Your Escape To The Country: Financing Your Rural Dream

Table of Contents

Understanding the Unique Challenges of Financing Rural Property

Rural properties often present unique challenges to lenders compared to urban properties. Lenders consider several factors that can impact your ability to secure a loan. These include:

-

Appraisals: Accurately appraising rural properties can be difficult. Lower sales volume and the unique features of rural properties (large acreage, unique outbuildings, etc.) make it challenging to establish a precise market value. This can lead to lower appraisals and potentially impact the loan amount you qualify for. Finding an appraiser experienced in rural property appraisal is crucial.

-

Accessibility: Remote locations make property inspections more challenging and time-consuming for lenders. This added cost and effort can influence their lending decisions. Furthermore, remote locations often mean higher rural property insurance costs due to increased risks associated with emergency services access.

-

Infrastructure: Limited access to essential utilities such as water, sewer, and electricity can significantly impact a property's value and a lender's willingness to offer a loan. Properties lacking these amenities often require substantial investments to become habitable, increasing the overall cost and potentially affecting the rural property market value.

-

Market Volatility: Rural property markets can be less predictable than their urban counterparts. Sales volume may be lower, and price fluctuations can be more significant due to factors like agricultural commodity prices or tourism trends. This unpredictability introduces additional risk for lenders.

Exploring Financing Options for Your Rural Dream

Securing financing for your rural property requires exploring various options. Let's examine some key possibilities:

Traditional Mortgages

Conventional mortgages from banks and credit unions are a common starting point. However, securing a traditional mortgage for rural property often requires a stronger financial profile.

- Strong Credit Score: A high credit score is essential to demonstrate creditworthiness to lenders.

- Sufficient Down Payment: Lenders typically require a larger down payment for rural properties than for urban properties to mitigate their risk.

- Loan-to-Value Ratio (LTV): Lenders may impose stricter LTV limits on rural properties, meaning you may need a larger down payment to secure the loan. Obtaining mortgage pre-approval before you begin your property search can help you understand your borrowing capacity and target properties within your budget. Keep in mind that rural mortgage rates might vary depending on the location and lender.

USDA Rural Development Loans

The USDA offers loans specifically designed to assist individuals in purchasing homes in eligible rural areas. These loans are particularly beneficial for those with lower incomes.

- Eligibility: To qualify for a USDA rural development loan, your property must be located in a designated rural area, and you must meet certain income requirements.

- Application Process: The application process involves providing detailed financial information and documentation, as well as a property appraisal from an approved appraiser.

- Loan Limits and Interest Rates: USDA loan eligibility and the specific terms, including loan limits and interest rates, vary depending on your location and income. Understanding USDA loan requirements is crucial before you begin your application.

Farm Credit Loans

If you're purchasing agricultural property or land for farming operations, Farm Credit institutions offer specialized financing options. These institutions have extensive experience in rural land financing and agricultural operations.

- Loan Types: Farm Credit offers a range of loan types, including operating loans for farm expenses and real estate loans for land purchases.

- Expertise: Their expertise in agricultural financing allows them to understand the unique aspects of valuing and financing farmland and related properties.

- Agricultural Loans: They provide farm loans tailored to the specific needs of agricultural businesses, including financing for equipment, livestock, and other agricultural inputs.

Tips for a Successful Rural Property Financing Application

Securing financing for your rural property requires diligent preparation:

- Thorough Research: Research lenders with experience in rural property financing.

- Strong Financial Profile: Maintain a stable income and excellent credit history.

- Detailed Property Information: Gather all necessary property information, including surveys, appraisals, and utility details.

- Professional Appraisal: Obtain a professional appraisal from a lender-approved appraiser with experience in rural properties.

- Patience and Persistence: The process may take longer than urban property financing. Be prepared for delays and work closely with your lender throughout the process.

Conclusion

Securing financing for your rural dream home might present unique challenges, but with careful planning and the right resources, it's entirely achievable. By understanding the nuances of rural property financing, exploring different loan options like traditional mortgages, USDA loans, or Farm Credit loans, and preparing a strong application, you can significantly increase your chances of success. Don't let the complexities of financing rural property deter you from achieving your country escape. Start your research today and begin the exciting journey of finding the perfect rural property and securing the financing to make your dream a reality! Start planning your financing rural property today!

