D-Wave Quantum (QBTS) Stock Performance: Impact Of Kerrisdale Capital's Report

Table of Contents

Kerrisdale Capital's Report: Key Allegations and Evidence

Kerrisdale Capital, a well-known short-selling firm, published a scathing report targeting D-Wave Quantum, alleging significant misrepresentations regarding the company's technology and financial performance. The report, which fueled a significant drop in QBTS stock price, leveled several serious accusations.

-

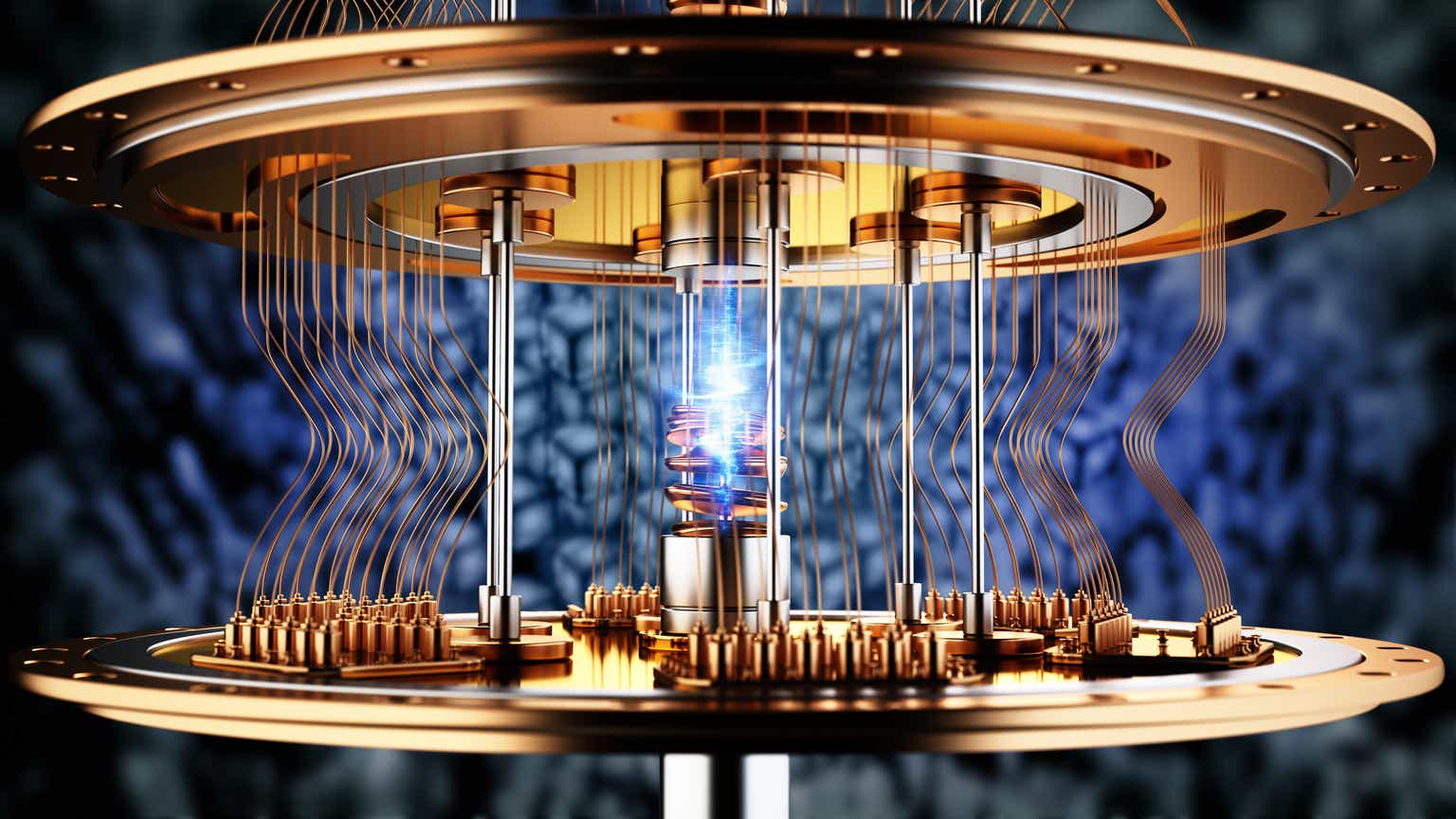

Overstated Technological Capabilities: Kerrisdale claimed D-Wave's quantum annealing technology was less advanced and less commercially viable than the company publicly portrayed. They argued that D-Wave's claims of quantum advantage were unsubstantiated and misleading.

