Amsterdam Stock Market Suffers 2% Decline Amidst Trump Tariff News

Table of Contents

Impact of Trump Tariffs on Dutch Businesses

The new Trump tariffs have dealt a substantial blow to several key sectors of the Dutch economy. Agriculture, a cornerstone of the Netherlands' export-oriented economy, has been particularly hard hit, with increased duties on Dutch agricultural products impacting export revenue and profitability. The technology sector, reliant on global supply chains, is also feeling the pinch, facing increased costs for imported components and potentially reduced competitiveness in international markets.

- Specific industries hit hardest by tariffs: Agriculture (dairy, flowers), technology (semiconductors, electronics), and manufacturing (certain specialized goods).

- Examples of affected Dutch companies and their stock performance: While pinpointing exact losses for individual companies immediately following the tariff announcement requires further detailed financial analysis, publicly traded companies in the affected sectors have shown a general negative trend in their stock prices. For example, companies heavily involved in exporting agricultural products experienced significant drops in their share prices. Specific examples require referencing real-time financial data.

- Analysis of supply chain disruptions: The tariffs have created significant supply chain disruptions, increasing lead times and costs for businesses reliant on imported components. This adds layers of complexity and uncertainty for Dutch companies operating in global markets.

Investor Sentiment and Market Volatility

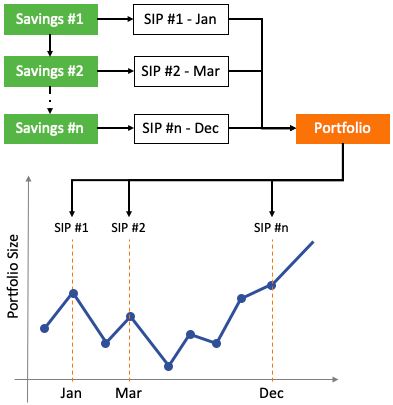

The announcement of the new tariffs triggered an immediate sell-off in the Amsterdam Stock Market, reflecting a sharp decline in investor confidence. This negative sentiment led to increased stock market volatility, with the AEX index experiencing significant fluctuations in the days following the news. The uncertainty surrounding the long-term impacts of the tariffs fueled this volatility, making investors hesitant to commit to new investments.

- AEX index fluctuations before and after the news: A detailed chart comparing AEX index performance before, during, and after the tariff announcement is needed for a comprehensive analysis. Data from reputable financial sources would be essential for this section.

- Changes in trading volume: Increased trading volume is usually observed during periods of heightened market volatility. Analyzing trading volume changes before, during, and after the tariff news offers valuable insight into investor behavior.

- Analysis of investor confidence indicators: Various investor confidence indicators, such as the consumer confidence index and business sentiment surveys, can provide further context on the market reaction to the Trump tariffs. These data points help gauge the overall economic outlook.

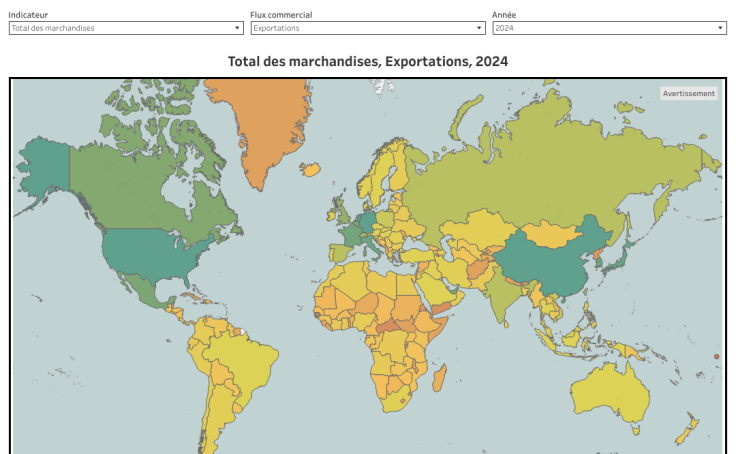

Global Market Reactions and Spillover Effects

The Amsterdam Stock Market decline wasn't an isolated event; it mirrored broader global market concerns about the escalating trade war. The interconnectedness of global financial markets means that events in one region quickly ripple outwards, affecting others. The Trump tariffs, therefore, impacted other European stock exchanges, reflecting a general sentiment of uncertainty and apprehension amongst investors.

- Comparison to other European stock market performances: Comparing the performance of the AEX index with other major European indices (e.g., FTSE 100, DAX) in the period following the tariff announcement would showcase the wider impact.

