Addressing High Stock Market Valuations: A BofA Analyst's Perspective

Table of Contents

Factors Contributing to High Stock Market Valuations

Several interconnected factors have contributed to the current environment of high stock market valuations. Understanding these underlying forces is vital for assessing the sustainability of current market levels and for formulating effective investment strategies.

Low Interest Rates and Quantitative Easing

Historically low interest rates and the implementation of quantitative easing (QE) policies by central banks have profoundly impacted asset prices, including stocks.

- Increased liquidity floods the market, boosting demand for stocks. With readily available capital at low costs, investors have sought higher-yielding assets, driving up demand and consequently, stock prices.

- Low borrowing costs encourage companies to take on debt, potentially fueling further growth (and valuations). Cheap debt allows companies to invest in expansion, acquisitions, and stock buybacks, all of which can inflate valuations.

- Investors seek higher returns in a low-yield environment, pushing up stock prices. When traditional safe havens like bonds offer meager returns, investors are more inclined to take on higher risk for potentially better returns in the stock market. This increased demand further inflates valuations.

Strong Corporate Earnings and Growth Expectations

Robust corporate earnings and optimistic future growth projections have also played a significant role in supporting higher valuations. However, it is crucial to analyze the sustainability of these factors.

- Analysis of recent earnings reports and forward-looking guidance from major companies. Examining the financial health and future prospects of leading companies provides a better understanding of the market’s current health.

- Discussion of the impact of technological innovation and disruption on growth expectations. Technological advancements frequently lead to rapid growth and increased valuations for innovative companies.

- Mention of specific sectors showing strong earnings growth and high valuations. Understanding which sectors are driving the high valuations can help investors identify potential opportunities and risks. For example, the technology sector has historically shown periods of rapid growth followed by corrections.

Inflationary Pressures and Their Influence

Inflation significantly impacts stock market valuations, influencing both real and nominal returns. Understanding this dynamic is crucial for effective investment decision-making.

- Discussion of the relationship between inflation, interest rates, and discount rates used in valuation models. Higher inflation often leads to higher interest rates, increasing the discount rate used to calculate the present value of future earnings, impacting valuations.

- Examination of how inflation affects corporate profitability and investor expectations. Unexpected inflation can erode corporate margins and alter investor expectations about future growth, leading to potential valuation adjustments.

- Analysis of how different types of inflation (e.g., demand-pull vs. cost-push) affect valuations differently. Different types of inflation have varied impacts on corporate profitability and investor sentiment, influencing how valuations react.

Investment Strategies for High Valuation Environments

Navigating high stock market valuations requires a carefully considered investment approach. The key is to balance potential returns with the inherent risks.

Focus on Quality and Sustainable Growth

In high-valuation environments, prioritizing companies with strong fundamentals and sustainable competitive advantages is paramount.

- Strategies for identifying high-quality companies with robust balance sheets and predictable cash flows. Look for companies with low debt, strong free cash flow, and a history of consistent earnings growth.

- Importance of considering long-term growth potential rather than solely focusing on short-term gains. Focus on companies with a proven track record and a clear path to sustained future growth.

- Examples of sectors or investment themes aligned with this strategy. Consider sectors such as healthcare, consumer staples, or technology companies with strong moats.

Diversification and Risk Management

Diversification across asset classes and geographies is crucial for mitigating risk in a potentially volatile market.

- Strategies for constructing a diversified portfolio appropriate for high-valuation environments. Consider allocating a portion of your portfolio to less correlated assets such as bonds, real estate, or commodities to reduce overall portfolio volatility.

- Importance of considering risk tolerance and investment time horizon. Adjust your portfolio’s risk profile to align with your risk tolerance and investment time horizon.

- Discussion of risk management tools and techniques, such as hedging and stop-loss orders. Implementing risk management techniques helps to protect your portfolio from significant losses.

Value Investing Opportunities

While the overall market may be characterized by high valuations, pockets of undervaluation may still exist.

- Identification of sectors or companies that may be temporarily undervalued due to market sentiment or short-term headwinds. Look for companies that have experienced temporary setbacks but possess strong long-term potential.

- Strategies for conducting thorough fundamental analysis to uncover hidden value. Thorough due diligence is crucial in identifying truly undervalued opportunities.

- Cautionary notes regarding the challenges of finding undervalued assets in a generally high-valuation market. Finding undervalued assets in a generally expensive market requires careful analysis and patience.

Conclusion

Addressing high stock market valuations requires a cautious yet strategic approach. By understanding the contributing factors and adopting appropriate investment strategies focused on quality, diversification, and risk management, investors can navigate this complex market environment more effectively. Remember to conduct thorough due diligence and consider seeking professional financial advice before making any investment decisions related to high stock market valuations. Learn more about navigating high stock market valuations and developing a robust investment strategy by exploring additional resources on [link to relevant resource]. Don't underestimate the importance of understanding stock market valuation metrics and their implications for your portfolio.

