SMFG Eyes Minority Stake In India's Yes Bank

Table of Contents

SMFG's Strategic Rationale for Investing in Yes Bank

SMFG, a leading player in the Asian banking market, may be eyeing Yes Bank for several strategic reasons. Their interest likely stems from a desire for expansion into a rapidly growing market and diversification of their investment portfolio. The potential acquisition represents a significant opportunity to gain a foothold in one of the world's fastest-growing economies.

-

Access to the rapidly growing Indian banking market: India's robust economic growth and burgeoning middle class present a lucrative opportunity for financial institutions. Yes Bank, despite past challenges, retains a significant customer base and established infrastructure, offering immediate market access. This presents a considerable advantage over starting from scratch in a new and complex market.

-

Diversification of SMFG's portfolio into emerging markets: Investing in Yes Bank allows SMFG to diversify its geographical risk and reduce reliance on mature markets. India's potential for growth provides an attractive counterbalance to potentially slower growth in more established economies. This diversification strategy is crucial for long-term stability and resilience.

-

Potential synergies with Yes Bank's existing operations and customer base: SMFG could leverage Yes Bank's existing network and customer relationships to quickly expand its presence in India. Combining SMFG's global expertise with Yes Bank's local knowledge could create significant synergies and boost efficiency. This collaborative approach allows for faster market penetration and increased profitability.

-

Strategic partnership to leverage Yes Bank's local expertise: Navigating the Indian regulatory environment and understanding local customer preferences requires significant on-the-ground knowledge. Partnering with Yes Bank provides SMFG with immediate access to this crucial expertise, minimizing the learning curve and accelerating the integration process. This partnership allows for a smoother and more efficient entry into the Indian market. The potential benefits for SMFG include increased market share, expanded revenue streams, and enhanced brand recognition in a key emerging market.

Implications for Yes Bank

A minority stake investment from SMFG could have profound implications for Yes Bank, potentially marking a turning point in its recent history. The infusion of capital and expertise from a global financial giant like SMFG could be transformative.

-

Capital injection to bolster financial stability: A significant capital infusion from SMFG would strengthen Yes Bank's balance sheet and enhance its financial stability, improving its resilience against future economic downturns. This injection of capital would provide much-needed resources for growth and expansion.

-

Improved access to global financial markets through SMFG’s network: SMFG’s extensive global network could open doors for Yes Bank to access international funding and investment opportunities previously unavailable. This expanded access could lead to better terms and conditions for borrowing and investment.

-

Technological advancements and operational efficiencies through knowledge sharing: SMFG could bring advanced technologies and operational best practices to Yes Bank, streamlining processes and improving efficiency. This transfer of knowledge and technology could significantly enhance Yes Bank's competitiveness.

-

Potential for enhanced corporate governance and risk management: SMFG’s reputation for strong corporate governance and risk management could positively influence Yes Bank's practices, fostering greater transparency and accountability. This improvement in governance could enhance investor confidence and attract further investment. The investment could be crucial in aiding Yes Bank's recovery and setting it on a path for sustainable future growth.

The Broader Impact on the Indian Banking Sector

The potential SMFG investment in Yes Bank carries significant implications for the broader Indian banking sector, potentially influencing competition, foreign investment, and regulatory policies.

-

Increased foreign investment in the Indian banking sector: The deal could signal increased confidence in the Indian banking sector and encourage further foreign direct investment (FDI) inflows. This influx of capital could stimulate competition and innovation within the industry.

-

Enhanced competition among banks, potentially leading to better services for customers: Increased competition generally benefits customers through improved services, lower fees, and more innovative financial products. SMFG's entry could spur other banks to enhance their offerings to stay competitive.

-

Potential for further consolidation within the Indian banking landscape: The deal could trigger further consolidation within the Indian banking sector, as other institutions seek strategic partnerships or mergers to enhance their competitiveness. This consolidation could lead to a more efficient and resilient banking system.

-

Impact on regulatory policies and future foreign direct investment (FDI) inflows: The success of the SMFG-Yes Bank partnership could influence future regulatory policies regarding FDI in the Indian banking sector, potentially leading to more liberalized regulations and attracting further international investment. This could have a positive impact on the overall growth of the Indian economy. The deal could ultimately shape the future of the Indian banking industry.

Conclusion

SMFG's potential investment in Yes Bank presents a strategic opportunity for both entities and could significantly influence the Indian banking sector. This minority stake represents a potential game-changer for Yes Bank's recovery and for SMFG's expansion in a key emerging market. The deal's ultimate success will hinge on effective integration and the synergy between the two institutions. The potential for increased competition, improved services, and further FDI inflows makes this a pivotal development in the Indian financial landscape.

Call to Action: Stay tuned for further updates on the SMFG and Yes Bank potential partnership. Follow our blog for continued coverage on this developing story and other significant developments in the Indian and global banking sectors. Learn more about the potential implications of the SMFG investment in Yes Bank by subscribing to our newsletter.

Featured Posts

-

El Colapso Fisico De Simone Biles Un Analisis De Su Revelacion

May 07, 2025

El Colapso Fisico De Simone Biles Un Analisis De Su Revelacion

May 07, 2025 -

The Making Of A Scream Queen Why Jenna Ortegas Horror Performances Stand Out

May 07, 2025

The Making Of A Scream Queen Why Jenna Ortegas Horror Performances Stand Out

May 07, 2025 -

Wolves Front Office Analyzing The Pros And Cons Of A Randle Acquisition

May 07, 2025

Wolves Front Office Analyzing The Pros And Cons Of A Randle Acquisition

May 07, 2025 -

Cavaliers Dominate Knicks In Blowout Win

May 07, 2025

Cavaliers Dominate Knicks In Blowout Win

May 07, 2025 -

Las Vegas Aces Training Camp Roster Update And Cuts

May 07, 2025

Las Vegas Aces Training Camp Roster Update And Cuts

May 07, 2025

Latest Posts

-

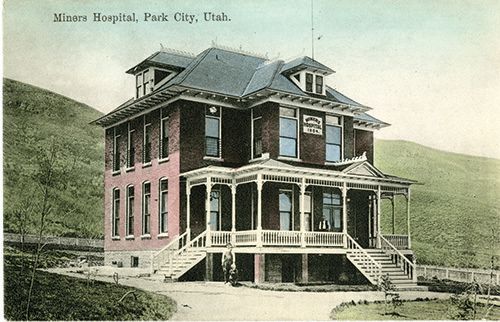

Demolition Of Historic Pierce County Home To Make Way For Park

May 08, 2025

Demolition Of Historic Pierce County Home To Make Way For Park

May 08, 2025 -

160 Year Old Pierce County House To Be Demolished For New Park

May 08, 2025

160 Year Old Pierce County House To Be Demolished For New Park

May 08, 2025 -

New War Film Challenges Saving Private Ryans Legacy

May 08, 2025

New War Film Challenges Saving Private Ryans Legacy

May 08, 2025 -

29 Years Of Service Us Coast Guard Honors Ryan Gentry In Outer Banks

May 08, 2025

29 Years Of Service Us Coast Guard Honors Ryan Gentry In Outer Banks

May 08, 2025 -

Pierce Countys 160 Year Old Home Demolition And Park Conversion

May 08, 2025

Pierce Countys 160 Year Old Home Demolition And Park Conversion

May 08, 2025