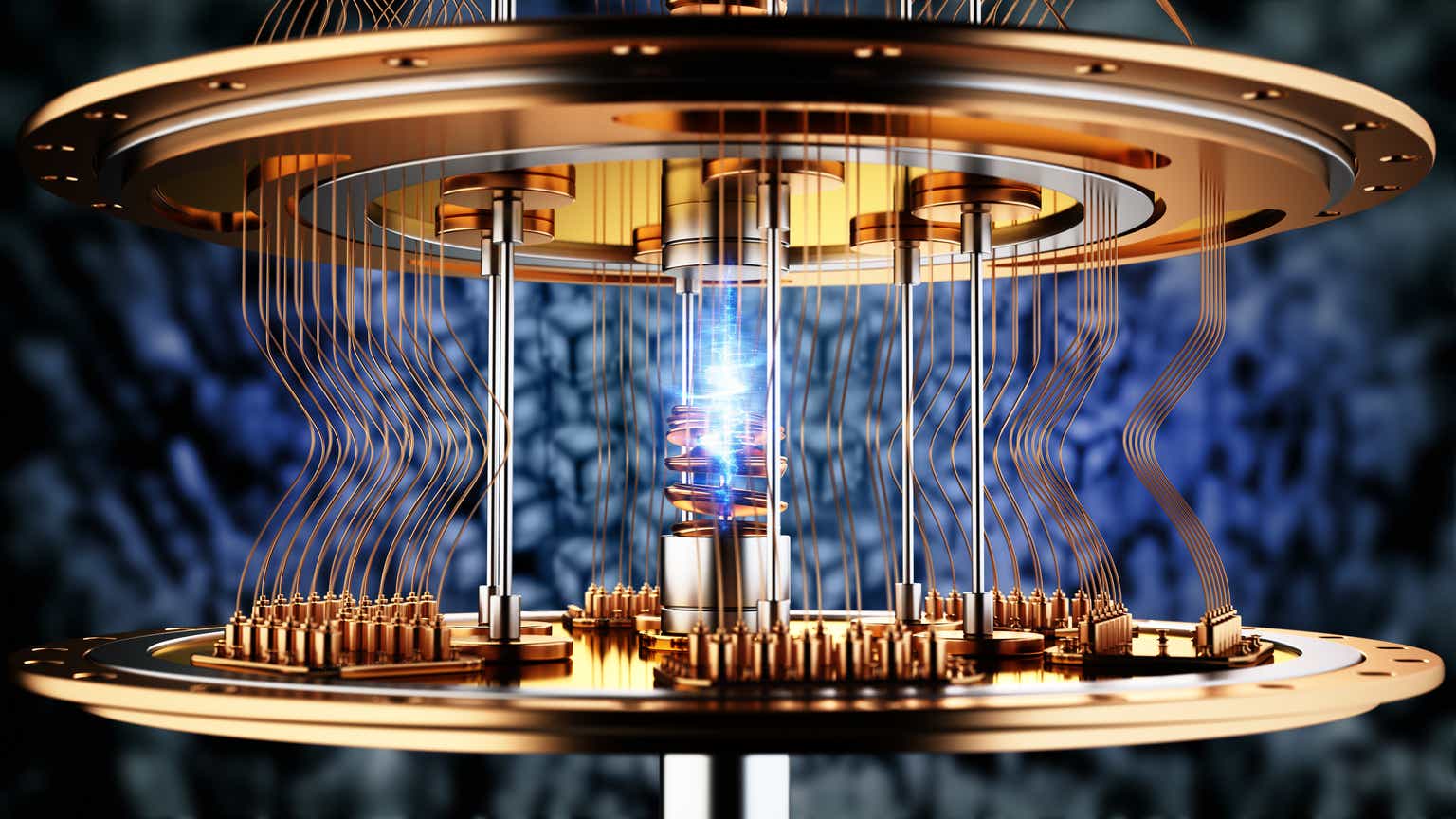

D-Wave Quantum Stock (QBTS) Falls: A Deep Dive Into Valuation Issues

Table of Contents

The Complexities of Valuing a Quantum Computing Company

Valuing a company in the quantum computing sector presents unique challenges. Unlike established industries with readily available historical data, the nascent nature of quantum computing makes traditional valuation methods less effective. The lack of comparable companies and the highly speculative nature of investments in this field introduce significant uncertainties.

- Limited Revenue Streams: Currently, most quantum computing companies, including D-Wave, generate limited revenue, relying heavily on research and development funding and strategic partnerships.

- High Research & Development Costs: The significant investment required for research and development (R&D) in quantum computing creates substantial operating expenses, impacting profitability in the short term.

- Uncertain Market Adoption: Predicting the widespread adoption of quantum computing technology remains challenging, making it difficult to forecast future market demand and revenue potential for companies like D-Wave.

