$800 Million XRP ETF Inflows: A Realistic Expectation After SEC Approval?

Table of Contents

The Ripple-SEC Lawsuit and its Impact on XRP's Future

The Ripple-SEC lawsuit, a protracted legal battle concerning the classification of XRP as a security, significantly impacted the cryptocurrency's trajectory and its prospects for ETF approval.

The Ruling and its Implications for ETF Approval

The court's ruling, while not a complete victory for Ripple, provided crucial clarity on the regulatory status of XRP.

- Key aspects of the ruling: The court determined that programmatic sales of XRP did not constitute securities offerings.

- Positive implications for ETF approval: This partial victory significantly increases the likelihood of SEC approval for an XRP ETF, as it removes a major regulatory hurdle.

- Negative implications for ETF approval: However, the ruling did not definitively declare XRP a non-security in all instances, leaving some uncertainty for the SEC to address.

Expert opinions are divided. Some legal analysts believe the ruling substantially weakens the SEC's case against XRP, paving the way for ETF approval. Others suggest the SEC might still raise concerns, leading to further delays or even rejection. The SEC’s future actions will be crucial in determining the ultimate fate of XRP ETF applications.

Increased Institutional Investor Interest

A favorable court ruling has the potential to unlock substantial institutional investment in XRP.

- Reasons for institutional interest: Reduced regulatory uncertainty makes XRP a more attractive asset for institutional portfolios seeking diversification within the cryptocurrency market. The potential for significant price appreciation also incentivizes investment.

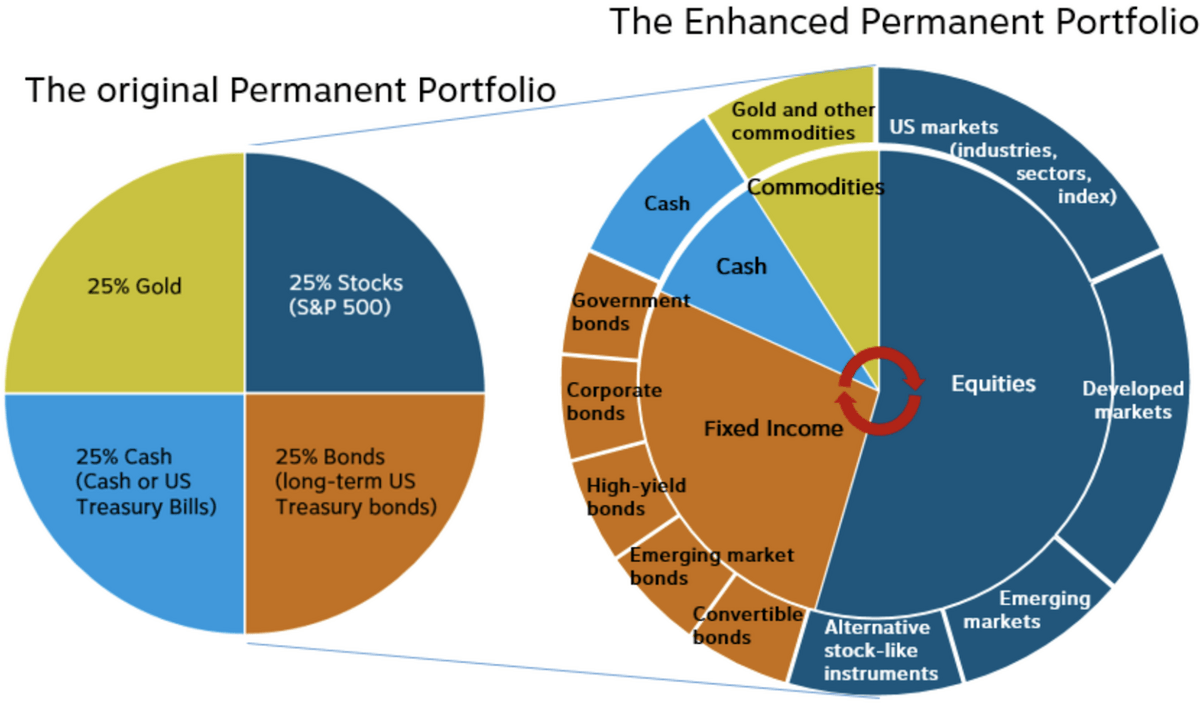

- Potential investment strategies: Institutional investors might utilize XRP ETFs as a means of gaining exposure to the cryptocurrency without directly holding it, mitigating the risks associated with self-custody.

The level of institutional interest in XRP will likely be compared to the current levels seen in Bitcoin and Ethereum. If institutional adoption mirrors the uptake seen in other major cryptocurrencies, this would significantly boost demand for an XRP ETF.

Factors Influencing Potential $800 Million Inflows

Reaching $800 million in inflows for an XRP ETF is ambitious, contingent on several factors.

Market Demand and Investor Sentiment

Current market sentiment toward XRP is cautiously optimistic following the court ruling.

