Tracking The Net Asset Value (NAV) Of Amundi MSCI All Country World UCITS ETF USD Acc

Table of Contents

Sources for Finding Amundi MSCI All Country World UCITS ETF USD Acc NAV Data

Reliable access to accurate NAV data is fundamental for effective Amundi MSCI All Country World UCITS ETF USD Acc NAV tracking. Several sources provide this crucial information:

-

Official Amundi Website: The official Amundi website is the primary source for accurate and up-to-date NAV data. Look for the ETF's fact sheet or dedicated fund page; this is usually updated daily. The advantage is the direct source, but it might not be in real-time.

-

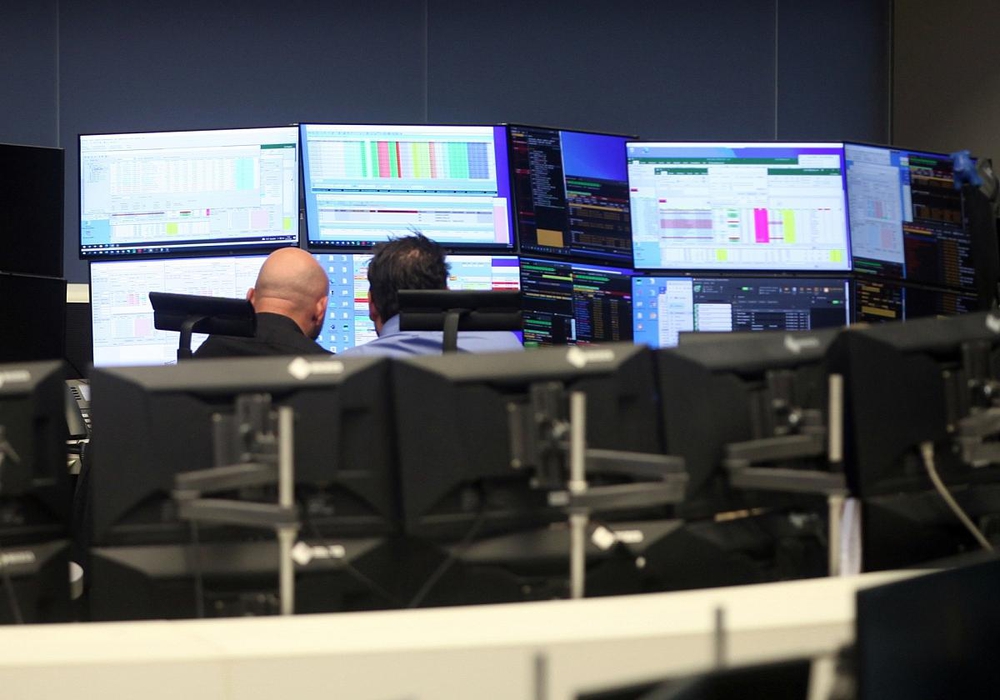

Major Financial Data Providers: Reputable financial data providers like Bloomberg, Refinitiv, and FactSet offer real-time and historical NAV data, often as part of a subscription service. These platforms provide comprehensive data sets, including charts and analysis tools, though access often comes at a cost.

-

Brokerage Platforms: Many online brokerage platforms, such as Interactive Brokers, Fidelity, and Schwab, display the NAV of ETFs held in client accounts. The convenience of seeing the NAV alongside your holdings is a major advantage. However, the specific presentation varies between platforms.

-

ETF Data Aggregators: Websites dedicated to ETF information, such as ETF.com or etf.morningstar.com, aggregate NAV data from various sources. While convenient for comparison, ensure the source’s credibility and the accuracy of its information.

Factors Influencing the Amundi MSCI All Country World UCITS ETF USD Acc NAV

The daily fluctuations in the Amundi MSCI All Country World UCITS ETF USD Acc NAV are influenced by several interconnected factors:

-

Global Market Movements: The primary driver is the performance of the underlying assets in the ETF’s portfolio. Positive global market sentiment generally leads to NAV increases, while negative sentiment results in decreases. Understanding global market volatility is crucial for predicting NAV changes.