-

Inflated Revenue Projections: The report questioned the accuracy of D-Wave's revenue projections, suggesting they were overly optimistic and lacked a solid foundation. Specific examples of allegedly inflated contracts and partnerships were cited.

-

Financial Irregularities: Kerrisdale alleged potential accounting irregularities and questioned the transparency of D-Wave's financial reporting, highlighting specific instances for further scrutiny.

The report included detailed analysis of D-Wave's financial statements, comparisons with competitors, and excerpts from industry expert opinions to support its claims. The evidence presented, while disputed by D-Wave, undeniably fueled significant investor concern. This detailed short seller report highlighted potential issues within the company's narrative, sparking significant debate within the quantum computing investment community.

QBTS Stock Price Reaction to the Report

The release of Kerrisdale Capital's report triggered an immediate and dramatic drop in QBTS stock price. Trading volume surged as investors reacted to the allegations. The following chart illustrates the volatility experienced by QBTS in the days and weeks after the report's publication:

[Insert Chart/Graph Showing QBTS Stock Price Fluctuation]

The initial panic selling was followed by a period of consolidation, although the stock price remained significantly below its pre-report levels. Investor sentiment turned overwhelmingly negative, with many questioning the long-term viability of D-Wave Quantum given the severity of the accusations. The market reaction clearly demonstrated the significant impact of the report on investor confidence, highlighting the inherent risks associated with investing in early-stage quantum computing companies. The rapid and substantial price drop underscores the power of negative news to sway investor perception, especially concerning a relatively young and uncertain sector like quantum computing.

D-Wave Quantum's Response to the Accusations

D-Wave Quantum swiftly responded to Kerrisdale Capital's report, issuing a detailed rebuttal that addressed each of the key allegations. The company denied the accusations of technological misrepresentation, emphasizing the unique capabilities of its quantum annealing technology and its growing customer base. D-Wave countered the claims of inflated revenue projections by providing additional context and clarifying its financial reporting practices. However, the effectiveness of their response in calming investor anxieties remains debatable. Many investors remained skeptical, leading to sustained downward pressure on the stock price.

- Public Statement: D-Wave issued a formal press release refuting the claims.

- Detailed Rebuttal: A point-by-point response to each allegation in Kerrisdale's report was published on their investor relations website.

- Engagement with Analysts: D-Wave engaged with financial analysts to provide further clarification on the issues raised in the report.

Despite these efforts, the damage to D-Wave's reputation and investor confidence was considerable. The response, while thorough, arguably failed to fully allay investor concerns about the company's long-term prospects and its financial transparency.

Long-Term Implications for D-Wave Quantum and the Quantum Computing Sector

The Kerrisdale Capital report has significant long-term implications, not only for D-Wave Quantum but also for the broader quantum computing sector. The fallout casts a shadow of doubt over the company's ability to deliver on its ambitious goals. This incident raises concerns about the overall transparency and maturity of the quantum computing industry, impacting investor confidence in the entire sector.

- Increased Scrutiny: The incident highlights the need for increased transparency and rigorous due diligence within the quantum computing sector.

- Impact on Funding: Securing future funding rounds may prove challenging for D-Wave, given the lingering uncertainties surrounding its technology and financial performance.

- Slowed Adoption: The controversy may hinder the broader adoption of quantum computing technologies by businesses wary of the associated risks.

The long-term outlook for D-Wave Quantum remains uncertain. The impact on the quantum computing industry is likely to be a more cautious approach to investment and a greater emphasis on robust validation of technological claims.

Conclusion: Assessing the Impact on D-Wave Quantum (QBTS) Stock Performance

The Kerrisdale Capital report undeniably had a profound and lasting impact on D-Wave Quantum (QBTS) stock performance. The allegations, the market's sharp negative reaction, and D-Wave's response all contributed to a significant decline in investor confidence. While D-Wave attempted to mitigate the damage, the long-term consequences remain to be seen. The incident serves as a cautionary tale for investors in the quantum computing sector, highlighting the importance of thorough due diligence and risk assessment before making investment decisions. The future of QBTS, and indeed the quantum computing industry, hinges on D-Wave's ability to regain trust and deliver on its technological promises. Further research into D-Wave Quantum (QBTS), its technology, and its competitors is crucial before making any investment decisions. Conduct your own thorough due diligence before investing in D-Wave Quantum or any company in the volatile quantum computing sector.

