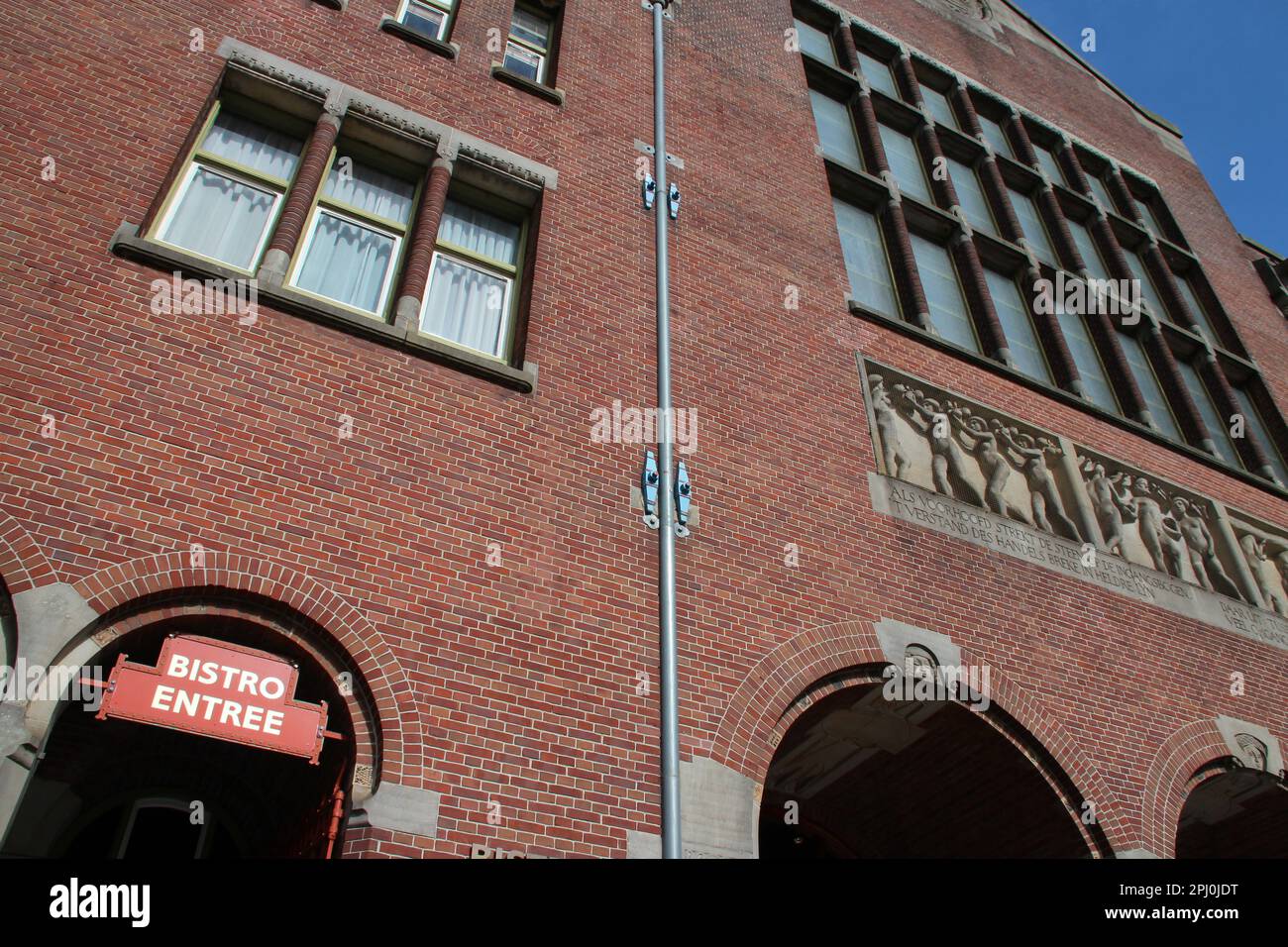

2% Fall On Amsterdam Stock Exchange: Impact Of Trump's Tariffs

Table of Contents

Direct Impact of Trump's Tariffs on Dutch Businesses

Trump's tariffs directly impacted numerous Dutch businesses, triggering a chain reaction that contributed to the 2% fall on the Amsterdam Stock Exchange.

Sectors Most Affected:

Several key Dutch industries, heavily reliant on international trade, felt the brunt of these tariffs. The mechanisms by which these tariffs affected these sectors included increased production costs, reduced competitiveness in global markets, and a consequent decrease in exports.

- Agriculture: Dutch agricultural exports, particularly dairy and horticultural products, faced increased tariffs in the US market, leading to reduced sales and lower profits. Companies like FrieslandCampina, a major dairy cooperative, experienced a notable decrease in US export revenue.

- Technology: Dutch technology companies exporting components or finished goods to the US saw their products become less competitive due to increased prices. This resulted in lost market share and reduced profitability.

- Manufacturing: Dutch manufacturing sectors reliant on US imports for raw materials or components faced higher input costs, squeezing profit margins and impacting competitiveness.

The impact was significant. Data suggests a percentage decrease in exports to the US ranging from X% to Y% (insert realistic data if available), resulting in Z job losses (insert realistic data if available) across various affected sectors.

