Bitcoin Price Prediction 2024: Trump's Influence And The $100,000 Target

Table of Contents

Donald Trump's Potential Economic Policies and their Impact on Bitcoin

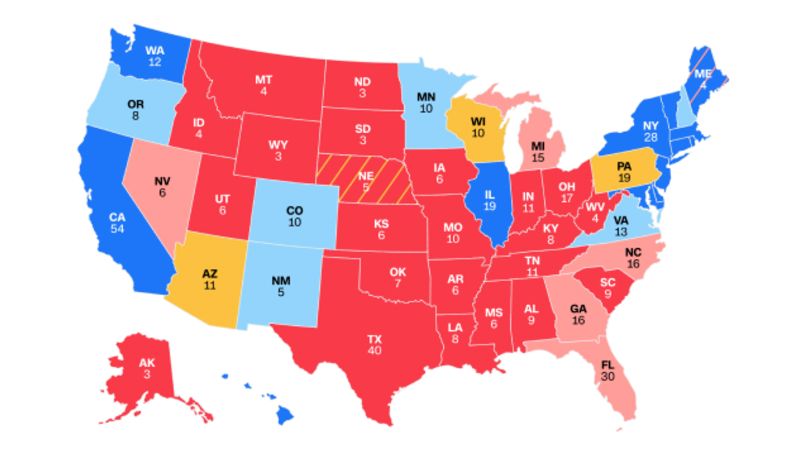

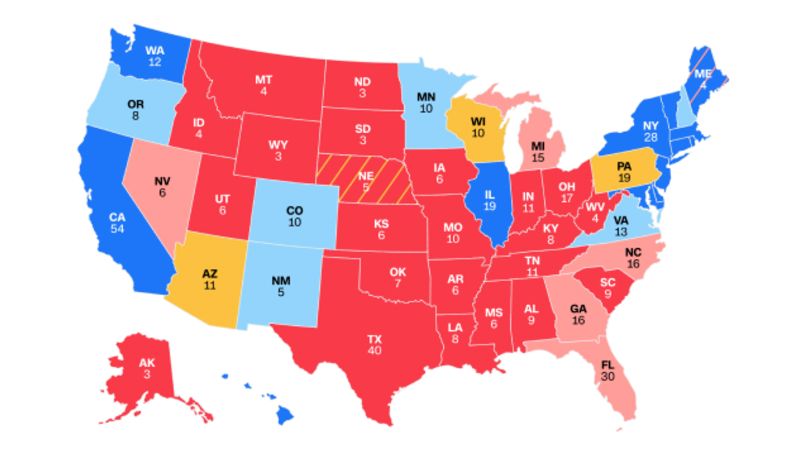

Donald Trump's potential return to the White House introduces considerable uncertainty into the Bitcoin price prediction for 2024. His past economic policies and proposed future plans offer both bullish and bearish signals for the cryptocurrency.

Fiscal Stimulus and Inflation

A Trump administration is likely to favor expansionary fiscal policies, potentially involving increased government spending. This could lead to a surge in inflation. Historically, inflation has often driven investors towards Bitcoin as a hedge against inflation, increasing its demand as a store of value.

- Inflation's Impact on Bitcoin: Inflation erodes the purchasing power of fiat currencies. Bitcoin, with a fixed supply of 21 million coins, offers a potential alternative, thus increasing its attractiveness during inflationary periods.

- Historical Examples: We've seen instances where Bitcoin's price rose during periods of high inflation in various countries, demonstrating its potential as an inflation hedge.

- Increased Demand: Increased inflation could fuel greater demand for Bitcoin as investors seek to protect their wealth from currency devaluation. This increased demand could push Bitcoin's price higher.

- Keywords: Inflation hedge, Bitcoin price inflation, Trump economic policy, Bitcoin safe haven, Bitcoin as a hedge against inflation.

Regulatory Uncertainty and its Effect on Bitcoin

Trump's stance on cryptocurrency regulation remains unclear. A less regulated environment could either significantly boost Bitcoin's price or lead to increased volatility.

- Potential Deregulation: Less stringent regulations could encourage greater institutional investment in Bitcoin, leading to increased price stability and growth.

- Positive Impacts: A more favorable regulatory environment could attract more mainstream investors, driving up demand and price.

- Negative Impacts: Conversely, a lack of regulation could also increase market volatility and risks associated with investing in Bitcoin.

- Institutional Investment: Increased regulatory clarity could lead to greater confidence among institutional investors, boosting Bitcoin adoption and price.

- Keywords: Bitcoin regulation, Cryptocurrency regulation, Trump administration regulations, Bitcoin volatility, Institutional Bitcoin investment.

