Activision Blizzard Acquisition: FTC Challenges Court Decision

Table of Contents

The FTC's Initial Concerns and Lawsuit

The FTC's initial lawsuit against the Microsoft-Activision Blizzard merger stemmed from concerns about potential anti-competitive practices. The commission argued that the acquisition would give Microsoft an unfair advantage in the gaming market, ultimately harming consumers. Their primary arguments centered on the potential for:

- Reduced Competition: The FTC feared that Microsoft, owning such a dominant player like Activision Blizzard, would stifle competition in the console gaming market, particularly regarding popular franchises like Call of Duty. This could lead to less innovation and fewer choices for gamers.

- Higher Prices: Concerns were raised about the potential for Microsoft to increase prices for popular Activision Blizzard games, or to make them exclusive to its Xbox ecosystem, thus harming players on other platforms. The FTC pointed to the potential for increased subscription prices for Xbox Game Pass as another significant concern.

- Stifled Innovation: The acquisition, according to the FTC, could discourage innovation by limiting access to Activision Blizzard's titles for competing platforms and developers. This could lead to a less dynamic and innovative gaming landscape.

Bullet Points Summarizing FTC Concerns:

- Loss of competition in the console gaming market (especially with Call of Duty)

- Potential for higher subscription prices for Xbox Game Pass and Activision Blizzard games.

- Reduced choices for gamers regarding game availability and pricing.

- Concerns about the impact on rival game developers and their ability to compete.

The Court's Ruling in Favor of Microsoft

Despite the FTC's strong arguments, a US District Court judge ruled in favor of Microsoft, allowing the acquisition to proceed. The court's decision emphasized Microsoft's arguments regarding the competitive landscape of the gaming industry, highlighting the presence of numerous other significant players and the overall dynamism of the market.

Bullet Points Summarizing the Court's Ruling:

- The judge found that the FTC failed to demonstrate that the acquisition would substantially lessen competition.

- Microsoft successfully argued that the gaming market is dynamic and competitive, with multiple significant players beyond Microsoft and Sony.

- The court's interpretation of antitrust laws played a significant role in the decision.

The FTC's Appeal and its Strategic Implications

Undeterred by the court's ruling, the FTC decided to appeal the decision, signaling a continued commitment to challenging the acquisition. This appeal suggests the FTC believes the court misapplied antitrust laws or failed to adequately consider the potential harm to consumers.

Bullet Points Regarding the FTC's Appeal:

- The FTC's grounds for appeal likely center on the court's interpretation of the evidence regarding market competition and consumer harm.

- Potential outcomes of the appeal range from a complete reversal of the lower court's decision to upholding the original ruling.

- A successful appeal could set a significant precedent for future mergers and acquisitions in the tech sector.

- A rejection of the appeal would solidify Microsoft's ownership of Activision Blizzard and potentially influence future acquisition strategies within the tech industry.

The Future of the Activision Blizzard Acquisition

The future of the Activision Blizzard acquisition remains uncertain pending the outcome of the FTC's appeal. Several scenarios are possible:

- Successful Appeal: The FTC could successfully overturn the lower court's ruling, potentially blocking the acquisition entirely or imposing conditions.

- Rejection of Appeal: The appellate court could uphold the lower court's decision, clearing the way for the acquisition to be finalized.

- Negotiated Settlement: Microsoft and the FTC could reach a negotiated settlement, potentially involving concessions from Microsoft to address the FTC's concerns.

Bullet Points Regarding Potential Outcomes:

- The timeline for the appeal process and subsequent legal proceedings remains unclear.

- The various outcomes would have significant and lasting implications for the gaming market, impacting competition, pricing, and game availability.

- The long-term consequences for Microsoft, Activision Blizzard, and the gaming industry as a whole depend entirely on the final resolution.