-

Currency Exchange Rates: As the ETF is denominated in USD, fluctuations in exchange rates between the USD and the currencies of the underlying assets impact the NAV. For instance, a strengthening USD against other currencies can lead to a lower NAV, even if the underlying assets perform well. This highlights the importance of understanding currency risk.

-

Dividend Distributions: Dividends received from underlying companies are generally reinvested, potentially increasing the NAV. However, the ex-dividend date will often show a temporary dip before the reinvestment.

-

Management Fees and Expenses: The ETF's expense ratio (management fees and other operational costs) reduces the NAV over time. A higher expense ratio directly impacts the ETF's overall returns and its NAV growth.

Interpreting and Utilizing Amundi MSCI All Country World UCITS ETF USD Acc NAV Data

Interpreting NAV changes is essential for evaluating the ETF’s performance and making informed investment decisions. Consider these aspects:

-

Performance Comparison: Compare the NAV changes over time to the ETF's benchmark (MSCI All Country World Index) to gauge relative performance. Consider using percentage changes to compare fluctuations over different periods.

-

Investment Decision-Making: While not a definitive buy/sell signal, consistent positive NAV trends generally indicate strong performance, making it a positive indicator (but always consider the broader market context). Conversely, prolonged negative trends might warrant a review of your investment strategy.

-

Return on Investment (ROI): Calculate your ROI by comparing your initial investment cost to the current NAV per share, accounting for any dividends received.

Common Mistakes to Avoid When Tracking the NAV

-

Confusing NAV with Share Price: The NAV represents the ETF's net asset value per share, while the share price is the market price at which the ETF is traded. These might differ slightly due to market supply and demand.

-

Ignoring Currency Fluctuations: Failing to account for currency exchange rate fluctuations can lead to misinterpretations of the NAV's performance, especially with globally diversified ETFs like this one.

-

Neglecting the Prospectus: Always refer to the ETF's prospectus for a complete understanding of its investment strategy, fees, and other relevant information.

Mastering Amundi MSCI All Country World UCITS ETF USD Acc NAV Tracking

Regularly tracking the Amundi MSCI All Country World UCITS ETF USD Acc NAV using the reliable sources outlined above is crucial for informed investment decisions. By understanding the factors influencing NAV fluctuations and correctly interpreting the data, you can better assess the ETF's performance against its benchmark and make strategic adjustments to your investment portfolio. Remember to consult the ETF prospectus and consider seeking professional financial advice if needed. Start tracking your Amundi MSCI All Country World UCITS ETF USD Acc NAV today and optimize your investment strategy! [Link to Amundi's website]

Featured Posts

-

Mamma Mia Review Of The New Ferrari Hot Wheels Car Sets

May 24, 2025

Mamma Mia Review Of The New Ferrari Hot Wheels Car Sets

May 24, 2025 -

Escape To The Country Making The Move To A Rural Life

May 24, 2025

Escape To The Country Making The Move To A Rural Life

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Nav

May 24, 2025 -

Joy Crookes Carmen New Single Released

May 24, 2025

Joy Crookes Carmen New Single Released

May 24, 2025 -

Dax Fall Bei Frankfurter Aktienmarktoeffnung Am 21 Maerz 2025

May 24, 2025

Dax Fall Bei Frankfurter Aktienmarktoeffnung Am 21 Maerz 2025

May 24, 2025

Latest Posts

-

Footballer Kyle Walker Spotted With Models In Milan Following Wifes Departure

May 24, 2025

Footballer Kyle Walker Spotted With Models In Milan Following Wifes Departure

May 24, 2025 -

Kyle Walkers Milan Party Details Emerge After Wifes Uk Flight

May 24, 2025

Kyle Walkers Milan Party Details Emerge After Wifes Uk Flight

May 24, 2025 -

Kyle Walker Milan Night Out With Models After Wifes Return

May 24, 2025

Kyle Walker Milan Night Out With Models After Wifes Return

May 24, 2025 -

The Kyle And Teddi Dog Walker Incident A Full Account

May 24, 2025

The Kyle And Teddi Dog Walker Incident A Full Account

May 24, 2025 -

The Kyle Walker Situation Mystery Women And Annie Kilners Reaction

May 24, 2025

The Kyle Walker Situation Mystery Women And Annie Kilners Reaction

May 24, 2025