US-Dutch Trade Conflict: Impact On Dutch Stock Market

Table of Contents

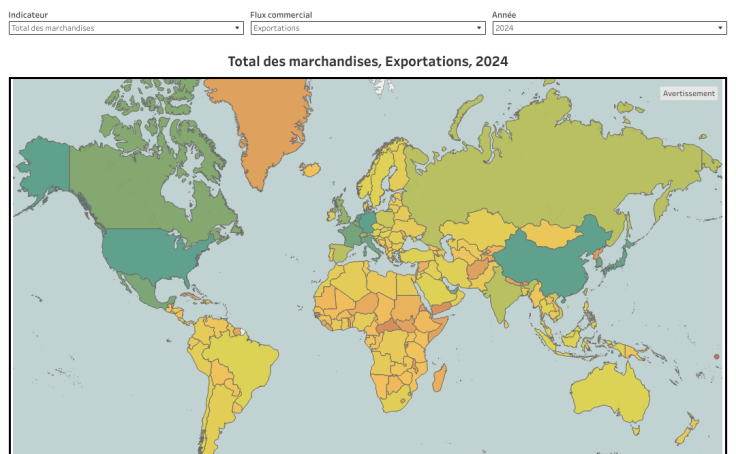

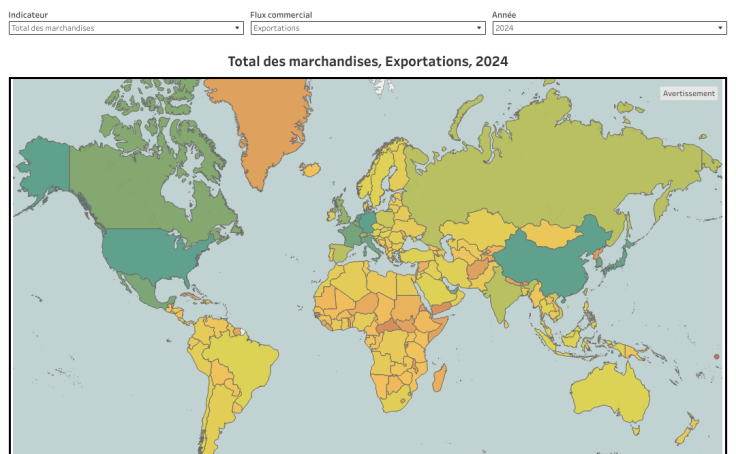

Understanding the Current State of US-Dutch Trade Relations

The US and the Netherlands have historically enjoyed strong bilateral trade ties, underpinned by shared economic interests and membership in various international organizations. However, recent years have witnessed growing friction. Existing trade agreements, while beneficial, aren't immune to the shifting sands of global trade policy. Current trade flows are significant, with the Netherlands being a major trading partner for the US in Europe. However, disagreements over tariffs, subsidies, and regulatory issues could easily escalate tensions and disrupt this mutually beneficial relationship.

- Key export products from the Netherlands to the US: Agricultural products (dairy, flowers), machinery, chemicals, and pharmaceuticals.

- Key import products from the US to the Netherlands: Machinery, agricultural products, chemicals, and aircraft.

- Existing trade agreements and their potential vulnerability: While no specific bilateral trade agreement exists between the US and the Netherlands, both countries are part of broader agreements like the WTO, which could be impacted by unilateral actions.

- Recent political statements or actions impacting trade relations: Closely monitoring statements from both governments regarding trade policy is crucial. Any indication of new tariffs or sanctions could significantly impact the market.

Potential Impacts of a US-Dutch Trade Conflict on Key Sectors

A significant US-Dutch trade conflict could have devastating consequences across several key sectors of the Dutch economy.

Agricultural Sector

The Dutch agricultural sector, renowned globally for its dairy and flower exports, would be highly vulnerable to increased trade barriers. Tariffs or import restrictions imposed by the US could severely impact export volumes, leading to price drops and reduced profitability for Dutch farmers and exporters.

- Specific companies vulnerable to trade disruptions: Major dairy producers and flower exporters.

- Potential impact on employment in each sector: Job losses are a significant risk, particularly in rural areas.