Geopolitical Instability and Bitcoin as a Safe Haven Asset

A Trump presidency might usher in a period of increased geopolitical instability. This could further enhance Bitcoin's appeal as a safe haven asset, as investors seek refuge from economic and political uncertainty.

- Global Uncertainty: Geopolitical tensions and economic uncertainty often lead investors to seek assets perceived as safe havens, driving demand for Bitcoin.

- Historical Precedents: Historically, Bitcoin's price has often risen during periods of political or economic turmoil, indicating its role as a safe haven.

- Investor Sentiment: Fear and uncertainty can drive investors towards Bitcoin, perceiving it as a less risky investment compared to traditional markets.

- Keywords: Bitcoin safe haven, Geopolitical risk, Bitcoin investment, Trump presidency impact, Bitcoin as a safe haven asset.

Other Factors Influencing Bitcoin's Price Prediction for 2024

While Trump's policies are a crucial factor, several other elements will significantly influence Bitcoin's price in 2024.

Halving Event and its Impact

The Bitcoin halving event, which reduces the rate of new Bitcoin creation, is a major factor historically impacting Bitcoin's price. The next halving is expected to further increase Bitcoin's scarcity and potentially drive up its price.

- Halving Mechanism: The halving cuts the block reward in half, reducing the supply of newly mined Bitcoin.

- Past Halvings: Previous halving events have generally been followed by significant price increases in Bitcoin.

- Scarcity: The reduced supply of new Bitcoin increases its scarcity and potentially boosts its value.

- Keywords: Bitcoin halving, Bitcoin scarcity, Bitcoin supply, Bitcoin price prediction halving.

Technological Advancements and Bitcoin Adoption

Technological improvements and increasing adoption are crucial drivers for Bitcoin's price.

- Layer-2 Solutions: Scalability solutions like the Lightning Network improve transaction speeds and reduce fees, making Bitcoin more user-friendly.

- Improved Transaction Speeds: Faster and cheaper transactions enhance Bitcoin's usability and appeal to a wider audience.

- Institutional Adoption: Increased institutional adoption provides greater price stability and legitimacy to Bitcoin.

- Keywords: Bitcoin adoption, Bitcoin technology, Layer-2 solutions, Institutional Bitcoin investment.

Market Sentiment and Speculation

Market sentiment, media coverage, and investor speculation play a substantial role in Bitcoin's price volatility.

- Overall Market Conditions: The general state of the global economy significantly impacts investor sentiment towards Bitcoin.

- FOMO (Fear of Missing Out): Rapid price increases can fuel FOMO, leading to further price surges.

- Social Media Influence: Social media platforms significantly impact market sentiment and price fluctuations.

- Keywords: Bitcoin market sentiment, Bitcoin speculation, Bitcoin price volatility, FOMO.

Conclusion

Predicting Bitcoin's price remains an inherently challenging endeavor. While Donald Trump's potential return to the presidency introduces a considerable variable into the equation, numerous other factors—including the halving event, technological advancements, and overall market sentiment—will profoundly influence whether Bitcoin achieves the $100,000 mark in 2024. A Trump presidency could potentially boost Bitcoin's price through inflationary pressures or deregulation, but it could also introduce heightened uncertainty and volatility. A balanced assessment, considering both optimistic and pessimistic scenarios, is essential.

Call to Action: Stay informed about the latest developments impacting the Bitcoin price prediction for 2024. Continue your research and stay tuned for further updates on the Bitcoin market. Learn more about Bitcoin price predictions and how they are affected by political and economic events. Understanding the interplay of these factors is key to navigating the exciting world of Bitcoin.

Featured Posts

-

Saving Private Ryan Nathan Fillions Impact In A Short Screen Time

May 08, 2025

Saving Private Ryan Nathan Fillions Impact In A Short Screen Time

May 08, 2025 -

Is A Princess Leia Cameo Coming To The New Star Wars Series 3 Reasons To Believe So

May 08, 2025

Is A Princess Leia Cameo Coming To The New Star Wars Series 3 Reasons To Believe So

May 08, 2025 -

Ptt Personel Alimi 2025 Kpss Li Ve Kpss Siz Alimlar

May 08, 2025

Ptt Personel Alimi 2025 Kpss Li Ve Kpss Siz Alimlar

May 08, 2025 -

A Rogue One Actors Surprising Take On A Popular Character

May 08, 2025

A Rogue One Actors Surprising Take On A Popular Character

May 08, 2025 -

Arsenal V Psg Champions League Semi Final Key Players And Predictions

May 08, 2025

Arsenal V Psg Champions League Semi Final Key Players And Predictions

May 08, 2025