Amundi DJIA UCITS ETF: A Deep Dive Into Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and why is it crucial for the Amundi DJIA UCITS ETF?

Net Asset Value (NAV) represents the net value of an ETF's assets after subtracting its liabilities. For the Amundi DJIA UCITS ETF, the NAV reflects the total value of the underlying assets that mirror the Dow Jones Industrial Average. Essentially, it shows you the intrinsic value of each share in the ETF.

- NAV is calculated daily: The Amundi DJIA UCITS ETF's NAV is calculated at the end of each trading day, providing investors with an up-to-date picture of the ETF's value.

- NAV reflects the market value of the ETF's holdings: The NAV directly correlates with the performance of the DJIA component stocks. If the DJIA goes up, the NAV generally goes up as well.

- Understanding NAV helps in evaluating investment performance: By tracking the NAV over time, investors can monitor the ETF's performance and assess the success of their investment.

- NAV fluctuations reflect market movements of the DJIA: Changes in the NAV are a direct reflection of the movements of the Dow Jones Industrial Average. This provides a clear indication of the market's sentiment towards the constituent companies.

How is the NAV of the Amundi DJIA UCITS ETF calculated?

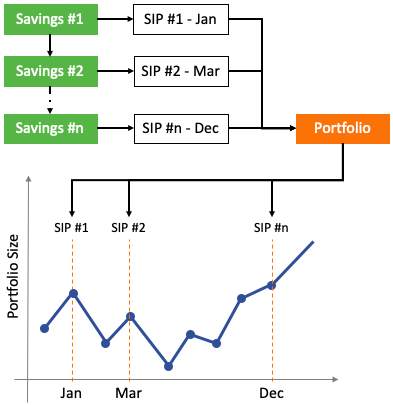

The calculation of the Amundi DJIA UCITS ETF's NAV involves a straightforward process:

- Sum of the market value of all holdings: The market value of each stock in the ETF's portfolio is determined based on the closing prices of those stocks.

- Less any liabilities (expenses): Expenses such as management fees and other operational costs are deducted from the total asset value.

- Divided by the number of outstanding shares: This calculation gives the NAV per share.

- Daily calculation and publication: The NAV is calculated daily and is usually published on the Amundi website and various financial news sources.

Factors influencing the Amundi DJIA UCITS ETF's NAV

Several key factors can influence the daily NAV of the Amundi DJIA UCITS ETF:

- Performance of the DJIA component stocks: The primary driver of NAV changes is the performance of the individual stocks that make up the Dow Jones Industrial Average.

- Changes in the weighting of the DJIA components: As the DJIA components' relative values change, the weighting within the index and, consequently, the ETF, will also adjust, influencing the NAV.

- Expense ratio of the ETF: The ETF's expense ratio, representing the annual cost of managing the fund, indirectly impacts the NAV. Although a small factor, it's crucial for long-term considerations.

- Currency exchange rate fluctuations (if applicable): If the ETF holds assets denominated in currencies other than the base currency, fluctuations in exchange rates will impact the NAV.

- Dividend payments from underlying stocks: Dividend payments from the underlying stocks in the DJIA will influence the NAV, usually resulting in a slight decrease immediately after the dividend is paid.

Using NAV to make informed investment decisions with the Amundi DJIA UCITS ETF

Investors can leverage NAV data to make more informed investment decisions:

- Comparing NAV to share price (Premium/Discount): The ETF's market price might trade at a premium or discount to its NAV. Understanding this difference can help in timing your buy and sell decisions.

- Tracking NAV changes over time: Monitoring the NAV over time allows investors to gauge the ETF's performance and assess the long-term growth potential.

- Using NAV for buy/sell decisions: While not the sole determining factor, NAV can inform investment decisions, particularly when considering long-term investment strategies.

- Comparing NAV with other similar ETFs: Comparing the NAV performance of the Amundi DJIA UCITS ETF with similar ETFs tracking the DJIA can help determine its relative performance.

- Understanding the implications of NAV changes: By comprehending the factors that influence the NAV, investors can better understand the market forces affecting their investment.