Featured Posts

-

Konchita Vurst Prognoz Peremozhtsiv Yevrobachennya 2025 Vid Unian

May 24, 2025

Konchita Vurst Prognoz Peremozhtsiv Yevrobachennya 2025 Vid Unian

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025 -

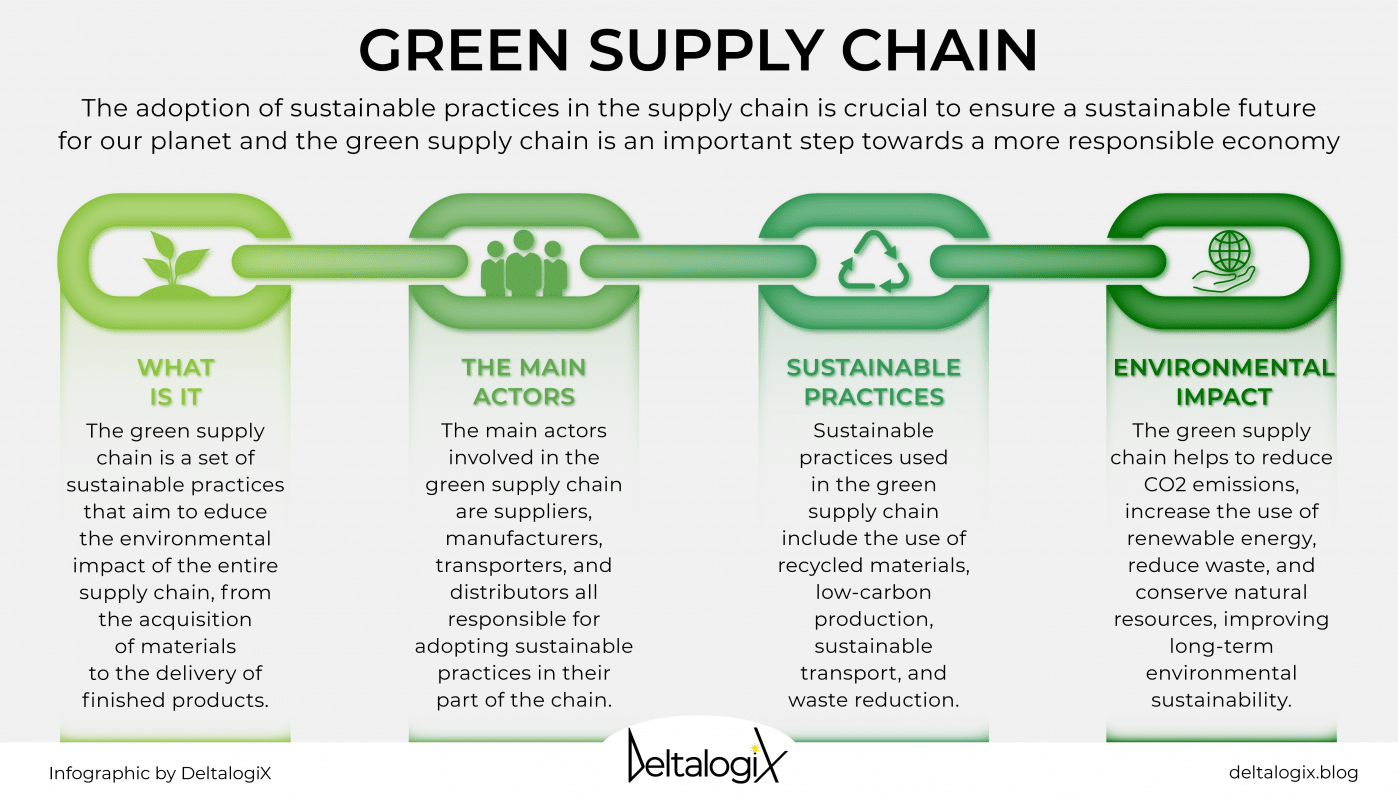

Massimo Vian Exits Gucci Impact On Industrial And Supply Chain Operations

May 24, 2025

Massimo Vian Exits Gucci Impact On Industrial And Supply Chain Operations

May 24, 2025 -

Southamptons Kyle Walker Peters Leeds Uniteds Transfer Interest

May 24, 2025

Southamptons Kyle Walker Peters Leeds Uniteds Transfer Interest

May 24, 2025

Latest Posts

-

Mia Farrow Demands Trump Be Prosecuted For Venezuelan Deportation

May 24, 2025

Mia Farrow Demands Trump Be Prosecuted For Venezuelan Deportation

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation

May 24, 2025 -

Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 24, 2025

Farrow Seeks Legal Action Against Trump Regarding Venezuelan Deportations

May 24, 2025 -

Mia Farrow Demands Trumps Imprisonment For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrow Demands Trumps Imprisonment For Deporting Venezuelan Gang Members

May 24, 2025 -

Exploring Frank Sinatras Four Marriages And Their Significance

May 24, 2025

Exploring Frank Sinatras Four Marriages And Their Significance

May 24, 2025