Analyzing XRP (Ripple): A Path To Financial Independence?

Table of Contents

Understanding XRP and its Technology

XRP is the native cryptocurrency of Ripple, a company focused on enabling fast and efficient cross-border payments. Unlike Bitcoin, which uses a proof-of-work consensus mechanism, XRP operates on the XRP Ledger, a unique, energy-efficient, and scalable distributed ledger technology. RippleNet, Ripple's payment network, utilizes XRP to facilitate transactions between financial institutions globally. This distinguishes XRP from other cryptocurrencies like Bitcoin and Ethereum, offering significant advantages in terms of transaction speed and cost.

- The Function of XRP: XRP acts as a bridge currency, facilitating quick and inexpensive conversions between different fiat currencies.

- Transaction Speed and Fees: XRP boasts significantly faster transaction speeds and lower fees compared to Bitcoin and Ethereum. Transactions are typically processed within seconds, a stark contrast to the minutes or even hours required by other cryptocurrencies.

- Scalability of the XRP Ledger: The XRP Ledger is designed for high scalability, meaning it can handle a large volume of transactions without compromising speed or efficiency. This scalability is a key factor in its potential for widespread adoption.

- Cross-border Payments: XRP's primary use case is facilitating cross-border payments, making it an attractive option for international financial institutions looking to streamline their operations and reduce costs.

XRP's Potential for Long-Term Growth and Passive Income

XRP's historical price performance has been volatile, reflecting the general unpredictability of the cryptocurrency market. However, its potential for long-term growth is tied to several factors. Increased adoption by financial institutions, positive regulatory developments, and further technological advancements within the Ripple ecosystem could all contribute to price appreciation.

- Historical Price Volatility: XRP, like most cryptocurrencies, has experienced significant price swings. Investors should be prepared for volatility and understand the risks involved.

- Catalysts for Future Price Appreciation: Wider adoption of RippleNet, successful partnerships with financial institutions, and positive regulatory outcomes are potential catalysts for future price growth.

- Passive Income Opportunities: While staking opportunities are limited compared to some other cryptocurrencies, lending XRP on certain platforms can generate passive income. However, always carefully assess the risks and legitimacy of any lending platform.

- Diversification is Key: Investing in XRP should be part of a diversified investment portfolio. Never invest more than you can afford to lose.

Risks and Considerations When Investing in XRP

Investing in XRP, like any cryptocurrency, involves considerable risk. Price volatility is a significant factor, with prices fluctuating dramatically based on market sentiment, regulatory news, and technological developments.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is constantly evolving, and regulatory decisions could significantly impact XRP's price and adoption.

- Security Risks: As with all digital assets, there are inherent security risks associated with storing and trading XRP. Investors must prioritize secure storage practices and choose reputable exchanges.

- The Importance of Diversification: A well-diversified investment portfolio reduces overall risk. Don't put all your eggs in one basket.

- Due Diligence is Crucial: Before investing in XRP, conduct thorough research to understand the technology, the risks, and the potential rewards.

Practical Steps for Incorporating XRP into Your Investment Strategy

Incorporating XRP into your investment strategy requires careful planning and risk management. It's essential to choose reputable platforms and adopt secure storage practices.

- Reputable Cryptocurrency Exchanges: Select well-established and regulated cryptocurrency exchanges for buying and selling XRP.

- Secure Wallets: Use secure hardware wallets or reputable software wallets to store your XRP offline, minimizing the risk of theft or hacking.

- Investment Strategies: Consider dollar-cost averaging to mitigate the risk of market volatility. This involves investing a fixed amount of money at regular intervals, regardless of price fluctuations.

- Further Research: Continue learning about XRP and the cryptocurrency market to make informed decisions.

Conclusion

Analyzing XRP for financial independence requires a balanced perspective. While XRP offers potential for growth through its innovative technology and expanding use cases, it's crucial to understand and accept the inherent risks associated with cryptocurrency investments. Price volatility, regulatory uncertainty, and security risks must be carefully considered. Financial independence is built on careful planning, diversification, and responsible risk management. Remember to conduct thorough research and only invest what you can afford to lose. Learn more about responsible XRP investment strategies and build your path to financial freedom.