- Difficulty in Predicting Long-Term Profitability: The long lead times associated with technological breakthroughs and market penetration make assessing long-term profitability a complex undertaking. Determining the ultimate return on investment in D-Wave Quantum Stock (QBTS) requires careful consideration of these factors.

Analyzing D-Wave Quantum's Current Financial Performance

A thorough analysis of D-Wave's recent financial reports is crucial for understanding the current market valuation of D-Wave Quantum Stock (QBTS). While specific numbers would require referencing publicly available financial statements (e.g., SEC filings), a review would typically include:

- Revenue: Examination of D-Wave's revenue streams, identifying the sources and growth trends. Is the revenue primarily derived from sales of quantum computers, software licenses, or cloud access? What is the rate of revenue growth (or decline)?

- Expenses: A detailed analysis of operating expenses, including R&D costs, selling, general, and administrative expenses. This helps assess the efficiency of operations and the impact on profitability.

- Debt: Assessing the level of debt and its impact on D-Wave's financial health and ability to fund future growth is important.

- Comparison with Competitors: Comparing D-Wave's key financial metrics to those of other prominent quantum computing companies (where data is publicly available) offers valuable context and helps gauge its relative performance and valuation.

Analyzing these factors provides a comprehensive picture of D-Wave's financial health and its implications for D-Wave Quantum Stock (QBTS).

Market Sentiment and Investor Expectations

The market value of D-Wave Quantum Stock (QBTS) is heavily influenced by broader market trends and investor sentiment toward quantum computing.

- Market Volatility: General market volatility significantly impacts investor behavior, affecting the price of even promising companies like D-Wave.

- Technological Breakthroughs (and Setbacks): News about technological advancements or setbacks in the quantum computing field can drastically shift investor confidence and influence the valuation of D-Wave Quantum Stock (QBTS).

- Investor Sentiment: Social media discussions, news articles, and analyst reports shape overall investor sentiment, impacting the perceived value of QBTS.

- Valuation Compared to Competitors and Expectations: Comparing D-Wave's valuation to that of competitors and considering investor expectations regarding future growth and profitability are crucial for understanding the current market pricing of QBTS. Were previous valuations overly optimistic, contributing to the recent decline?

Future Outlook and Potential for Growth of D-Wave Quantum Stock (QBTS)

Despite the recent decline, D-Wave's long-term growth potential remains a subject of considerable debate.

- Potential Market Applications: Identifying potential applications of D-Wave's quantum computing technology across various industries (finance, pharmaceuticals, materials science, etc.) is essential for projecting future revenue streams.

- Partnerships and Collaborations: Strategic partnerships with leading companies can accelerate D-Wave's technological advancements and market penetration, influencing the future value of D-Wave Quantum Stock (QBTS).

- Technological Advantages and Disadvantages: A thorough assessment of D-Wave's technological strengths and weaknesses compared to competitors is vital for understanding its competitive position and future prospects.

- Risks and Uncertainties: Acknowledging the inherent risks and uncertainties associated with investing in a nascent technology like quantum computing is crucial for managing investment expectations and mitigating potential losses.

Conclusion: Navigating the D-Wave Quantum Stock (QBTS) Valuation Landscape

The valuation of D-Wave Quantum Stock (QBTS) presents significant challenges due to the unique characteristics of the quantum computing industry. While the company holds immense potential, investing in QBTS involves considerable risk. Understanding the complexities of valuing a company in this early stage, carefully analyzing D-Wave’s financial performance, and monitoring market sentiment are crucial. Before investing in D-Wave Quantum Stock (QBTS), thorough due diligence is crucial. Stay updated on the latest developments in D-Wave Quantum Stock (QBTS) and the quantum computing market to make informed investment decisions.