Featured Posts

-

Changes To Hmrc Tax Codes Savings And Your Tax Liability

May 20, 2025

Changes To Hmrc Tax Codes Savings And Your Tax Liability

May 20, 2025 -

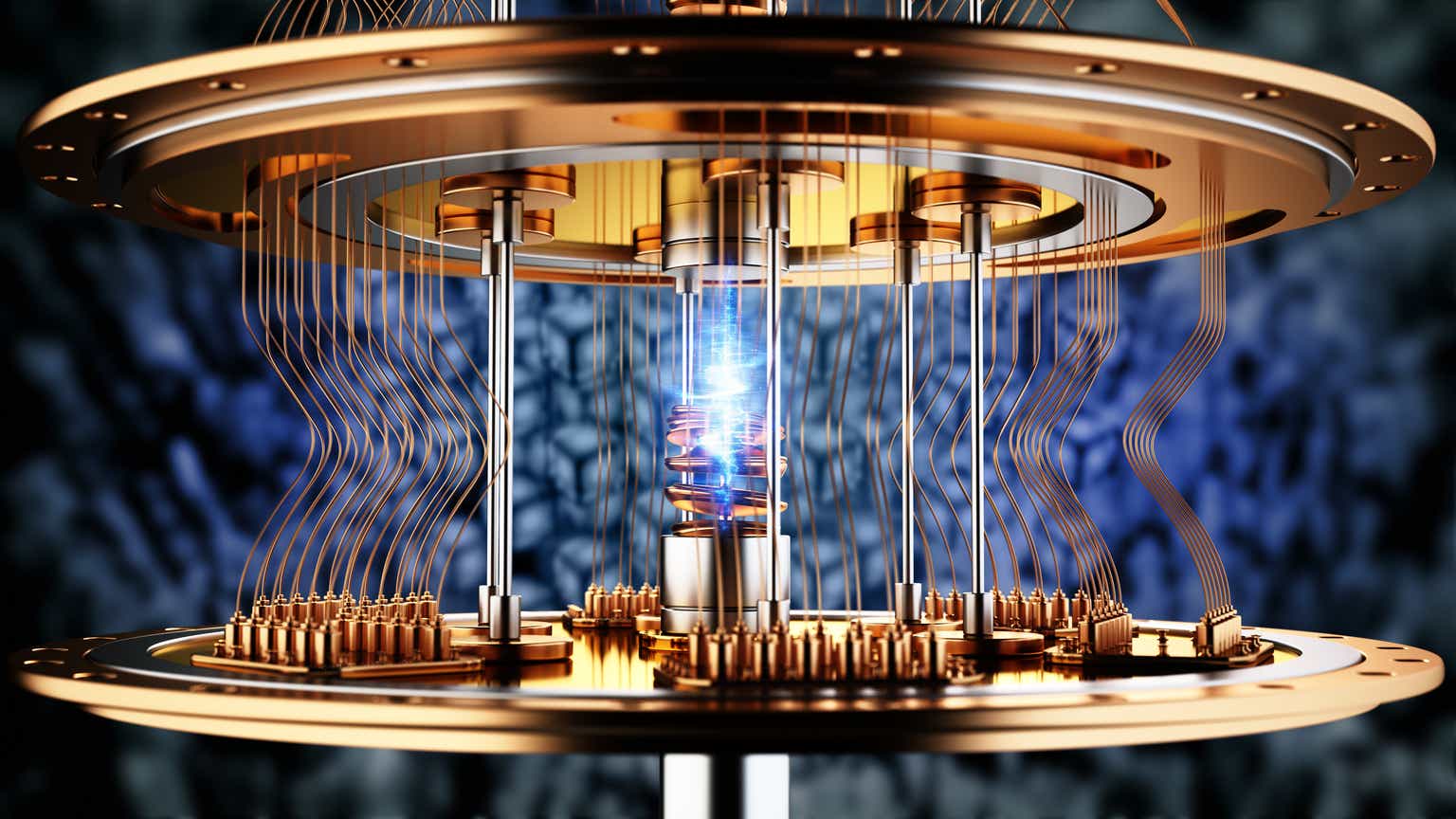

D Wave Quantum Qbts Deciphering Mondays Stock Market Movement

May 20, 2025

D Wave Quantum Qbts Deciphering Mondays Stock Market Movement

May 20, 2025 -

Fenerbahce De Talisca Tartismasi Ve Tadic Transferi Yoenetim Ne Yapacak

May 20, 2025

Fenerbahce De Talisca Tartismasi Ve Tadic Transferi Yoenetim Ne Yapacak

May 20, 2025 -

Former Munster Prop James Cronin Takes Highfield Coaching Role

May 20, 2025

Former Munster Prop James Cronin Takes Highfield Coaching Role

May 20, 2025 -

Ecowas Economic Affairs Department Sets Strategic Priorities At Niger Retreat

May 20, 2025

Ecowas Economic Affairs Department Sets Strategic Priorities At Niger Retreat

May 20, 2025

Latest Posts

-

Understanding The D Wave Quantum Qbts Stock Price Jump This Week

May 20, 2025

Understanding The D Wave Quantum Qbts Stock Price Jump This Week

May 20, 2025 -

D Wave Quantum Stock Qbts Falls A Deep Dive Into Valuation Issues

May 20, 2025

D Wave Quantum Stock Qbts Falls A Deep Dive Into Valuation Issues

May 20, 2025 -

D Wave Quantum Qbts Stock Soars Analyzing The Weeks Price Increase

May 20, 2025

D Wave Quantum Qbts Stock Soars Analyzing The Weeks Price Increase

May 20, 2025 -

D Wave Quantum Qbts Stock Performance Impact Of Kerrisdale Capitals Report

May 20, 2025

D Wave Quantum Qbts Stock Performance Impact Of Kerrisdale Capitals Report

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Surge Reasons Behind The Recent Rise

May 20, 2025

D Wave Quantum Inc Qbts Stock Surge Reasons Behind The Recent Rise

May 20, 2025