- Potential for alternative trade partners to mitigate the effects: Exploring and expanding trade relationships with other countries in the EU and beyond could partially offset the impact.

Technology Sector

The Netherlands boasts a significant technology sector, including a prominent semiconductor industry. US sanctions or restrictions targeting specific Dutch tech companies could severely disrupt supply chains and hinder innovation.

- Specific companies vulnerable to trade disruptions: Semiconductor manufacturers and technology firms with significant US ties.

- Potential impact on employment in each sector: Job losses in the high-skilled technology sector would have broad economic consequences.

- Potential for alternative trade partners to mitigate the effects: Diversifying supply chains and seeking partnerships with non-US entities is crucial for resilience.

Financial Sector

Dutch banks and investment firms heavily involved in US markets would experience increased uncertainty and potential losses. Reduced cross-border investment flows and tighter regulations could significantly impact profitability.

- Specific companies vulnerable to trade disruptions: Major Dutch banks with significant US operations.

- Potential impact on employment in each sector: Potential job losses in the finance sector due to reduced activity.

- Potential for alternative trade partners to mitigate the effects: Diversification of investment portfolios and exploring opportunities in other markets.

Analyzing the Impact on the Dutch Stock Market

Escalating US-Dutch trade tensions would likely trigger significant volatility in the Dutch stock market. The AEX index, the benchmark for the Amsterdam Stock Exchange, would be particularly sensitive. Companies heavily reliant on US trade would see their stock prices decline.

- Key stock market indices to watch (e.g., AEX): The AEX index and other relevant sector indices will reflect the market's response to the trade conflict.

- Potential impact on foreign direct investment (FDI) in the Netherlands: Decreased FDI would have a negative impact on the economy.

- Strategies for investors to mitigate potential risks: Diversification, hedging strategies, and careful portfolio management are crucial.

Mitigating the Risks: Strategies for Dutch Businesses and Investors

Proactive strategies are essential for Dutch businesses and investors to navigate the potential challenges.

- Government support programs for affected businesses: The Dutch government should implement support programs to aid affected businesses.

- Risk management techniques for investors: Diversification of assets and hedging strategies are crucial.

- Potential benefits of international trade agreements with other countries: Strengthening ties with other trading partners reduces reliance on a single market.

Conclusion: Navigating the US-Dutch Trade Conflict and its Impact on the Dutch Stock Market

The potential for a US-Dutch trade conflict presents significant risks to the Dutch economy and its stock market. The agricultural, technology, and financial sectors are particularly vulnerable. Closely monitoring developments in US-Dutch trade relations, including any new tariffs or sanctions, is crucial. Investors should adopt diversified investment strategies to mitigate potential risks associated with a US-Dutch trade conflict, or any Dutch-US trade tensions. Consult with financial advisors to develop personalized investment strategies tailored to navigate the uncertainties surrounding the US-Dutch trade conflict and its potential impact on the AEX and the broader Dutch economy. Staying informed is key to mitigating risks and capitalizing on emerging opportunities amidst this evolving trade landscape.