Practical Applications of NAV Information

To find the daily NAV of the Amundi DJIA UCITS ETF, you can check the Amundi website, reputable financial news websites (such as Bloomberg or Yahoo Finance), and many brokerage platforms that list the ETF.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi DJIA UCITS ETF is crucial for any investor seeking to make informed decisions. By regularly monitoring the NAV and considering it alongside other market indicators, you can effectively track your investment's performance and adjust your strategy as needed. Remember that the NAV is just one piece of the puzzle; you should always conduct thorough research and consider your overall investment objectives. Learn more about the Amundi DJIA UCITS ETF's NAV and make informed investment decisions today!

Featured Posts

-

Nagyerteku Porsche 911 80 Millio Forintos Extrak

May 24, 2025

Nagyerteku Porsche 911 80 Millio Forintos Extrak

May 24, 2025 -

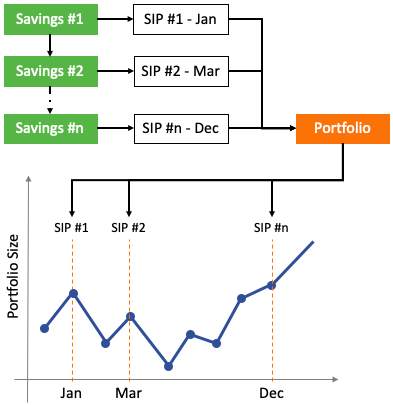

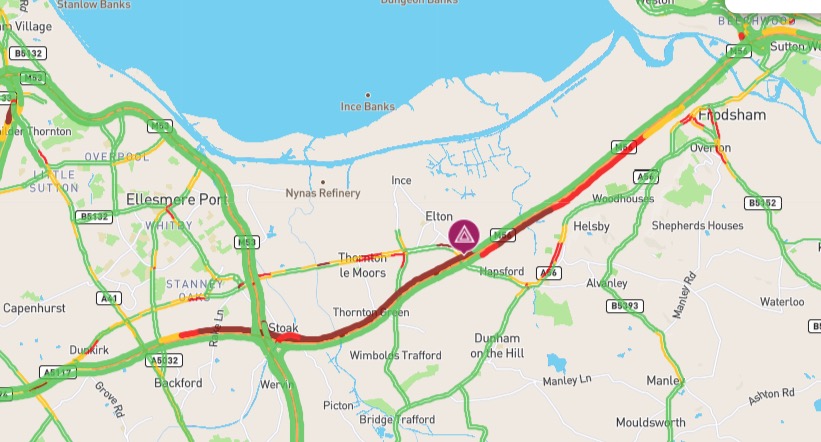

Mueze Sergilerinde Porsche 956 Nin Havada Asili Olmasinin Anlami

May 24, 2025

Mueze Sergilerinde Porsche 956 Nin Havada Asili Olmasinin Anlami

May 24, 2025 -

Country Living Under 1 Million A Buyers Guide

May 24, 2025