Featured Posts

-

Antimetopizontas Ta Tampoy I Istoria Tis Marthas Kai Toy Gamoy Tis

May 20, 2025

Antimetopizontas Ta Tampoy I Istoria Tis Marthas Kai Toy Gamoy Tis

May 20, 2025 -

Canada Post Financial Crisis Report Calls For End To Door To Door Mail

May 20, 2025

Canada Post Financial Crisis Report Calls For End To Door To Door Mail

May 20, 2025 -

Aston Villa Vs Manchester United Fa Cup Match Report Rashfords Decisive Goals

May 20, 2025

Aston Villa Vs Manchester United Fa Cup Match Report Rashfords Decisive Goals

May 20, 2025 -

Former Us Attorney Zachary Cunha Joins Private Firm

May 20, 2025

Former Us Attorney Zachary Cunha Joins Private Firm

May 20, 2025 -

Daily Mail Delivery In Canada A Commissions Recommendation For Change

May 20, 2025

Daily Mail Delivery In Canada A Commissions Recommendation For Change

May 20, 2025

Latest Posts

-

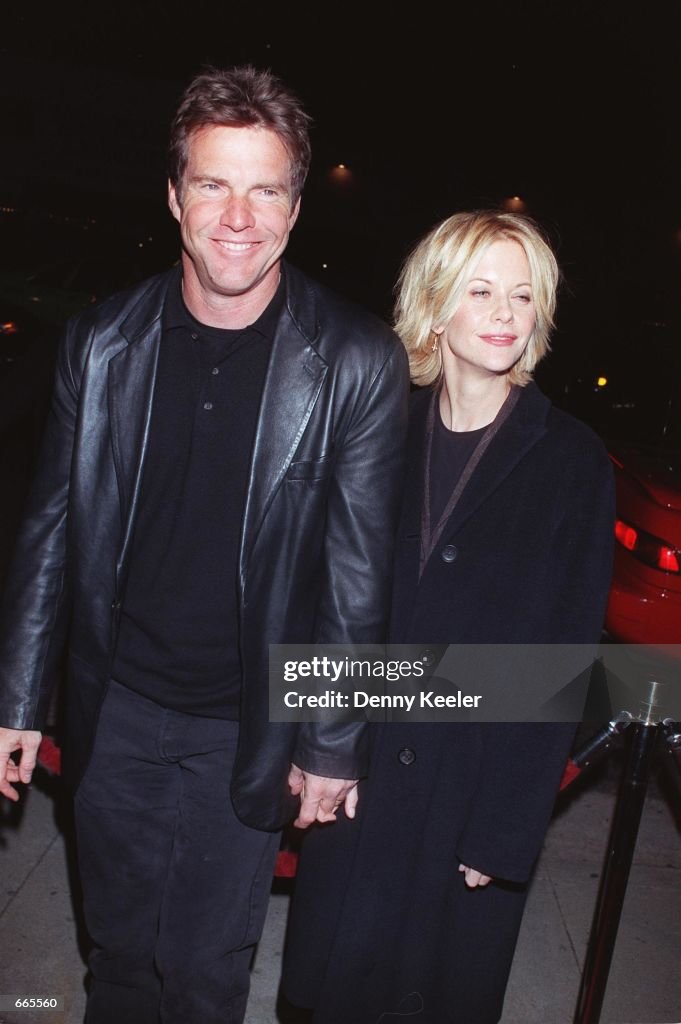

The Underrated Western Neo Noir Starring Dennis Quaid Meg Ryan And James Caan

May 21, 2025

The Underrated Western Neo Noir Starring Dennis Quaid Meg Ryan And James Caan

May 21, 2025 -

Faktor Kunci Keberhasilan Liverpool Sosok Pelatih Di Liga Inggris 2024 2025

May 21, 2025

Faktor Kunci Keberhasilan Liverpool Sosok Pelatih Di Liga Inggris 2024 2025

May 21, 2025 -

A Western Neo Noir Gem Rediscovering Dennis Quaid Meg Ryan And James Caan

May 21, 2025

A Western Neo Noir Gem Rediscovering Dennis Quaid Meg Ryan And James Caan

May 21, 2025 -

Analisis Kesuksesan Liverpool Kontribusi Pelatih Dalam Menjuarai Liga Inggris 2024 2025

May 21, 2025

Analisis Kesuksesan Liverpool Kontribusi Pelatih Dalam Menjuarai Liga Inggris 2024 2025

May 21, 2025 -

Sejarah Kemenangan Liverpool Di Liga Inggris Peran Krusial Para Pelatih

May 21, 2025

Sejarah Kemenangan Liverpool Di Liga Inggris Peran Krusial Para Pelatih

May 21, 2025