Featured Posts

-

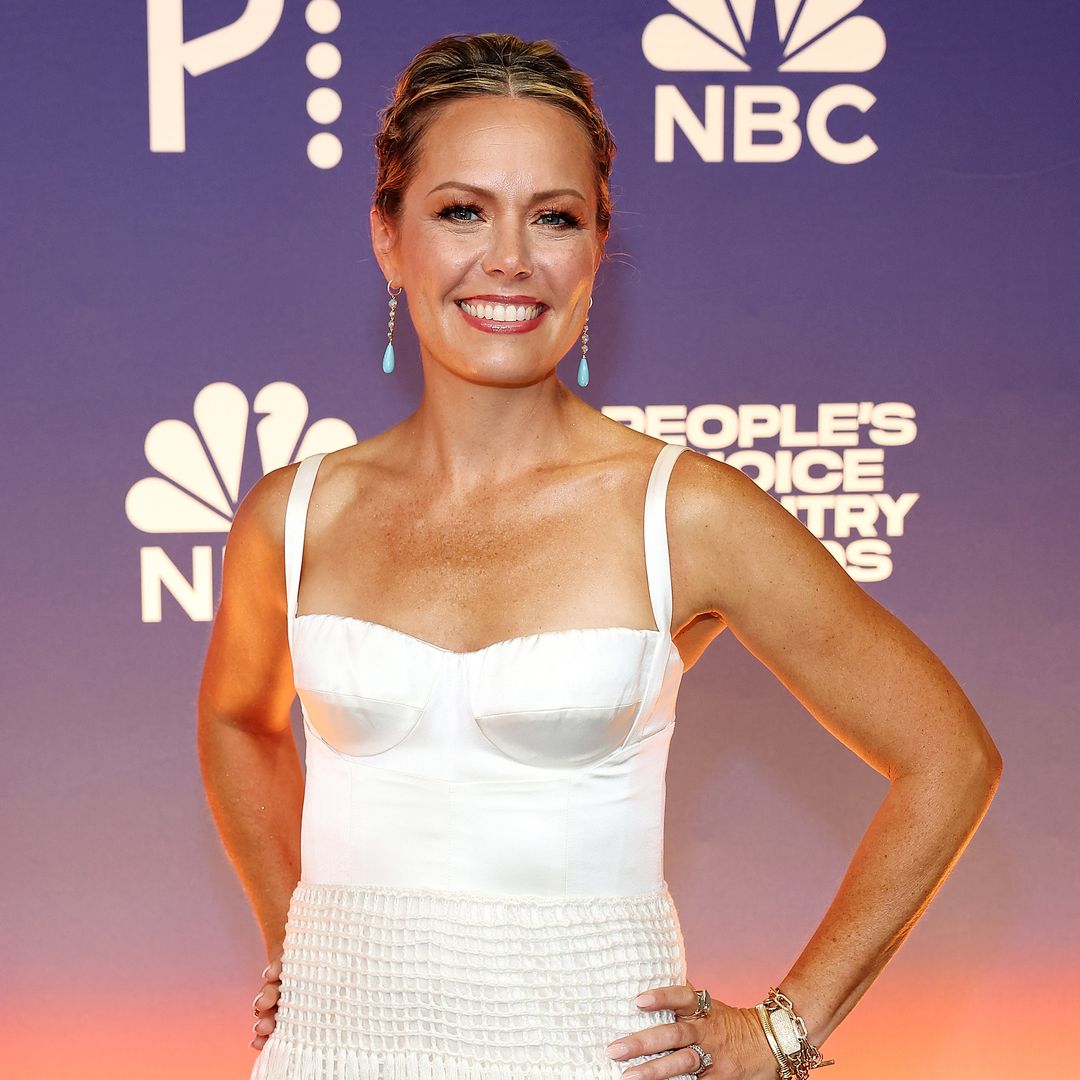

Dylan Dreyers Son Post Surgery Hospital Update From Mom

May 24, 2025

Dylan Dreyers Son Post Surgery Hospital Update From Mom

May 24, 2025 -

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 24, 2025

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 24, 2025 -

Flying During Memorial Day 2025 Tips For Avoiding Delays

May 24, 2025

Flying During Memorial Day 2025 Tips For Avoiding Delays

May 24, 2025 -

Porsche 956 Nin Ters Yuez Edilmis Sergisi Tasarim Ve Muehendislik

May 24, 2025

Porsche 956 Nin Ters Yuez Edilmis Sergisi Tasarim Ve Muehendislik

May 24, 2025 -

Exploring Frank Sinatras Four Marriages And Their Significance

May 24, 2025

Exploring Frank Sinatras Four Marriages And Their Significance

May 24, 2025