Conclusion: The Uncertain Future of the Activision Blizzard Acquisition

The ongoing legal battle surrounding the Activision Blizzard acquisition highlights the complexities of antitrust law in the rapidly evolving tech sector. The FTC's persistent challenge to the court's initial decision underscores the significant concerns about potential anti-competitive practices and their impact on the gaming industry. The outcome of this case will not only determine the fate of the Activision Blizzard merger but will also significantly influence future mergers and acquisitions in the technology sector, establishing crucial precedents for regulatory oversight. Stay informed about further developments in the Activision Blizzard acquisition case, the Microsoft acquisition of Activision, and the ongoing legal challenges to ensure you understand the implications for the future of gaming.

Featured Posts

-

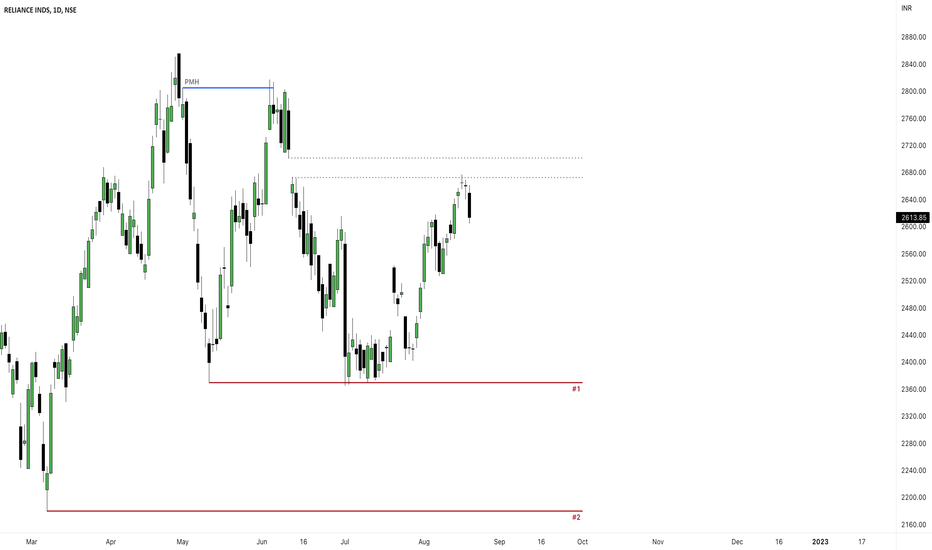

Indias Large Cap Stocks How Reliance Earnings Influence Performance

Apr 29, 2025

Indias Large Cap Stocks How Reliance Earnings Influence Performance

Apr 29, 2025 -

Dismissing Stock Market Valuation Concerns A Bof A Perspective

Apr 29, 2025

Dismissing Stock Market Valuation Concerns A Bof A Perspective

Apr 29, 2025 -

Strong Earnings Drive Reliance Shares To 10 Month Peak

Apr 29, 2025

Strong Earnings Drive Reliance Shares To 10 Month Peak

Apr 29, 2025 -

Trump Administrations Threat To Cut Funding Harvards Legal Response

Apr 29, 2025

Trump Administrations Threat To Cut Funding Harvards Legal Response

Apr 29, 2025 -

Did Trumps China Tariffs Hurt The Us Economy A Look At Inflation And Supply Chains

Apr 29, 2025

Did Trumps China Tariffs Hurt The Us Economy A Look At Inflation And Supply Chains

Apr 29, 2025

Latest Posts

-

Data Breach Costs T Mobile 16 Million Details Of The Security Lapses

Apr 29, 2025

Data Breach Costs T Mobile 16 Million Details Of The Security Lapses

Apr 29, 2025 -

16 Million Fine For T Mobile A Three Year Data Breach Timeline

Apr 29, 2025

16 Million Fine For T Mobile A Three Year Data Breach Timeline

Apr 29, 2025 -

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 29, 2025

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 29, 2025 -

T Mobile Penalized 16 Million For Repeated Data Breaches

Apr 29, 2025

T Mobile Penalized 16 Million For Repeated Data Breaches

Apr 29, 2025 -

Building Voice Assistants Made Easy Key Announcements From Open Ais 2024 Event

Apr 29, 2025

Building Voice Assistants Made Easy Key Announcements From Open Ais 2024 Event

Apr 29, 2025