Country Living Under 1 Million A Buyers Guide

May 24, 2025 -

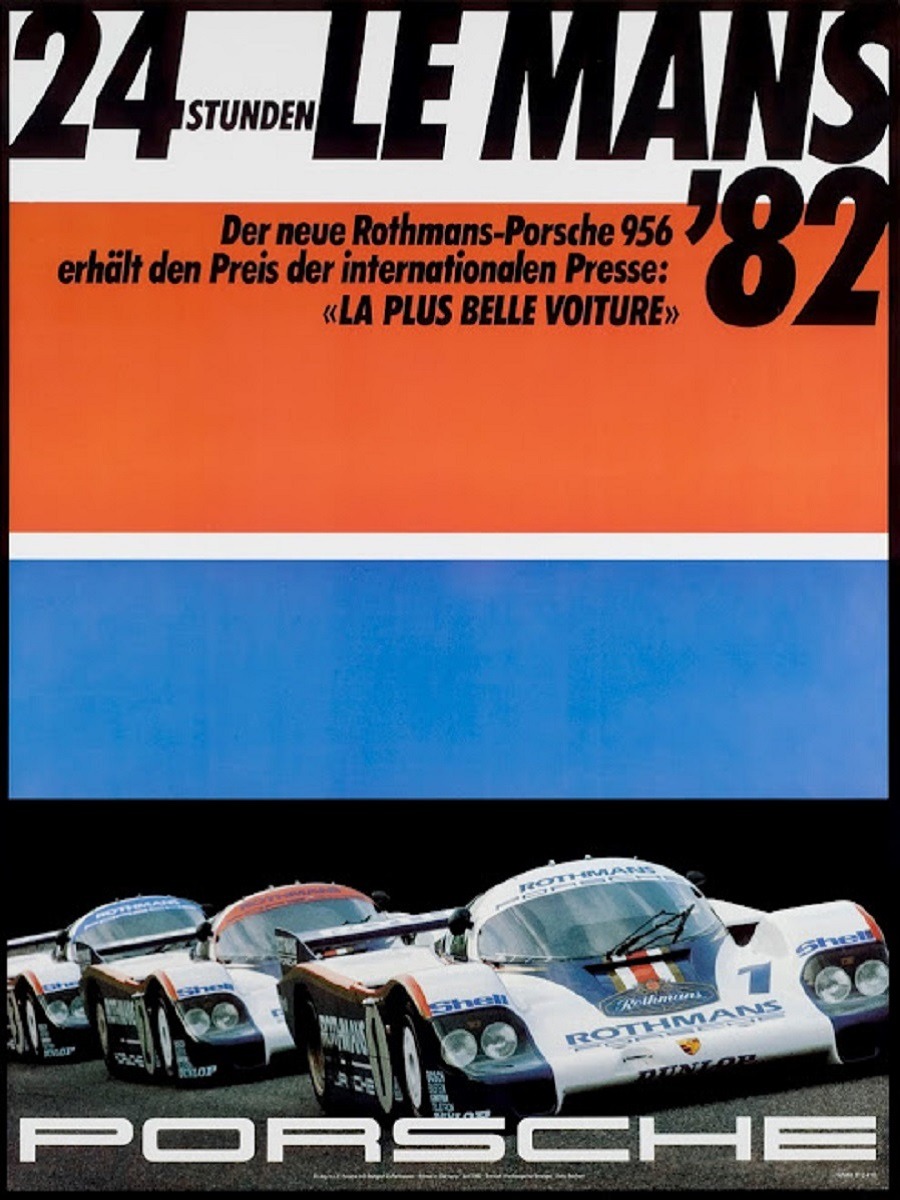

Cheshire Deeside M56 Delays Following Road Accident

May 24, 2025

Cheshire Deeside M56 Delays Following Road Accident

May 24, 2025 -

Buying Bbc Radio 1 Big Weekend 2025 Tickets A Step By Step Process

May 24, 2025

Buying Bbc Radio 1 Big Weekend 2025 Tickets A Step By Step Process

May 24, 2025

Latest Posts

-

Aex In De Plus Ondanks Onrust Op Wall Street Een Dieper Duik In De Oorzaken

May 24, 2025

Aex In De Plus Ondanks Onrust Op Wall Street Een Dieper Duik In De Oorzaken

May 24, 2025 -

Analyse Krijgt De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Een Vervolg

May 24, 2025

Analyse Krijgt De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Een Vervolg

May 24, 2025 -

Europese Aandelen Vs Wall Street Doorzetting Van De Snelle Marktdraai

May 24, 2025

Europese Aandelen Vs Wall Street Doorzetting Van De Snelle Marktdraai

May 24, 2025 -

Amsterdam Stock Market Suffers 2 Decline Amidst Trump Tariff News

May 24, 2025

Amsterdam Stock Market Suffers 2 Decline Amidst Trump Tariff News

May 24, 2025 -

2 Fall On Amsterdam Stock Exchange Impact Of Trumps Tariffs

May 24, 2025

2 Fall On Amsterdam Stock Exchange Impact Of Trumps Tariffs

May 24, 2025