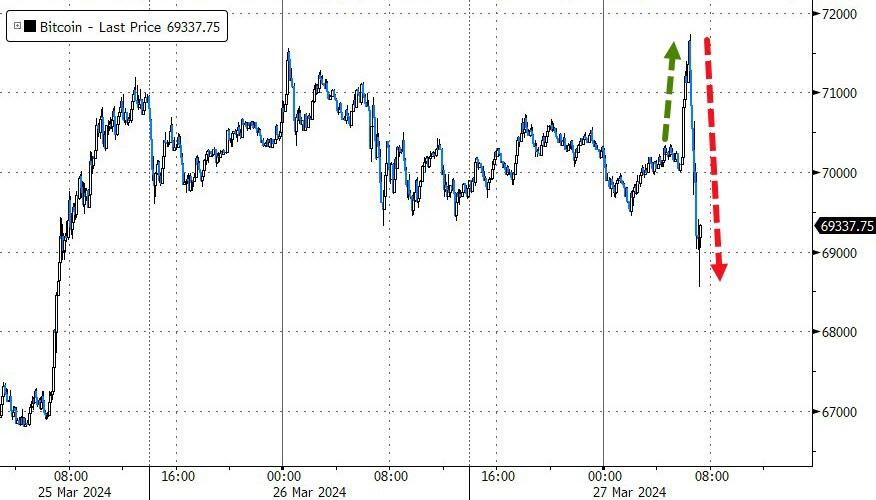

- Influencing factors: News coverage, price movements, and further regulatory clarifications will all play a vital role in shaping investor confidence.

- Historical ETF launch data: Analyzing historical ETF launch data can offer insights into the potential demand for an XRP ETF. However, the cryptocurrency market is unique and subject to higher volatility compared to traditional asset classes.

The actual price of XRP after ETF approval will be influenced by the inflow of investment. A larger influx would likely drive the price up significantly, while smaller inflows would have a more limited impact.

The Role of Asset Managers and ETF Providers

The success of an XRP ETF also hinges on the involvement of major players in the financial industry.

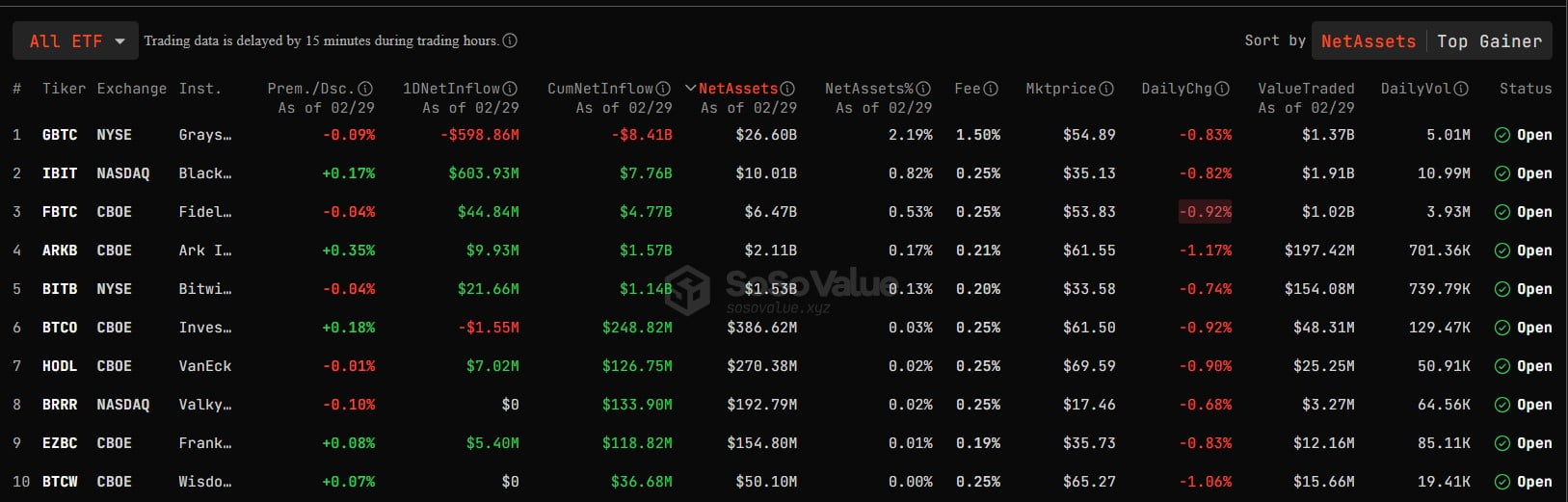

- Potential ETF providers: Large asset management firms with experience in launching and managing successful ETFs would be key to driving significant inflows.

- Investment strategies and market influence: Their distribution networks, marketing strategies, and reputation will heavily influence investor participation.