Featured Posts

-

Quick Answers Nyt Mini Crossword April 13

May 20, 2025

Quick Answers Nyt Mini Crossword April 13

May 20, 2025 -

Patra Lista Efimereyonton Giatron 10 And 11 Maioy

May 20, 2025

Patra Lista Efimereyonton Giatron 10 And 11 Maioy

May 20, 2025 -

Uk Wide Hmrc Website Down Thousands Affected By System Failure

May 20, 2025

Uk Wide Hmrc Website Down Thousands Affected By System Failure

May 20, 2025 -

Michael Schumacher Gina Schumacher A Devenit Mama O Fetita S A Nascut

May 20, 2025

Michael Schumacher Gina Schumacher A Devenit Mama O Fetita S A Nascut

May 20, 2025 -

Femicide Examining The Reasons For Its Disturbing Rise

May 20, 2025

Femicide Examining The Reasons For Its Disturbing Rise

May 20, 2025

Latest Posts

-

Espns Insight Decisive Moves Shaping The Boston Bruins Future

May 21, 2025

Espns Insight Decisive Moves Shaping The Boston Bruins Future

May 21, 2025 -

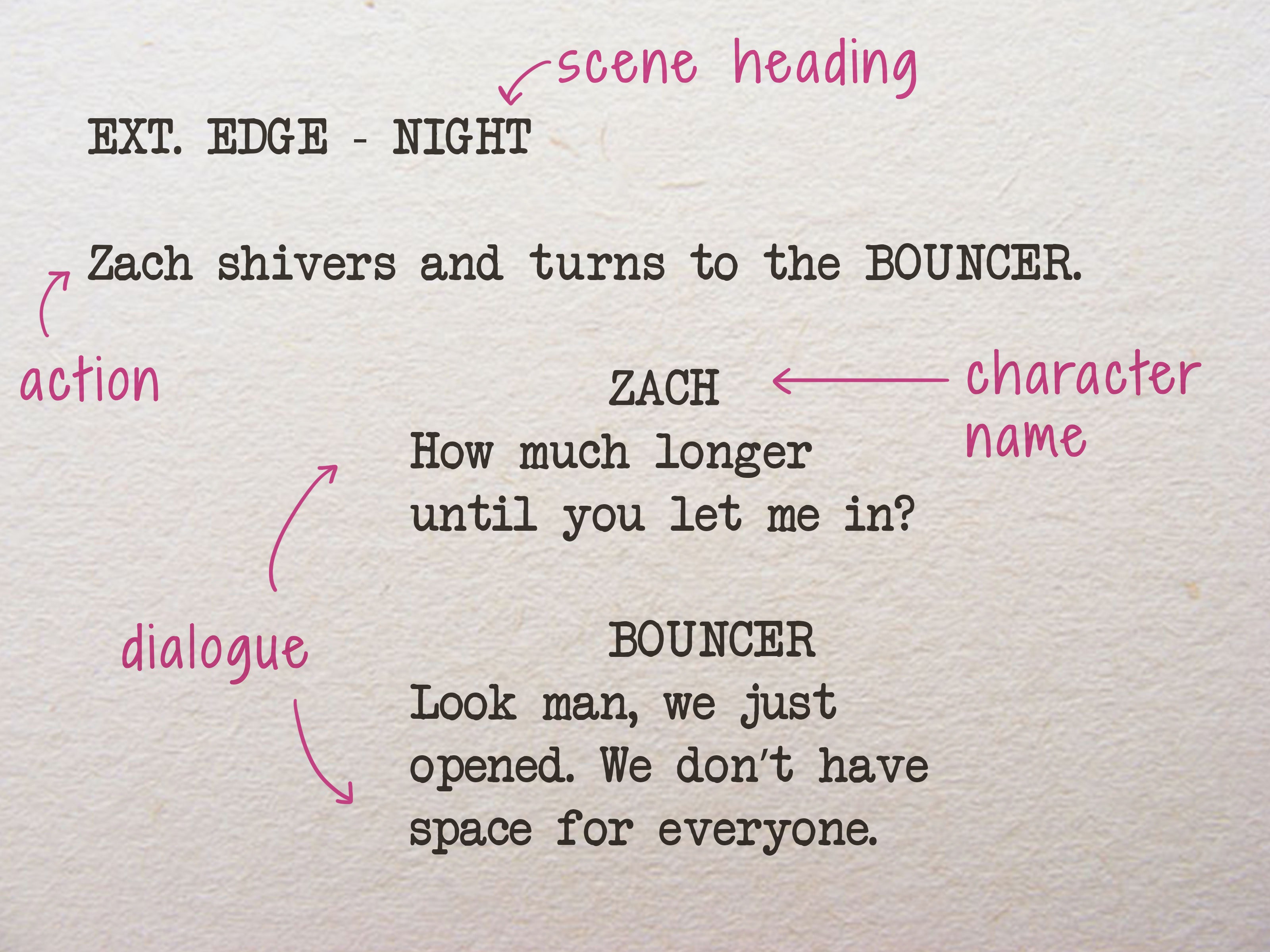

Review Is This Young Playwrights Watercolor Script A Success

May 21, 2025

Review Is This Young Playwrights Watercolor Script A Success

May 21, 2025 -

Bruins Offseason Espn Highlights Key Decisions And Their Franchise Impact

May 21, 2025

Bruins Offseason Espn Highlights Key Decisions And Their Franchise Impact

May 21, 2025 -

Watercolor Review A Young Playwrights Script The Real Deal

May 21, 2025

Watercolor Review A Young Playwrights Script The Real Deal

May 21, 2025 -

Espns Bruins Offseason Analysis Key Franchise Altering Moves

May 21, 2025

Espns Bruins Offseason Analysis Key Franchise Altering Moves

May 21, 2025