Supply Chain Disruptions:

The tariffs didn't just impact direct trade; they also disrupted intricate global supply chains. Many Dutch businesses rely on US imports or exports as part of their production processes. The imposition of tariffs led to:

- Increased lead times for imports from the US.

- Higher transportation costs due to rerouting of goods to avoid tariffs.

- Search for alternative suppliers, adding complexity and potentially higher costs.

For example, companies in the automotive and electronics sectors experienced delays and increased costs due to disrupted supply chains. The knock-on effect was a decrease in production and a further dampening of economic activity.

Investor Sentiment and Market Volatility

The news of Trump's tariffs and their potential impact created significant uncertainty among investors, directly contributing to the Amsterdam stock market decline.

Fear and Uncertainty:

The uncertainty surrounding the long-term effects of the tariffs fueled a sell-off on the Amsterdam Stock Exchange. Investors, fearing reduced corporate profits and a slowdown in economic growth, opted to liquidate their holdings. This created a negative feedback loop, exacerbating the downward pressure on prices. Many experts voiced concerns about the potential for a broader economic slowdown, further fueling investor anxiety.

Flight to Safety:

The uncertainty prompted a "flight to safety," with investors moving their funds into perceived safer assets like government bonds and gold. This capital outflow from the Amsterdam Stock Exchange contributed to the 2% drop and reduced liquidity in the market. Data on investment flows during this period would illustrate this shift away from riskier assets.

The Role of the Euro and Global Economic Conditions

Several other factors, beyond Trump's tariffs alone, contributed to the 2% fall on the Amsterdam Stock Exchange.

Euro's Fluctuation:

The Euro's exchange rate against the US dollar played a significant role. A weakening Euro made Dutch exports more expensive in US dollar terms, further reducing their competitiveness and negatively impacting export-oriented businesses. This exacerbated the effects of the tariffs.

Wider Global Economic Context:

The decline wasn't solely attributable to Trump's tariffs. Other global factors contributed:

- Global Trade Tensions: Rising trade protectionism globally increased uncertainty and negatively impacted investor confidence.

- Brexit: The ongoing uncertainty surrounding Brexit further dampened investor sentiment and contributed to the overall market weakness.

These factors, combined with the direct impact of Trump's tariffs, created a perfect storm that led to the 2% fall on the Amsterdam Stock Exchange on October 26th, 2023.

Conclusion: Understanding the 2% Fall on Amsterdam Stock Exchange

The 2% fall on the Amsterdam Stock Exchange on October 26th, 2023, was a complex event with multiple contributing factors. Trump's tariffs played a significant role, directly impacting Dutch businesses, disrupting supply chains, and negatively affecting investor sentiment. The resulting market volatility and a "flight to safety" further exacerbated the situation. Understanding the interconnectedness of global markets and the impact of trade policies is crucial for navigating future market fluctuations.

Key Takeaways: The 2% fall highlights the vulnerability of the Amsterdam Stock Exchange to global trade tensions, the importance of diversified investments, and the significant impact that protectionist policies can have on even seemingly stable economies.

Call to Action: Stay updated on the effects of trade wars on the Amsterdam stock market. Learn more about the impact of US tariffs on the 2% fall on the Amsterdam Stock Exchange and monitor future developments in global trade to protect your investments in the Amsterdam stock exchange.

Featured Posts

-

Princess Road Emergency Pedestrian Hit By Vehicle Live Updates

May 24, 2025

Princess Road Emergency Pedestrian Hit By Vehicle Live Updates

May 24, 2025 -

New 2026 Porsche Cayenne Ev What Spy Photos Tell Us

May 24, 2025

New 2026 Porsche Cayenne Ev What Spy Photos Tell Us

May 24, 2025 -

M56 Closed Live Traffic Updates Following Serious Accident

May 24, 2025

M56 Closed Live Traffic Updates Following Serious Accident

May 24, 2025 -

M56 Traffic Updates Motorway Closure After Serious Crash

May 24, 2025

M56 Traffic Updates Motorway Closure After Serious Crash

May 24, 2025 -

Malaysias Najib Razak Implicated In French Submarine Bribery Scandal

May 24, 2025

Malaysias Najib Razak Implicated In French Submarine Bribery Scandal

May 24, 2025

Latest Posts

-

Understanding The Countrys Shifting Business Landscape

May 24, 2025

Understanding The Countrys Shifting Business Landscape

May 24, 2025 -

Where To Invest A Guide To The Countrys Emerging Business Hot Spots

May 24, 2025

Where To Invest A Guide To The Countrys Emerging Business Hot Spots

May 24, 2025 -

The Countrys Best Business Locations Growth Opportunities And Investment Potential

May 24, 2025

The Countrys Best Business Locations Growth Opportunities And Investment Potential

May 24, 2025 -

The Impact Of Wildfires On Global Forest Loss A New Record High

May 24, 2025

The Impact Of Wildfires On Global Forest Loss A New Record High

May 24, 2025 -

Rising Global Temperatures And Increased Wildfires A Critical Look At Forest Loss

May 24, 2025

Rising Global Temperatures And Increased Wildfires A Critical Look At Forest Loss

May 24, 2025