- Analysis of currency fluctuations (Euro/Dollar): Trade tensions often lead to currency fluctuations. Analyzing the Euro/Dollar exchange rate in the aftermath of the tariff announcement would reveal the impact on currency markets.

- Mention any similar reactions in other global markets: Similar declines were observed in other global markets, particularly those closely tied to the US economy, indicating a widespread negative reaction to the Trump tariffs.

Potential Long-Term Consequences for the Amsterdam Stock Market

The uncertainty generated by the Trump tariffs poses a significant risk to the long-term health of the Amsterdam Stock Market. Prolonged trade tensions could discourage investment, hamper economic growth, and lead to further market volatility. The Dutch government's response will be crucial in mitigating these potential negative consequences.

- Predictions for the AEX index in the coming months: Predicting the AEX index’s future performance requires extensive financial modeling and analysis, factoring in various macroeconomic indicators. Speculative forecasts should be clearly identified as such.

- Potential government intervention strategies: Government intervention could involve measures to support affected industries, stimulate investment, or negotiate trade agreements to lessen the impact of tariffs.

- Long-term outlook for Dutch economic growth: The long-term impact on Dutch economic growth will depend on several factors, including the duration of the trade war, the government's policy responses, and the resilience of Dutch businesses.

Conclusion: Understanding the Amsterdam Stock Market Decline

The 2% decline in the Amsterdam Stock Market following the announcement of Trump tariffs underscores the significant impact of global trade policies on national economies. The decline was driven by a combination of factors, including the direct impact of tariffs on Dutch businesses, decreased investor confidence, and broader global market reactions. The interconnectedness of the Amsterdam Stock Market with global events highlights the importance of monitoring international trade developments.

To make informed investment decisions, monitor the Amsterdam Stock Market closely, stay updated on Trump's tariff policies, and understand the implications of global trade for your investments. The volatility of the AEX index and the ongoing uncertainty make it crucial to stay informed about developments affecting the Amsterdam Stock Market and the broader global economy.

Featured Posts

-

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value Nav

May 24, 2025

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value Nav

May 24, 2025 -

Aex Stijgt Na Trump Uitstel Analyse Van De Marktwinsten

May 24, 2025

Aex Stijgt Na Trump Uitstel Analyse Van De Marktwinsten

May 24, 2025 -

Leeds Uniteds Pursuit Of Kyle Walker Peters Transfer Update

May 24, 2025

Leeds Uniteds Pursuit Of Kyle Walker Peters Transfer Update

May 24, 2025 -

Us Dutch Trade Conflict Impact On Dutch Stock Market

May 24, 2025

Us Dutch Trade Conflict Impact On Dutch Stock Market

May 24, 2025 -

Ferrari Nappasi 13 Vuotiaan Lupauksen Nimi Muistiin

May 24, 2025

Ferrari Nappasi 13 Vuotiaan Lupauksen Nimi Muistiin

May 24, 2025

Latest Posts

-

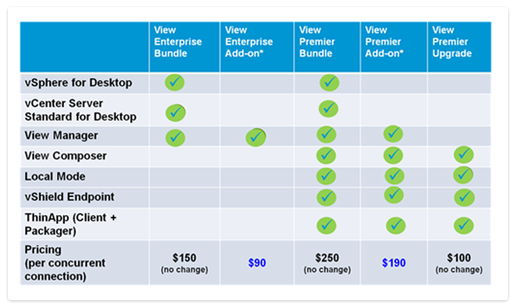

V Mware Price Shock At And T Reports 1 050 Increase From Broadcom

May 24, 2025

V Mware Price Shock At And T Reports 1 050 Increase From Broadcom

May 24, 2025 -

Investigation Reveals Prolonged Chemical Presence After Ohio Train Disaster

May 24, 2025

Investigation Reveals Prolonged Chemical Presence After Ohio Train Disaster

May 24, 2025 -

Resistance To Ev Mandates Grows Among Car Dealers

May 24, 2025

Resistance To Ev Mandates Grows Among Car Dealers

May 24, 2025 -

Ohio Train Derailment Lingering Chemical Contamination In Nearby Structures

May 24, 2025

Ohio Train Derailment Lingering Chemical Contamination In Nearby Structures

May 24, 2025 -

Auto Dealers Intensify Fight Against Electric Vehicle Regulations

May 24, 2025

Auto Dealers Intensify Fight Against Electric Vehicle Regulations

May 24, 2025