Analyzing successful and unsuccessful ETF launches in the past will reveal key lessons. For example, a strong marketing campaign combined with competitive fees significantly improves the adoption rate.

Market Conditions and Overall Economic Climate

Macroeconomic factors will significantly affect investor appetite for riskier assets.

- Economic headwinds and tailwinds: Inflation, interest rates, and overall market volatility can influence the success of any new investment vehicle, including an XRP ETF.

- Correlation between economic conditions and crypto investments: Historically, cryptocurrency investments often show inverse correlation with traditional markets. Economic downturn could lead to increased interest in safe haven assets like gold, at the expense of cryptocurrencies.

Understanding these macroeconomic trends is critical to predicting the potential for significant inflows into an XRP ETF.

Comparing XRP ETF Potential to Other Crypto ETFs

Analyzing the success of Bitcoin and Ethereum ETFs provides valuable context for predicting the potential of an XRP ETF.

Bitcoin and Ethereum ETF Success

Bitcoin and Ethereum ETFs (where approved) have experienced varying degrees of success.

- Market capitalization comparison: XRP's market capitalization is significantly smaller than Bitcoin's and Ethereum's, implying potentially lower initial inflows.

- Relative demand and investor interest: Investor interest in XRP is currently growing, but the overall market share held by XRP is relatively lower.

Understanding the factors contributing to their success and failures can provide valuable lessons for the potential XRP ETF.

Learning from Past ETF Launches

Analyzing past ETF launches can inform future expectations.

- Successful ETF launches: Successful launches often involved a combination of strong market demand, effective marketing, strategic partnerships, and favorable regulatory conditions.

- Unsuccessful ETF launches: Failures often stem from insufficient demand, poor marketing, regulatory hurdles, or unfavorable market conditions.

Applying these lessons, it's possible to predict the potential success or failure of an XRP ETF. Factors like regulatory approval, market timing, and investor sentiment are crucial to its success.

Conclusion

While the potential for significant inflows into an XRP ETF after SEC approval is substantial, reaching $800 million remains highly speculative. The Ripple-SEC lawsuit outcome has positively impacted XRP's outlook, potentially attracting institutional investors and boosting market demand. However, several factors—market sentiment, macroeconomic conditions, the role of ETF providers, and a comparison to other successful crypto ETFs—could influence the actual inflow significantly. While the $800 million figure is a compelling target, a more realistic assessment requires careful consideration of all these factors.

Call to Action: The potential for an XRP ETF remains an exciting development in the crypto space. Stay informed about the progress of XRP ETF applications and potential implications for the XRP price and the broader cryptocurrency landscape. Learn more about the potential of XRP ETFs and stay ahead of the curve. Continue monitoring market developments and regulatory updates to make informed investment decisions regarding XRP and other cryptocurrencies.

Featured Posts

-

Car Dealers Renew Opposition To Ev Mandates Industry Fights Back

May 07, 2025

Car Dealers Renew Opposition To Ev Mandates Industry Fights Back

May 07, 2025 -

Lewis Capaldi Performs For The First Time Since 2023 At Tom Walkers Charity Concert

May 07, 2025

Lewis Capaldi Performs For The First Time Since 2023 At Tom Walkers Charity Concert

May 07, 2025 -

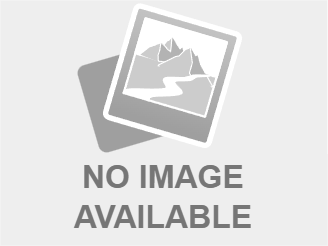

Smfg Eyes Minority Stake In Indias Yes Bank

May 07, 2025

Smfg Eyes Minority Stake In Indias Yes Bank

May 07, 2025 -

Warrior Steve Kerr Optimistic About Stephen Currys Speedy Injury Recovery

May 07, 2025

Warrior Steve Kerr Optimistic About Stephen Currys Speedy Injury Recovery

May 07, 2025 -

The Last Of Us Isabela Merced Discusses A Powerful Change

May 07, 2025

The Last Of Us Isabela Merced Discusses A Powerful Change

May 07, 2025

Latest Posts

-

Black Rock Etf Billionaire Investment Strategy And 2025 Projections

May 08, 2025

Black Rock Etf Billionaire Investment Strategy And 2025 Projections

May 08, 2025 -

Black Rock Etf Billionaire Investment Strategy For 2025 And Beyond

May 08, 2025

Black Rock Etf Billionaire Investment Strategy For 2025 And Beyond

May 08, 2025 -

110 Potential Return Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025

110 Potential Return Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025 -

110 Potential Why Billionaires Are Betting Big On This Black Rock Etf In 2025

May 08, 2025

110 Potential Why Billionaires Are Betting Big On This Black Rock Etf In 2025

May 08, 2025 -

Wall Street Predicts 110 Surge This Black Rock Etf Attracts Billionaire Investors

May 08, 2025

Wall Street Predicts 110 Surge This Black Rock Etf Attracts Billionaire Investors

May 08, 2025