Latest Posts

-

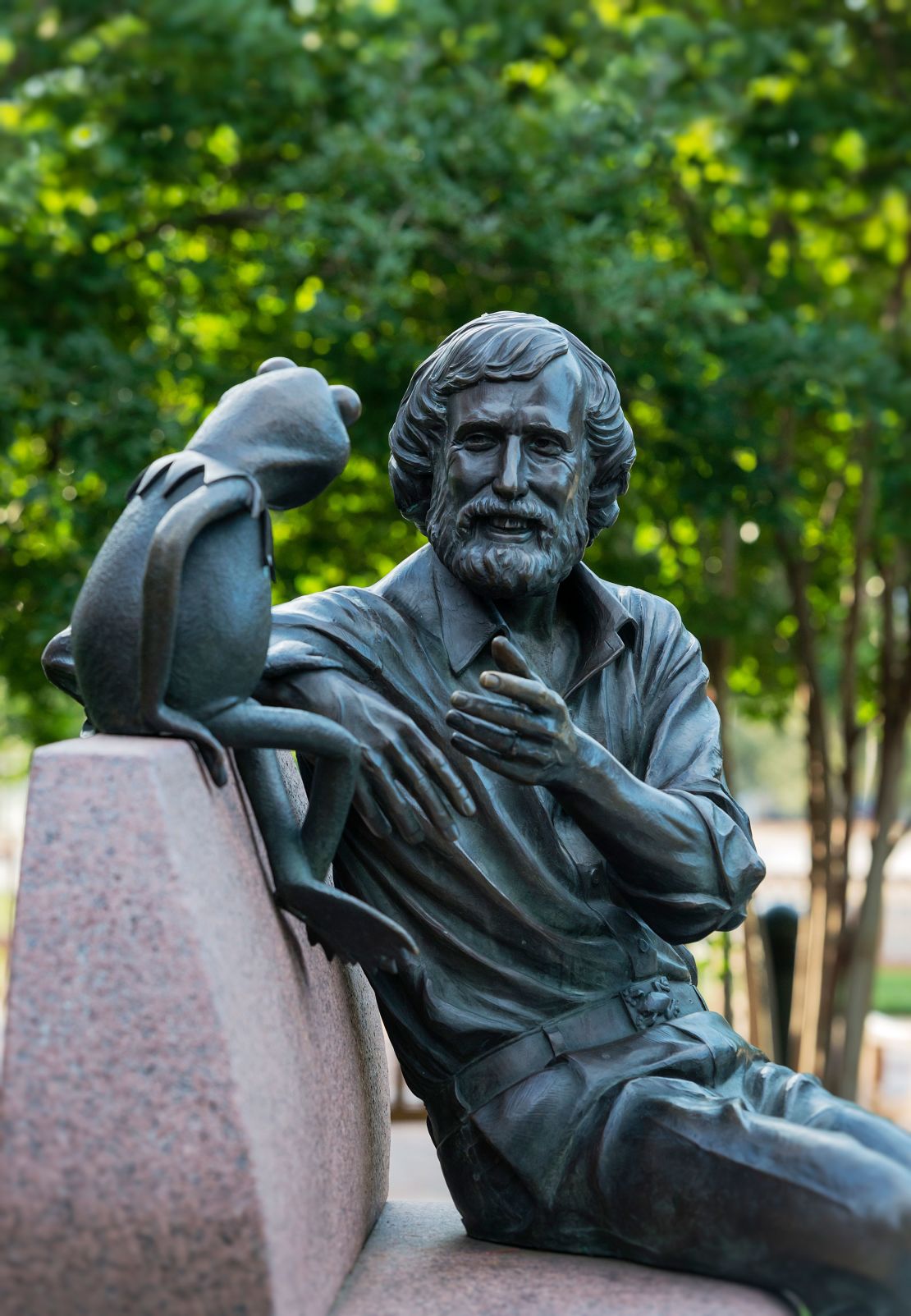

Umd 2025 Commencement Kermit The Frog To Address Graduates

May 24, 2025

Umd 2025 Commencement Kermit The Frog To Address Graduates

May 24, 2025 -

Umd Commencement 2025 Kermit The Frog To Address Graduates

May 24, 2025

Umd Commencement 2025 Kermit The Frog To Address Graduates

May 24, 2025 -

Official Kermit The Frog Speaks At University Of Maryland Commencement

May 24, 2025

Official Kermit The Frog Speaks At University Of Maryland Commencement

May 24, 2025 -

Internet Reacts Kermit The Frog At Umd Graduation

May 24, 2025

Internet Reacts Kermit The Frog At Umd Graduation

May 24, 2025 -

Umd Commencement 2025 Kermit The Frogs Inspiring Speech

May 24, 2025

Umd Commencement 2025 Kermit The Frogs Inspiring Speech

May 24, 2025