Featured Posts

-

Inter Milan Books Champions League Final Spot After Barcelona Win

May 08, 2025

Inter Milan Books Champions League Final Spot After Barcelona Win

May 08, 2025 -

Road Rage Incident Van Strikes Motorcycle Cnn Coverage

May 08, 2025

Road Rage Incident Van Strikes Motorcycle Cnn Coverage

May 08, 2025 -

Bitcoins 10x Multiplier Could It Shock Wall Street

May 08, 2025

Bitcoins 10x Multiplier Could It Shock Wall Street

May 08, 2025 -

Ps 5 Pros Ray Tracing A Visual Comparison In Assassins Creed Valhalla

May 08, 2025

Ps 5 Pros Ray Tracing A Visual Comparison In Assassins Creed Valhalla

May 08, 2025 -

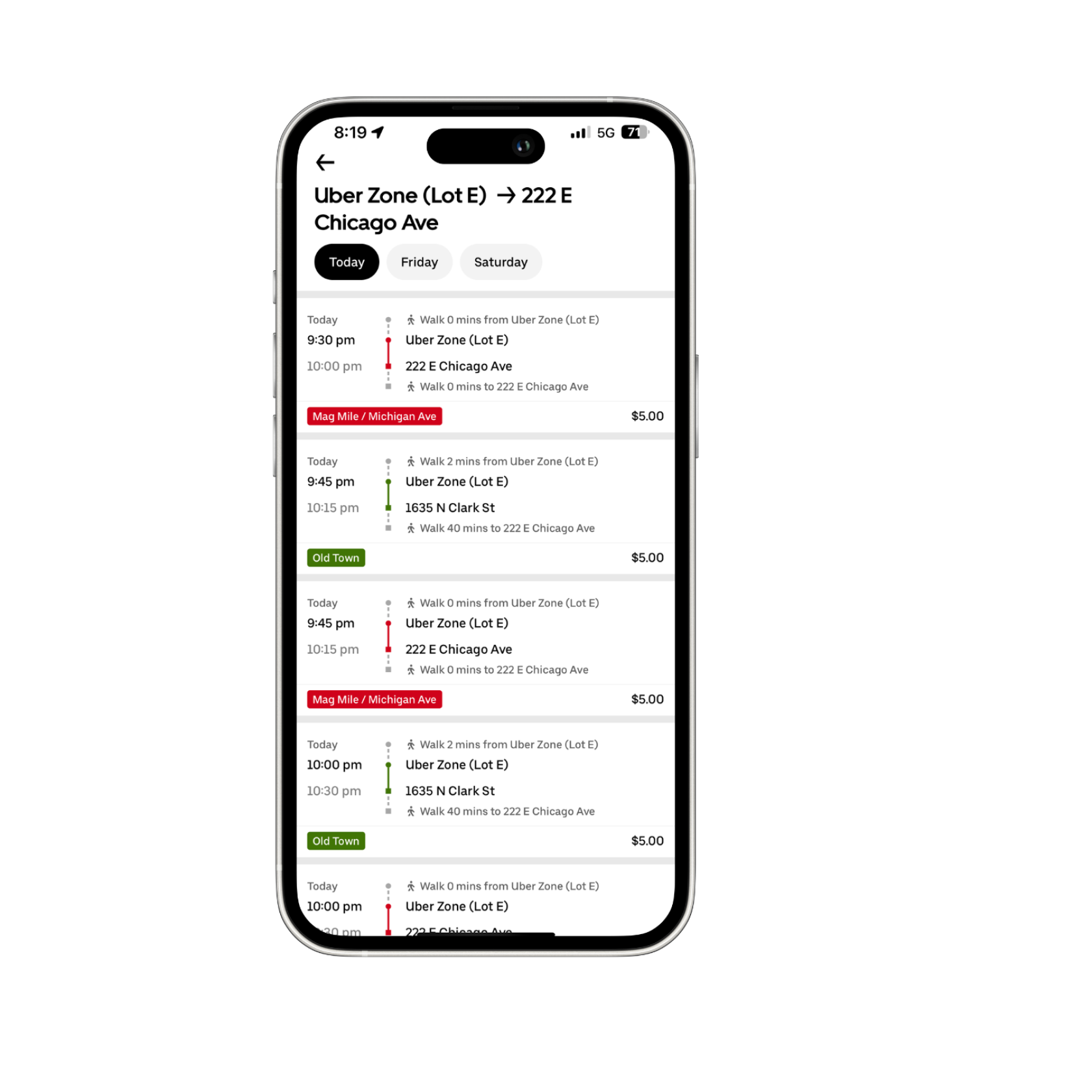

Post Game Transportation Solution 5 Uber Shuttle From United Center

May 08, 2025

Post Game Transportation Solution 5 Uber Shuttle From United Center

May 08, 2025