constituent stocks within the Dow Jones Industrial Average (DJIA). This process ensures that the NAV reflects the market's closing valuation of the index.

- Why understanding NAV is critical for evaluating ETF performance: Monitoring the NAV helps you assess the ETF's performance relative to its benchmark, the DJIA. Consistent upward trends in NAV generally indicate positive performance, while downward trends may signal underperformance.

Factors Affecting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF. Understanding these factors is key to predicting potential NAV fluctuations and making better investment choices.

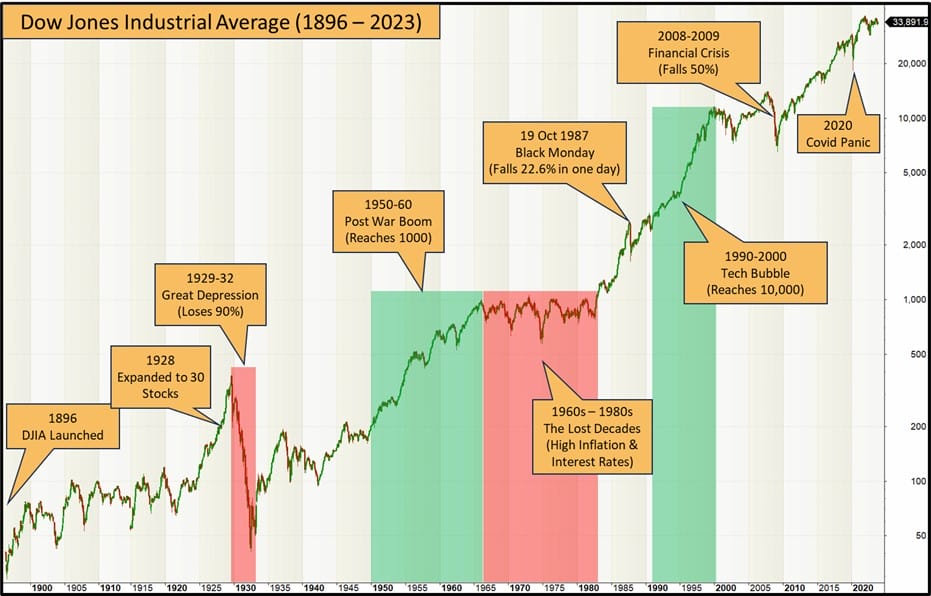

- Market movements of the DJIA components: The primary driver of the ETF's NAV is the performance of the underlying Dow Jones Industrial Average. Positive movements in the DJIA generally lead to an increase in the ETF's NAV, while negative movements result in a decrease. Individual stock performance within the DJIA also plays a significant role.

- Currency exchange rate impact on international holdings (if any): While the DJIA is a US-based index, currency fluctuations could indirectly affect the NAV if the ETF holds any international assets or invests in companies with substantial international operations. Changes in exchange rates can impact the value of these holdings in the ETF's base currency.

- Dividend reinvestment and its effect on NAV growth: Dividends paid by the companies within the DJIA are usually reinvested back into the ETF, increasing the number of shares and potentially boosting the NAV over time.

- Expense ratio and its subtle effect on NAV over time: The ETF's expense ratio (the annual fee charged for managing the fund) gradually reduces the NAV over time. While the impact is subtle, it's important to consider this factor when evaluating long-term performance.

How to Find the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Finding the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Several reliable sources provide this crucial data.

- Amundi's official website: The most reliable source is the fund manager's official website. Amundi typically publishes daily NAV information for all their ETFs.

- Financial news websites and data providers: Many financial news websites and data providers (e.g., Bloomberg, Yahoo Finance) list the real-time and historical NAV data for various ETFs, including the Amundi DJIA UCITS ETF.

- Brokerage platforms offering the ETF: If you hold the ETF through a brokerage account, the platform will usually display the current NAV, along with other relevant investment information.

- Checking the ETF fact sheet: The ETF's fact sheet or prospectus often contains details on how and where to find the NAV.

Using NAV to Make Informed Investment Decisions

The NAV is a valuable tool for making informed investment decisions, but it shouldn't be the sole factor.

- Comparing NAV against the DJIA index performance: Compare the ETF's NAV performance to the DJIA's performance to evaluate how effectively the ETF tracks its benchmark. Significant deviations may indicate potential issues with the fund's management or tracking methodology.

- Identifying upward and downward trends in NAV: Monitoring NAV changes over time allows you to identify trends and assess the long-term performance of your investment. Consistent upward trends suggest positive performance, while prolonged downward trends may necessitate a review of your investment strategy.

- NAV as a factor in portfolio diversification strategy: Consider the NAV alongside other factors when diversifying your investment portfolio. The NAV helps assess the risk and return profile of the ETF relative to other assets in your portfolio.

- Importance of considering other factors beyond NAV for investment decisions: Remember that NAV is just one piece of the puzzle. Other factors, like the expense ratio, the ETF's trading volume, and your overall investment goals, should also be considered when making buy/sell decisions.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for investors seeking to track its performance and make informed decisions. By considering the factors that influence NAV and utilizing readily available data sources, investors can effectively monitor their investment in this popular index-tracking ETF. Learn more about the Amundi Dow Jones Industrial Average UCITS ETF and its Net Asset Value (NAV) to optimize your investment strategy. Regularly monitor the NAV and stay updated on market trends for a more informed approach to investing in this and similar exchange-traded funds.

Featured Posts

-

Kyle Walker Peters To West Ham Transfer News And Offer Speculation

May 24, 2025

Kyle Walker Peters To West Ham Transfer News And Offer Speculation

May 24, 2025 -

Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 24, 2025

Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 24, 2025 -

Leeds Uniteds Transfer Bid For Kyle Walker Peters

May 24, 2025

Leeds Uniteds Transfer Bid For Kyle Walker Peters

May 24, 2025 -

One Womans Sanctuary A Seattle Park During The Pandemics Early Days

May 24, 2025

One Womans Sanctuary A Seattle Park During The Pandemics Early Days

May 24, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025

Latest Posts

-

Trade War Intensifies Amsterdam Stock Market Suffers 7 Plunge

May 24, 2025

Trade War Intensifies Amsterdam Stock Market Suffers 7 Plunge

May 24, 2025 -

Borsa Europa Cauta Attesa Per La Fed Banche Deboli A Piazza Affari

May 24, 2025

Borsa Europa Cauta Attesa Per La Fed Banche Deboli A Piazza Affari

May 24, 2025 -

Amsterdam Stock Market Opens Down 7 On Trade War Concerns

May 24, 2025

Amsterdam Stock Market Opens Down 7 On Trade War Concerns

May 24, 2025 -

Amsterdam Stock Market Plunge 7 Drop Amidst Rising Trade War Fears

May 24, 2025

Amsterdam Stock Market Plunge 7 Drop Amidst Rising Trade War Fears

May 24, 2025 -

Analyse Sterke Aex Ondanks Onrust Op De Amerikaanse Beurs

May 24, 2025

Analyse Sterke Aex Ondanks Onrust Op De Amerikaanse Beurs

May 24, 2025